CrowdStrike maintains strong financial performance, but shares remain overvalued

CrowdStrike Holdings reported strong results for Q3 of fiscal year 2026, exceeding market expectations for both revenue and earnings. The company continues to show steady growth in annual recurring revenue (ARR) and maintains high profitability; however, its shares appear overvalued at current price levels.

CrowdStrike Holdings, Inc. (NASDAQ: CRWD) delivered strong results for Q3 of fiscal year 2026 (the quarter ended 31 October 2025), slightly ahead of market expectations. Revenue totalled around 1.23 billion USD (+22% y/y), compared with analysts’ forecasts of 1.21–1.22 billion USD, while non-GAAP earnings per share (EPS) reached 0.96 USD versus expectations of around 0.94 USD.

The company maintained solid profitability: non-GAAP net income totalled 245 million USD, and the operating margin remained around 21%. The subscription business continues to form the core of its model – annual recurring revenue (ARR) rose to 4.92 billion USD (+23% y/y), with new ARR additions of 265 million USD for the quarter, marking a record level and highlighting robust demand for the Falcon platform and its add-on modules.

For Q4 FY2026, management expects revenue of 1.29–1.30 billion USD and non-GAAP EPS of 1.09–1.11 USD. The full-year guidance has been raised to revenue of 4.80–4.81 billion USD and non-GAAP EPS of 3.70–3.72 USD, reflecting expectations of continued double-digit growth and stable profitability.

This article examines CrowdStrike Holdings, its business model, and includes a fundamental analysis of the company’s results. It also includes a technical analysis of CRWD shares based on current price dynamics, forming the basis for the CrowdStrike Holdings share price forecast for 2026.

About CrowdStrike Holdings, Inc.

CrowdStrike Holdings, Inc., founded in 2011, is a US-based cybersecurity company. It is known for providing cloud-based solutions that protect against cyberattacks, information security threats, and e-commerce fraud.

On 12 June 2019, CrowdStrike went public on the NASDAQ exchange under the CRWD ticker symbol. Its share price surged by 70% on the first day of trading, closing at 58 USD.

The company’s flagship product is the CrowdStrike Falcon platform. This cloud-based cybersecurity solution utilises artificial intelligence (AI), machine learning, and big data analytics to detect, neutralise, and prevent cyber threats in real time.

Image of the company name CrowdStrike Holdings, Inc.Key business segments of CrowdStrike Holdings, Inc.

CrowdStrike Holdings’ key lines of business include:

- Endpoint security : CrowdStrike Falcon provides security for electronic devices, including computers, servers, and mobile devices. It helps detect and prevent unauthorised intrusions such as viruses, ransomware, and other malicious software.

- Incident management and response : the company provides services for the rapid response to security incidents and detailed investigations of cyberattacks. This enables organisations to address the consequences of data breaches or system compromises.

- Threat intelligence : CrowdStrike provides information analytics and cyber threat data, helping organisations better understand attack sources, trends, and existing vulnerabilities.

- Cloud protection : the company’s solutions secure data and infrastructure across cloud environments, including platforms such as AWS, Microsoft Azure, and Google Cloud.

CrowdStrike Holdings, Inc.’s main revenue streams

The main revenues reported by CrowdStrike include:

- Software as a Service (SaaS) subscription : CrowdStrike’s primary revenue stream comes from subscriptions to the CrowdStrike Falcon platform. This allows clients to flexibly use its cloud-based solutions, paying for access based on the number of protected devices or other parameters.

- Professional services : the company also earns from consulting, incident management, and security system audits.

CrowdStrike Holdings, Inc. Q2 FY2025 report

CrowdStrike Holdings delivered strong results for Q2 fiscal 2025. Below are the key figures compared to the same period last year:

- Revenue : 963.90 million USD (+32%)

- Net income : 260.76 million USD (+44%)

- Earnings per share : 1.04 USD (+40%)

- Gross margin : 75.37% (+133 basis points)

- Subscription revenue : 918.30 million USD (+33%)

- Professional services revenue : 45.60 million USD (+10%)

Compared to the previous year, the company demonstrated solid growth in revenue, profitability, and subscription revenue, confirming the strong demand for CrowdStrike’s cybersecurity solutions. Clients’ subscriptions to the company’s services remain its primary revenue stream.

