Record quarter fails to lift NVIDIA shares – Google strengthens its position in the AI market

NVIDIA delivered outstanding results for Q3 2026, surpassing analyst expectations for both revenue and profit. However, the market reaction was muted amid concerns about overheating in the AI sector and rising competition from Alphabet.

NVIDIA Corporation (NASDAQ: NVDA) reported excellent results for Q3 of fiscal year 2026, once again exceeding market expectations. Revenue reached 57 billion USD, up 62% year-on-year, while adjusted earnings per share stood at 1.30 USD. This was slightly above analyst forecasts, which had projected revenue of around 55 billion USD and EPS of 1.26 USD.

Profitability remains exceptionally high, with a gross margin of 73.6%, operating income of 37.8 billion USD, and non-GAAP net income of 31.8 billion USD. The main growth driver was the Data Centre segment, where revenue climbed by 66% year-on-year to 51.2 billion USD, accounting for around 90% of total sales. This underscores the sustained demand for AI infrastructure and the successful launch of the Blackwell product line. The Gaming segment also expanded to 4.3 billion USD (+30% y/y), though it now plays a smaller role in overall revenue.

Management expects growth to continue in the next quarter, forecasting revenue of around 65 billion USD and a gross margin of 75%. Demand for AI accelerators and cloud GPUs remains exceptionally strong, with some products already sold out and no signs of a slowdown in orders. According to management, NVIDIA has already received confirmed orders for Blackwell solutions and upcoming Rubin systems totalling around 500 billion USD through the end of 2026, ensuring high utilisation and sustained growth for at least the next several years.

Investor reaction to the Q3 2026 report was mixed and volatile. Immediately after publication, NVIDIA’s shares rose about 5%, adding roughly 220 billion USD to its market capitalisation, as investors welcomed the revenue increase to 57 billion USD, the EPS beat, and the strong Q4 guidance of 65 billion USD. This briefly lifted the broader technology sector and futures on the S&P 500 and NASDAQ.

However, during the session, sentiment shifted as profit-taking set in amid growing concerns about a potential AI bubble. By the close on 20 November, NVIDIA shares had fallen about 3%, dragging down the wider semiconductor sector. Jensen Huang remarked that the market had failed to appreciate the company’s “incredible quarter”, as the stock fell from 195 USD to 180 USD in a single day – a loss of roughly 350 billion USD in market value.

Overall, the reaction revealed investors’ ambivalence: acknowledging NVIDIA’s phenomenal financial performance while questioning the sustainability of the AI boom and the stock’s elevated valuation. The report confirmed robust demand, but the market responded with volatility rather than growth – a sign that expectations for NVIDIA and the entire AI sector remain extremely high.

This article examines NVIDIA Corporation, outlines its revenue sources, reviews its quarterly performance, and presents expectations for the next quarter. It also provides an NVIDIA stock forecast for 2025.

About NVIDIA Corporation

NVIDIA Corporation is a US tech company established in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem. Jensen Huang has remained the company’s CEO since its foundation. NVIDIA specialises in producing GPUs, chips for AI, data centres, and autopilot systems. The company plays a key role in developing gaming, professional visualisation, and AI computing. NVIDIA also held a prominent place in the cryptocurrency mining industry as its graphics cards were widely used for mining Bitcoin, Ethereum, and other digital assets. The company went public on 22 January 1999 on the NASDAQ under the NVDA ticker symbol.

Image of the company name NVIDIA CorporationNVIDIA Corporation’s main revenue streams

NVIDIA is primarily known for its GPUs, but it has recently expanded into the AI segment, dominating the market with high-performance chips used for AI technology development. The company reports revenues from this segment under the Data Center section. NVIDIA’s business model focuses on several key areas:

- GPUs : this includes the Gaming and Professional Visualization segments. The company supplies the gaming industry with GPUs for gaming PCs, consoles, and other devices, ensuring high-performance gaming experiences. Professional Visualization includes GPU sales for professionals involved in 3D graphics, CAD, animation, video editing, and other tasks that require high computing power.

