As long as the AI bubble continues to inflate, these AI stocks are likely to retain upside potential

The artificial intelligence sector is in the midst of a major investment cycle that, according to analysts, could persist for several years. The beneficiaries of this expansion are not only Big Tech firms but also the suppliers of equipment, infrastructure, and energy.

According to research by Dell’Oro and Citigroup, total Big Tech investment in artificial intelligence could exceed 2.8 trillion USD by 2029. The bulk of this investment will go into the construction and modernisation of data centres, with their cumulative value projected to reach 1.2 trillion USD.

The main beneficiaries of this investment cycle are high-speed memory manufacturers – SK hynix, Samsung, and Micron Technology, Inc. (NASDAQ: MU). The transition to HBM4 and HBM4E standards is expected to drive revenue and margin growth for suppliers at least through 2027.

However, the AI investment boom is not without its vulnerabilities. The main risks include power shortages, higher capital costs, reliance on a limited number of large clients, and extended payback periods. According to IEA estimates, global data centre electricity consumption could double by 2030 to 945 TWh, requiring more than 500 billion USD in annual investments in energy infrastructure.

This article examines the global investment boom in artificial intelligence, the surge in spending on data centres, semiconductors, and energy systems, and identifies which companies – beyond Big Tech – stand to benefit from this trend. Particular attention is given to Micron Technology, Inc. and the potential impact of AI development on its revenue growth.

The AI and Data Centre investment boom continues

Global spending on artificial intelligence and the infrastructure that supports it continues to accelerate. According to data from IDC – a global research firm specialising in the IT and telecommunications markets – companies worldwide are expected to spend around 307 billion USD on AI in 2025, with that figure projected to rise to 632 billion USD by 2028, more than doubling in just three years.

At the hardware level, analysts at Dell’Oro – a research company focused on telecommunications and network infrastructure – expect total investment in data centre construction and modernisation to reach 1.2 trillion USD by 2029. This implies an average annual growth rate of about 21%, with spending in 2025 already rising by more than 30%, driven mainly by strong investment in AI servers from major cloud providers such as Amazon (NASDAQ: AMZN), Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOG), and Meta (NASDAQ: META).

Separately, Citigroup projects that cumulative Big Tech investment in AI will reach 2.8 trillion USD by 2029, rising to 490 billion USD by 2026. Taken together, these estimates suggest that the current cycle of intensive AI infrastructure expansion is likely to continue for at least another two to three years.

Investor attention turns to Micron Technology, Inc.

Micron Technology, Inc. (NASDAQ: MU) has increasingly attracted investor attention, as memory (HBM/DRAM) remains a critical component and one of the primary beneficiaries of AI technology development. According to data from TrendForce – an analytics firm specialising in semiconductor industry research – the memory market remains an oligopoly dominated by three players: SK hynix, Samsung, and Micron.

Demand for high-bandwidth memory (HBM) is rising rapidly, and by 2026, total shipments could exceed 30 billion gigabits.

In the second half of 2026, HBM4 is expected to become the new industry standard. This means that even if the overall volume of accelerator purchases slows, the amount of HBM per board will continue to increase. For instance, the next-generation NVIDIA Blackwell accelerators will feature 192–288 GB of HBM memory per board, compared with 80 GB in the H100 model. This directly enhances revenue and profitability for HBM suppliers. Micron, meanwhile, is expanding its product portfolio: HBM3E 12-Hi is set to launch in 2025, while HBM4/HBM4E, developed in partnership with TSMC, is planned for release in 2027. These developments suggest sustained demand at least through 2026–2027.

According to TrendForce estimates, DRAM prices are expected to continue rising into Q4 2025. In addition, part of global production capacity will be redirected towards HBM4 manufacturing in the first half of 2026, maintaining shortages in DDR5 and server DRAM. For Micron, this implies a high probability of sustaining high gross margins in the server DRAM and HBM segments throughout 2026, even amid weaker trends in NAND.

Micron Technology, Inc. stock chartOutlook for Micron Technology, Inc.

Over the next 12–18 months, Micron is likely to benefit from a favourable pricing and product environment in the server DRAM and HBM segments. The main growth drivers are the transition to NVIDIA’s Blackwell accelerators and the start of HBM4 memory shipments. Together, these factors provide a positive backdrop for the company’s revenue and profitability.