Following the software incident, CrowdStrike’s management revised its 2024 revenue forecast downwards. Annual revenue was projected to range between 3.89 and 3.90 billion USD, lower than the previous forecast of 3.97–4.00 billion USD. Adjusted EPS was expected to be between 3.61 and 3.65 USD, down from the prior estimate of 3.88 USD. The company’s management explained the downward revision due to a potential negative impact from the payment of 60 million USD in compensation to clients related to the outage.

CrowdStrike Holdings, Inc. Q3 FY2025 report

On 26 November 2024, CrowdStrike Holdings, Inc. released its report for Q3 of fiscal 2025, which ended on 31.10.2024. Below is a summary of the report’s key data:

- Revenue : 1.01 billion USD (+29%)

- Net income : 234.25 million USD (+18)

- Earnings per share : 0.93 USD (+13)

- Gross margin : 74.75% (–79 bps)

- Subscription revenue : 962.73 million USD (+31%)

- Professional services revenue : 47.44 million USD (–9%)

In the Q3 FY2025 report, CrowdStrike’s management highlighted strong growth across key financial indicators. Notably, the incident, caused by a faulty software update that affected Microsoft Windows systems worldwide and led to significant disruptions, did not have a severe impact on the company’s revenue or profit.

Given the increased demand for cybersecurity solutions, management remains confident in CrowdStrike’s long-term growth trajectory. The revenue forecast for Q4 FY2025 has been raised to 1.02–1.03 billion USD, with income expected to be between 210.90 and 215.80 million USD.

CEO George Kurtz reaffirmed that the company remains focused on AI-driven cybersecurity innovations and on expanding its product portfolio. CrowdStrike is also expected to maintain strong momentum in attracting and retaining clients through the continued development of cloud security and personal data protection solutions.

CrowdStrike Holdings, Inc. Q4 FY2025 report

On 4 March, CrowdStrike Holdings, Inc. released its report for Q4 fiscal 2025, which ended on 31.01.2024. Below are its key highlights:

- Revenue : 1.06 billion USD (+25%)

- Net income : 260.95 million USD (+10%)

- Earnings per share : 1.03 USD (+8%)

- Gross margin : 74.12% (–121 bps)

- Subscription revenue : 1.00 billion USD (+26%)

- Professional services revenue : 50.22 million USD (+2%)

In comments on the report, CEO George Kurtz highlighted a 23% increase in annual recurring revenue (ARR) to 4.24 billion USD, including a record 223.90 million USD of new net ARR. Kurtz said, “CrowdStrike had a great Q4, ending an amazing year.” He emphasised that the introduction of AI in cybersecurity is becoming critical, with leak prevention requiring a platform initially built on such technologies.

CFO Burt Podbere highlighted the company’s stability, reporting 31% annual growth in subscription revenue, an operating cash flow of 1.38 billion USD, and a free cash flow of 1.07 billion USD. He said, “These results underscore our operating discipline and position us well to deliver quality services to clients and shareholders.”

CrowdStrike anticipates significant growth in the 2026 fiscal year, driven by demand for the Falcon platform and expanding market opportunities. In Q1 FY2026, which ends on 30 April 2025, revenue is projected to grow by 25% to 1.05 billion USD. Operating profit is expected to range between 252.80 million USD and 258.10 million USD, with diluted EPS between 0.98 USD and 0.99 USD. For the full fiscal year, revenue growth may reach 23-24%, between 4.63 billion USD and 4.67 billion USD, and operating profit is projected to be between 1.09 billion USD and 1.13 billion USD, with EPS between 4.27 USD and 4.40 USD.

