PayPal after the earnings release: analysis of results and PYPL stock forecast for 2025

PayPal exceeded expectations in Q3 2025 and raised its full-year guidance, but the rally in its shares proved short-lived – a decline in transaction volumes cooled investor optimism.

PayPal Holdings, Inc. (NASDAQ: PYPL) delivered better-than-expected results for Q3 2025. Revenue rose 7% to 8.42 billion USD, compared with market expectations of around 8.22 billion USD. Non-GAAP earnings per share (EPS) were 1.34 USD, exceeding forecasts by 10%.

Total payment volume increased by 8% to 458.1 billion USD, while the number of transactions fell by 5% to 6.3 billion. This indicates that growth is primarily driven by larger transaction sizes and the activity of major online retailers and digital services rather than by higher payment frequency. Venmo delivered particularly strong results, with revenue up about 20% year-on-year – the key driver of growth in PayPal’s consumer segment.

Following the successful quarter, management raised its full-year guidance: earnings are now expected at 5.35–5.39 USD per share (+15–16% y/y), above the previous range. The company also upgraded its forecast for transaction margin dollars, projecting 5–6% growth, and expects free cash flow to reach 6–7 billion USD. Around 6 billion USD has been allocated to share buybacks during the year.

The outlook for Q4 remains conservative: earnings per share are expected in the range of 1.27–1.31 USD, roughly in line with market expectations.

Investor reaction to the PayPal report unfolded in two stages. Initially, the market responded sharply positively: the company exceeded forecasts for both revenue and profit, raised its full-year guidance, and announced its first dividend. An additional catalyst was the announcement of a partnership with OpenAI and the integration of PayPal and Venmo wallets into the ChatGPT ecosystem, which investors viewed as a strong trigger for AI-driven growth. As a result, trading opened more than 8% higher following the report’s release.

However, profit-taking began only the next day. Investors noted that despite the positive figures, business growth remains moderate: revenue is rising, but the number of transactions is declining. The expansion is being driven mainly by larger transaction values and higher-margin payments rather than an increase in the user base.

Against this backdrop, some market participants concluded that the stock rally had been excessive. Following a brief surge in interest, the shares quickly corrected – not only returning to pre-report levels but falling more than 5% below them.

This article examines PayPal Holdings, outlining its sources of revenue, providing a fundamental analysis of PayPal’s financial results, and presenting a technical analysis of PYPL shares, which together form the basis for the PayPal stock forecast for the 2025 calendar year.

About PayPal Holdings, Inc.

PayPal Holdings, Inc. was founded in December 1998 by Max Levchin, Peter Thiel, and Luke Nosek as Confinity. The company initially developed security software for hand-held devices but later shifted its focus to digital payments. In 2000, Confinity merged with X.com, an online banking company founded by Elon Musk, and was renamed PayPal in 2001.

Today’s PayPal Holdings offers online payment solutions, enabling individuals and businesses to send and receive money worldwide. Its services include digital wallets, merchant payment processing, user-to-user transfers, and fintech solutions.

PayPal went public on the NASDAQ under the PYPL ticker on 15 February 2002. Later that year, the company was acquired by eBay and became its primary payment service. In 2015, PayPal became independent again and resumed trading under the same ticker, PYPL.

Image of the company name PayPal Holdings, Inc.About PayPal Holdings, Inc.’s CEO

Alex Chriss has served as the Chief Executive Officer (CEO) of PayPal Holdings, Inc. since September 2023, having joined the company from Intuit, where he spent nearly two decades and was recognised as a key architect of the firm’s growth. At Intuit, he led the Small Business and Self-Employed Group. He was instrumental in the 12 billion USD acquisition of Mailchimp, which provided the company with new avenues for growth and customer loyalty. His expertise is particularly strong in digital transformation, product development, and strategic partnerships.

Since joining PayPal, Chriss has focused on enhancing business efficiency, restructuring costs, simplifying the product portfolio, and strengthening the company’s emphasis on customer value. He initiated the launch of the PayPal World platform, advanced AI integration, and promoted new payment formats such as agentic commerce and cryptocurrency solutions. These actions reflect his commitment to a comprehensive modernisation of the platform and positioning it for future growth.

Given his achievements at Intuit, swift adaptation to PayPal’s corporate environment, and bold initiatives within the company, the likelihood that he will successfully elevate PayPal Holdings to a new level is considered high.