Over a longer horizon of 18–36 months, growth may begin to normalise following the peak year of 2025, primarily as the first wave of AI data centres reaches saturation and supply balances out. However, the increasing amount of HBM used per accelerator, coupled with the market’s continued shift towards higher-value HBM4 and HBM4E standards, should continue to support average selling prices (ASP) and improve the overall product mix.

Key risks include potential delays in connecting new data centres to the power grid, pauses in capital spending by hyperscalers due to elevated financing costs, and technological improvements that could reduce overall memory demand volumes.

The base-case scenario for Micron does not imply a boom-and-bust cycle, but rather a transition from accelerated growth in 2025 to a sustained period of strong demand and moderate growth through 2026–2027. Micron continues to capitalise on AI growth, primarily through its supply of HBM and server DRAM.

Energy shortages and data centres may slow AI growth

The main threat to the continuation of the AI investment boom is not disillusionment with the technology itself, but the physical constraints of infrastructure – most notably electricity shortages and the challenges associated with expanding data centres. According to data from the IEA (International Energy Agency), total global electricity consumption by data centres could double by 2030, reaching around 945 TWh. Analysts at the Uptime Institute note that server racks are becoming increasingly power-dense, while requirements for electricity supply and cooling are becoming increasingly stringent.

Consulting firm Bain & Company estimates that sustaining the current pace of AI infrastructure development could require more than 500 billion USD in data centre investments annually by 2030, along with 100–200 GW of new generation capacity. This represents an exceptionally high threshold and could become a key limiting factor. If the energy infrastructure fails to keep pace with demand, the commissioning of new facilities is likely to be delayed. This would not eliminate the need for AI infrastructure but could slow its overall expansion.

Beneficiaries of AI in the energy sector

Given that AI expansion is constrained less by financing than by energy availability, power utilities stand out as key beneficiaries. Rising electricity demand could drive higher revenue and profitability for these companies, although in the initial stages, they will need to increase capital expenditure to expand capacity. The main beneficiaries in the energy sector can be grouped as follows:

- Regulated utilities in regions with a high concentration of AI data centres :