CrowdStrike Holdings, Inc. Q1 FY2026 report

On 3 June, CrowdStrike Holdings, Inc. published its report for Q1 of fiscal year 2026, which ended on 30 April 2025. Key figures are as follows:

- Revenue : 1.10 billion USD (+20%)

- Net profit : 184.70 million USD (–6%)

- Earnings per share : 0.73 USD (–7%)

- Gross margin : 73.80% (–177 bps)

- Subscription segment revenue : 1.05 billion USD (+20%)

- Professional services segment revenue : 52.66 million USD (+8%)

CrowdStrike Holdings’ Q1 FY2026 financial results demonstrate steady growth and support a positive outlook for investors in the cybersecurity sector. Annual recurring revenue (ARR) reached 4.44 billion USD, up 22% year-on-year. The customer retention rate of 97% underscores the enduring value of the AI-powered, cloud-based Falcon platform, which continues to strengthen the company’s position as a leader in cyber threat protection.

The Falcon Flex subscription model delivered significant growth, with total deal value reaching 3.2 billion USD across more than 820 accounts – six times higher than the previous year. This offering is driving broader adoption of the platform’s modules: 48% of customers now use six or more modules, 32% use seven or more, and 22% use eight or more.

The company’s results demonstrated strong liquidity. Operating cash flow reached a record 384 million USD, while free cash flow stood at 279 million USD. These funds will support a 1 billion USD share repurchase program approved by the board of directors, reflecting management’s confidence in the company’s long-term stability and financial strength. At current share prices, the company could repurchase approximately 3% of its outstanding capital. Cash reserves of 4.61 billion USD provide financial flexibility for further investments and strategic initiatives.

The quarter also included a record-breaking major deal with a Fortune 100 healthcare company that had previously used Microsoft solutions and experienced a security breach. The CrowdStrike team rapidly deployed over 46,000 sensors, stopped the attack, and migrated the client to the Falcon platform – including Falcon Complete Identity, Falcon Cloud Security, LogScale Next-Gen SIEM, and Charlotte AI modules – replacing more than three previous vendors and reducing the number of agents by 75%.

The Q2 FY2026 forecast guided to revenue in the range of 1.145–1.152 billion USD (up 17–18% year-on-year) and non-GAAP EPS of 0.82–0.84 USD. For the full fiscal year, revenue is expected at 4.74–4.80 billion USD (up 23–25%), with non-GAAP EPS projected at 3.44–3.56 USD, pointing to potential margin improvement in the second half of the year. Growth in net new ARR is also expected to accelerate, supported by the success of Falcon Flex and the company’s strong competitive advantages.

The incident of 19 July 2024, caused by an incorrect update to the Falcon sensor, affected the company’s financial performance, leading to losses of 39.7 million USD and raising the likelihood of reputational risks. Nevertheless, strategic partnerships with Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOG), and NVIDIA (NASDAQ: NVDA), together with ongoing market consolidation around the CrowdStrike platform, reinforce the company’s position.

For investors, the report confirmed the company’s resilient business model, supported by strong cash flow, a flexible product offering, and a strategic share buyback program, making CrowdStrike Holdings an attractive investment opportunity in the cybersecurity sector.

CrowdStrike Holdings, Inc. Q2 FY2026 financial report

On 27 August, CrowdStrike Holdings, Inc. released its report for Q2 FY2026, which ended on 31 July 2025. The key figures are as follows:

- Revenue : 1.17 billion USD (+21% year-on-year)

- Net income : 237.40 million USD (+7% year-on-year)

- Earnings per share (EPS) : 0.93 USD (+6% year-on-year)

- Gross margin : 73.46% (–191 bps)

- Subscription revenue : 1.10 billion USD (+20% year-on-year)

- Professional services revenue : 66.00 million USD (+45% year-on-year)

In Q2 FY2026, the company delivered strong results: revenue reached 1.17 billion USD, up 21% year-on-year and 6% higher than in the previous quarter. This exceeded analyst expectations on both revenue and earnings, with adjusted EPS at 0.93 USD versus forecasts of around 0.83–0.91 USD. Subscriptions remained the primary revenue driver at approximately 1.10 billion USD (94% of total revenue), while professional services contributed about 66 million USD. Growth was slightly faster than in the prior quarter, primarily driven by the acceleration of the subscription business (Annual Recurring Revenue, ARR).

