PayPal – stock forecast for 2026: weak growth outlook and potential decline towards 21 USD

PayPal’s Q4 2025 report showed sluggish growth momentum despite solid revenue and profitability figures. Guidance for 2026 came in below market expectations, triggering a decline in the company’s share price.

PayPal Holdings, Inc. (NASDAQ: PYPL) delivered mixed results for Q4 2025. Revenue reached 8.68 billion USD, representing a solid year-on-year increase, but growth in key metrics fell short of expectations. Non-GAAP earnings per share came in at 1.23 USD, below the forecast of 1.29 USD. Weak growth in transaction margin dollars and challenges in the branded checkout segment also raised investor concerns. Management noted that Venmo and BNPL continue to expand, while total payment volume (TPV) reached 475.1 billion USD. However, branded checkout growth was only 1%, highlighting a slowdown in this strategically important area. The company attributed the deceleration to intensifying competition and elevated investment levels, which are temporarily weighing on margins.

For the next quarter, PayPal issued cautious guidance, expecting a decline in transaction margin dollars and a moderate decrease in non-GAAP EPS. The company also plans to maintain strong free cash flow generation and continue share buybacks at approximately 6 billion USD.

Despite solid momentum in areas such as Venmo, weaker margin guidance and slower branded checkout growth triggered a share price decline following the earnings release. This suggests that while PayPal remains operationally resilient, its current performance and forward outlook disappointed investors.

This article examines PayPal Holdings, outlines the structure of its revenue streams, provides a fundamental analysis of PayPal’s financial reports, and presents a technical analysis of PYPL shares, forming the basis for the PayPal stock forecast for the 2026 calendar year.

About PayPal Holdings, Inc.

PayPal Holdings, Inc. was founded in December 1998 by Max Levchin, Peter Thiel, and Luke Nosek as Confinity. The company initially developed security software for hand-held devices but later shifted its focus to digital payments. In 2000, Confinity merged with X.com, an online banking company founded by Elon Musk, and was renamed PayPal in 2001.

Today’s PayPal Holdings offers online payment solutions, enabling individuals and businesses to send and receive money worldwide. Its services include digital wallets, merchant payment processing, user-to-user transfers, and fintech solutions.

PayPal went public on the NASDAQ under the PYPL ticker on 15 February 2002. Later that year, the company was acquired by eBay and became its primary payment service. In 2015, PayPal became independent again and resumed trading under the same ticker, PYPL.

Image of the company name PayPal Holdings, Inc.About PayPal Holdings, Inc.’s CEO

Alex Chriss has served as the Chief Executive Officer (CEO) of PayPal Holdings, Inc. since September 2023, having joined the company from Intuit, where he spent nearly two decades and was recognised as a key architect of the firm’s growth. At Intuit, he led the Small Business and Self-Employed Group. He was instrumental in the 12 billion USD acquisition of Mailchimp, which provided the company with new avenues for growth and customer loyalty. His expertise is particularly strong in digital transformation, product development, and strategic partnerships.

Since joining PayPal, Chriss has focused on enhancing business efficiency, restructuring costs, simplifying the product portfolio, and strengthening the company’s customer value focus. He initiated the launch of the PayPal World platform, advanced AI integration, and promoted new payment formats such as agentic commerce and cryptocurrency solutions. These actions reflect his commitment to a comprehensive modernisation of the platform and positioning it for future growth.

Given his achievements at Intuit, swift adaptation to PayPal’s corporate environment, and bold initiatives within the company, the likelihood that he will successfully elevate PayPal Holdings to a new level is considered high.

PayPal Holdings, Inc.’s main revenue sources

PayPal’s revenue comes from a variety of sources, primarily from digital payments. The primary revenue streams are divided into subcategories and outlined below:

- Transaction revenue:

- Transaction fees for merchants: PayPal charges merchants a fee for each transaction processed on the platform, typically a percentage of the transaction amount plus a flat fee. These commissions apply to payments for goods and services.

- Transaction fees for consumers: PayPal charges fees for some consumer operations, such as instant transfers from a PayPal or Venmo account to a bank account or a debit card.