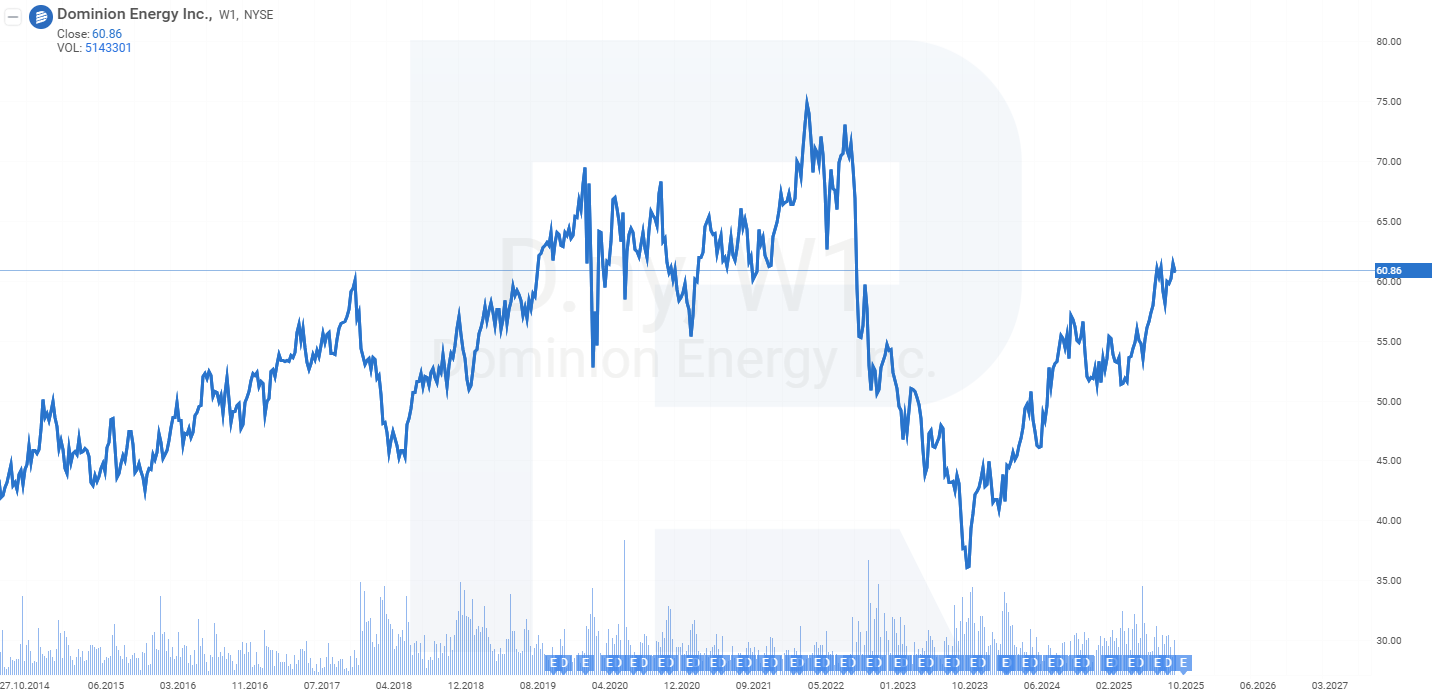

Dominion Energy, Inc. (NYSE: D) – the leading electricity supplier in Virginia, home to the largest data centre cluster in the US. The company is investing tens of billions of USD in grid and generation expansion to meet growing demand, with part of these costs likely to be recovered through regulated tariffs approved by the state regulator.

