Gold (XAUUSD) weekly forecast: gold rally continues

Gold (XAUUSD) consolidated around 3,860 per ounce, very close to its all-time high of 3,897. Support for the metal comes from expectations of further Federal Reserve rate cuts following the September easing decision. Additional drivers include rising geopolitical tensions and steady demand for gold as a safe-haven asset.

This outlook reviews the key factors that will shape gold’s dynamics during the week of 6–10 October.

XAUUSD forecast for this week: quick overview

- Weekly dynamics: XAUUSD maintains its bullish momentum, trading near its all-time high of 3,897. Growth is driven by expectations of further Fed easing, a weaker US dollar, and increased safe-haven demand amid the US government shutdown

- Support and resistance: the key support level lies at 3,627, followed by 3,245 and 3,118. The nearest resistance level is at 3,897. A breakout above 3,900 would open the path to new record highs, while consolidation below 3,627 would deepen the correction, pushing gold back to 3,500 and 3,440

- Fundamentals: a dovish Fed tone and high probability of an October rate cut, cooling US labour market, and growing uncertainty due to the shutdown all create a favourable backdrop for gold. Additional support comes from central bank demand and intensifying geopolitical tensions

- Forecast: the base case for 6–10 October is consolidation near the highs with potential growth above 3,900 and new record levels. A drop below 3,627 would signal a deeper correction to the 3,500–3,440 area

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) hovered around 3,868 USD per ounce, staying very close to its all-time high. Expectations of Federal Reserve rate cuts and strong demand for safe-haven assets provided support for prices.

According to the ADP report, US private sector employment fell in September, marking the first decline since 2020 and the largest drop since March 2023. These figures boosted expectations for further Federal Reserve monetary policy easing this year.

Meanwhile, the Department of Labor announced that the Nonfarm Payrolls report, a key data point for the Fed’s October meeting, would be postponed due to the shutdown. The partial government closure left thousands of federal employees out of work, increasing demand for safe-haven assets and positively impacting the position of gold (XAUUSD).

Some uncertainty eased following a US Supreme Court decision regarding Fed Governor Lisa Cook. This reduced doubts about the regulator’s independence and the likelihood of overly dovish appointments.