- Data Center : this is one of NVIDIA’s fastest-growing segments. The company develops GPUs and other hardware solutions for data centres, which are used in AI infrastructure, deep learning technologies, cloud computing, and big data processing.

- Automotive segment : NVIDIA is actively developing products for the automotive sector, including self-driving platforms and advanced driver-assistance systems (ADAS).

- OEM and Others : this category includes earnings from technology licensing, sales of other chips and solutions for OEM manufacturers, such as laptop and other electronic device producers.

NVIDIA diversifies its operations, covering various segments from gaming to data centres and automotive components. The company publishes statistics on the Gaming, Data Center, Professional Visualization, and Automotive segments in its quarterly reports, while other indicators are included in the Other Revenues section.

NVIDIA Corporation Q2 2025 financial results

On 28 August 2024, NVIDIA released its earnings report for Q2 fiscal year 2025, which ended on 28 July 2024. Below are the key figures compared to the corresponding period of last year:

- Revenue : 30.04 billion USD (+122%)

- Net income : 16.95 billion USD (+152%)

- Earnings per share : 0.68 USD (+152%)

- Operating profit : 19.94 billion USD (+156%)

- Gross margin : 75.1% (+500 basis points)

Revenue by segment:

- Data Center : 26.27 billion USD (+154%)

- Gaming : 2.88 billion USD (+16%)

- Professional Visualization : 454 million USD (+20%)

- Automotive : 346 million USD (+37%)

In the first half of 2024, NVIDIA returned 15.40 billion USD to shareholders through share repurchases and dividends. As of the end of Q2 2024, the company had 7.50 billion USD remaining for stock buybacks. On 26 August 2024, the Board of Directors approved an additional 50.00 billion USD for share repurchases, with no expiration date.

Although the Q2 fiscal 2025 results surpassed analyst forecasts, NVIDIA shares fell immediately after the release. Investors were not particularly impressed by the revenue and profit growth, as financial indicators had surged from 200% to 700% in the previous quarter. Maintaining such rapid growth over the long term is clearly unrealistic, but investor expectations remain elevated.

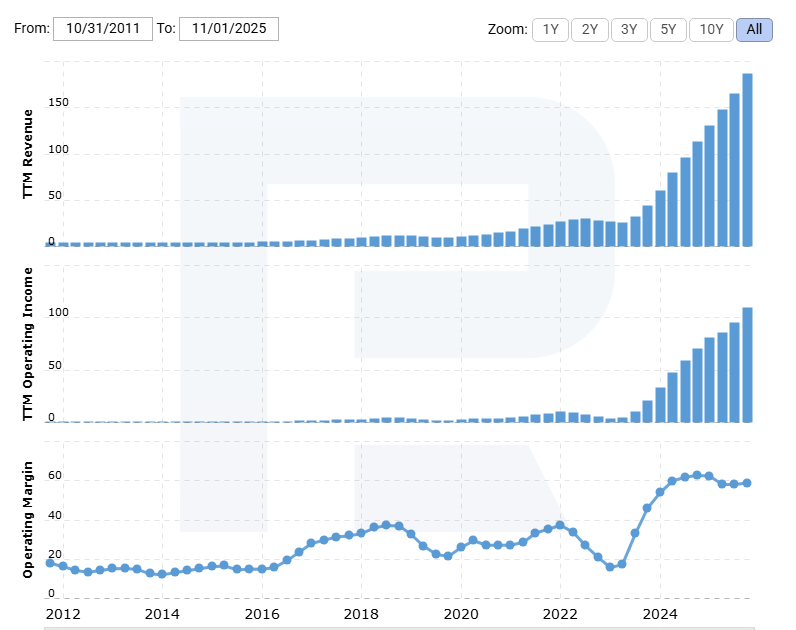

A fundamental analysis of NVIDIA’s report showed that revenue increased across all segments. The Data Center segment, which focuses on AI technologies, remained the leader. The company’s operating margin chart below illustrates the extent to which AI has influenced NVIDIA’s performance.