- International transaction fees: for international transfers, PayPal adds extra fees, typically as a percentage of the transaction amount plus currency conversion fees, if applicable.

- Cryptocurrency transaction fees: PayPal charges fees for buying, selling, or transferring cryptocurrencies through its platform. These vary depending on the transaction amount.

- Revenue from additional services:

- Interest on loans and loan products: PayPal provides financing, such as PayPal Working Capital and PayPal Business Loans for merchants, and consumer loans in some markets. The company earns interest and fees on these loans, with annual interest rates ranging from 15% to 30%.

- Interest on customer account balances: funds held in PayPal accounts are placed in liquid investments or interest-bearing accounts, generating revenue for PayPal that is not shared with account holders.

- Subscription fees: PayPal charges merchants for premium features such as PayPal Payments Pro, which provides broader payment processing tools or Payflow Pro for customisable payment gateways.

- Partner and referral fees: PayPal generates revenue

through partnerships with companies such as Visa, Mastercard, and e-commerce platforms, as well as referral fees from cashback programs and partner services

- Gateway fees: through services like Payflow, PayPal charges fees for payment gateway integration, including transaction fees and additional services such as fraud protection.

- Revenue from subsidiaries:

- Venmo: generates income through fees for instant transfers, credit card payments, and merchant transactions via Venmo’s payment acceptance features.

- Braintree: this payment processing platform charges merchant transaction processing fees, often tailored to larger enterprises, contributing to PayPal’s overall revenue.

- Xoom: this international money transfer service earns revenue from transfer fees and foreign exchange margins on cross-border transactions.

- Other revenue sources include:

- Card reader sales and fees: services such as PayPal Here and Zettle provide mobile card readers for offline payments, generating revenue from device sales and transaction fees.

- Interchange fees: in some cases, PayPal receives a share of interchange fees when users make payments with linked debit or credit cards through partnerships with card networks.

- Cryptocurrency-related services: in addition to transaction fees, PayPal may generate additional revenue from cryptocurrency storage or related services as it expands its digital assets offerings.

PayPal’s revenue primarily comes from the sources listed above, with transaction fees contributing to the bulk of revenue, supported by income from additional services and subsidiaries. This diversified model supports PayPal’s operations in over 200 markets and serves millions of active accounts.

PayPal Holdings, Inc. Q4 2024 report

On 4 February 2025, PayPal Holdings released its Q4 2024 report. The key highlights are as follows:

- Revenue: 8.36 billion USD (+4%)

- Net income: 1.21 billion USD (–2%)

- Earnings per share: 1.19 USD (+5%)

- Operating profit: 1.5 billion USD (+2%)

Account and activity metrics:

- Active accounts: 434 (+2%)

- Monthly active accounts: 229 (+2%)

- Number of payment transactions: 6.62 (–3%)

- Transactions per active account: 60.60 (+3)

- TPA ex. PSP (unbranded card processing): 34.90 (+4%)

CEO Alex Chriss stated that PayPal ended 2024 on a strong note, delivering results that exceeded expectations. He highlighted that throughout 2024, the company focused on improving execution and repositioning the business, laying a solid foundation for long-term profitable growth. Chriss pointed to specific improvements in branded payments, P2P services, and Venmo, as well as progress in its price-to-value strategy, which had a positive impact on results.

For the calendar Q1 2025, PayPal forecast earnings per share in the range of 1.15 to 1.17 USD, up from 1.08 USD for the corresponding period last year. For the full year 2025, the company projected adjusted EPS between 4.95 USD and 5.10 USD, compared to 4.65 USD in the previous year.

At its Investor Day in February 2025, PayPal unveiled a new unified platform for merchants, PayPal Open, announced a partnership with Verifone, and outlined its plans for the international expansion of its quick-payment service, Fastlane. The company also reaffirmed its financial targets for 2025 and expressed optimism about future growth.

Investors reacted negatively to PayPal’s Q4 2024 report, sending its shares down by 11% despite better-than-expected income and revenue. The main reason for the decline was a slowdown in branded transactions, raising concerns that users were switching to competitors such as Apple Pay and Google Pay. Investor scepticism was further intensified by additional pressure on commission revenue and uncertainty about whether new initiatives such as PayPal Open and Fastlane could drive substantial future growth. Elevated market expectations also played a role, as investors expected a faster acceleration in growth.

