Adobe stock forecast for 2026: targets of 420–550 USD and fundamental valuation of ADBE

Adobe delivered a strong quarterly performance and solid ARR growth amid the active integration of AI across its products, while also providing a robust outlook for 2026. At current levels, the shares appear to be a high-quality asset, although not a cheap one.

Based on the Q4 results of the 2025 financial year, Adobe Inc. (NASDAQ: ADBE) exceeded market expectations. Revenue amounted to approximately 6.19 billion USD (+10% y/y), compared with a consensus forecast of 6.11 billion USD, while non-GAAP earnings per share reached 5.50 USD (+14% y/y), above expectations of around 5.40 USD. Non-GAAP operating income totalled 2.82 billion USD, and non-GAAP net income came in at 2.29 billion USD. The Digital Media segment generated revenue of 4.62 billion USD (+11% y/y), while Digital Experience contributed 1.52 billion USD (+9% y/y), indicating broadly balanced growth across Adobe’s core business lines. Annual recurring revenue (ARR) increased to approximately 25.2 billion USD (+11.5% y/y), with a significant portion of this base already linked to products incorporating AI functionality.

For Q1 2026, management expects revenue in the range of 6.25–6.30 billion USD and non-GAAP EPS of around 5.85–5.90 USD, implying continued double-digit earnings growth. For the full 2026 financial year, the company forecasts revenue of 25.9–26.1 billion USD and adjusted earnings per share of approximately 23.3–23.5 USD.

This article examines Adobe Inc., outlines the sources of its revenue, summarises Adobe’s quarterly performance, and presents expectations for the 2026 financial year. It also includes a technical analysis for ADBE, based on which a forecast for Adobe shares for the 2026 calendar year is developed.

About Adobe Inc.

Adobe was founded in December 1982 by John Warnock and Charles Geschke. The company specialises in software for businesses and individual users through the Adobe Acrobat, Illustrator, Photoshop, and Premiere Pro applications. It also provides digital marketing and document management solutions through the Creative Cloud and Experience Cloud platforms. The company went public on 20 August 1986, listing its shares on the NASDAQ under the ticker symbol ABDE.

Image of the company name Adobe Inc.Adobe Inc.’s main revenue streams

Adobe’s revenue comes from the following sources:

- Digital Media : products and solutions that help create, edit, and distribute digital content. This segment enables users to work with graphics, video, animation, web design, and other digital media. It forms the core of Adobe’s business.

- Digital Experience : business solutions that improve client interaction through digital channels. This includes Adobe Experience Cloud, which offers analytics, marketing campaign management, content personalisation, and client experience optimisation tools. It helps businesses analyse data, automate marketing processes, and create a seamless user experience across websites, apps, and other platforms.

Since Q1 of fiscal year 2025, Adobe has begun providing information on subscription revenue by creating two groups:

- Business Professionals and Consumers Group : this group includes revenues from Acrobat, Adobe Express, and Document Cloud subscriptions.

- Creative and Marketing Professionals Group : includes revenues from Digital Experience subscriptions and all other Creative Cloud subscriptions.

Adobe Inc. Q1 2025 financial results

On 12 March, Adobe Inc. released its Q1 fiscal 2025 results for the period ended on 28 February 2025. Below are its highlights:

- Revenue : 5.71 billion USD (+10%)

- Net income : 2.22 billion USD (+8%)

- Earnings per share : 5.08 USD (+13%)

- Operating income : 2.71 billion USD (+10%)

Revenue by segment:

- Digital Media : 4.23 billion USD (+11%)

- Digital Experience : 1.41 billion USD (+10%)

- Business Professionals and Consumers Group : 1.53 billion USD (+15%)

- Creative and Marketing Professionals Group : 3.92 billion USD (+10%)

Commenting on its record Q1 FY 2025 revenue, Adobe’s management emphasised the significant role of AI-based innovation. CEO Shantanu Narayen stated that Adobe’s AI achievements drive creative economic growth. In particular, he noted that AI-focused products (Acrobat AI Assistant, Firefly App, and GenStudio) generated over 125.00 million USD in revenue, which is expected to double by the end of the fiscal year 2025.

