US Tech forecast: the index hits new all-time high after Fed rate cut

The US Tech index continues to grow steadily, reaching fresh all-time highs. The US Tech forecast for next week is positive.

US Tech forecast: key trading points

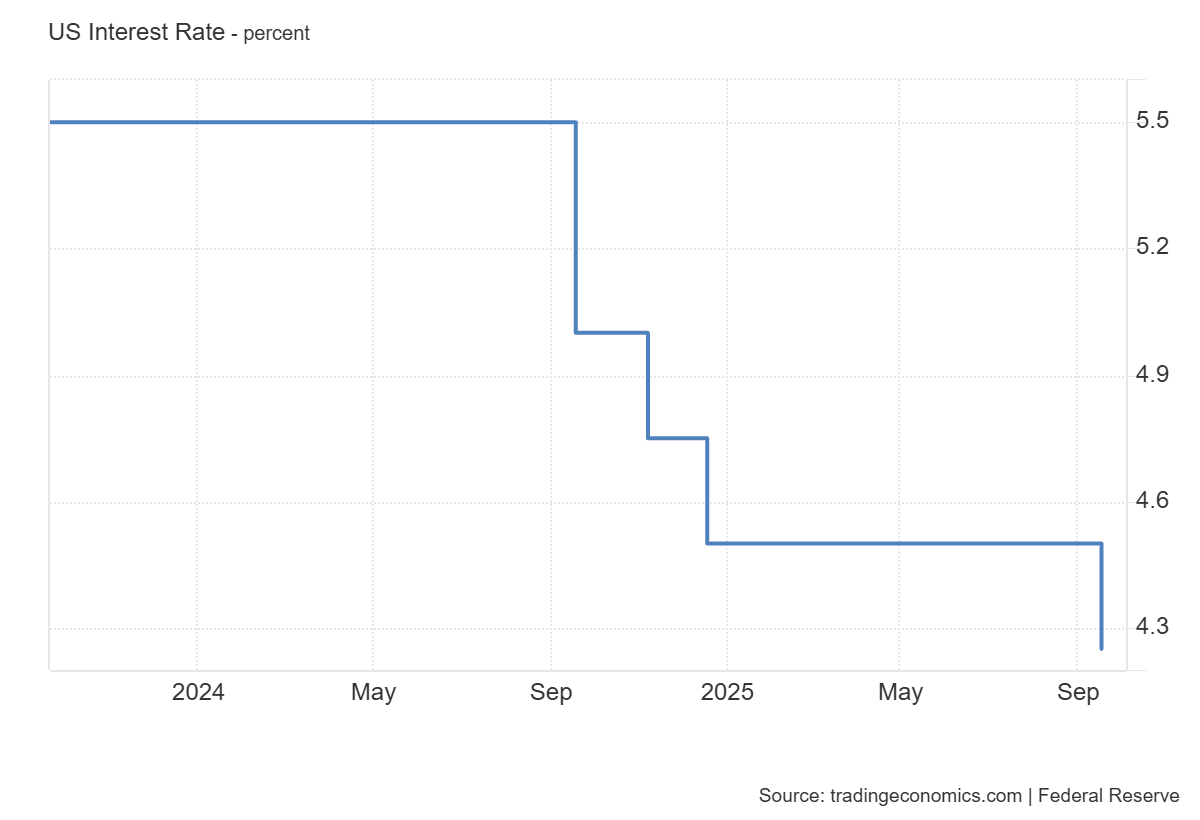

- Recent data: the Federal Reserve lowered its key rate to 4.25% per annum

- Market impact: this decision has a largely positive effect on the technology sector

US Tech fundamental analysis

The Federal Reserve’s decision to lower the key rate from 4.50% to 4.25%, in line with market expectations, sends a significant signal to US financial markets. The rate cut reflects the Fed’s intention to support economic activity amid slowing GDP growth and labour market weakness. Lower rates reduce borrowing costs for corporations and households, potentially stimulating investment and consumption. However, Jerome Powell’s accompanying comments pointed to persistent inflation risks, partly driven by tariff policy, which tempers excessive investor optimism.

US Fed Funds Interest Rate: https://tradingeconomics.com/united-states/interest-rateFor financial markets, the effect is balanced: liquidity support combines with warnings about structural inflation risks. For the technology sector, the rate cut has a dual impact. On the one hand, cheaper borrowing and lower mortgage rates indirectly support demand for digital goods and services. In addition, high-tech companies with long-term investment programs benefit from lower capital costs.

