Gold (XAUUSD) weekly forecast: Waiting mode extended, сatalysts тeeded

Gold (XAUUSD) counts on a possible easing of the US Federal Reserve's monetary policy and therefore maintains an upward outlook. Global interest in the safe-haven asset remains low, but the situation can change at any moment. The weakness of the US dollar allows gold to rise in price, but its prospects are not the strongest. Let’s analyse which factors can support XAUUSD Gold prices and what will put pressure in the new week.

XAUUSD forecast for this week: quick overview

- Weekly dynamics:

Gold strengthened to 3,320 per ounce, continuing its rise from previous levels thanks to dollar weakness and geopolitical tensions. Weekly low – 3,246.90, high – near 3,330. Despite local fluctuations, the market remains in a consolidation phase below resistance at 3,400.

- Key support:

3,300 – the nearest level for buyers. Below lies the strategic zone at 3,245 and 3,120, a break of which could change the medium-term trend.

- Key resistance:

3,400 – the main obstacle for growth. A break above would open the potential for a move to 3,450 and further to historical highs around 3,500.

- Fundamental factors:

Dollar weakness following the FOMC minutes, where a possible rate cut as early as July was discussed, supports gold. Donald Trump’s trade rhetoric increases demand for safe-haven assets: the wave of new tariffs affects 14 countries, including Brazil, Iraq, and the Philippines. An additional factor remains instability in the Red Sea, posing a threat to supply chains.

- General sentiment:

Moderately positive. While above 3,300, there remains a chance for a breakout above 3,400 and development of a new growth impulse. The main scenario is bullish, provided dollar weakness and high geopolitical uncertainty continue.

- XAUUSD forecast for the week:

The baseline growth target is 3,400. A confident breakout would open the path to 3,450–3,500. Support levels – 3,300 and 3,245; with increased pressure – 3,120.

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) rose to 3,320 USD. Investors are assessing trade risks and the Fed's reaction to global economic changes.

Markets continue to monitor a series of tariff notifications from US President Donald Trump. Brazil became the latest country hit by high tariffs after similar threats on copper imports and several other states. These measures raised fears of widespread disruptions to global trade.

Additional support for gold comes from the publication of the June FOMC meeting minutes. The document showed officials were divided: some members advocate for a rate cut as early as July, others prefer to wait for stronger signals. A third group sees no need for policy easing until year-end.

Overall, the Federal Reserve maintains a cautious data-dependent stance, considering tariff-linked inflation risks, slowing consumer spending, and continued labour market resilience.

Currently, exchanges are focused on risk assets, so demand for gold as a safe haven is not very high. At the same time, these risks are sufficient to keep prices at optimal levels.