As part of its Q2 2025 financial guidance, Adobe expects total revenue to be between 5.77 and 5.82 billion USD and EPS between 4.95 and 5.00 USD. The company also anticipates an operating margin of approximately 45%. In the Digital Media segment, Adobe expects revenue of 4.27-4.30 billion USD. Overall, these projections are broadly in line with analysts’ expectations. However, following their release, the company’s stock fell by over 14% as investors voiced concerns about the pace of monetising Adobe’s AI initiatives.

Adobe Inc. Q2 2025 financial results

On 12 June, Adobe Inc. released its Q2 fiscal 2025 results for the period ending 30 May. Below are its key highlights:

- Revenue : 5.87 billion USD (+10%)

- Net income : 2.17 billion USD (+8%)

- Earnings per share (EPS) : 5.06 USD (+13%)

- Operating profit : 2.67 billion USD (+10%)

Revenue by segment:

- Digital Media : 4.35 billion USD (+11%)

- Digital Experience : 1.46 billion USD (+10%)

- Business Professionals and Consumers Group : 1.60 billion USD (+15%)

- Creative and Marketing Professionals Group : 4.02 billion USD (+10%)

Adobe reported a strong performance in Q2 fiscal 2025, with revenue reaching 5.87 billion USD, up 11% year-on-year. Growth was underpinned by sustained demand for Creative Cloud products and robust performance in the Digital Experience segment.

Artificial intelligence remains a key growth driver, with Firefly (image and video generation), Acrobat AI Assistant, Adobe Express and GenStudio contributing to increased user engagement. Adobe stated that it expects to exceed 250 million USD in annual revenue from AI products by year-end.

Management raised its full-year 2025 guidance. Revenue was expected in the range of 23.50-23.60 billion USD and EPS at 20.50-20.70 USD, both above previous estimates. For Q3 FY2025, Adobe projected non-GAAP EPS of 5.15-5.20 USD and revenue of 5.87-5.92 billion USD, also above analysts’ consensus forecasts. The operating margin was anticipated at around 45.5%.

The company’s cash flows remained strong, with an operating cash flow of 2.19 billion USD and 3.5 billion USD spent on share buybacks. A further 10.9 billion USD remained in repurchase reserves, supporting shareholder value.

Nevertheless, the shares came under pressure as investors grew concerned about intensifying competition in AI-based solutions from players such as Canva, OpenAI, and Alphabet Inc. The market was also waiting for firm evidence that AI integration would deliver sustained margin expansion rather than remain just a buzzword.

Adobe Inc. Q3 2025 financial results

On 11 September, Adobe Inc. published its results for Q3 FY2025, which ended on 29 August. The key figures are as follows:

- Revenue : 5.99 billion USD (+11% year-on-year)

- Net profit : 2.25 billion USD (+8% year-on-year)

- Earnings per share (EPS) : 5.31 USD (+14% year-on-year)

- Operating profit : 2.77 billion USD (+10% year-on-year)

Revenue by segment:

- Digital Media : 4.46 billion USD (+12% year-on-year)

- Digital Experience : 1.48 billion USD (+9% year-on-year)

- Business Professionals and Consumers Group : 1.65 billion USD (+15% year-on-year)

- Creative and Marketing Professionals Group : 4.12 billion USD (+11% year-on-year)

Adobe outperformed expectations in Q3 FY2025. Revenue was 5.99 billion USD (+11% year-on-year), while non-GAAP EPS reached 5.31 USD – both ahead of analyst estimates of 5.92 billion USD in revenue and 5.18 USD in EPS. Growth was driven primarily by subscription products, with Digital Media revenue rising to 4.46 billion USD (+12% year-on-year) and annual recurring revenue (ARR) in this segment reaching 18.59 billion USD (+11.7% year-on-year). Digital Experience contributed 1.48 billion USD (+9% year-on-year), while remaining performance obligations (RPO) rose to 20.44 billion USD, of which 67% are short-term. Operating cash flow totalled 2.20 billion USD, and the company repurchased around 8 million shares.

