Weak US economic data strengthens support for XAUUSD

XAUUSD prices are under pressure; however, key macroeconomic and monetary factors continue to generate bullish signals, with quotes currently at 4,222 USD. Find more details in our analysis for 2 December 2025.

XAUUSD forecast: key trading points

- The US manufacturing sector is contracting for the ninth consecutive month

- Weak US macroeconomic data supports demand for gold

- XAUUSD forecast for 2 December 2025: 4,3250

Fundamental analysis

XAUUSD quotes are declining slightly as sellers firmly defend the 4,235 USD resistance level. Gold had previously gained upward momentum amid rising expectations that the Federal Reserve would cut interest rates as early as next week. Traders are pricing in an 87.2% probability of a 25-basis-point rate cut, driven by weak US macroeconomic statistics and dovish comments from Fed officials.

Monday’s data release showed that the US ISM manufacturing PMI fell to 48.2 in November 2025, marking the lowest reading in four months, down from 48.7 in September and below market expectations of 48.6. The sector has now been contracting for nine consecutive months, with the pace of decline accelerating.

Market attention now turns to Federal Reserve Chairman Jerome Powell, who is scheduled to speak today. His comments may provide additional signals regarding the future interest rate trajectory.

XAUUSD technical analysis

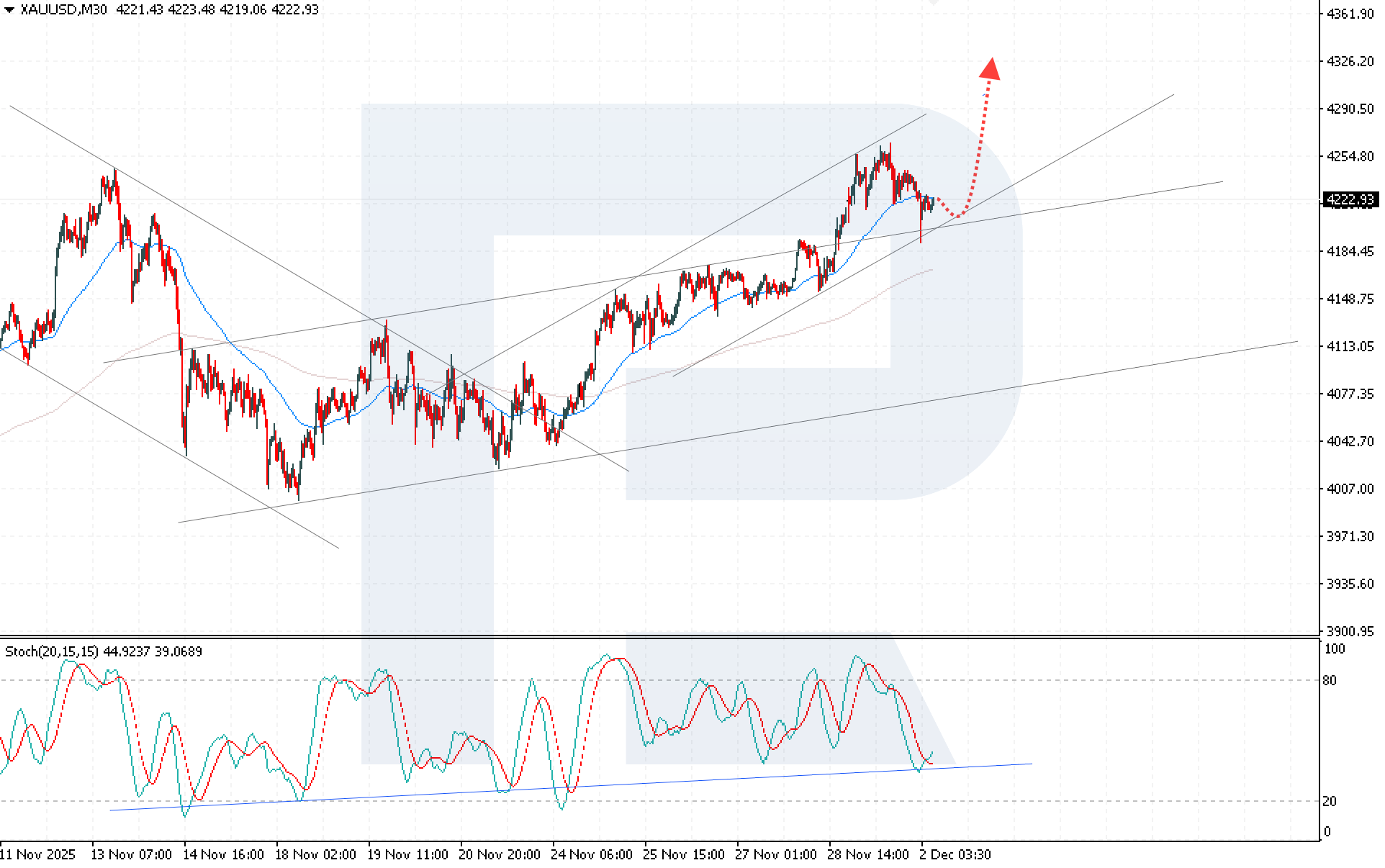

XAUUSD quotes are edging lower, but buying pressure persists: after testing the EMA-65, prices have rebounded confidently. The XAUUSD price forecast suggests the bearish correction is nearing completion, followed by a potential resumption of growth towards the 4,3250 USD level.

The Stochastic Oscillator further confirms the bullish scenario, with the signal lines bouncing from the support level and crossing upwards, indicating strengthening buying activity.

A breakout and firm consolidation above 4,245 USD will serve as key confirmation of the end of the correction and the formation of a new bullish impulse.

Summary

Weak US economic data and expectations of a Federal Reserve rate cut continue to form solid support for XAUUSD, despite ongoing selling pressure near the key resistance zone. Today’s XAUUSD analysis indicates the completion of the correction and a high likelihood of renewed growth towards 4,3250 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.