US Tech forecast: the index has recovered and resumed growth

The US Tech index entered an uptrend after a recovery. The US Tech forecast for next week is negative.

US Tech forecast: key trading points

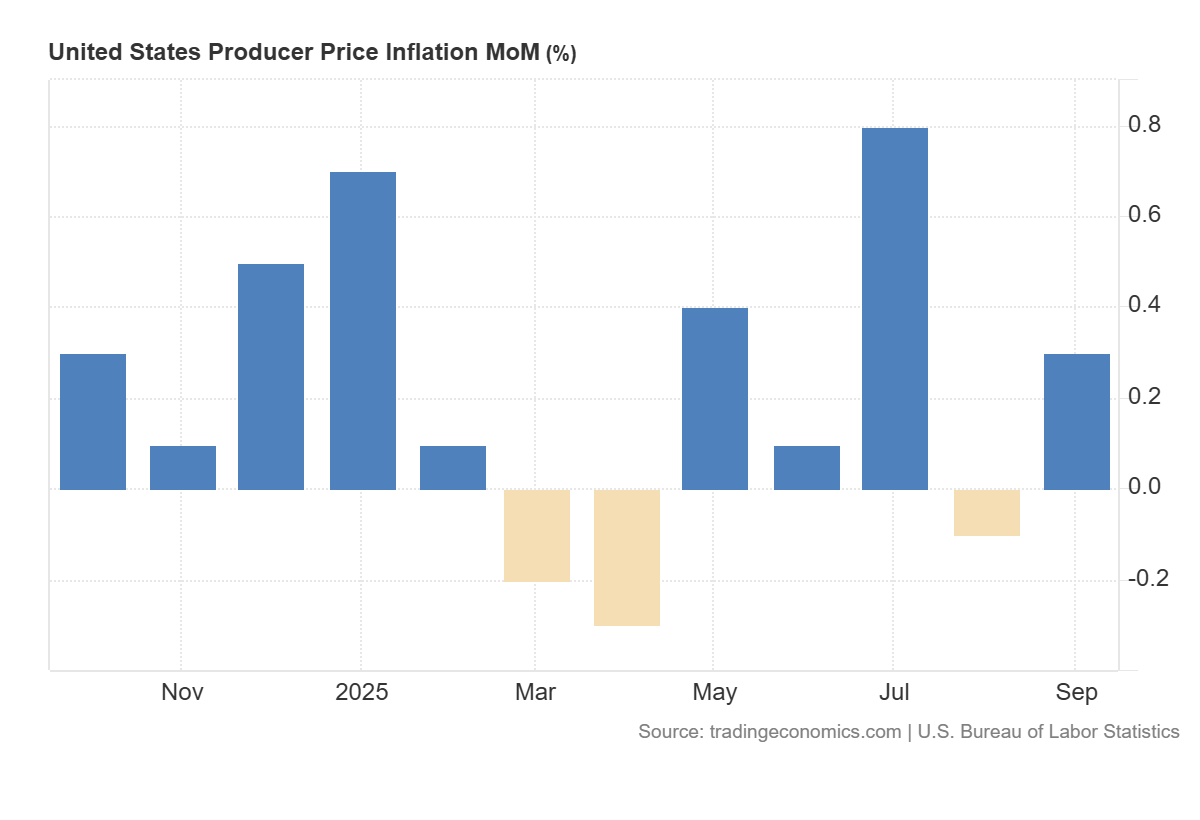

- Recent data: US PPI for September increased by 0.3% compared to August

- Market impact: the current data has a mixed impact on the technology sector

US Tech fundamental analysis

The published monthly US Producer Price Index (PPI) showed an increase of 0.3%, matching forecasts but noticeably different from the previous reading of -0.1%, when wholesale prices were declining. This means the market received a signal: cost pressure on businesses is rising again, albeit in a way that analysts expected. Producers are paying more for raw materials, components, and services, and eventually, part of these costs may be passed on to end consumers and reflected in consumer inflation.

US producer price inflation MoM: https://tradingeconomics.com/united-states/producer-price-inflation-momFor the US stock market as a whole, such data carries a rather neutral-to-negative signal. On the one hand, the figure did not exceed expectations, so investors did not receive a bad surprise, and the scenario of sharply tightening Fed policy due to the PPI did not arise. On the other hand, the turnaround from a negative reading to steady growth shows that there is still inflationary pressure at the producer level. This limits hopes for a quick and aggressive rate-cutting cycle in the coming months. For companies, this may mean margin contraction if they are unable to fully pass rising costs onto consumers. Therefore, some investors may respond with cautious profit-taking, especially after strong rallies driven by expectations of easier monetary policy.