Total ARR reached 4.66 billion USD, an increase of 20% year-on-year, while net new ARR for the quarter came in at a record 221 million USD. Management highlighted the acceleration in new subscription growth and expects this metric to increase at a rate of at least 40% year-on-year in the second half of the fiscal year.

The subscription business demonstrated strong gross margins – 77% under GAAP and 80% under non-GAAP. The overall adjusted gross margin was about 78%. The non-GAAP operating margin stood at 22%, slightly below last year’s level, with operating profit on this measure at 255 million USD. On a GAAP basis, the company reported an operating loss of 113 million USD, driven by one-off expenses related to last year’s Falcon outage as well as elevated personnel and stock-based compensation costs. Cash flow remained robust: free cash flow totalled 284 million USD, representing around 24% of revenue.

In the outlook for Q3 FY2026, revenue was projected in the range of 1.208–1.218 billion USD, slightly below analyst consensus (around 1.23 billion USD), while adjusted EPS was projected at 0.93–0.95 USD, ahead of market expectations. Management did not provide precise guidance on free cash flow for the quarter but expects to achieve a margin of around 27% in Q4 and above 30% in FY2027. For the full fiscal year 2026, revenue was projected at 4.749–4.806 billion USD and adjusted EPS at 3.60–3.72 USD. Management also highlighted that new subscription growth was expected to accelerate in the second half of the year.

CrowdStrike Holdings, Inc. Q3 FY2026 financial results

On 2 December, CrowdStrike Holdings, Inc. released its financial results for Q3 of fiscal year 2026, which ended on 31 October 2025. The key figures are as follows:

- Revenue : 1.23 billion USD (+22%)

- Net income : 245.40 million USD (+29%)

- Earnings per share : 0.96 USD (+26%)

- Gross margin : 74.96% (+21 bps)

- Subscription revenue : 1.17 billion USD (+21%)

- Professional services revenue : 65.50 million USD (+38%)

CrowdStrike’s Q3 FY2026 report was strong and slightly ahead of market expectations. Revenue grew 22% year-on-year to 1.23 billion USD, exceeding the consensus estimate of roughly 1.21–1.22 billion USD. Adjusted earnings per share (non-GAAP EPS) reached 0.96 USD, above expectations of 0.94 USD. Non-GAAP operating income rose to 264.6 million USD, with an operating margin of 21% (up 1 p.p. year-on-year), while non-GAAP net income totalled 245.4 million USD. This indicates that, on an adjusted basis, the business is already consistently profitable while sustaining double-digit revenue growth.

Key subscription metrics also improved: annual recurring revenue (ARR) reached 4.92 billion USD (+23% y/y), while quarterly net new ARR was a record 265 million USD (+73% y/y), reflecting strong demand for the Falcon platform and continued cross-selling of modules to existing clients.

From a cash-flow perspective, the quarter was solid: operating cash flow totalled 398 million USD, free cash flow was 296 million USD, and cash and equivalents on the balance sheet reached 4.8 billion USD.

On a GAAP basis, the company still reported a small net loss (–34 million USD), mainly due to substantial stock-based compensation expenses and residual costs related to the Windows update incident in July 2024. However, these items are largely non-cash and one-off and therefore do not detract from the company’s strong non-GAAP and cash performance.

Management issued a confident outlook: for Q4 FY2026, the company expects revenue of 1.29–1.30 billion USD and non-GAAP EPS of 1.09–1.11, both above current analyst estimates. The full-year guidance was raised to revenue of 4.80–4.81 billion USD and non-GAAP EPS of 3.70–3.72.

In its commentary, the company highlighted growing demand for AI-integrated cybersecurity solutions and the ongoing expansion of Falcon’s capabilities, which it expects will continue to drive ARR and revenue growth.