US Tech technical analysis

Inflationary risks tied to tariff-driven price increases may persist, limiting the scope for aggressive monetary easing. In the short term, the US Tech may deliver moderate growth thanks to easier financing conditions, but the sector’s high sensitivity to inflation expectations and geopolitical risks leaves room for correction.

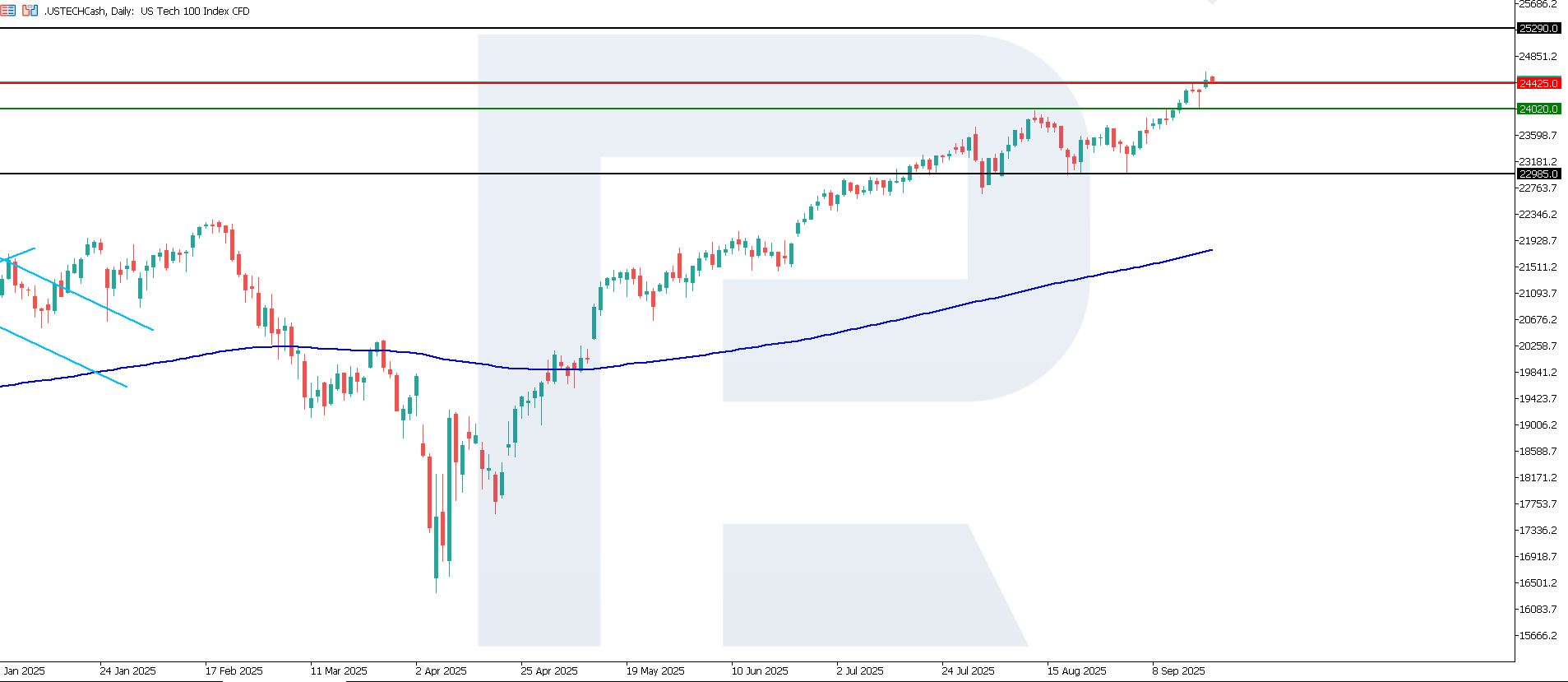

US Tech technical analysis for 19 September 2025The US Tech index broke above the previous resistance level at 24,425.0, with a new support line formed at 24,020.0. A new resistance level is yet to form. The uptrend will likely be medium-term, with the nearest upside target at 25,290.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech scenario: a breakout below the 24,020 support level could push the index to 22,985.0

- Optimistic US Tech scenario: if the price consolidates above the previously breached resistance level at 24,425.0, the index could climb to 25,290

Summary

The US equity market received a clear support signal from the Federal Reserve. However, lingering uncertainty over the long-term inflation path and tariff policy implies that the US Tech rally will likely remain moderate and volatile. Investors are shifting focus towards companies with strong balance sheets and the ability to pass costs onto end consumers. The next upside target for the US Tech could be 25,290.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.