PayPal Holdings, Inc.’s main revenue sources

PayPal’s revenue comes from a variety of sources, mainly related to digital payments. The primary revenue streams are divided into subcategories and outlined below:

- Transaction fees for merchants: PayPal charges merchants a fee for each transaction processed on the platform, typically a percentage of the transaction amount plus a flat fee. These commissions apply to payments for goods and services.

- Transaction fees for consumers: PayPal charges fees for some consumer operations, such as instant transfers from a PayPal or Venmo account to a bank account or a debit card.

- International transaction fees: for international transfers, PayPal adds extra fees, typically as a percentage of the transaction amount plus currency conversion fees, if applicable.

- Cryptocurrency transaction fees: PayPal charges fees for buying, selling, or transferring cryptocurrencies through its platform. These vary depending on the transaction amount.

through partnerships with companies such as Visa, Mastercard, and e-commerce platforms, as well as referral fees from cashback programs and partner services

PayPal’s revenue primarily comes from the sources listed above, with transaction fees contributing to the bulk of revenue, supported by income from additional services and subsidiaries. This diversified model supports PayPal’s operations in over 200 markets and serves millions of active accounts.

PayPal Holdings, Inc. Q4 2024 report

On 4 February 2025, PayPal Holdings released its Q4 2024 report. The key highlights are as follows:

- Revenue: 8.36 billion USD (+4%)

- Net income: 1.21 billion USD (–2%)

- Earnings per share: 1.19 USD (+5%)

- Operating profit: 1.5 billion USD (+2%)

Account and activity metrics:

- Active accounts: 434 (+2%)

- Monthly active accounts: 229 (+2%)

- Number of payment transactions: 6.62 (–3%)

- Transactions per active account: 60.60 (+3)

- TPA ex. PSP (unbranded card processing): 34.90 (+4%)

CEO Alex Chriss stated that PayPal ended 2024 on a strong note, delivering results that exceeded expectations. He highlighted that throughout 2024, the company focused on improving execution and repositioning the business, which laid a solid foundation for long-term profitable growth. Chriss pointed to specific improvements in branded payments, P2P services, and Venmo, as well as progress in its price-to-value strategy, which had begun to impact results positively.

For the calendar Q1 2025, PayPal forecast earnings per share in the range of 1.15 to 1.17 USD, up from 1.08 USD for the corresponding period last year. For the full year 2025, the company projected adjusted EPS between 4.95 USD and 5.10 USD, compared to 4.65 USD in the previous year.

At its Investor Day in February 2025, PayPal unveiled a new unified platform for merchants, PayPal Open, announced a partnership with Verifone, and outlined its plans for the international expansion of its quick-payment service, Fastlane. The company also reaffirmed its financial targets for 2025 and expressed optimism about future growth.

Investors reacted negatively to PayPal’s Q4 2024 report, sending its shares down by 11% despite better-than-expected income and revenue. The main reason for the decline was a slowdown in branded transactions, raising concerns that users were switching to competitors such as Apple Pay and Google Pay. Investor scepticism was further intensified by additional pressure on commission revenue and uncertainty about whether new initiatives like PayPal Open and Fastlane could drive substantial future growth. Elevated market expectations also played a role, as investors expected a faster acceleration in growth.

PayPal Holdings, Inc.’s stock buyback program

PayPal Holdings, Inc. announced a new stock buyback program in its Q4 2024 report, released on 4 February 2025. The company’s Board of Directors approved a 15 billion USD share repurchase plan, reflecting confidence in PayPal’s long-term value and its commitment to returning capital to shareholders.

This new program builds on the company’s current capital allocation strategy, following significant share repurchase activity in 2024. Over the full year of 2024, PayPal bought back approximately 75 million shares, returning 6.0 billion USD to shareholders.

The new 15 billion USD program replaces all previous initiatives, providing PayPal with the flexibility to reduce the number of outstanding shares further, potentially boosting EPS over time by concentrating ownership among the remaining shareholders.

CEO Alex Chriss and CFO Jamie Miller emphasised that the program reflects PayPal’s strong financial position and the undervaluation of its shares, which closed 2024 at levels they believe do not fully reflect the company’s growth potential, particularly in high-margin segments such as branded payments and Venmo.

Buybacks were expected to be carried out depending on market conditions, share price, and the company’s liquidity requirements, with no fixed completion date.