US Tech technical analysis

For the US Tech index, the impact may be more pronounced. The technology sector depends heavily on expectations of future earnings, and its valuation is strongly influenced by interest rates and bond yields. If market participants interpret rising PPI as confirmation that inflation is not cooling fast enough and the Fed will need to keep rates elevated for longer, government bonds will be more preferable for investors. The cost factor is equally important: some IT and semiconductor companies purchase expensive equipment and components, so rising wholesale prices may further increase their cost burden.

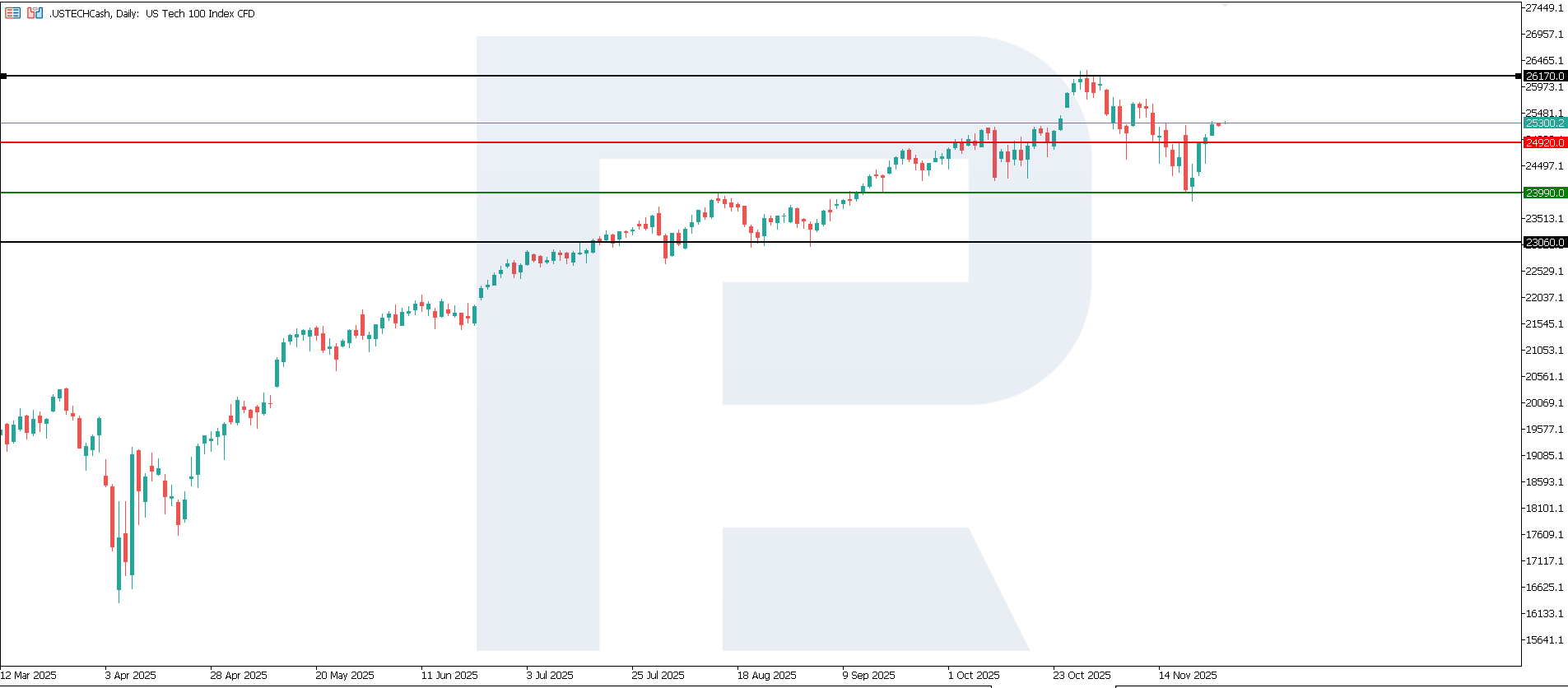

US Tech technical analysis for 28 November 2025The US Tech index managed to reverse its downtrend and resume growth. The nearest resistance level at 24,920.0 has been broken, and support has shifted to 23,990.0. The next upside target may be 26,170.0.

The US Tech price forecast outlines the following scenarios:

- Pessimistic US Tech scenario: a breakout below the 23,990.0 support level could push the index to 23,060.0

- Optimistic US Tech scenario: if the price consolidates above the previously breached 24,920.0 resistance level, the index could climb to 26,170.0

Summary

The current PPI release at 0.3% is not a shock to the market, but it is a reminder that the path to sustainably low inflation will be uneven. For the broader US stock market, this means a moderate cooling of optimism regarding a quick Fed policy easing. For the US Tech index, risks look slightly higher: the sector may react more strongly to any change in yields and revised rate expectations, making tech stock performance more volatile amid such inflation data. The nearest upside target may be the 26,170.0 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.