US Tech forecast: the index continues its correction, down more than 4%

The correction in the US Tech index has intensified. The US Tech forecast for the upcoming week is negative.

US Tech forecast: key trading points

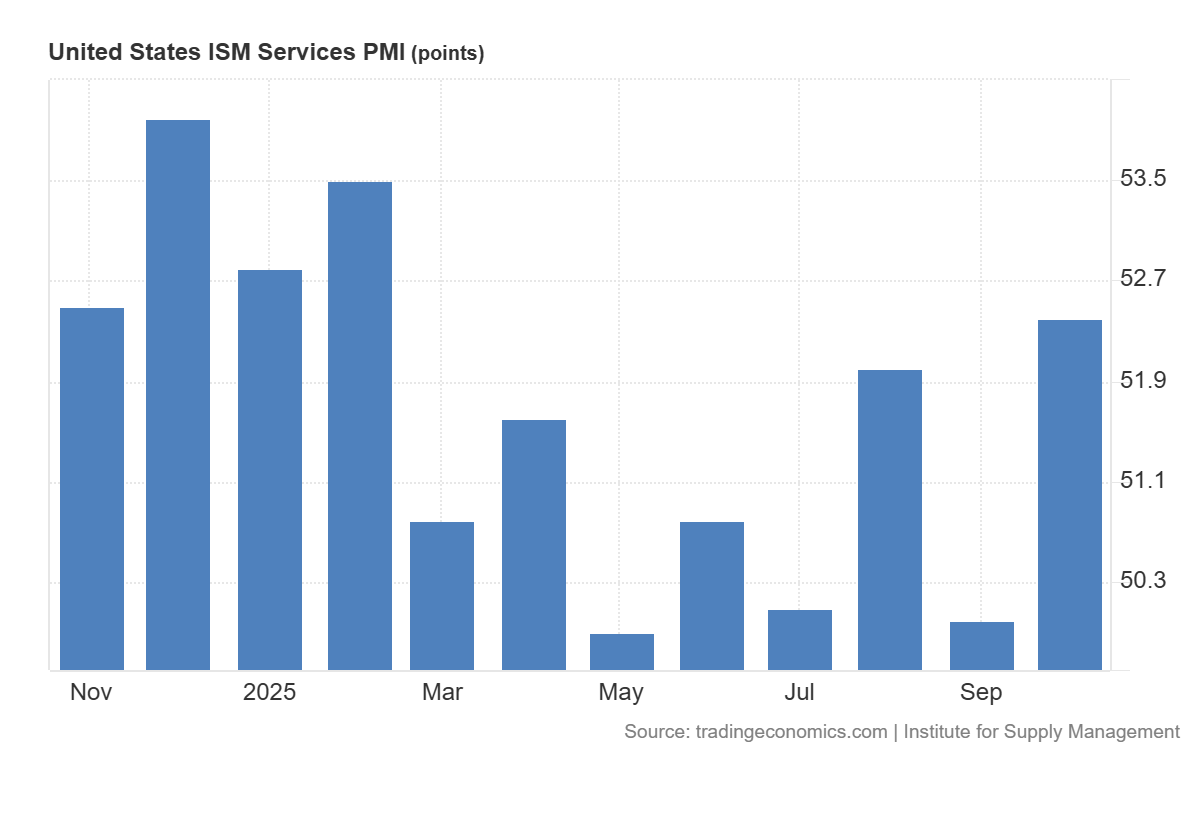

- Recent data: US ISM services PMI for October stood at 52.4

- Market impact: the data has a positive effect on the technology sector

US Tech fundamental analysis

The US ISM non-manufacturing PMI came in at 52.4, above the forecast of 50.7 and the previous reading of 50.0. This indicates that the services sector not only remains in expansion territory (readings above 50.0 signal growth) but is also accelerating compared with the previous month, beating analysts’ expectations. As services represent the largest part of the US economy, the data indicates stable domestic demand and suggests that businesses are more confident than anticipated.

US ISM services PMI: https://tradingeconomics.com/united-states/non-manufacturing-pmiOn the other hand, stronger employment metrics compared with consensus forecasts raise concerns that the disinflation process might proceed more slowly than desired by the Federal Reserve. For the Fed, this is a signal for caution when considering further rate cuts. For the US stock market, the overall impact tends to be positive. Stronger service sector activity suggests potential revenue and profit growth for companies focused on domestic consumption – retail, transport, hospitality, restaurants, and financial services. At the same time, recession fears are reduced: since services usually weaken before an economic downturn, the rebound above stagnation levels indicates a resilient economy.