NVIDIA Corporation operating margin chart from 2009 to 2025OpenAI announced ChatGPT on 30 November 2022, and by Q1 2023, NVIDIA reported an increase in its operating margin. It then grew at a rapid pace, even surpassing the levels seen during the cryptocurrency mining boom. In fact, this suggests that the company has been raising product prices without a decline in demand, allowing it to generate more than 50 cents in profit for every dollar invested.

NVIDIA Corporation Q3 2025 financial results

On 20 November 2024, NVIDIA released its earnings report for Q3 fiscal 2025, which ended on 27 October 2024. Below are the key figures compared with the corresponding period of last year:

- Revenue : 35.08 billion USD (+94%)

- Net income : 19.31 billion USD (+109%)

- Earnings per share : 0.78 USD (+111%)

- Operating profit : 21.86 billion USD (+110%)

- Gross margin : 74.6% (+60 basis points)

Revenue by segment:

- Data Center : 30.77 billion USD (+112%)

- Gaming : 3.27 billion USD (+15%)

- Professional Visualization : 486 million USD (+17%)

- Automotive : 449 million USD (+72%)

Jensen Huang commented on the report, saying that “The age of artificial intelligence is in full steam, driving a global shift to NVIDIA computing,” emphasising the strong demand for the Hopper and Blackwell microarchitecture products, which drove record results in the last quarter.

For Q4 fiscal 2025, NVIDIA forecast revenue of 37.50 billion USD (with a possible deviation of 2%) and a non-GAAP gross margin of 73.5%, reflecting confidence in further growth despite supply restraints, particularly due to the Blackwell production ramp-up.

NVIDIA Corporation Q4 2025 financial results

On 26 February 2024, NVIDIA published its earnings report for Q4 fiscal 2025, which ended on 26 January 2025. Below are the key figures compared with the corresponding period of last year:

- Revenue : 39.33 billion USD (+78%)

- Net income : 22.09 billion USD (+80%)

- Earnings per share : 0.89 USD (+82%)

- Operating profit : 24.03 billion USD (+77%)

- Gross margin : 73.0% (+300 basis points)

Revenue by segment:

- Data Center : 35.58 billion USD (+93%)

- Gaming : 2.54 billion USD (–11%)

- Professional Visualization : 511 million USD (+10%)

- Automotive : 570 million USD (+103%)

Jensen Huang commented on the Q4 fiscal 2025 earnings report, saying that “artificial intelligence has been developing at an incredible pace, as agentic AI and physical AI are creating the basis for the next AI wave, which will revolutionise the largest industries”, underscoring the company’s key role in the AI boom, which led to record revenues of 39.30 billion USD. He highlighted the strong results of the Data Center segment, which reached 35.60 billion USD, thanks to demand for the Hopper and Blackwell microarchitecture solutions.

For Q1 fiscal 2026, NVIDIA had projected revenue of 43.00 billion USD (with a possible variance of 2%) and a non-GAAP gross margin of 71.0%, indicating the company’s revenue remained robust. However, the decline in gross margin raised concerns among investors.

NVIDIA Corporation Q1 2026 financial results

On 28 May 2025, NVIDIA released its report for Q1 fiscal 2026, which ended on 27 April 2025. Below are the key figures compared with the corresponding period last year:

- Revenue : 44.06 billion USD (+69%)

- Net income : 18.78 billion USD (+26%)

- Earnings per share : 0.76 USD (+27%)

- Operating profit : 21.63 billion USD (+28%)

- Gross margin : 60.5% (–1,790 basis points)

Revenue by segment:

- Data Center : 39.11 billion USD (+73%)

- Gaming : 3.76 billion USD (+42%)

- Professional Visualization : 509 million USD (+20%)

- Automotive : 567 million USD (+72%)

NVIDIA’s Q1 fiscal 2026 report reinforced the company’s leading position in the global AI race despite serious geopolitical and regulatory obstacles. It was a record-breaking quarter, with revenue reaching 44.06 billion USD, up 69% year-on-year. Growth was primarily driven by continued high demand for accelerated computing and AI infrastructure. The Data Center segment, which includes sales of high-performance GPUs to large cloud providers and corporate clients, generated 39.1 billion USD, up 73% from the previous year.