PayPal Holdings, Inc.’s stock buyback program

PayPal Holdings, Inc. announced a new stock buyback program in its Q4 2024 report, released on 4 February 2025. The company’s Board of Directors approved a 15 billion USD share repurchase plan, reflecting confidence in PayPal’s long-term value and its commitment to returning capital to shareholders.

This new program builds on the company’s current capital allocation strategy, following significant share repurchase activity in 2024. Over the full year of 2024, PayPal bought back approximately 75 million shares, returning 6.0 billion USD to shareholders.

The new 15 billion USD program replaces all previous initiatives, giving PayPal the flexibility to reduce the number of outstanding shares further, potentially boosting EPS over time by concentrating ownership among the remaining shareholders.

CEO Alex Chriss and CFO Jamie Miller emphasised that the program reflects PayPal’s strong financial position and the undervaluation of its shares, which closed 2024 at levels they believe do not fully reflect the company’s growth potential, particularly in high-margin segments such as branded payments and Venmo.

Buybacks were expected to be carried out depending on market conditions, share price, and the company’s liquidity requirements, with no fixed completion date.

PayPal Holdings, Inc. Q2 2025 financial results

PayPal Holdings released its Q2 2025 financial results on 29 July 2025. Key figures are as follows:

- Revenue: 8.29 billion USD (+5%)

- Net income: 1.37 billion USD (+10%)

- Earnings per share: 1.40 USD (+18%)

- Operating profit: 1.64 billion USD (+15%)

Account and activity metrics:

- Active accounts: 438 (+2%)

- Monthly active accounts: 226 (+2%)

- Number of payment transactions: 6.22 (–5%)

- Transactions per active account: 58.3 (–4%)

- TPA ex. PSP (unbranded card processing): 35.60 (+4%)

In Q2 2025, PayPal reported revenue growth of 5% to approximately 8.3 billion USD. Adjusted earnings per share came in at 1.40 USD, slightly beating analyst expectations but below the earlier projection of 1.47 USD. Total payment volume (TPV) rose by 6% to 443.5 billion USD. Venmo was a standout performer, with revenue growing by more than 20% and delivering its strongest quarterly result in three years.

The company raised its full-year 2025 guidance, expecting adjusted earnings per share of between 5.15 and 5.30 USD (up from the previous range of 4.95 to 5.10 USD). Transaction-based revenue was expected to rise to 15.35– 15.50 billion USD, 5–6% higher year on year. For Q3 2025, the forecast for adjusted earnings per share was 1.18–1.22 USD, broadly in line with market expectations.

Investor reaction to the report was negative. Despite earnings growth and upgraded guidance, PayPal’s shares fell by 9% on the day of the release, marking one of the weakest performances on the Nasdaq. This was due to concerns about slowing growth in branded checkout and an overall deceleration in payment volume growth.

There was also some negative sentiment driven by competitive pressures, although fundamental metrics remained robust.

PayPal Holdings, Inc. Q3 2025 report

On 28 October 2025, PayPal Holdings released its Q3 2025 financial results. The key figures are as follows:

- Revenue: 8.42 billion USD (+7%)

- Net income: 1.29 billion USD (+5%)

- Earnings per share: 1.34 USD (+12%)

- Operating profit: 1.57 billion USD (+6%)

Account and activity metrics:

- Active accounts: 438 million (+1%)

- Monthly active accounts: 227 million (+2%)

- Number of payment transactions: 6.33 billion (–5%)

- Transactions per active account: 57.6 (–6%)

- TPA excl. PSP (unbranded card processing): 36.20 (+5%)

In Q3 2025, PayPal’s revenue rose by 7% to 8.4 billion USD, while non-GAAP earnings per share (EPS) increased by 12% to 1.34 USD, and net profit was up 5%. The faster EPS growth compared with net income reflects the impact of share buybacks.

Revenue growth was primarily driven by an increase in payment volumes. Total payment volume (TPV) rose by 8%, with branded payments and Venmo showing particularly strong momentum. Venmo grew at double-digit rates and remained a key driver of the platform’s overall performance: the higher the share of such payments, the stronger the company’s profitability.