Fundamental analysis of CrowdStrike Holdings, Inc.

Below is the fundamental analysis of CRWD based on Q3 FY2026 results:

- Liquidity and balance sheet : as of the end of Q3 FY2026 (31 October 2025), CrowdStrike held around 4.8 billion USD in cash and equivalents. Total assets stood at 10.0 billion USD, reflecting significant balance-sheet growth over the year. The company has only one outstanding issue of convertible senior notes totalling approximately 0.7–0.8 billion USD, so its net cash position remains positive. Quarterly interest expenses of about 7 million USD are more than offset by interest income from cash and investments (over 50 million USD), meaning that even at the financing level, CrowdStrike generates net interest income rather than incurring a debt-servicing burden. Overall, the balance sheet appears sound – moderate liabilities, a large base of liquid assets, a positive net cash position, and no refinancing dependence.

- Cash flow and capital allocation : operating cash flow for Q3 FY2026 reached a record 397–398 million USD, up from 326 million USD a year earlier, while free cash flow increased to 296 million USD from 231 million USD. This represents an FCF margin of around 24% of revenue – a high level for a subscription-based software model. Capital expenditure remains relatively low, with the main spending areas being operating costs and R&D rather than heavy investment in hardware or infrastructure, allowing growth to convert efficiently into cash. CrowdStrike pays no dividends and has no major active share-repurchase program, effectively maintaining a strategy of reinvesting free cash flow into expanding the Falcon platform and its AI functionality. This supports financial resilience: there are no fixed capital-return commitments, and if needed, the pace of investment can be moderated to quickly increase free-cash reserves.

- Profitability and margins : quarterly revenue totalled 1.23 billion USD, non-GAAP net income 245 million USD, and non-GAAP EPS 0.96 USD. Gross margin on a non-GAAP basis was 75%, with the subscription business maintaining even higher profitability and non-GAAP operating margin at around 21%. Annual recurring revenue (ARR) reached 4.92 billion USD (+23% y/y), while net new ARR for the quarter was a record 265 million USD (+73% y/y), indicating healthy organic subscription growth – meaning the company combines double-digit revenue growth with a sustained double-digit operating margin and a high share of recurring income.

Fundamental analysis of CRWD – conclusion:

From a financial stability standpoint, CrowdStrike appears confident and well-balanced. The company maintains a strong liquidity buffer, carries minimal debt fully covered by cash, and faces no strain from interest payments. Operating and free cash flow are rising faster than revenue, and FCF remains consistently positive – an impressive figure for a software business.

The main risks for CrowdStrike stem not from its balance sheet but from valuation and competition. The stock trades at a significant premium to the market, and future results depend on sustaining strong demand for cybersecurity solutions and maintaining a technological edge over Microsoft (NASDAQ: MSFT) and Palo Alto Networks (NASDAQ: PANW).

Analysis of key valuation multiples for CrowdStrike Holdings, Inc.

Below are the key valuation multiples for CrowdStrike Holdings for Q3 of the fiscal year 2026, calculated based on a share price of 512 USD:

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | Price paid for 1 USD of earnings over the past 12 months | 138 | ⬤ Extremely expensive – would require many years of sustained profit growth to justify |

| P/S (TTM) | Price paid for 1 USD of annual revenue | 26.8 | ⬤ The Price-to-Sales ratio is exceptionally high, even by top-tier software standards |

| EV/Sales (TTM) | Enterprise value to sales, accounting for debt | 25.9 | ⬤ Similar to P/S: the business is valued at around 26 times annual revenue – a clear sign of market euphoria |

| P/FCF (TTM) | Price paid for 1 USD of free cash flow | 107 | ⬤ On a cash-flow basis, CrowdStrike also looks very expensive, trading at over 100 times annual FCF at the current level |

| FCF Yield (TTM) | Free cash flow yield to shareholders | 0.9% | ⬤ Free cash flow yields less than 1% – effectively a bet on strong future FCF growth |