PayPal Holdings, Inc. Q2 2025 financial results

PayPal Holdings released its Q2 2025 financial results on 29 July 2025. Key figures are as follows:

- Revenue: 8.29 billion USD (+5%)

- Net income: 1.37 billion USD (+10%)

- Earnings per share: 1.40 USD (+18%)

- Operating profit: 1.64 billion USD (+15%)

Account and activity metrics:

- Active accounts: 438 (+2%)

- Monthly active accounts: 226 (+2%)

- Number of payment transactions: 6.22 (–5%)

- Transactions per active account: 58.3 (–4%)

- TPA ex. PSP (unbranded card processing): 35.60 (+4%)

In Q2 2025, PayPal reported revenue growth of 5% to approximately 8.3 billion USD. Adjusted earnings per share came in at 1.40 USD, slightly beating analyst expectations but below the earlier projection of 1.47 USD. Total payment volume (TPV) rose by 6% to 443.5 billion USD. Venmo was a standout performer, with revenue growing by more than 20% and delivering its strongest quarterly result in three years.

The company raised its full-year 2025 guidance, expecting adjusted earnings per share of between 5.15 and 5.30 USD (up from the previous range of 4.95 to 5.10 USD). Transaction-based revenue was expected to rise to 15.35– 15.50 billion USD, 5–6% higher year on year. For Q3 2025, the forecast for adjusted earnings per share was 1.18–1.22 USD, broadly in line with market expectations.

Investor reaction to the report was negative. Despite earnings growth and upgraded guidance, PayPal’s shares fell by 9% on the day of the release, marking one of the weakest performances on the Nasdaq. This was due to concerns about slowing growth in branded checkout and an overall deceleration in payment volume growth.

There was also some negative sentiment driven by competitive pressures, although fundamental metrics remained robust. Nevertheless, PayPal shares are considered among the strongest on the market according to Investor’s Business Daily ratings and continue to attract steady interest from institutional investors.

PayPal Holdings, Inc. Q3 2025 report

On 28 October 2025, PayPal Holdings released its financial results for Q3 2025. The key figures are as follows:

- Revenue: 8.42 billion USD (+7%)

- Net income: 1.29 billion USD (+5%)

- Earnings per share: 1.34 USD (+12%)

- Operating profit: 1.57 billion USD (+6%)

Account and activity metrics:

- Active accounts: 438 million (+1%)

- Monthly active accounts: 227 million (+2%)

- Number of payment transactions: 6.33 billion (–5%)

- Transactions per active account: 57.6 (–6%)

- TPA excl. PSP (unbranded card processing): 36.20 (+5%)

In Q3 2025, PayPal’s revenue rose by 7% to 8.4 billion USD, while non-GAAP earnings per share (EPS) increased by 12% to 1.34 USD, with net profit up 5%. The faster EPS growth compared with net income reflects the impact of share buybacks.

Revenue growth was primarily driven by an increase in payment volumes. Total payment volume (TPV) rose by 8%, with branded payments and Venmo showing particularly strong momentum. Venmo continued to grow at double-digit rates and remains a key driver of the platform’s overall performance: the higher the share of such payments, the stronger the company’s profitability.

User metrics were more mixed. The number of active accounts increased slightly, but users made fewer transactions: payment frequency fell by approximately 5%, meaning that, on average, each customer transacts less frequently than they did a year ago.

PayPal’s margins remain under some pressure due to its business structure, as growth in large merchant partners and external transaction processing lowers the average commission rate. Nonetheless, the company continues to sustain its operating margin and improve profitability through cost control.

Cash flow remains strong: PayPal generates more than 2 billion USD in operating cash per quarter, maintains a solid balance sheet, and actively returns capital to shareholders through buybacks and dividends.

PayPal raised its 2025 guidance, now expecting non-GAAP EPS in the range of 5.35–5.39 USD, slightly above the previous outlook – a reflection of management’s confidence in the resilience of current trends. The forecast for Q4 2025, at 1.27–1.31 USD per share, is broadly in line with market expectations, suggesting a realistic and balanced approach by management.

The company is focused on improving business efficiency. Its main priority is increasing the transaction margin – that is, the actual profit generated per payment. To achieve this, PayPal is actively redirecting traffic towards more profitable channels, such as branded payment scenarios via the PayPal platform and the Venmo ecosystem, where fees are higher and risk is lower.