However, the quarter also saw serious challenges. One of the key negative factors was the US government’s restrictions on the export of advanced AI chips to China. Jensen Huang commented on this situation during a conference call, noting that despite persistent strong demand from China, the company was unable to meet it due to regulatory constraints. As a result, NVIDIA wrote off inventory worth 4.5 billion USD, primarily related to H20 chips intended for the Chinese market, and estimated lost revenue for the quarter at approximately 2.5 billion USD. For Q2 fiscal 2026, the company had projected a revenue loss of 8 billion USD due to the restrictions.

Huang also expressed concerns about the broader fallout from these trade restrictions, warning that the ban on advanced AI technology exports could have inadvertently accelerated the development of China’s domestic semiconductor industry, which might ultimately have undermined US global technological leadership. Huang also emphasised that revenue from China accounted for a smaller part of NVIDIA’s total sales at the time, with losses offset mainly by growing demand in North America, Europe, and newly emerging markets, including the Middle East.

For Q2 fiscal 2026, NVIDIA had expected revenue of approximately 45 billion USD. This forecast reflected the active rollout of the new Blackwell chip architecture, which, according to Huang, was already experiencing unprecedented demand from hyperscalers, government AI development programs, and major corporate clients. The company anticipated that strong demand for hardware solutions and AI software products would persist through the end of the fiscal year.

However, despite continued technological leadership and robust demand for AI solutions, NVIDIA faced signs of a slowdown in its key Data Center segment. Although revenue rose 73% year-on-year, the segment fell short of market expectations, which constrained the stock’s growth following the report’s release. This may have indicated the start of a normalisation phase after the rapid acceleration driven by the AI boom.

Nevertheless, the company continued to demonstrate exceptional financial performance and remained at the forefront of technological innovation. Losses related to export restrictions on China were severe but were offset mainly by global demand and the rollout of the next-generation Blackwell architecture. NVIDIA’s strategy to diversify its client base and actively expand into regions with rising AI initiatives forms a strong foundation for sustainable growth in fiscal 2026 and beyond.

NVIDIA Corporation Q2 2026 financial results

On 27 August 2025, NVIDIA released its Q2 2026 financial results for the quarter ended 27 July 2025. Key figures compared with the same period last year are as follows:

- Revenue : 46.74 billion USD (+56%)

- Net income : 26.42 billion USD (+59%)

- Earnings per share (non-GAAP) : 1.05 USD (+56%)

- Operating profit : 30.16 billion USD (+30%)

- Gross margin : 72.7% (–300 bps)

Revenue by segment:

- Data Center : 41.09 billion USD (+56%)

- Gaming : 4.28 billion USD (+48%)

- Professional Visualization : 601 million USD (+32%)

- Automotive : 586 million USD (+69%)

- OEM & Other : 173 million USD (+97%)

NVIDIA reported strong results for Q2 2026. Revenue reached 46.7 billion USD (+6% q/q, +56% y/y). The main driver was the data centre segment, which posted 41.1 billion USD (+5% q/q, +56% y/y), with growth supported by Blackwell chip shipments (the Blackwell Data Center subsegment rose 17% sequentially). Gross margin was 72.4% GAAP and 72.7% non-GAAP. Adjusted earnings per share (non-GAAP EPS) came in at 1.05 USD, although this included a one-time positive effect from the release of a previously established 180 million USD reserve related to H20 chip deliveries to China. Excluding this one-off, EPS would have been 1.04 USD. Gaming revenue increased to 4.3 billion USD, Professional Visualization reached 601 million USD, and Automotive was 586 million USD.

The company emphasised that there were no H20 chip sales to China during the quarter, and forecasts for the next period also exclude these sales. The board approved an increase in the share repurchase program by a further 60 billion USD. The dividend was set at 0.01 USD per share, with a record date of 11 September 2025 and a payment date of 2 October 2025.