XAUUSD technical analysis

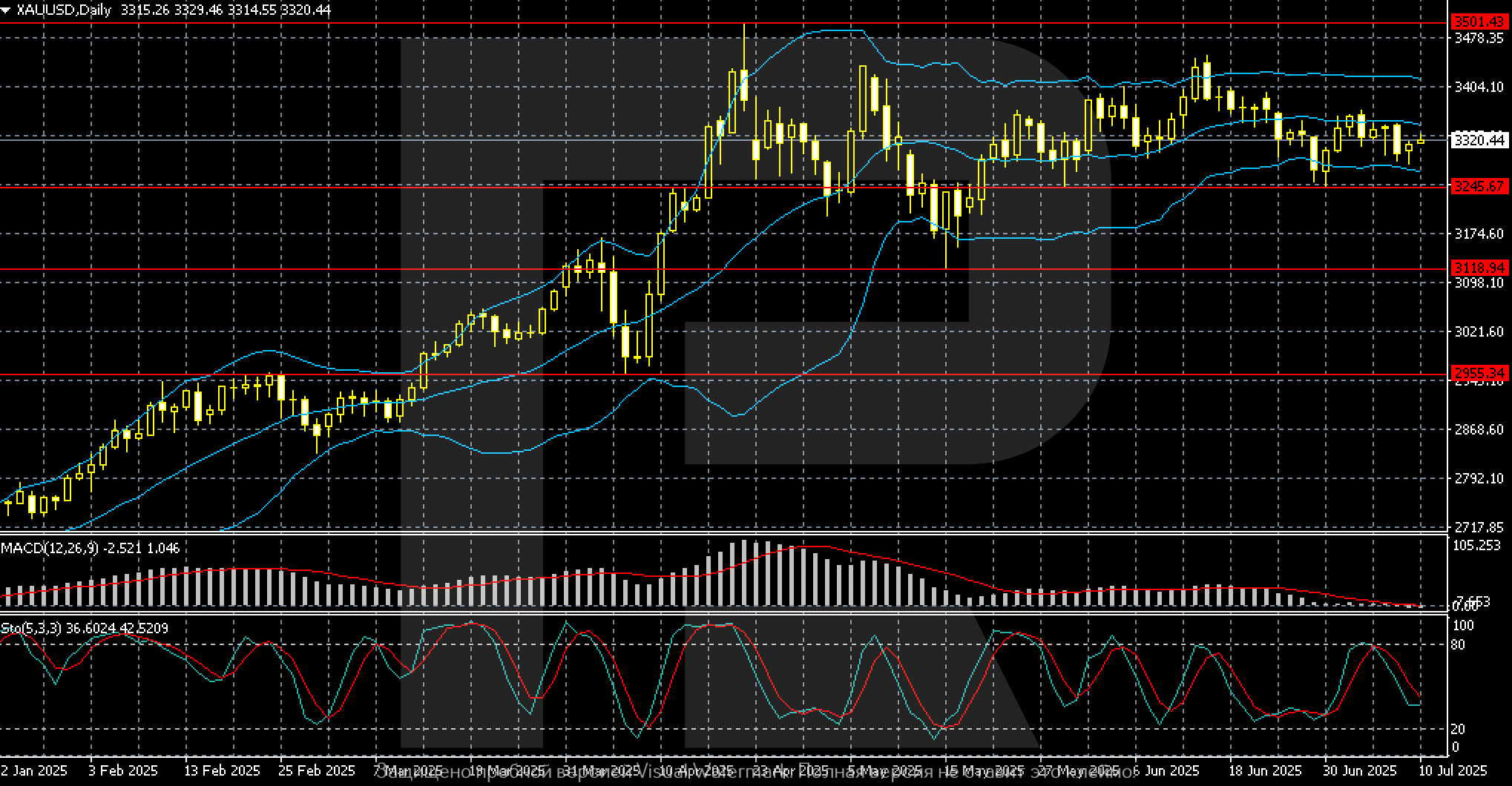

On the daily chart of XAUUSD gold, quotes remain in a range since mid-May. A prolonged sideways trend continues after a strong impulse rise in Q1 2025.

In the last two months, the price has fluctuated within the 3,245–3,400 USD range, periodically approaching its upper and lower boundaries. Such a sideways channel indicates market participants' uncertainty as they await new macroeconomic guidelines and signals from the Fed.

Bollinger Bands have begun to narrow. This is a classic sign of decreasing volatility. Such formations often precede strong movements in either direction. The MACD has remained in negative territory for several weeks. Its histogram is approaching zero, but there is no clear reversal signal yet. The Stochastic (5,3,3) is fluctuating in the neutral zone (around 36–42). The indicator lines have turned upwards, which may indicate an attempt to resume growth in the short term.

Nearest support: 3,245 USD. This is where quotes found footing in June and early July. Below lies the level at 3,118 USD, which may become the target if the range breaks down.

Resistance: the 3,400 USD area capped growth in June. A break above this level opens the way to retest historical highs around 3,500 USD.

XAUUSD trading scenarios

Given the current picture, the sentiment for XAUUSD gold remains moderately neutral-positive. The price holds within the consolidation range of 3,245–3,400, retaining most of its H1 growth.

Fundamental factors such as trade risks and the Fed's dovish rhetoric support interest in safe-haven assets. The technical structure does not yet show signs of a downward trend reversal.

- Buy scenario:

Long positions can be considered if support holds above 3,300. This confirms the preservation of the consolidation channel and the possibility of growth towards its upper boundary.

Key target – a breakout of 3,400. Sustained consolidation above this level on the daily chart will create conditions for a move into the 3,450 area, further towards the historical high at 3,500. If the fundamental backdrop (dollar weakness, demand for protection) remains, the next impulse target lies within 3,520–3,550.

The optimal entry point is on a pullback into the 3,320–3,300 area with a reversal signal (reversal pattern, candlestick confirmation, bounce from the Bollinger midline).

- Sell/short scenario:

A short position would be justified if there is a breakout and consolidation below 3,300 support, which would be the first technical signal of weakening bullish inertia.

The nearest decline target is the 3,245–3,220 area. Below opens the road to support at 3,118.

Such a scenario will be relevant with a strengthening US dollar, a hawkish Fed tone, or declining geopolitical risks.

Scenarios are balanced: the market is waiting for a catalyst. Meanwhile, the bias remains in favour of the bulls as long as 3,300 holds as key support.

Summary

The gold market is currently in wait-and-see mode. Market participants assess the implications of new US tariff initiatives and signals from the FOMC minutes regarding further rate policy. Despite pressure from a strong dollar, gold maintains stability thanks to safe-haven demand amid global uncertainty.

A breakout of the 3,245–3,400 range will signal a new trend move. Until that happens, intraday traders should focus on short-term rebounds within the range.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.