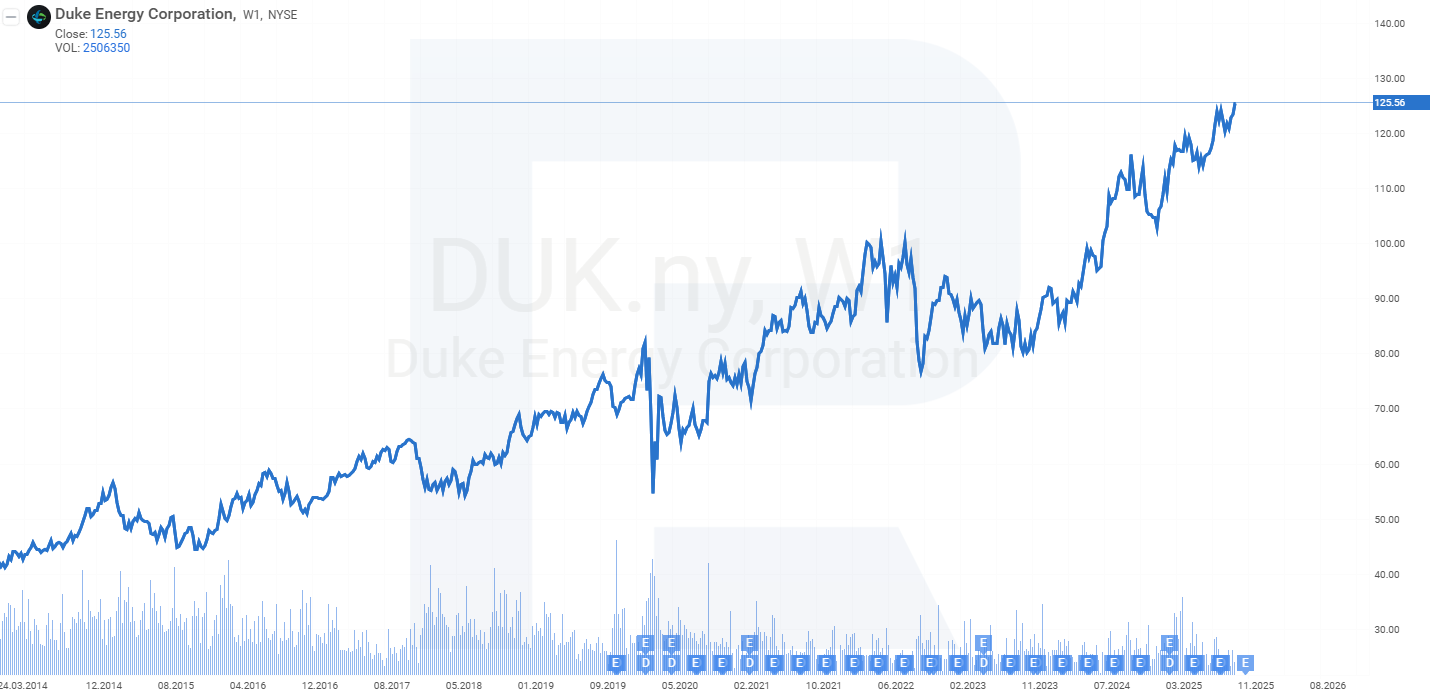

Dominion Energy, Inc. stock chartDuke Energy Corporation (NYSE: DUK) operates across North and South Carolina and is preparing a large-scale expansion of its generation capacity, including the development of small modular nuclear reactors (SMRs) and energy storage systems. According to the company’s internal estimates, electricity demand is currently growing eight times faster than over the previous 15 years, driven by the construction of AI data centres, the transition to electric transport, and the revival of manufacturing.

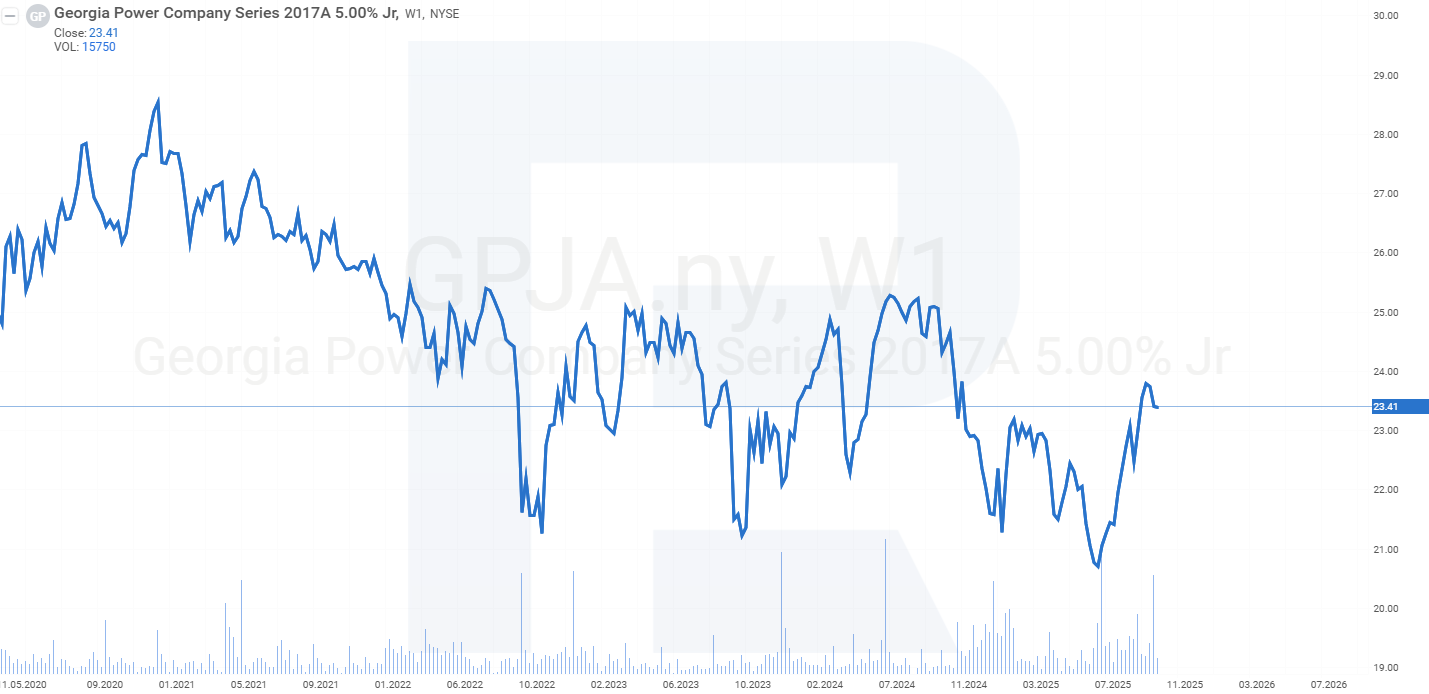

Duke Energy Corporation stock chartIn Georgia, Southern Company (NYSE: SO) subsidiary Georgia Power Company (NYSE: GPJA) has obtained regulatory approval for an investment plan (IRP), which includes retaining part of its thermal generation capacity while expanding the share of renewable energy and batteries. This initiative is aimed at meeting peak load demand from AI data centres.