The outlook for Q3 2026 projected revenue of approximately 54.0 billion USD (±2%), a non-GAAP gross margin of around 73.5% (±50 bps), non-GAAP operating expenses of roughly 4.2 billion USD, other income around 500 million USD, and an effective tax rate of roughly 16.5% (±1 pp). The company expected to close the financial year with a non-GAAP margin of around 73.5%. It is important to note that this forecast did not factor in potential H20 chip sales to China. For investors, this meant that management’s base-case scenario was built solely on current global demand and the acceleration of new Blackwell chip shipments, without assuming a recovery in the Chinese market.

NVIDIA Corporation Q3 2026 financial results

On 19 November 2025, NVIDIA published its Q3 financial results for fiscal year 2026, which ended on 26 October 2025. The key figures, compared with the same period in the previous year, are as follows:

- Revenue : 57.01 billion USD (+62%)

- Net income (non-GAAP) : 31.76 billion USD (+59%)

- Earnings per share (non-GAAP) : 1.30 USD (+60%)

- Operating profit (non-GAAP) : 37.75 billion USD (+62%)

- Gross margin (non-GAAP) : 73.6% (–140 bps)

Revenue by segment:

- Data Center : 51.22 billion USD (+66%)

- Gaming : 4.27 billion USD (+30%)

- Professional Visualisation : 760 million USD (+56%)

- Automotive : 592 million USD (+32%)

- OEM & Other : 174 million USD (+79%)

NVIDIA’s Q3 FY2026 results came in ahead of market expectations. Revenue reached approximately 57 billion USD, and non-GAAP EPS was 1.30 USD – both exceeding analyst forecasts. The company once again delivered strong growth in both revenue and profit.

The primary source of income remains the Data Centre segment, which generated 51.2 billion USD, up 66% year-on-year and accounting for nearly 90% of total revenue. Other segments, including Gaming, continue to grow at a slower pace and make up a smaller share of the total.

Management issued a strong outlook for Q4 FY2026, forecasting revenue of around 65 billion USD and a gross margin of about 75% – also above analyst expectations. According to management, NVIDIA has already secured confirmed orders for its new Blackwell and Rubin chips worth around 500 billion USD through the end of 2026, and demand for AI hardware continues to exceed supply.

Management also emphasised that the current growth does not appear to be a bubble: clients continue to invest heavily in infrastructure, while production capacity remains a limiting factor. However, analysts caution that growth rates may eventually slow due to power-supply constraints and market saturation. For now, based on the Q3 results and guidance for the next quarter, demand for NVIDIA’s products remains extremely strong.

Fundamental analysis of NVIDIA Corporation

Below is the fundamental analysis of NVIDIA Corporation (NVDA) based on Q3 FY2026 results:

- Liquidity and access to financing : at the end of Q3 FY2026, NVIDIA held 60.6 billion USD in cash, equivalents, and marketable securities – an exceptionally strong liquidity buffer, even by the standards of a company of this scale. During the quarter, operating cash flow reached 23.8 billion USD, while free cash flow amounted to 22.1 billion USD. This shows that NVIDIA’s cash generation is driven by sustained profitability rather than one-off asset disposals.

The company is not reliant on borrowing: credit rating agencies assign it a high investment-grade rating, which ensures low interest rates and strong market confidence. In practice, NVIDIA fully funds its investments through internal resources and can continue expanding without external capital, even under less favourable market conditions.

- Debt and leverage : NVIDIA’s debt load is minimal relative to its scale. At the end of the quarter, long-term liabilities stood at 7.47 billion USD, down from the previous quarter. Meanwhile, with 60.6 billion USD in cash and investments, the company’s net cash position is approximately +53 billion USD – a rare situation for a corporation of this size. Interest payments place no pressure on the company’s finances: NVIDIA not only covers its debt entirely from profit but also earns additional income from investing its surplus cash.

From a financial stability standpoint, NVIDIA faces virtually no debt risk. The main potential vulnerability lies not in the balance sheet but in the cyclicality of demand for AI infrastructure.