User metrics were more mixed. The number of active accounts increased slightly, but users made fewer transactions: payment frequency fell by approximately 5%, meaning that, on average, each customer transacted less frequently than they did a year earlier.

PayPal’s margins remained under pressure due to its business structure, as growth in large merchant partners and external transaction processing lowers the average commission rate. Nonetheless, the company maintained its operating margin and continued to increase profitability through cost control.

Cash flow remained strong: PayPal generated more than 2 billion USD in operating cash per quarter, maintained a solid balance sheet, and actively returned capital to shareholders through buybacks and dividends.

PayPal raised its 2025 guidance, now expecting non-GAAP EPS in the 5.35–5.39 USD range, slightly above the previous outlook, reflecting management’s confidence in the resilience of current trends. The forecast for Q4 2025, at 1.27–1.31 USD per share, was almost exactly in line with market expectations, indicating a realistic and balanced approach by management.

The company focused on improving business efficiency. Its main priority is increasing the transaction margin – that is, the actual profit generated per payment. To achieve this, PayPal actively reallocated traffic towards more profitable channels, such as branded payment scenarios via the PayPal platform and the Venmo ecosystem, where fees are higher and risk is lower.

PayPal Holdings, Inc. Q4 2025 report

On 3 February 2025, PayPal Holdings released its Q4 2025 report. Below are the key figures:

- Revenue: 8.68 billion USD (+4%)

- Net income (non-GAAP): 1.16 billion USD (–4%)

- Earnings per share: 1.23 USD (+3%)

- Operating profit: 1.57 billion USD (+6%)

Account and activity metrics:

- Active accounts: 439 million (+1%)

- Monthly active accounts: 231 million (+1%)

- Number of payment transactions: 6.75 billion (+2%)

- Transactions per active account: 57.7 (–5%)

- TPA ex. PSP (unbranded card processing): 36.60 billion USD (+5%)

PayPal’s Q4 2025 report disappointed the market. Revenue grew to 8.68 billion USD, and adjusted earnings came in at 1.23 USD per share, but both figures fell short of analyst expectations. However, the total payment volume (TPV) increased to 475.1 billion USD (+9%), but operating profit and margin showed little growth. The key product, branded checkout, underperformed: its turnover grew by only around 1%, which investors viewed as a problem amid heightened competition and weak demand in online retail.

There were positive aspects too. Venmo continued to grow rapidly, with revenue of 1.7 billion USD (+20%), and the BNPL (Buy Now Pay Later) segment exceeded 40 billion USD in volume. Adjusted earnings per share for the full year grew by 14% to 5.31 USD. However, the market focused not on the past but on the outlook: management gave a cautious forecast and effectively acknowledged that a recovery for branded checkout would take time and require additional investment.

The 2026 forecast is measured. For Q1, the company expects a decline or stagnation in key margin metrics and a slight drop in non-GAAP EPS. For the full year, the outlook is similar: flat earnings per share or modest growth, with PayPal expecting to generate more than 6 billion USD in free cash flow and allocate about 6 billion USD for stock buybacks. The forecast is pressured by lower interest rates, investments in product development, reduced contributions from credit services, and the continued weak growth of branded checkout.

An additional negative signal for the market was the change in CEO, which investors saw as an acknowledgement that the pace of transformation had been insufficient. Against this backdrop, positive news such as the launch of a quarterly dividend of 0.14 USD, an active stock buyback program, and a strong balance sheet with 14.8 billion USD in cash and 11.6 billion USD in debt, could not offset the general perception that PayPal’s issues are structural rather than temporary.

Analysis of key valuation multiples for PayPal Holdings, Inc.