Financial analysis of PayPal Holdings, Inc.

Below is the fundamental analysis of PYPL based on the results for Q3 2025:

- Operating trends: in Q3 2025, PayPal demonstrated stable business growth. Revenue increased by 7%, and total payment volume by 8%. While the number of active accounts rose to 438 million (+1%), users made fewer transactions: total transactions declined by 5%, and payment frequency fell by 6%, indicating that customers are making fewer small payments but more high-value purchases. Meanwhile, activity is rising in more profitable segments such as branded payments and Venmo, reflecting healthy growth in the company’s key areas.

- Profitability and earnings quality: on a non-GAAP basis, PayPal reported profit growth broadly in line with revenue. Operating profit reached 1.568 billion USD (+6%), and operating margin stood at 18.6% (compared with 18.8% a year earlier). Non-GAAP net profit was 1.29 billion USD (+5%), and earnings per share (EPS) rose by 12% to 1.34 USD, supported by share buybacks and a lower tax rate. Transaction margin dollars increased by 6% to 3.871 billion USD, or by 7% excluding interest income on client balances, demonstrating the steady expansion of the core business.

- Cash flow and liquidity: operating cash flow for Q3 amounted to 1.974 billion USD (+22% y/y), free cash flow (FCF) to 1.718 billion USD (+19%), and adjusted FCF (excluding the BNPL-portfolio effect) reached 2.279 billion USD (+48% y/y). This indicates that the company is generating more cash than is reflected in its net profit, with a cash conversion efficiency exceeding 100%. Management maintained its full-year 2025 FCF forecast in the range of 6–7 billion USD and continues to actively repurchase shares and pay dividends without reducing liquidity.

- Balance sheet strength: as of the end of September 2025, PayPal held 14.4 billion USD in cash and short-term investments and 11.4 billion USD in debt, resulting in a net cash position of around 3.0 billion USD. The company carries a low debt load and maintains ample liquidity to cover all obligations. During the quarter, PayPal repurchased 1.5 billion USD worth of shares, and 5.7 billion USD over the past twelve months. In addition, the company introduced a regular dividend of 0.14 USD per share, equivalent to about 10% of non-GAAP earnings.

- Conclusion – fundamental analysis of PYPL: from a financial-stability perspective, PayPal remains strong. The business continues to expand, margins are high and only slightly compressed, and free cash flow consistently covers both investment needs and shareholder returns through buybacks and dividends. The balance sheet, supported by a net cash position and moderate debt, offers resilience against market downturns or additional investment requirements. The main risks include a decline in transactions per user and margin pressure resulting from a shift in the mix towards larger merchants. Should these trends intensify, profit growth may slow. However, as of Q3 2025, PayPal can be regarded as a financially stable company with a moderate risk profile and a clear ability to generate cash and return it to shareholders.

Expert forecasts for PayPal Holdings, Inc. stock

- Barchart: 12 out of 43 analysts rated PayPal Holdings shares as a Strong Buy, 2 as a Moderate Buy, 25 as Hold, and 4 as a Strong Sell. The highest price target is 105 USD, and the lowest is 64 USD.

- MarketBeat: 15 out of 36 specialists rated the stock as a Buy, 17 as Hold, and 4 as Sell. The highest forecast is 107 USD, and the lowest is 65 USD.

- TipRanks: 11 out of 29 professionals rated the stock as a Buy, 15 as Hold, and 3 as Sell. The highest price target is 105 USD, and the lowest is 66 USD.

- Stock Analysis: 4 out of 27 experts rated the stock as a Strong Buy, 7 as a Buy, 13 as Hold, and 3 as a Strong Sell. The highest price target is 100 USD, and the lowest is 56 USD.

PayPal Holdings, Inc. stock price forecast for 2025

The coronavirus pandemic marked the most successful period for PayPal, as demand for online payments surged, allowing the company to more than double its profit, sending its share price up by 230%. However, sustaining such high growth proved challenging, particularly amid intensifying competition from new market entrants. As a result, in Q2 2022, PayPal reported a loss of 340 million USD, and its share price plunged by 80%. Since then, however, the company has been gradually recovering, with an ascending channel now forming on the PYPL share chart, within which the stock continues to trade.

