Gold (XAUUSD) weekly forecast: uptrend remains intact

Gold (XAUUSD) remains in a stable consolidation zone around $4230 per ounce, near October highs. Support for prices comes from dovish signals from the Fed following the December rate cut, improved forecasts for U.S. economic growth, and lower inflation expectations for 2025–2026. Additional demand for gold arises from ongoing geopolitical risks, including the interception of a sanctioned tanker off the coast of Venezuela and continued uncertainty surrounding key conflict negotiations.

This report examines the key factors expected to drive gold prices during 15–19 December 2025, with a focus on market reactions to the Fed meeting, expectations for the 2026 rate path, and the technical structure within the 4150–4250 range where XAUUSD has been consolidating since the September–October rally.

XAUUSD forecast for this week: quick overview

- Weekly performance: Gold (XAUUSD) ends the week higher at $4230 per ounce, near October levels. Support came from the anticipated Fed rate cut and Powell’s comments confirming no plans for tightening. An additional factor was rising demand for safe-haven assets amid geopolitical uncertainty.

- Support and resistance: Gold is trading within a broad upward channel of 3883–4378. The nearest support lies in the 4150–4165 zone, with key support at 3883. Resistance is concentrated at 4250 (upper boundary of the current consolidation) and 4378 (local high from late October).

- Fundamentals: The Fed maintained a moderately dovish tone, signaling possible further rate cuts. This boosted interest in gold. The central bank improved its U.S. growth outlook and lowered inflation expectations, while geopolitical events increased the appeal of safe-haven assets. Official central bank demand also continues to support prices.

- Outlook: The base case is continued consolidation within 4150–4250 as markets await new drivers. A breakout above 4250 would open the way for a test of the all-time high at 4378. A drop below 4150 would raise the risk of a deeper correction toward 4050 and then 3883. The medium-term structure remains bullish.

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) prices closed the week higher at $4230 per ounce, close to October levels when a record high was reached. This time, the driver was the expected Fed rate cut following the FOMC meeting.

Fed Chair Jerome Powell stated that the central bank is considering three policy paths: a slower pace of cuts, moderate reductions, or more aggressive steps. A rate hike is not on the table.

The Fed also maintained its forecast for one rate cut in 2026 but emphasized increased uncertainty around the timing and scale of future decisions.

In addition, the Fed raised its U.S. economic growth forecast and lowered inflation expectations for 2025–2026.

Geopolitical developments further supported gold. These include the U.S. interception of a sanctioned tanker off Venezuela’s coast and continued uncertainty in global conflict negotiations — both of which are increasing safe-haven demand.

XAUUSD technical analysis

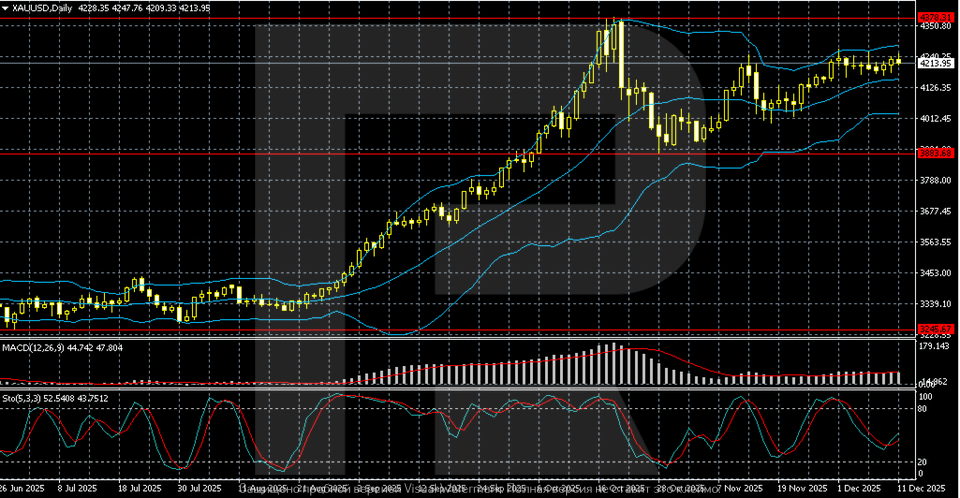

On the daily chart, Gold (XAUUSD) maintains a strong uptrend that began after breaking through the key 3883 area. Gold remains above the Bollinger midline, confirming bullish dominance and momentum. The upper band is widening, reflecting increased volatility. However, over the past weeks, price has been consolidating within the 4150–4250 range, entering a sideways phase.

MACD remains in positive territory, but the histogram shows a noticeable decline in amplitude, indicating weakening momentum after October’s surge. The MACD lines are converging, often a precursor to consolidation or a deeper correction.

Stochastic, after exiting overbought territory, is now turning higher following a pullback, suggesting an attempt to resume the rally, though without a clear reversal signal yet.

The nearest resistance lies around 4378 — the local high from late October. A breakout above this level would open the path to new all-time highs. Support is at 3883, and a loss of this area would signal a deeper correction toward the lower Bollinger Band.

Overall, the structure remains bullish, but the market has entered a consolidation phase awaiting new drivers for trend continuation.

XAUUSD trading scenarios

The fundamental backdrop for gold remains positive. Gold (XAUUSD) ends the week near $4230 per ounce — close to October highs. The market was supported by dovish Fed signals: Powell confirmed that only rate cut scenarios are being discussed, with no hikes in sight. Growth forecasts were upgraded and inflation expectations lowered.

Additional demand for gold comes from geopolitical risks, such as the U.S. tanker interception and uncertainty over negotiations. Technically, gold is consolidating within the 4150–4250 range, maintaining a medium-term uptrend.

- Buy scenario

Longs are appropriate if price holds above 4150–4165.

A breakout above 4240–4250 would open the way to a retest of 4378 and potential new all-time highs.

Support for bulls comes from dovish Fed commentary and strong safe-haven demand.

- Sell scenario

Shorts may be considered if price breaks below 4150.

Targets: 4050 — key support at 3883.

Selling pressure would increase with a strengthening U.S. dollar and rising bond yields.

Conclusion

The base scenario is continued consolidation in the 4150–4250 range while awaiting new catalysts.

A breakout above 4250 would strengthen bullish momentum, while a drop below 4150 would signal a deeper correction.

The medium-term trend remains bullish.

Summary

Gold (XAUUSD) ends the week at $4230 per ounce, in a phase of stable consolidation following the autumn rally. The market is pricing in the expected Fed rate cut: the likelihood of a 25 bps move in December is nearing 90%, and Jerome Powell’s statements have reinforced expectations of a dovish policy path in 2026.

Gold is also supported by geopolitical risks.

The technical picture remains neutral-to-bullish. XAUUSD continues to trade within the 4150–4250 range, above key support at 3883.

The nearest resistance is at 4240–4250: a breakout above this area would open the way to a retest of the all-time high at 4378.

A break below 4150 would raise the risk of a deeper correction toward the 4050–3883 area.

The medium-term trend remains bullish.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.