Below are the key valuation multiples for PayPal Holdings, Inc. based on Q4 2025 results, calculated using a share price of 41 USD.

| Valuation multiple | What it measures | Value | Commentary |

|---|---|---|---|

| P/E (TTM) | Price per 1 USD of earnings over the last 12 months | 7.6 | ⬤ Low: valuation based on earnings appears inexpensive |

| P/S (TTM) | Price per 1 USD of annual revenue | 1.1 | ⬤ Low: the market is not pricing in high growth, so there is re-rating potential if business momentum improves |

| EV/Sales (TTM) | Enterprise value relative to revenue (including debt) | 1.1 | ⬤ Low: supportive for the medium term if the company restores growth rates |

| P/FCF (TTM) | Price per 1 USD of free cash flow | 6.8 | ⬤ Very inexpensive on an FCF basis |

| FCF Yield (TTM) | Free cash flow yield to shareholders | 16.9% | ⬤ High yield |

| EV/EBITDA (TTM) | Enterprise value relative to operating earnings before depreciation and amortisation | 5.3 | ⬤ Low: typical for companies where the market questions the sustainability of growth |

| EV/EBIT (TTM) | Enterprise value relative to operating profit | 6.5 | ⬤ Low: with stable operating performance, the share price could re-rate quickly |

| P/B | Price to book value | 1.9 | ⬤ Moderate: for PayPal, book value is not the primary valuation anchor |

| Net Debt/EBITDA | Debt burden relative to EBITDA | 0.23 | ⬤ Very low leverage: financial risk is limited |

| Interest Coverage (TTM) | Operating profit coverage of interest expense | 13.8 | ⬤ Strong coverage: interest expenses do not materially pressure profitability |

Valuation multiples analysis for PayPal Holdings, Inc. – conclusion

Based on its valuation multiples, PayPal currently appears to be a significantly undervalued large-scale payments company. Low P/E and EV/EBIT ratios, alongside a very high FCF yield, suggest that the market is pricing in a weak growth scenario and questioning the sustainability of current profitability and cash flow. Such a valuation is typical for a business where investors expect margin pressure amid intensifying competition.

Investor scepticism is understandable. In payments, competition has strengthened: Apple Pay and Google Pay dominate the front end, Stripe and Adyen are gaining ground in processing, while BNPL providers and in-marketplace payment solutions continue to expand. As a result, strong financial results alone are not sufficient – investors want confirmation that PayPal can accelerate payment volumes and revenue growth without effectively “buying” growth through higher expenses, sustain transaction margins, and at the same time preserve strong free cash flow generation.

Over the next 6–12 months, upside potential for the shares will largely depend on a re-rating. If PayPal demonstrates improving growth and monetisation dynamics in the coming quarters while maintaining cost discipline, the current depressed valuation could be revised upwards relatively quickly. However, if guidance remains weak or growth requires materially higher investment, valuation multiples may stay compressed, and the stock could continue to trade sideways or lower, even with ongoing share buybacks.