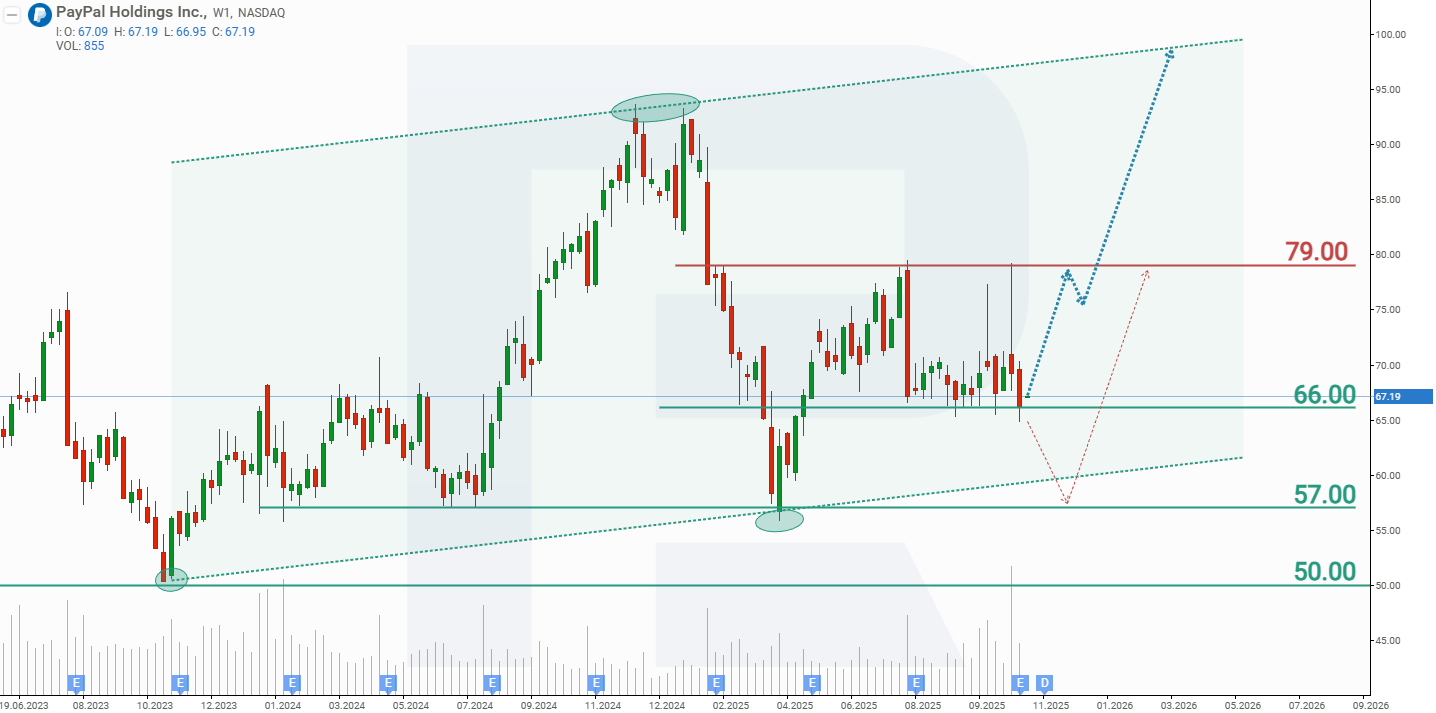

The publication of the Q3 2025 report increased volatility in the company’s shares but did not trigger a breakout above or below the key support or resistance levels at 66 and 79 USD. Based on the current performance of PayPal shares, the possible scenarios for 2025 are as follows:

The base-case forecast for PayPal shares in 2025 assumes a rebound from support at 66 USD, followed by an upward move towards resistance around 79 USD. If this level is breached, the share price could continue rising towards the upper boundary of the channel at 100 USD. This scenario is supported by the company’s stable cash flow, which is being directed towards dividends and share buybacks, encouraging investors to purchase and hold PYPL shares in their portfolios.

The alternative forecast for PayPal stock envisions a breakdown of support at 66 USD. In this case, the share price could decline to 57 USD. At this level, demand for PYPL shares may increase from both investors and the company itself, which would likely intensify its share repurchase activity. As a result, a rebound from support at 57 USD is expected, followed by a recovery towards 79 USD.

PayPal Holdings, Inc. stock analysis and forecast for 2025Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.