- Cash flow, dividend coverage, and share repurchases :

NVIDIA’s financial strength is most evident in its cash flow. In Q3, the company generated free cash flow of 22.1 billion USD – more than enough to fund both investment and shareholder returns. During the quarter, NVIDIA returned 12.7 billion USD to shareholders, including 12.5 billion USD in share buybacks and around 243 million USD in dividends.

Over the first nine months of FY2026, total capital returns reached 37 billion USD, with 62.2 billion USD remaining under the current authorisation, allowing the company to continue its aggressive buyback program.

Dividends remain symbolic at 0.01 USD per share per quarter and account for only a negligible share of cash flow. While NVIDIA could easily increase payouts, management prefers buybacks – a logical choice given the high return on capital and growth potential.

Fundamental analysis of NVIDIA – conclusion:

As of Q3 FY2026, NVIDIA demonstrates an exceptionally strong financial position. The company holds vast liquidity reserves, maintains a net cash position, carries minimal debt, and generates record profitability and robust free cash flow – sufficient to fund both growth and shareholder returns.

The key question for NVIDIA is not financial stability but the sustainability of the AI market – namely, how long the data centre investment boom can last. Even if growth moderates, the company’s strong balance sheet and consistent cash generation give it significant resilience, enabling NVIDIA to weather a potential slowdown without increasing debt or diluting shareholders.

Analysis of key valuation multiples for NVIDIA Corporation

Below are NVIDIA’s key valuation multiples based on Q3 FY2026 results, calculated using a share price of 178 USD.

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | The price of 1 USD of earnings over the past 12 months | 44.2 | ⬤ Expensive relative to the broader market but partly justified by exceptional earnings growth. However, the margin for safety is limited. |

| P/S (TTM) | The price of 1 USD of annual revenue | 23.1 | ⬤ Very high valuation relative to sales, even for a leader in the AI cycle. Any slowdown in growth could sharply impact the share price. |

| EV/Sales (TTM) | Enterprise value to revenue, including debt | 22.8 | ⬤ A massive premium reflecting expectations of continued margin expansion and future growth. |

| P/FCF (TTM) | The price of 1 USD of free cash flow | 56.0 | ⬤ Expensive on a cash-flow basis – the market is already pricing in a substantial future increase in free cash generation. |

| FCF Yield (TTM) | Free cash flow yield for shareholders | 1.8% | ⬤ Low yield – the stock is expensive relative to the company’s current cash generation. |

| EV/EBITDA (TTM) | Enterprise value to EBITDA | 37.9 | ⬤ Extremely high valuation, even given NVIDIA’s exceptional profitability. |

| EV/EBIT (TTM) | Enterprise value to operating profit | 38.8 | ⬤ Elevated valuation, sustainable only if current growth rates persist. |

| P/B | Price to book value | 36.4 | ⬤ Large premium to book value. Less relevant for NVIDIA, but indicative of market overheating driven by high expectations. |

| Net Debt/EBITDA | Debt load relative to EBITDA | –0.46 | ⬤ Net cash position – virtually no debt risk. |

| Interest Coverage (TTM) | Operating profit to interest expense ratio | 444 | ⬤ Interest costs are negligible relative to earnings – financial stability remains excellent. |

Analysis of NVIDIA’s valuation multiples – conclusion

From a financial standpoint, NVIDIA remains exceptionally strong. The company generates substantial profit, produces around 77 billion USD in free cash flow over the past twelve months, maintains a net cash position, and comfortably services all its debt – indicating a genuinely high-quality business.

However, the current market valuation is extremely high. Nearly all key multiples (P/S, EV/Sales, EV/EBIT, and P/FCF) are at levels typically seen only during rapid-growth phases. This means the share price is justified only if the company can sustain robust revenue and profit growth in the Data Centre segment for several more years.