XAUUSD technical analysis

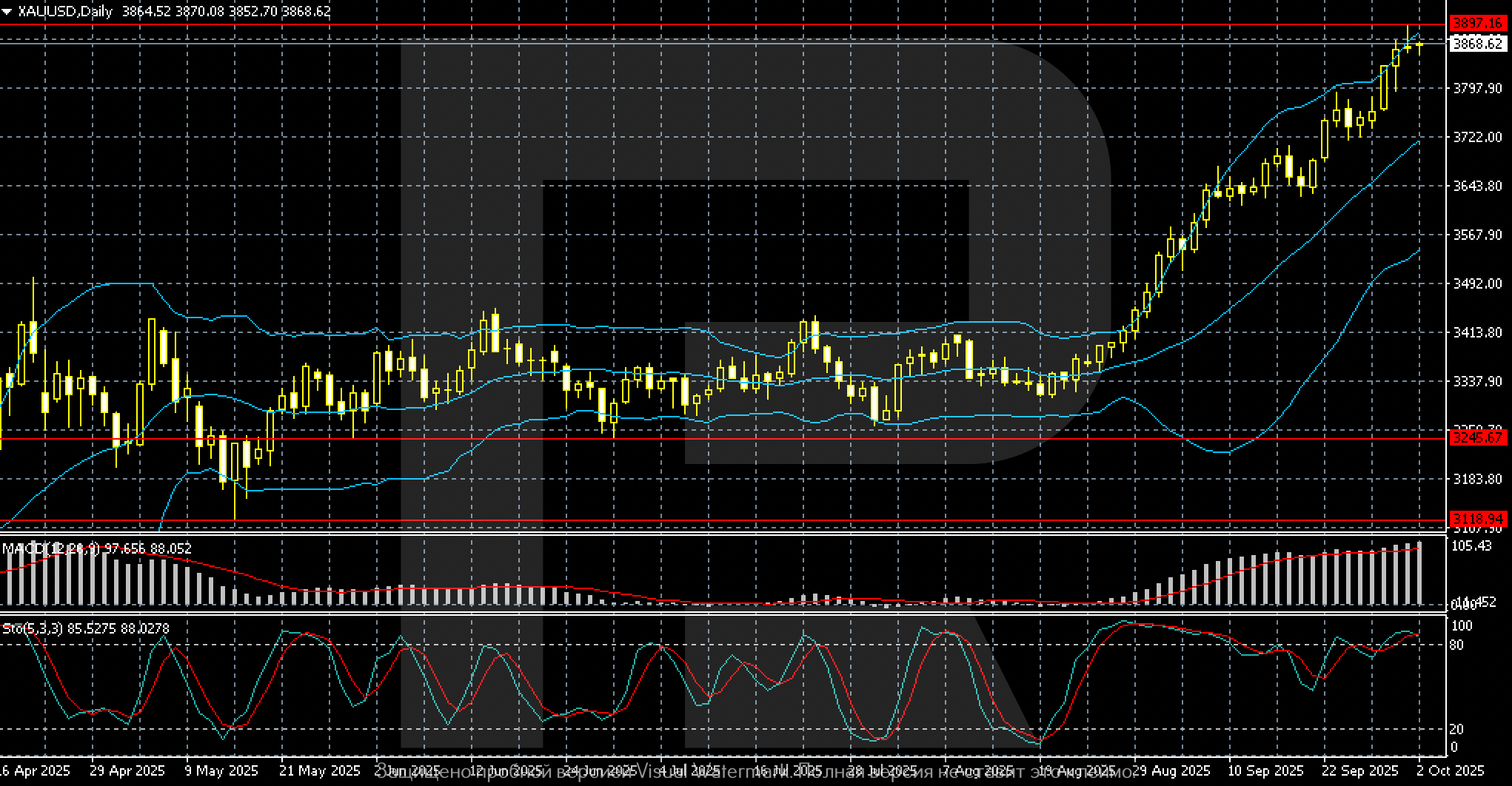

The XAUUSD daily chart shows a strong uptrend that began in the second half of August 2025. Prices broke out of a multi-month sideways range above 3,600 and continue their upward trajectory towards 3,868–3,870. The key resistance level lies at 3,897, which coincides with a local high.

Technical indicators confirm the strength of the move. MACD is rising, and the histogram is expanding, signalling sustained momentum. Prices are hovering near the upper boundary of Bollinger Bands, reflecting overbought conditions. The Stochastic Oscillator is also in overbought territory (85–88), increasing the likelihood of a pullback.

The nearest support level is at 3,627, followed by 3,245 and 3,118. Overall, gold remains in strong bullish momentum, but the risks of a short-term pullback remain ahead of a potential test of the 3,900 level.

XAUUSD trading scenarios

The fundamental backdrop for gold remains positive: expectations of Fed rate cuts, growing safe-haven interest, and escalating geopolitical tensions support the bulls.

- Buy scenario

Long positions remain in focus if prices hold above the 3,750–3,760 support zone. A rebound from this area could send prices towards 3,860 and then to the all-time high area of 3,875–3,900. Weak US labour market data and declining Treasury yields could provide an extra boost.

- Sell scenario

Short positions become relevant if the 3,750 level breaks to the downside. In this case, targets shift to 3,700 and then 3,627. Pressure would increase with the release of strong US macroeconomic data and a rise in Treasury yields, which would strengthen the dollar.

Conclusion

Gold remains in the 3,750–3,875 range. The base case for the week is consolidation above 3,750 with the potential to hit new record highs under a dovish Fed stance. A breakout below the support level would open the door to a deeper correction towards the 3,700–3,627 area.

Summary

Gold (XAUUSD) remains near record highs on the back of expectations for continued Fed easing, strong demand for safe-haven assets, and persistent geopolitical tensions. Central bank purchases also support demand.

Growth is capped by US dollar strength and rising Treasury yields. Key levels remain at the 3,627 support level and the 3,750 and 3,790 resistance lines. A breakout above 3,790 would signal new all-time highs, while consolidation below 3,627 increases the risk of a correction towards 3,500–3,440. In the coming days, gold’s movement will depend on macroeconomic data and signals from the Fed.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.