Top 3 trade ideas for 18 November 2025

Trade ideas for EURUSD, GBPUSD, and AUDUSD are available today. The ideas expire on 19 November 2025 at 9:00 AM (GMT +3).

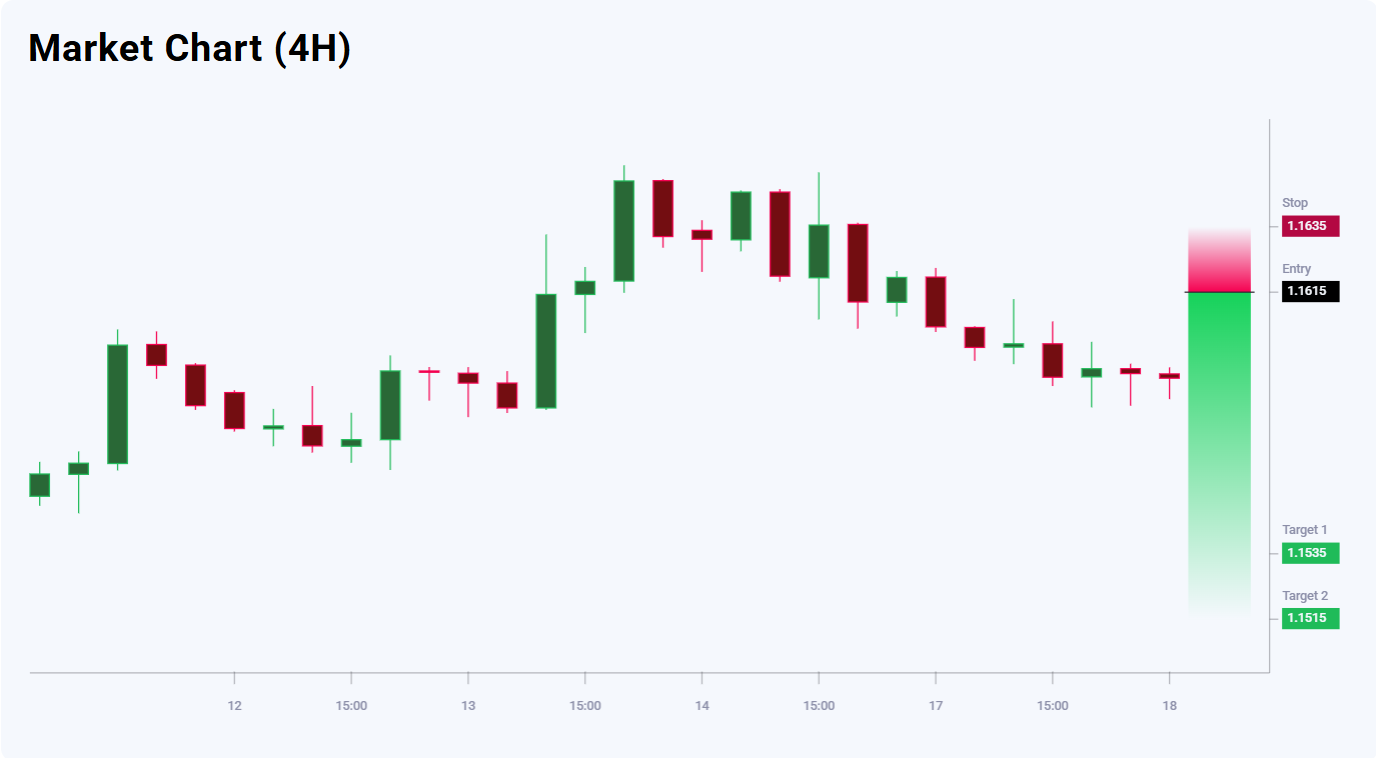

EURUSD trade idea

The main medium-term trend for the EURUSD currency pair remains bearish. The short-term RSI indicator is moving upwards, indicating a possible correction. The preferred strategy remains selling on pullbacks, as selling at market prices currently provides an unfavourable risk-to-reward ratio. The key resistance level has formed at 1.1615. Today’s EURUSD trade idea suggests placing a pending Sell Limit order.

Market sentiment for EURUSD shows a bearish bias – 62% vs 38%. The risk-to-reward ratio is 1:5. Potential profit is 80 pips at the first take-profit target and 100 pips at the second, while possible losses are limited to 20 pips.

Trading plan

- Entry point: 1.1615

- Target 1: 1.1535

- Target 2: 1.1515

- Stop-Loss: 1.1635

GBPUSD trade idea

The GBPUSD currency pair appears to be forming a top. Therefore, the preferred strategy at the moment is to sell after a correction with a tight stop-loss, anticipating the continued bearish momentum. The key resistance level is located at 1.3240. Today’s GBPUSD trade idea suggests placing a pending Sell Limit order.

Market sentiment for GBPUSD shows a bearish bias – 75% vs 25%. The risk-to-reward ratio exceeds 1:3. Potential profit is 130 pips at the first take-profit target and 156 pips at the second, with possible losses capped at 46 pips.

Trading plan

- Entry point: 1.3240

- Target 1: 1.3110

- Target 2: 1.3084

- Stop-Loss: 1.3286

AUDUSD trade idea

The medium-term trend for the AUDUSD currency pair remains bearish. The pair is trading in oversold territory, with a temporary upward correction expected. Therefore, the preferred strategy at the moment is to sell after a correction with a tight stop-loss. The key support level is located at 0.6505. Today’s AUDUSD trade idea suggests placing a pending Sell Limit order.

Market sentiment for AUDUSD shows a bearish bias – 64% vs 36%. The risk-to-reward ratio is 1:5. Potential profit is 60 pips at the first take-profit target and 75 pips at the second, with possible losses limited to 15 pips.

Trading plan

- Entry point: 0.6505

- Target 1: 0.6445

- Target 2: 0.6430

- Stop-Loss: 0.6520

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.