A positive development was management’s upward revision of the company’s full-year guidance: Adobe now anticipates revenue of 23.65–23.70 billion USD and non-GAAP EPS of 20.80–20.85 USD. Progress in AI monetisation was also highlighted: ARR linked to AI features surpassed 5 billion USD, while revenue from new AI products had already exceeded the full-year target of 250 million USD in the latest quarter.

However, the report also included factors that concerned investors. Growth in Digital Media ARR slowed compared with previous periods, and the outlook for monetising generative AI remained uncertain against a backdrop of intensifying competition. These issues tempered market optimism despite the strong results.

For Q4 FY2025, Adobe expected revenue of 6.075–6.125 billion USD, GAAP EPS of 4.27–4.32 USD and non-GAAP EPS of 5.35–5.40 USD. Expected segment revenue included 4.53–4.56 billion USD from Digital Media and 1.495–1.515 billion USD from Digital Experience.

Adobe Inc. Q4 2025 financial results

On 10 December, Adobe Inc. released its Q4 results for the 2025 financial year, which ended on 28 November. The key figures are as follows:

- Revenue : 6.19 billion USD (+10%)

- Net income (non-GAAP) : 2.29 billion USD (+7%)

- Earnings per share (EPS) : 5.50 USD (+14%)

- Operating income : 2.82 billion USD (+8%)

Revenue by segment:

- Digital Media : 4.62 billion USD (+11%)

- Digital Experience : 1.52 billion USD (+9%)

- Business Professionals and Consumers Group : 1.72 billion USD (+15%)

- Creative and Marketing Professionals Group : 4.25 billion USD (+11%)

Adobe delivered record results in Q4 of the 2025 financial year and exceeded market expectations on both revenue and earnings. Revenue amounted to 6.19 billion USD (+10% y/y), compared with a consensus estimate of around 6.11 billion USD, while non-GAAP earnings per share reached 5.50 USD (+14% y/y), above expectations of approximately 5.40 USD. Non-GAAP operating income totalled 2.82 billion USD, and non-GAAP net income came in at 2.29 billion USD. The Digital Media segment generated 4.62 billion USD (+11% y/y), while Digital Experience contributed 1.52 billion USD (+9% y/y), indicating solid growth across the company’s core segments. Annual recurring revenue (ARR) increased to 25.2 billion USD (+11.5% y/y), with more than one-third of this base already attributable to products incorporating AI capabilities. This suggests that AI integration is genuinely supporting subscription growth rather than serving purely as a marketing tool. Operating cash flow for the quarter amounted to 3.16 billion USD, and the company continued active share repurchases, buying back 7.2 million shares in Q4 and 30.8 million shares over the full year. This points to management’s confidence in the sustainability of cash flows and the underlying business valuation.

For Q1 2026, Adobe forecasts revenue of 6.25–6.30 billion USD and non-GAAP EPS of 5.85–5.90 USD. For the full 2026 financial year, the company expects revenue of 25.9–26.1 billion USD and adjusted earnings per share of 23.3–23.5 USD, implying continued double-digit growth in ARR and earnings. Management has placed particular emphasis on AI initiatives, with further expansion of AI functionality across Creative Cloud, Document Cloud, and Experience Cloud. The acquisition of Semrush for 1.9 billion USD was also announced, alongside deeper integration of Adobe applications with ChatGPT.

Overall, the report shows that Adobe is currently leveraging AI effectively as a growth driver, maintaining strong non-GAAP performance metrics alongside a measured yet positive outlook for 2026.

Analysis of key valuation multiples for Adobe Inc.

Below are the key valuation multiples for Adobe Inc. based on the Q4 2025 financial year, calculated at a share price of 350 USD.

