Gold enters a new rally phase, XAUUSD may soar towards 4,300 USD

With markets awaiting US economic data and the upcoming Federal Reserve meeting, XAUUSD may test the 4,300 USD level. Discover more in our analysis for 5 December 2025.

XAUUSD forecast: key trading points

- US core PCE price index: previously at 2.9%, projected at 2.9%

- Markets await the Federal Reserve’s interest rate decision

- Current trend: moving upwards

- XAUUSD forecast for 5 December 2025: 4,300

Fundamental analysis

Today’s XAUUSD price forecast shows that gold is undergoing a correction, with prices currently trading near 4,210 USD per ounce. The core PCE price index is a key inflation gauge in the US, tracking changes in prices for goods and services excluding food and energy. It reflects underlying inflation trends and serves as the primary benchmark for monetary policy decisions. The core PCE helps measure real consumer purchasing power and overall economic stability, as it is less affected by short-term volatility.

The XAUUSD forecast for 5 December 2025 assumes that the index may remain unchanged at 2.9%. However, it should be noted that this is only a forecast value, and the situation will become clear only after the actual data is published. A weaker-than-expected result would negatively impact the US dollar and trigger XAUUSD growth.

Markets remain focused on the upcoming Federal Reserve meeting, where policymakers will consider a potential interest rate adjustment. Monetary policy easing could further weaken the USD, which has already been losing ground in recent months. A rate cut would become a catalyst for another rally in XAUUSD.

XAUUSD technical analysis

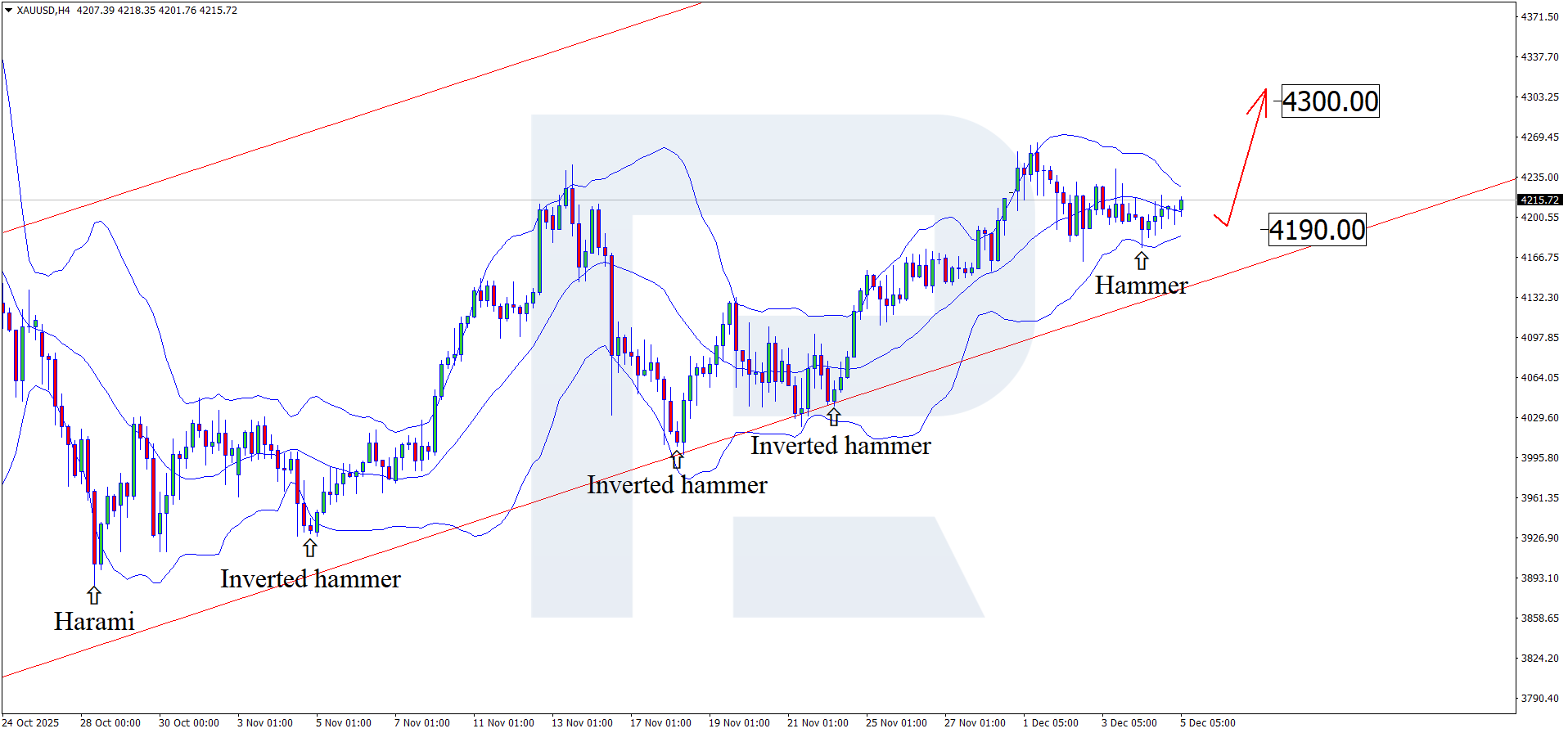

On the H4 chart, XAUUSD prices formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, they may continue their upward trajectory as the pattern plays out. Since XAUUSD quotes remain within an ascending channel, an upside target could be the 4,300 USD level.

However, the technical outlook for today also includes an alternative scenario, suggesting a correction towards 4,190 USD before growth.

The bullish trend remains intact, and XAUUSD prices may soon move towards the next psychological level at 4,500 USD.

Summary

Ahead of the Federal Reserve’s rate decision, gold continues to strengthen. The XAUUSD technical analysis suggests continued upward momentum once the correction is complete.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisThis article offers a Gold (XAUUSD) price forecast for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.