Gold (XAUUSD) near its all-time high

The XAUUSD price has risen into the area near the all-time high of 4,381 USD amid US dollar weakness following the Fed’s rate cut. Details — in our analysis for 15 December 2025.

XAUUSD forecast: key trading points

- Market focus: tomorrow the market awaits key US labor market data for November — Nonfarm Payrolls and the Unemployment Rate

- Current trend: an upward impulse is observed

- XAUUSD forecast for 15 December 2025: 4,381 or 4,300

Fundamental analysis

XAUUSD quotes are rising, approaching the all-time high at 4,381 USD. Investors are awaiting several key US economic reports this week. The main focus will be on the labor market reports (Nonfarm Payrolls and the Unemployment Rate), expected on Tuesday, as well as inflation data (CPI) due on Thursday.

Last week, the Federal Reserve cut interest rates by 25 basis points for the third time this year. However, the decision was not unanimous: three Fed officials voted against it. As a result, the scale of further monetary policy easing by the Fed in 2026 remains uncertain.

XAUUSD technical analysis

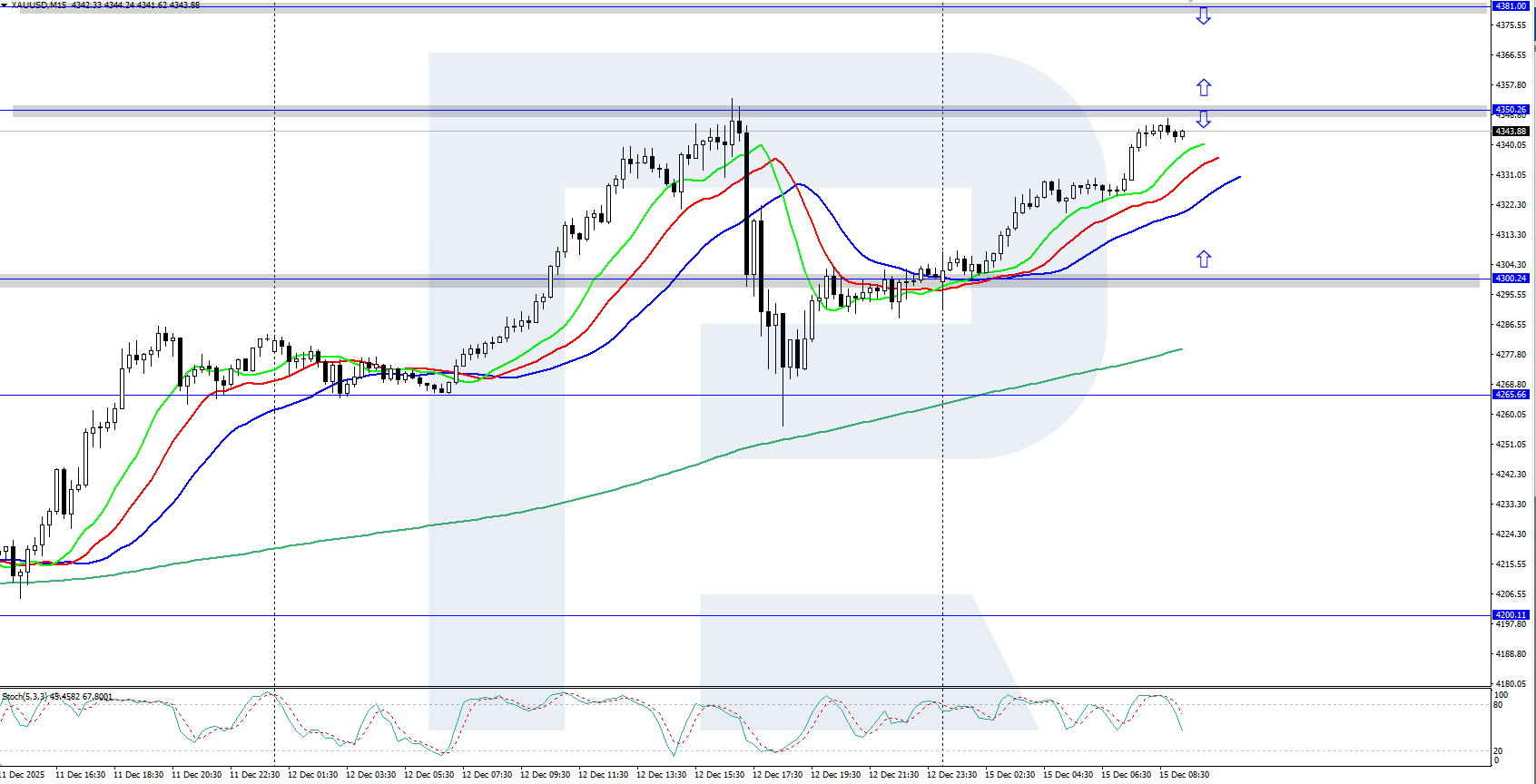

XAUUSD quotes continue to rise on the chart, consolidating above the 4,300 USD level. The Alligator indicator has turned upward, suggesting the potential continuation of the upward move after a brief correction.

Within the short-term XAUUSD outlook, if bulls manage to maintain the current initiative, further growth toward the 4,381 USD high may follow. If bears manage to regain control, a corrective move toward support at 4,300 USD is possible.

Summary

Gold is rising, having moved into the price area above 4,300 USD. Tomorrow, the market’s focus will be on US labor market statistics for November (Nonfarm Payrolls and the Unemployment Rate).

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.