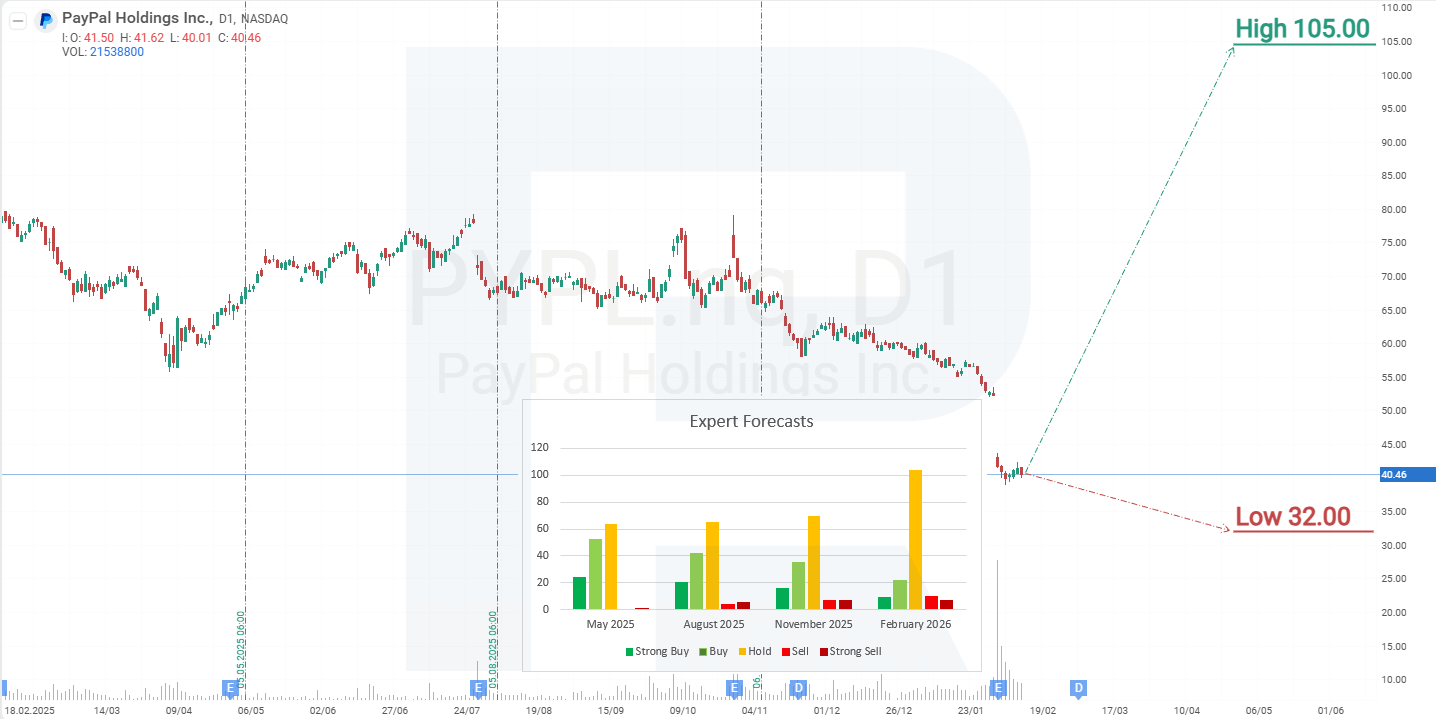

Expert forecasts for PayPal Holdings, Inc. stock

- Barchart: 6 out of 44 analysts rated PayPal Holdings shares as Strong Buy, 2 as Moderate Buy, 31 as Hold, 1 as Sell, and 4 as Strong Sell. The upper price target is 105 USD, and the lower bound is 34 USD.

- MarketBeat: 10 out of 44 analysts assigned a Buy rating to the shares, 30 recommended Hold, and 4 recommended Sell. The upper price target is 100 USD, and the lower bound is 32 USD.

- TipRanks: 5 out of 35 analysts rated the shares as Buy, 26 recommended Hold, and 4 recommended Sell. The upper price target is 74 USD, and the lower bound is 34 USD.

- Stock Analysis: 3 out of 30 analysts rated the shares as Strong Buy, 5 as Buy, 18 as Hold, 1 as Sell, and 3 as Strong Sell. The upper price target is 95 USD, and the lower bound is 34 USD.

PayPal Holdings, Inc. stock price forecast for 2026

The coronavirus pandemic marked the most successful period in PayPal’s history. Demand for online payments surged, allowing the company to more than double its profits, while its share price rose by 230%. However, sustaining such high growth rates proved challenging, particularly amid intensifying competition from new market entrants. After reaching a peak in December 2024, PYPL shares began to decline. Despite solid financial results, the introduction of dividends, and an ongoing share buyback program, investors no longer see sufficient potential for further earnings growth.

The change of CEO also signals a search for a new growth strategy, but without a clearly articulated vision capable of convincing investors, the company risks facing continued weakening interest in its shares. Although stable revenues and a large customer base allow PayPal to maintain dividend payments and share repurchases, the business is increasingly perceived as a mature company with limited growth potential.

For dividend-focused investors, the current quarterly payout of 0.14 USD per share offers a yield that is too low to justify the risks associated with intense competition. As a result, pressure on PayPal shares is likely to persist until the company presents credible steps to restore sustainable growth.