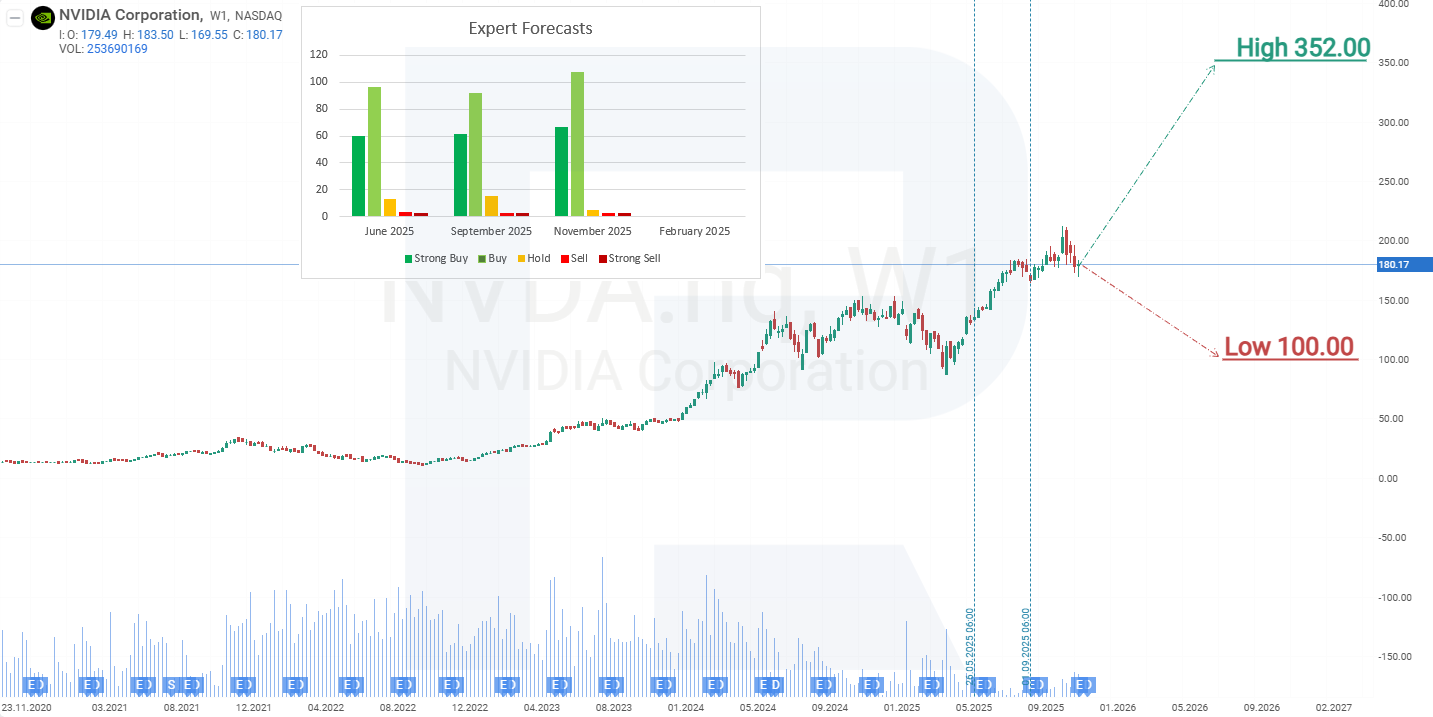

Expert forecasts for NVIDIA Corporation

stock

- Barchart : 42 out of 47 analysts rated NVIDIA shares as a Strong Buy, 2 as a Buy, 2 as Hold, and 1 as a Strong Sell. The highest price target is 352 USD, and the lowest is 140 USD.

- MarketBeat : 50 out of 53 analysts gave the stock a Buy rating, 2 a Hold, and 1 a Sell. The highest price target is 352 USD, and the lowest is 205 USD.

- TipRanks : 39 out of 41 analysts rated the stock as a Buy, 1 as Hold, and 1 as Sell. The highest price target is 352 USD, and the lowest is 200 USD.

- Stock Analysis : 24 out of 42 analysts rated the shares as a Strong Buy, 16 as a Buy, 1 as Hold, and 1 as a Strong Sell. The highest price target is 352 USD, and the lowest is 100 USD.