Georgia Power Company stock chart- Corporate Clean Energy Contracts :

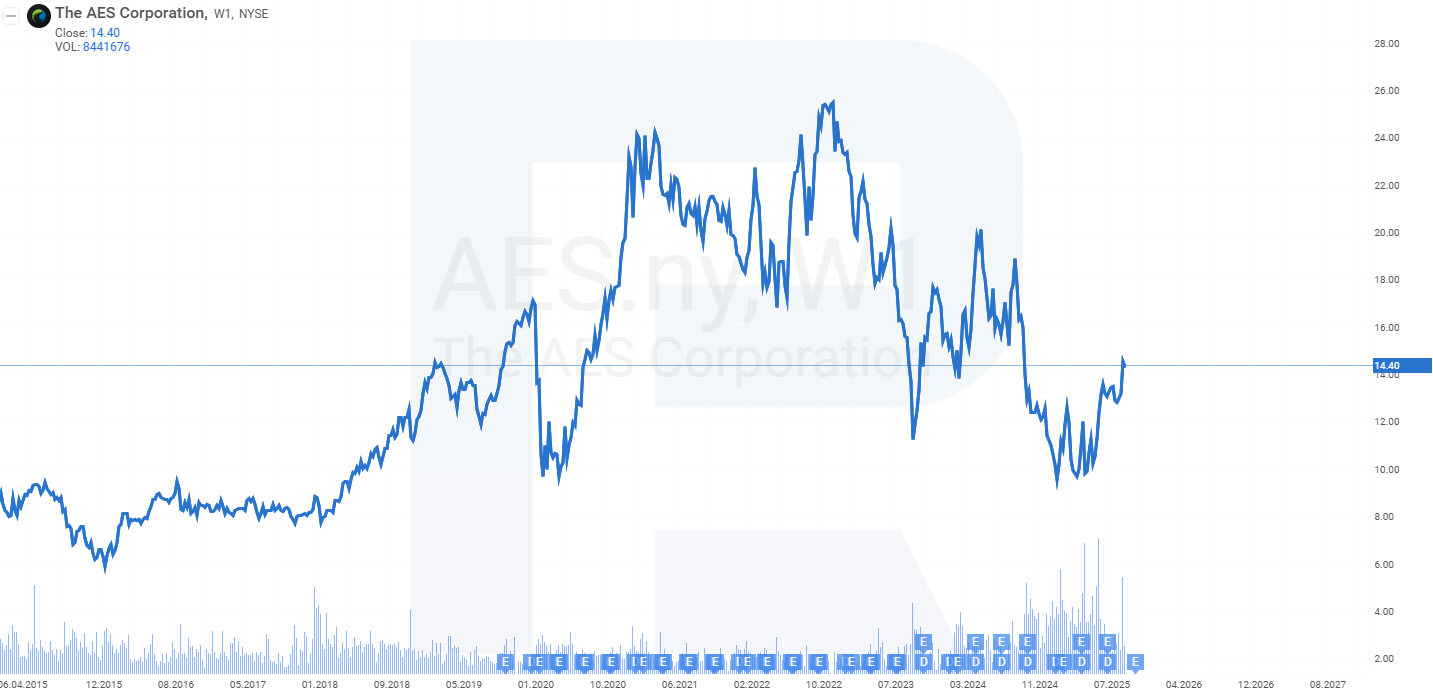

The AES Corporation (NYSE: AES) is actively pursuing long-term agreements with Microsoft and other IT companies for specific data centres. The company is expanding its portfolio of renewable energy and energy storage projects to meet the needs of these clients.