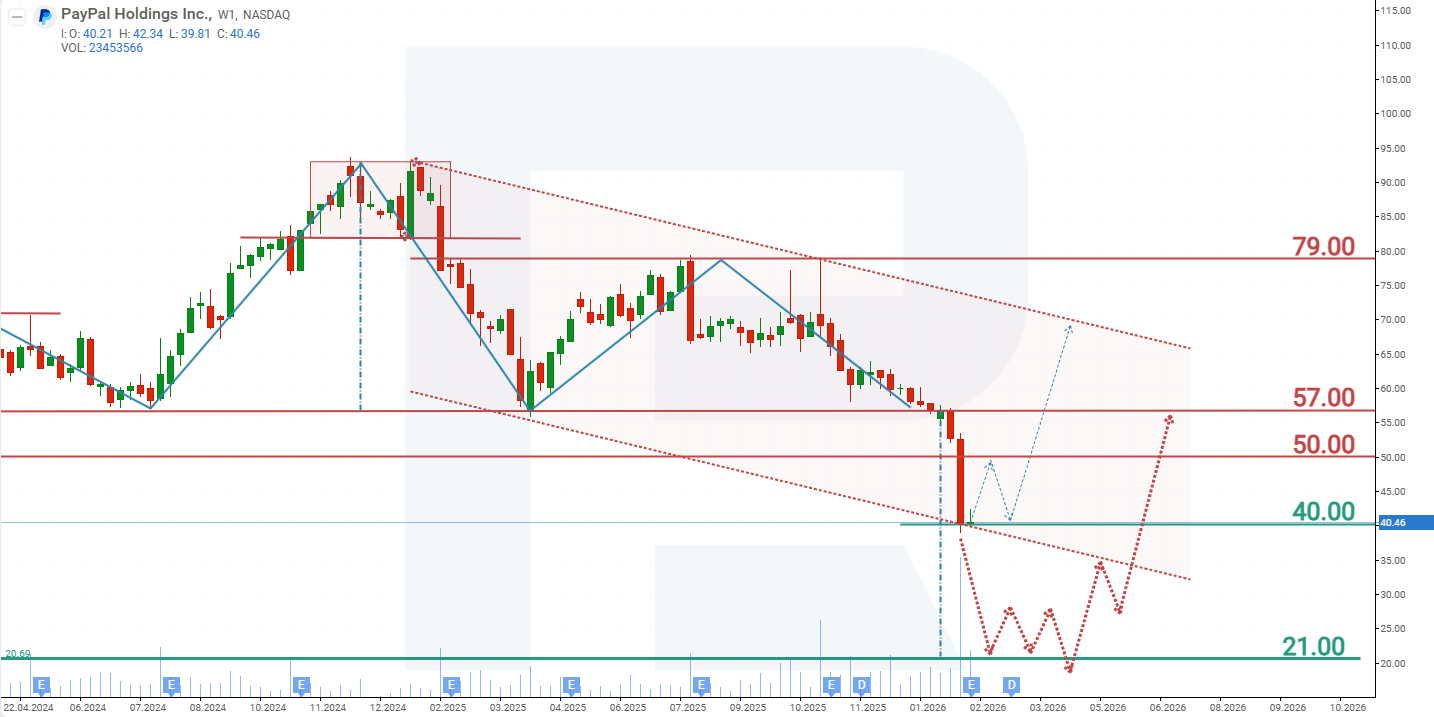

As of February 2026, PYPL shares are trading within a descending channel and have reached the lower boundary, which currently serves as support. However, a Head and Shoulders pattern has previously formed on the chart, signalling the risk of further downside. Against the backdrop of intensifying competition and subdued investor interest, the scenario of continued price weakness appears the most probable. Based on the current price dynamics of PayPal shares, the possible scenarios for 2026 are as follows:

The base-case forecast for PayPal stock in 2026 suggests a break below the 40 USD support level, followed by a decline towards 21 USD, which corresponds to the measured target of the Head and Shoulders pattern. Thereafter, a period of consolidation is expected while the market awaits further strategic updates from the company. If investors are presented with a credible new strategy and gain confidence in PayPal’s ability to materially increase profitability, interest in the shares could recover, in which case PYPL may rebound towards resistance at 57 USD.

The alternative forecast for PayPal shares suggests a recovery from current levels. For this scenario to materialise, a supportive news flow and the announcement of a clear new development strategy would be required. Once the new CEO takes office, he could introduce meaningful changes. If the proposed direction proves both compelling and potentially profitable, the share price could advance towards the trendline around 70 USD.

PayPal Holdings, Inc. stock analysis and forecast for 2026Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.