NVIDIA Corporation stock price forecast for 2025

On 29 October 2025, NVIDIA’s share price reached a peak of around 210 USD before starting to decline. Even the publication of a strong Q3 FY2026 earnings report failed to halt the downward trend. Additional pressure on NVIDIA’s stock has come from Alphabet’s expanding presence in the AI market and from elevated valuation multiples, which imply an overly optimistic growth scenario needed to justify the company’s current valuation.

A key factor supporting NVIDIA’s share price remains its share buyback program and strong cash-generating ability, which the company channels in part into repurchasing its own shares. However, if investors begin to diversify their portfolios and rotate into Alphabet stock, even large-scale buybacks may not be sufficient to prevent further declines in NVIDIA’s share price.

From a fundamental perspective, the market is gradually shifting from a phase of euphoria to one of reassessing expectations. Investors are starting to factor in the risks of an AI-cycle slowdown, intensifying competition from hyperscalers, and limited scope for further multiple expansion. In this environment, NVIDIA remains the industry leader, but it is no longer the only game in town when it comes to investing in artificial intelligence.

Based on the current performance of NVIDIA shares, the potential scenarios for 2025 are as follows:

The base-case forecast for NVIDIA shares anticipates a rise towards resistance at around 200 USD, followed by a short-term correction to support near 166 USD. Given the company’s large-scale share buyback program, long-term chip supply contracts for AI systems, and dominant market position, investor interest in NVIDIA’s stock is expected to remain strong. Consequently, a rebound from support at 166 USD could lead to renewed growth towards 210 USD.

The alternative forecast for NVIDIA stock envisions a break below support at 166 USD. Such a move could intensify negative market sentiment and trigger a wave of selling, pushing the share price down to the next support level at 130 USD.

NVIDIA Corporation stock analysis and forecast for 2025Alphabet Inc. challenges NVIDIA Corporation’s dominance

Alphabet Inc. (NASDAQ: GOOG) is now one of the key strategic risks to NVIDIA’s dominant position in the AI infrastructure market. Formally, Google remains a major client of NVIDIA, but it is simultaneously building its own alternative ecosystem. Its TPU accelerators have already reached their seventh generation, while Axion processors based on Arm architecture allow certain server workloads to run without using NVIDIA solutions. The more successful these developments become, the less Alphabet depends on GPU purchases – meaning that part of the future demand for AI hardware could bypass NVIDIA altogether.

The risk is particularly significant because Google no longer sells only cloud capacity, but a fully integrated AI platform. TPU and Axion are now part of Google Cloud’s AI Hypercomputer concept, meaning clients receive ready-made solutions (such as Vertex AI, Gemini, and others) without needing to consider whose chips perform the computations. As developers and enterprises adopt this technology stack, the unique advantage of NVIDIA’s CUDA ecosystem gradually erodes. For many use cases, NVIDIA’s solutions are no longer the only viable option, and the company increasingly faces competition from other technology giants building their own vertically integrated systems.

Another concern lies in the scale of Alphabet’s capital expenditure. Google is significantly increasing its investment in data centres, network infrastructure, and chip manufacturing – rather than in purchasing NVIDIA GPUs. Major partners such as Anthropic have already demonstrated that large language models can be effectively trained on TPUs. If other technology leaders follow this trend, NVIDIA’s share of global AI hardware investment could decline more rapidly than the market currently expects.

Nevertheless, this threat should not be seen as critical. In the coming years, Alphabet will remain not only a competitor but also one of NVIDIA’s largest customers, as many computational workloads remain better suited to NVIDIA’s chips. The maturity of the CUDA ecosystem, the extensive developer base, and the ease of migrating projects between cloud platforms continue to give NVIDIA a competitive advantage.

From a fundamental analysis perspective, the ceiling for ultra-optimistic scenarios is becoming clearer: the more successful Alphabet’s in-house chip strategy becomes, the greater the pressure on NVIDIA’s future growth rates, market share, and pricing power. This is not a risk of business collapse, but rather the risk that NVIDIA’s long-term financial results will prove very strong instead of extraordinary, while much of the current valuation is based on the latter expectation.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.