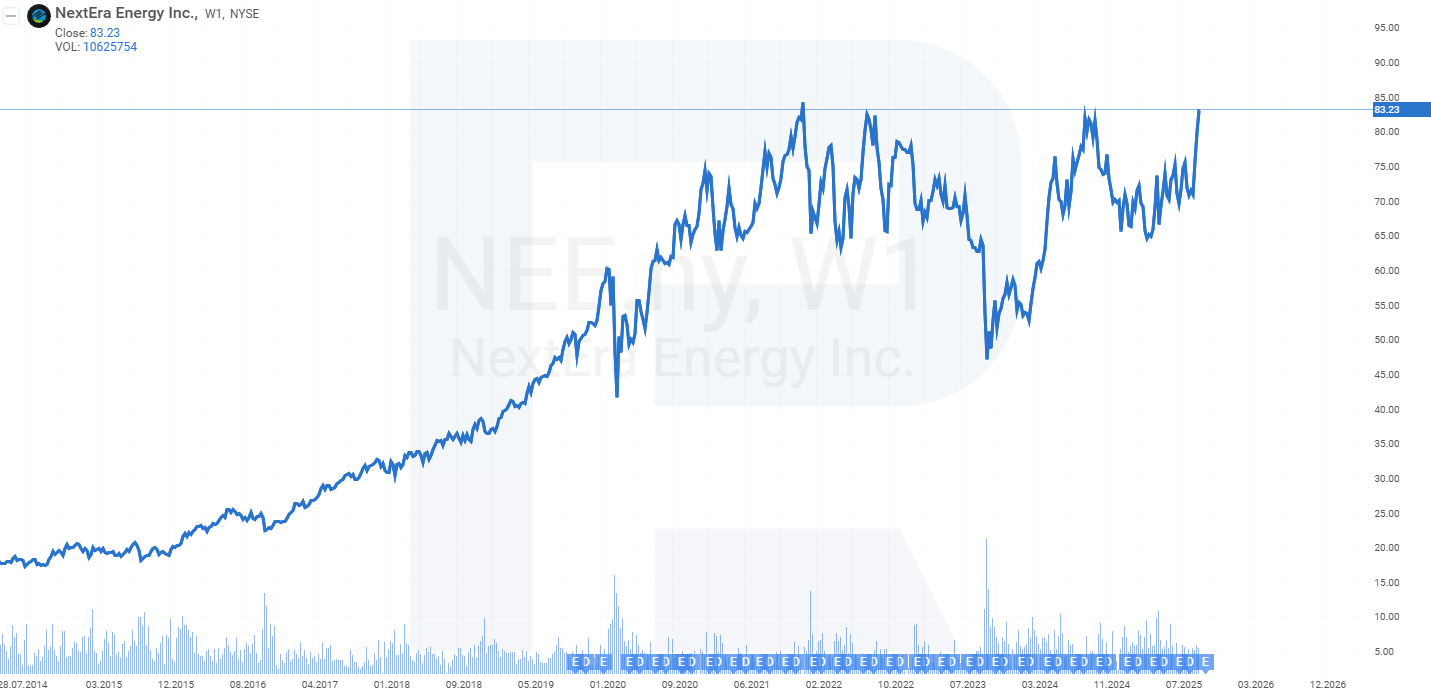

The AES Corporation stock chartNextEra Energy, Inc. (NYSE: NEE), one of the largest developers of renewable energy and transmission infrastructure in the US, states explicitly in its investor materials that it expects an acceleration in investment growth, driven by rising demand from data centres. Both AES and NextEra stand to benefit from the broader decarbonisation trend, as major corporations seek to power their AI and cloud facilities with round-the-clock clean energy.

NextEra Energy, Inc. stock chart- Independent power producers in the deregulated market :

Constellation Energy Corporation (NASDAQ: CEG) – the largest privately owned operator of nuclear power plants in the US. The growing demand from data centres for reliable, carbon-free electricity is enhancing the strategic value of nuclear generation, particularly given the federal tax incentives supporting the sector.

Constellation Energy Corporation stock chartVistra Corp. (NYSE: VST) – a major electricity supplier in Texas with assets in gas-fired generation and some of the largest energy storage systems in the US, including projects in California. The rise in infrastructure-driven demand and higher grid utilisation are strengthening generation margins and improving the profitability of battery storage operations.