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | Price paid for 1 USD of earnings over the past 12 months | 21 | ⬤ A moderate premium: for a large software business with double-digit revenue growth, this level appears reasonable. |

| P/S (TTM) | Price paid for 1 USD of annual revenue | 6.2 | ⬤ A high price-to-revenue multiple but justified by Adobe’s very high margins and subscription-based business model. |

| EV/Sales (TTM) | Enterprise value to sales, accounting for debt | 6.2 | ⬤ Valuation looks somewhat expensive, but not extreme for a market leader with a strong brand and ecosystem. |

| P/FCF (TTM) | Price paid for 1 USD of free cash flow | 15 | ⬤ Based on free cash flow, the valuation appears attractive. |

| FCF Yield (TTM) | Free cash flow yield to shareholders | 6.7% | ⬤ A very strong level for a large software company. |

| EV/EBITDA (TTM) | Enterprise value to operating profit before depreciation and amortisation | 17 | ⬤ A mid-range level: investors are paying a premium for quality, but not an excessive one. |

| EV/EBIT (TTM) | Enterprise value to operating profit | 15 | ⬤ A comfortable valuation for a mature software business. |

| P/B | Price to book value | 13 | ⬤ For a software company with significant intangible assets, P/B is not a key metric, but it shows that the market is paying a substantial premium to the balance sheet for brand strength and platform value. |

| Net Debt/EBITDA | Debt burden relative to EBITDA | 0 | ⬤ Effectively no net debt: cash is broadly equal to total debt, resulting in a very comfortable balance sheet. |

| Interest Coverage (TTM) | Ability to cover interest expenses with operating profit | 35 | ⬤ Interest expenses are negligible relative to operating profit. |

Valuation multiples analysis for ADBE – conclusion

Adobe’s business appears very robust. Revenue is growing at double-digit rates, margins are high, operating and free cash flows are strong, and the company effectively has no net debt. Adobe is successfully monetising its subscription-based model while continuing to integrate AI functionality into its core products, supporting the growth of recurring revenue.

From a valuation perspective, this is a high-quality asset. The shares trade at a modest premium on both earnings and revenue metrics, while free cash flow yield remains attractive for a business of this scale and quality. In this context, a share price of 350 USD can reasonably be viewed as fair value.