US Tech technical analysis

For the US Tech index, the effect is moderately positive. A robust services sector supports demand for digital infrastructure, cloud computing, software, online advertising, and e-commerce. Many tech companies derive a significant portion of their income from corporate and consumer services. When services in the economy are growing, IT budgets are cut less frequently, and in some segments, they are even expanded. This strengthens expectations for tech companies' revenue and profits and, in theory, should support the US Tech index.

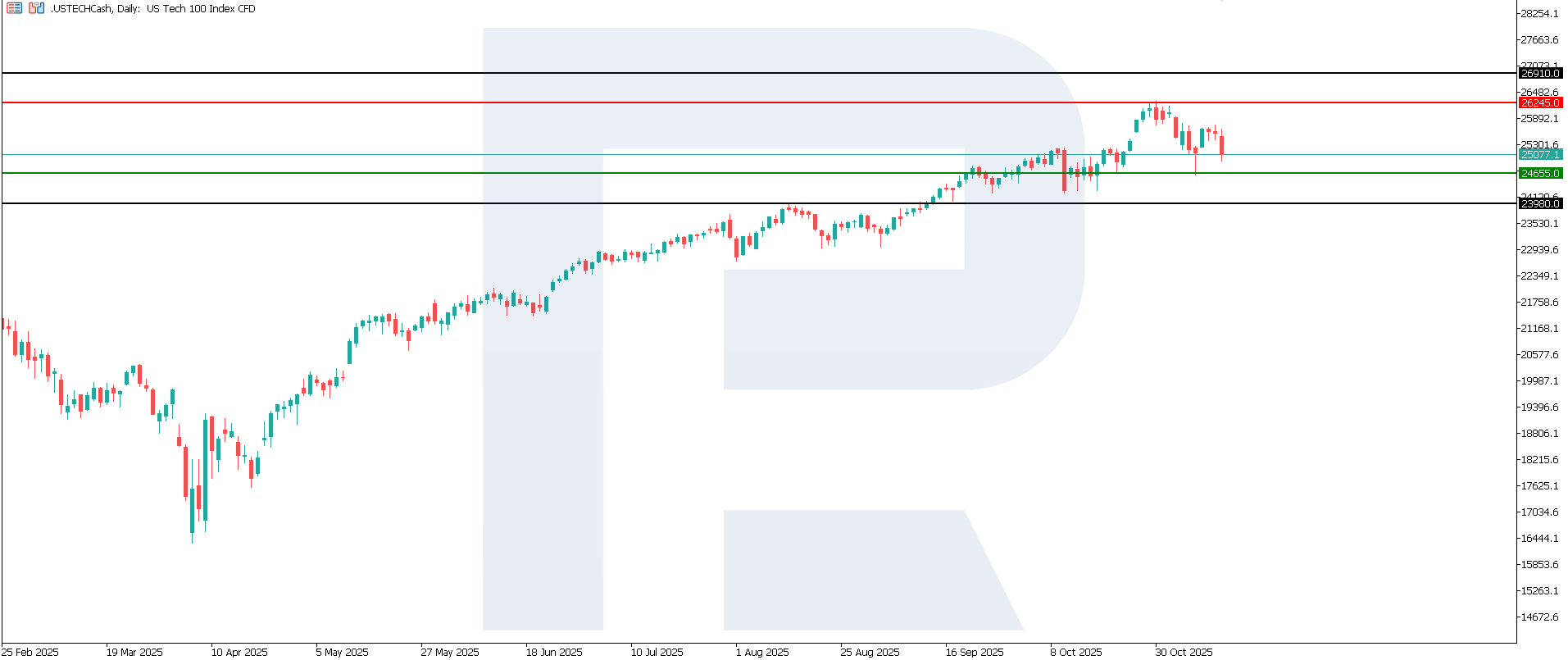

US Tech technical analysis for 14 November 2025The US Tech index continues to decline within its ongoing correction, while the broader uptrend remains intact. The nearest resistance level is located at 26,245.0, and a new support zone has formed around 24,655.0. The next potential upside target is 26,910.0.

The US Tech price forecast outlines the following scenarios:

- Pessimistic US Tech scenario: a breakout below the 24,655.0 support level could push the index down to 23,980.0

- Optimistic US Tech scenario: a breakout above the 26,245.0 resistance level could boost the index to 26,910.0

Summary

The expected increase in tech-sector revenues and demand may partly offset the pressure from higher or prolonged interest rates. In the medium term, the direction of the US Tech index will depend on what investors consider more important: the sustained business growth of tech companies or the potential persistence of high borrowing costs and bond yields. From a technical perspective, the next upside target for the US Tech index could be 26,910.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.