| EV/EBITDA (TTM) | Enterprise value to operating profit before depreciation and amortisation | 108 | ⬤ The market is paying hundreds of times EBITDA – an extremely high valuation for a mature software company |

| EV/EBIT (TTM) | Enterprise value to operating profit | 123 | ⬤ Over 120 times annual operating profit – virtually no margin of safety, only confidence in future growth |

| P/B | Price to book value | 32.14 | ⬤ The market is paying more than 32 USD for every 1 USD of equity – a very high premium to book value and a clear sign of elevated expectations |

| Net Debt/EBITDA | Debt burden relative to EBITDA | -3.5 | ⬤ Strong liquidity buffer |

| Interest Coverage (TTM) | Ability to cover interest expenses with operating profit | 45 | ⬤ Interest expenses remain very low |

Valuation analysis of CRWD – conclusion

CrowdStrike is a fast-growing, profitable, and financially robust company with high free cash flow and a net cash position supported by minimal debt. The business is genuinely strong.

However, at a share price of 512 USD, nearly all valuation multiples fall into the overvaluation zone. Such pricing can only be justified if the company continues to deliver exceptionally strong revenue and profit growth over the coming years. For investors, this is a high-quality business, but it is extremely expensive and offers virtually no margin of safety in its valuation.

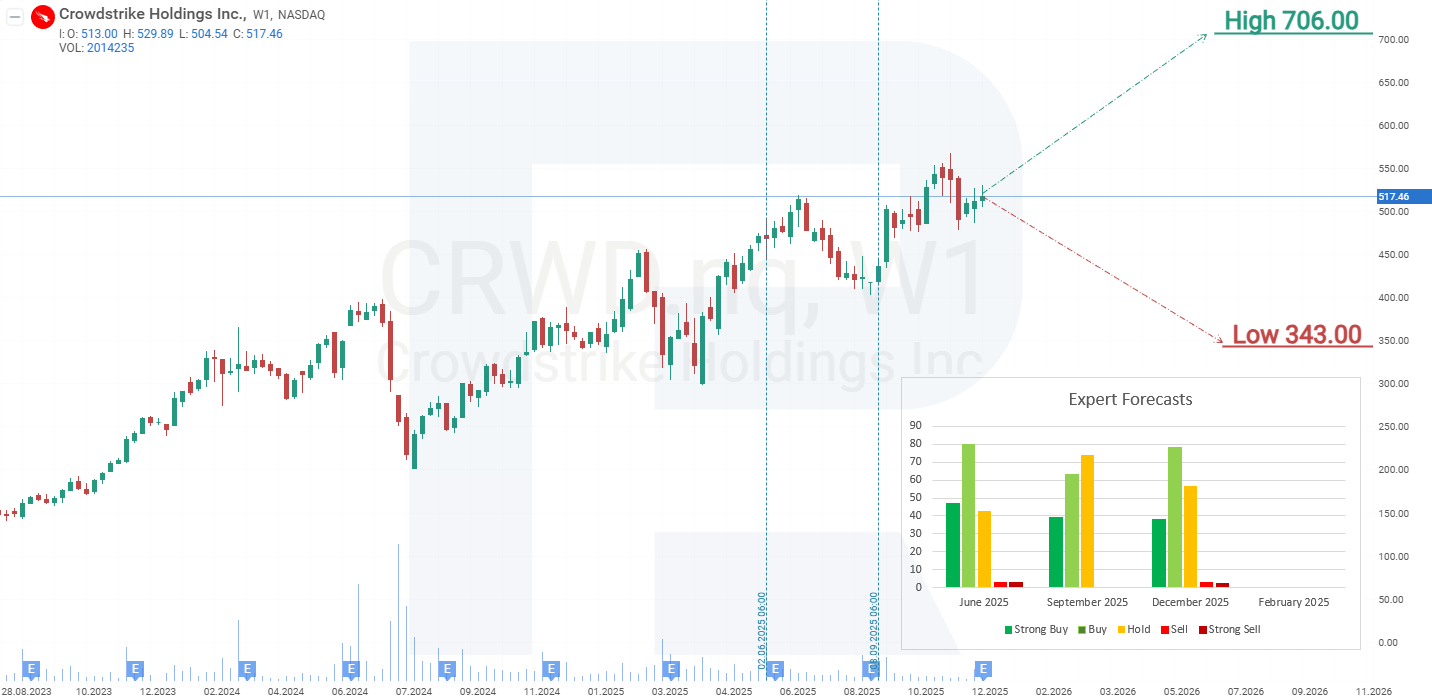

Expert forecasts for CrowdStrike Holdings, Inc. stock for 2025

- Barchart : 26 out of 46 analysts rated CrowdStrike Holdings shares as a Strong Buy, 3 as a Moderate Buy, 15 as Hold, and 2 as Strong Sell. The upper-end forecast is at 706 USD, and the lower-end forecast is at 353 USD.

- MarketBeat : 33 out of 52 analysts gave the stock a Buy rating, 17 recommended Hold, and 2 advised Sell. The upper-end forecast is at 706 USD, and the lower-end forecast is at 353 USD.

- TipRanks : 26 out of 38 analysts rated the stock as Buy, 11 as Hold, and 1 as Sell. The upper-end forecast is at 706 USD, and the lower-end forecast is at 353 USD.

- Stock Analysis : 12 out of 42 experts rated the stock as a Strong Buy, 16 as Buy, and 14 as Hold. The upper-end forecast is at 640 USD, and the lower-end forecast is at 343 USD.

CrowdStrike Holdings, Inc. stock price forecast for 2026

On the weekly chart, CrowdStrike Holdings shares are trading within an upward channel.

At the beginning of November, CRWD shares pulled back from the upper boundary of the channel and began to decline. Additional pressure on the stock has been reinforced by a divergence forming on the MACD indicator. Based on the current performance of CrowdStrike Holdings shares, the potential movement scenarios for 2026 are as follows.