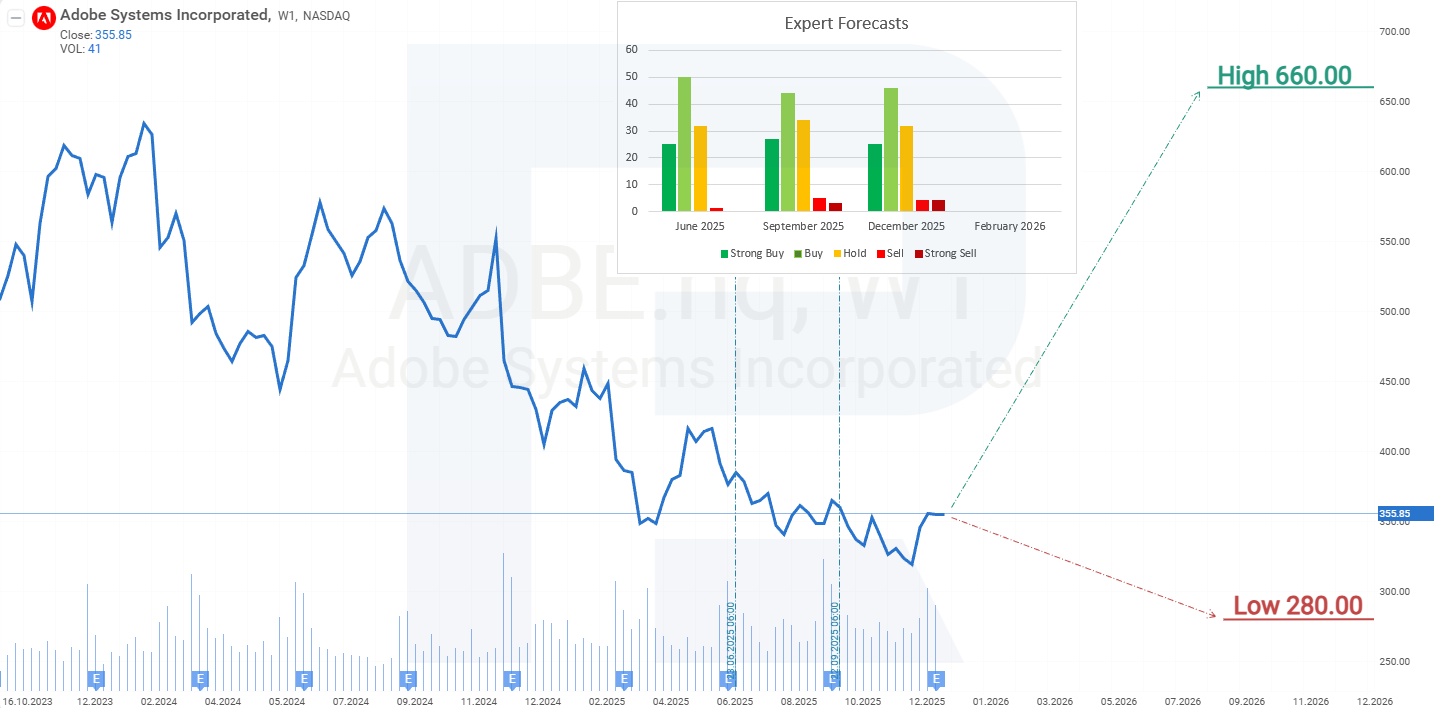

Expert forecasts for Adobe Inc.’s stock

- *Barchart* : 21 of 36 analysts rated Adobe shares as Strong Buy, 2 as Moderate Buy, 10 as Hold, and 3 as Strong Sell. The upper price target is 660 USD, and the lower bound is 270 USD.

- *MarketBeat* : 15 of 29 analysts assigned a Buy rating to the shares, 11 issued Hold recommendations, and 3 rated them Sell. The upper price target is 540 USD, and the lower bound is 280 USD.

- *TipRanks* : 19 of 24 surveyed analysts rated the shares as Buy, 4 issued Hold recommendations, and 1 rated them Sell. The upper price target is 660 USD, and the lower bound is 310 USD.

- *Stock Analysis* : 4 of 23 experts rated the shares as Strong Buy, 10 as Buy, 7 as Hold, 1 as Sell, and 1 as Strong Sell. The upper price target is 540 USD, and the lower bound is 280 USD.

Adobe Inc. stock price forecast for 2026

On the weekly timeframe, Adobe shares continue to trade within a descending channel. At the same time, the decline below 335 USD triggered a sharp rebound, with the share price rising to 360 USD. Investor demand for ADBE shares is clearly present, though price levels remain a concern. The release of strong results for the previous quarter may encourage market participants to buy at current levels, driven by concerns that a correction may not materialise.

Based on the current performance of Adobe shares, the forecast for Adobe stock implies a breakout above resistance at 367 USD, followed by a move higher towards 420 USD. If resistance at 420 USD is breached, ADBE shares could advance towards the descending trendline in the region of 550 USD. Given the company’s strong financial position and a robust outlook for the next quarter, the likelihood of this scenario playing out in 2026 appears high.

Adobe Inc. stock analysis and forecast for 2026Risks of investing in Adobe Inc. stock

Investing in Adobe stock involves several risks that may negatively impact the company’s profitability, revenue, and investor returns:

- Macroeconomic factors : Adobe’s performance is influenced by the broader global economy. Economic downturns and geopolitical events may adversely affect the company’s financial position.

- Competitive environment : the emergence of new competitors, including affordable AI models from startups such as DeepSeek, threatens Adobe’s market share. Intensified competition may exert pricing pressure and reduce profitability.

- Market volatility : Adobe’s financial performance is subject to market fluctuations and other macroeconomic factors. Investors should consider diversifying their portfolio to mitigate the risks associated with investing in the company’s shares.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.