Vistra Corp. stock chartAI investment growth continues despite overheating concerns

Discussions around a potential AI bubble continue, yet leading analytical and investment firms still expect capital expenditure in the sector to grow. While the pace may slow in 2026 compared with the overheated levels of 2025, the overall trend remains positive.

According to Barclays’ estimates, investment in AI infrastructure continues to gain momentum. The bank notes that hyperscaler capital expenditure – by firms such as Microsoft, Amazon, and Google – is rising rapidly, but is largely underpinned by strong fundamentals, as most spending is financed through operating cash flow rather than debt or external capital. This makes the investment cycle more sustainable.

Barclays has run stress tests to assess the impact of a potential slowdown. In a conservative scenario, instead of annual expenditure growing by 30%, data-centre investment could fall by 20% over two years. In that case, profits for S&P 500 companies could decline by 3–4% in 2026 and a further 1.5% in 2027. The bank views this outcome as an alternative, rather than a base-case scenario.

One of the main constraints identified by Barclays is the shortage of available capacity and electricity. This could delay project execution and extend construction timelines, particularly amid strong demand from AI clusters. The bank believes that capacity shortages among hyperscalers are likely to persist at least until early 2026.

Overall, Barclays maintains its base-case assumption, under which the AI cycle continues at a robust pace over the next 12–24 months, with any potential slowdown or normalisation occurring later– but not imminently and not abruptly.

The AI investment cycle and its risks

The AI investment cycle currently operates in the following way: major consumers of AI computing power – such as OpenAI and other AI model developers – sit at the top of the value chain. Beneath them lies a network of companies that enable the system to function. Cloud providers such as Microsoft, Amazon, Alphabet, Oracle, and CoreWeave build data centres. Hardware manufacturers – including NVIDIA, Broadcom, and others – supply accelerators, chips, and network components. Banks, investment funds, and government agencies provide capital and subsidies.

A single large contract can set off a chain reaction. For example, NVIDIA and OpenAI have announced a strategic partnership to deploy up to 10 GW of NVIDIA systems for OpenAI’s infrastructure, with NVIDIA planning to invest as much as 100 billion USD to support the project. As a result, cloud companies gain predictable revenue streams, which they use to raise financing and begin building infrastructure. Hardware producers receive prepayments and ramp up production. Investors see revenue growth and increase company valuations, facilitating the next round of financing. The cycle then repeats.

This structure functions because there is genuine demand: training and deploying AI models require vast computational resources, and corporations as well as governments are willing to pay to accelerate AI adoption. Hyperscalers generate strong operating cash flows, which enable them to finance major investments. In addition, technology evolves rapidly – every 12–24 months, new GPUs, memory standards such as HBM4, and networking solutions like 800G or 1.6T are introduced, prompting constant upgrades. Finally, scale effects reinforce the cycle: the larger the AI clusters, the lower the unit costs and the higher the barriers to entry for new competitors.

Key risks within this AI investment cycle:

- Return on investment

If AI service revenue grows too slowly while spending continues to surge, the investment model could falter. Warning signs would include slower subscription growth, underutilised data centres, tariff revisions, and extended payback periods.

- Cost of capital and debt

If borrowing costs rise – for example, if the Federal Reserve tightens monetary policy – or if access to financing weakens, construction and procurement will become more expensive. Existing projects would likely be completed, but new ones could be postponed.

- Electricity and connectivity

Not all regions have sufficient power capacity, substations, transmission lines, or water for server cooling. If new facilities cannot be connected to the grid, construction slows, orders are delayed, and temporary (often costly) solutions are implemented, all of which can weigh on profitability.

- Dependence on a handful of players

Demand is concentrated among a few major companies. If they were to slow investment simultaneously – due to weaker returns or shifting priorities – the impact would quickly cascade through the entire supply chain, from GPU and memory suppliers to data centre builders, prompting a sharp downward correction in company valuations.

- Operational risks.

Large prepayments create supply bottlenecks and temporary shortages for some suppliers, generating windfall profits that may fade once supply catches up with demand. Other risks include production issues (quality, lead times) and regulatory or export restrictions that could unexpectedly disrupt logistics.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.