Gold (XAUUSD) corrects ahead of Nonfarm Payrolls

The price of XAUUSD declined to 4,270 USD during a downward correction amid profit-taking by investors ahead of US employment data. Details — in our analysis for 16 December 2025.

XAUUSD forecast: key trading points

- Market focus: today the market’s attention is on US employment data — Nonfarm Payrolls and the Unemployment Rate

- Current trend: a downward correction is observed

- XAUUSD forecast for 16 December 2025: 4,350 or 4,270

Fundamental analysis

XAUUSD quotes fell to the 4,270 USD per ounce level as investors locked in profits ahead of the release of US labor market statistics. During the US session, the Nonfarm Payrolls and Unemployment Rate figures will be published.

Employment data may influence expectations regarding changes in the Federal Reserve’s monetary policy. At present, markets estimate a 75.6% probability that the Fed will keep interest rates unchanged at its January meeting. At the same time, some analysts expect two additional rate cuts over the course of next year.

Emerging prospects of a potential peace agreement between Russia and Ukraine are also reducing demand for gold as a safe-haven asset.

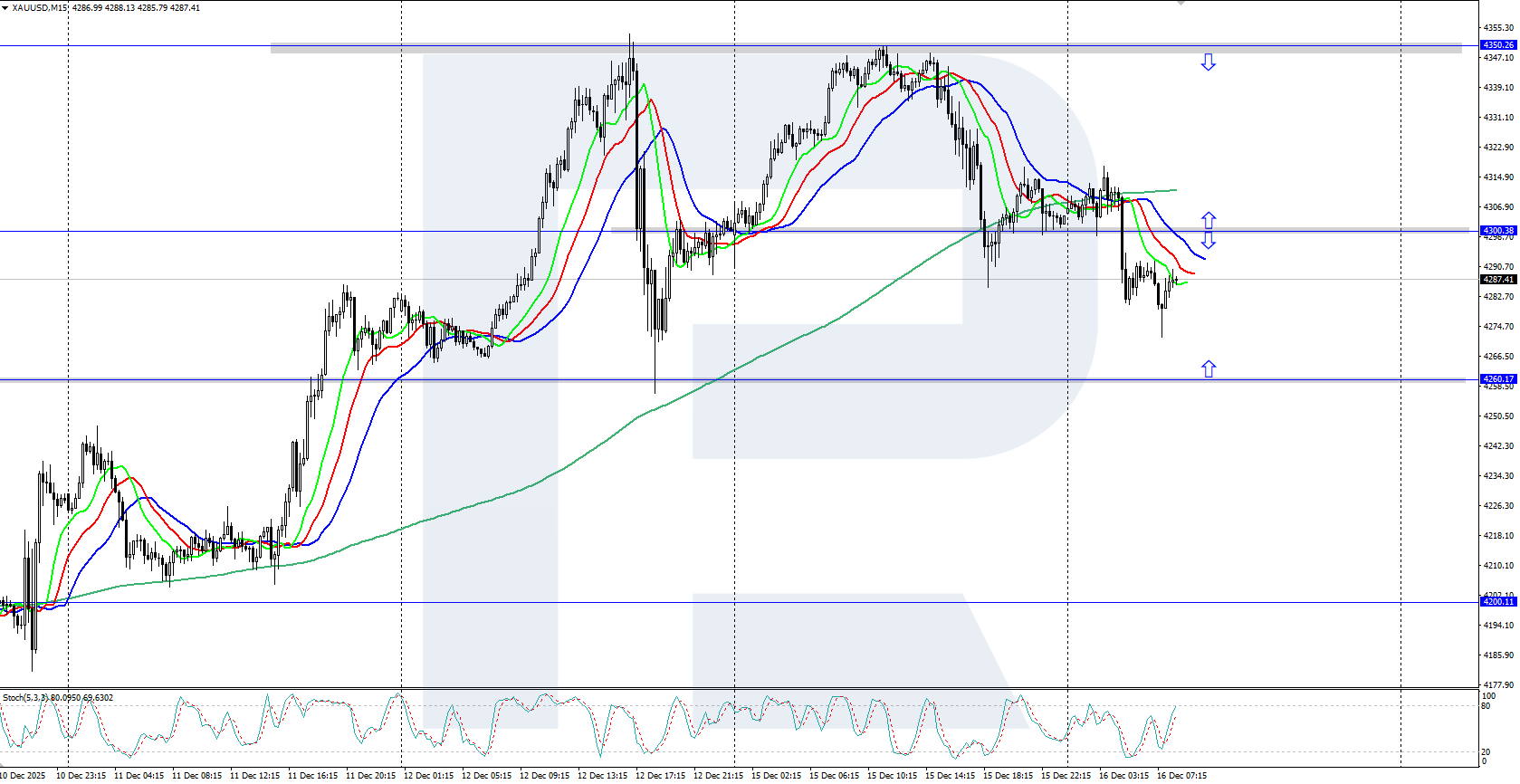

XAUUSD technical analysis

XAUUSD quotes have corrected into the price area below the 4,300 USD level. The daily trend, confirmed by the Alligator indicator, remains upward, indicating the possibility of a continuation of the bullish move once the current correction is completed.

Within the framework of the short-term price forecast for XAUUSD, it can be assumed that if bulls manage to regain control, growth toward resistance at 4,350 USD may follow. If bears succeed in extending the decline, a further correction toward support at 4,270 USD is possible.

Summary

Gold is undergoing a moderate correction, falling to the 4,270 USD level. Today, the market’s focus is on US employment data.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.