The base-case forecast for CrowdStrike Holdings shares assumes a decline from current levels towards support at 400 USD. A rebound from this level would signal a resumption of growth, with a target at 520 USD. At this point, the next direction will depend on whether the price can break through resistance at 520 USD. If successful, the shares could rise back towards the upper boundary of the channel near 600 USD, continuing to set new all-time highs. However, if resistance proves too strong — which is plausible given the elevated valuation — CRWD shares could correct towards the trendline near 350 USD.

The optimistic forecast for CrowdStrike Holdings stock envisions a breakout above resistance at 565 USD, which coincides with the historical high. In this case, the stock could extend its rally towards the next target level at 700 USD.

CrowdStrike Holdings, Inc. stock analysis and forecast for 2026Risks of investing in CrowdStrike Holdings, Inc.

stock

Investing in CrowdStrike Holdings shares carries certain risks, including the ones listed below:

- Competition in the cybersecurity market : the cybersecurity sector is competitive, with players such as Palo Alto Networks and Zscaler offering similar solutions. If competitors implement innovations at a greater pace, offer lower prices, or combine services more effectively, CrowdStrike could lose market share, which could affect its share price.

- Software failures : the incident on 19 July, caused by an error in the Falcon platform update, was a serious test of CrowdStrike’s reputation. A recurrence of such an event poses risks to revenue growth and could affect CrowdStrike’s ability to secure major contracts, particularly in the public and financial sectors.

- Macroeconomic and geopolitical uncertainty : an economic downturn or budget cuts for businesses could reduce spending on cybersecurity, even if it is considered a critical need. Additionally, geopolitical issues, such as trade restrictions or sanctions affecting CrowdStrike’s international operations, may slow growth in key markets.

- Post-acquisition integration problems : CrowdStrike is actively growing through acquisitions. If integration efforts fail, revenue growth may stall as resources are redirected to resolve these issues.

- Market saturation : as cybersecurity becomes essential for many organisations, the total addressable market could contract if the sector reaches saturation. Should CrowdStrike fail to innovate or expand into new segments, revenue growth is likely to slow.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.