US Tech forecast: the index hits a new all-time high on US inflation data

After completing a correction, the US Tech index resumed its upward movement and set a new all-time high. The US Tech forecast for next week is positive.

US Tech forecast: key trading points

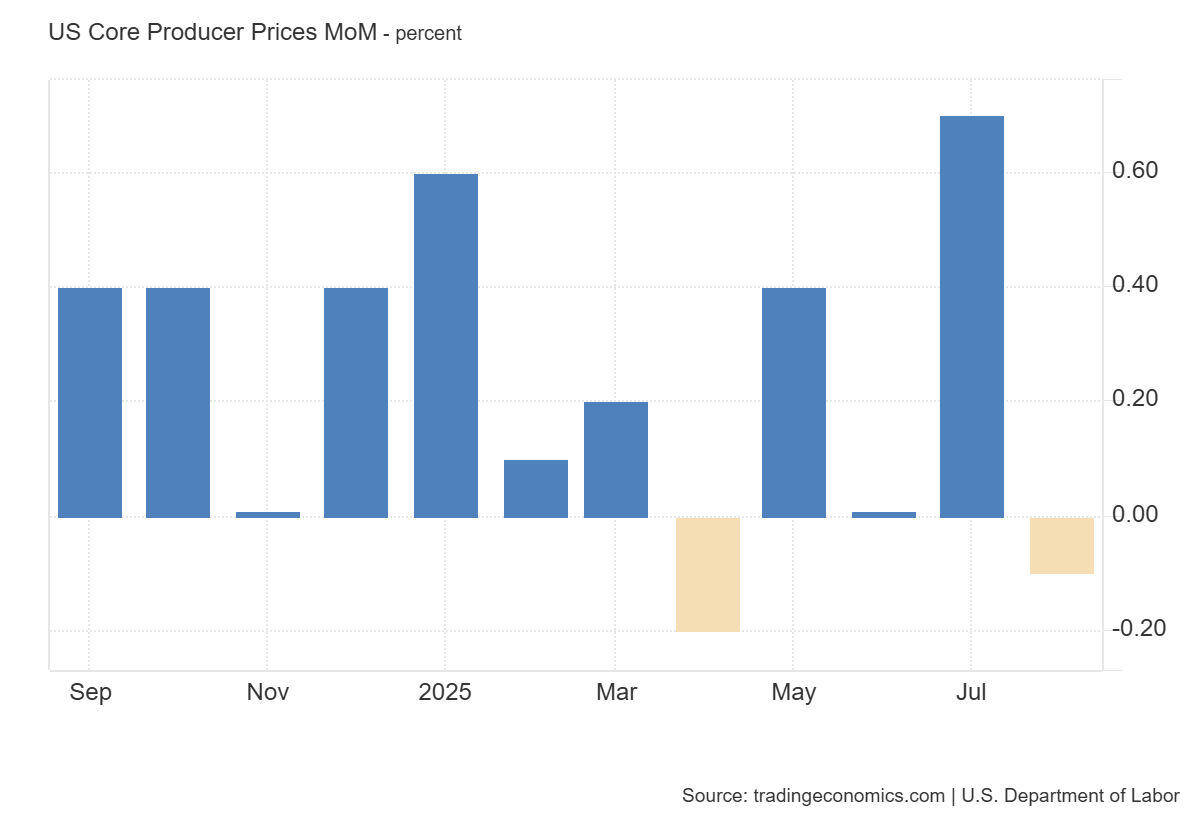

- Recent data: US PPI for August declined by 0.1%

- Market impact: this is broadly positive for the US stock market, as it increases the likelihood of a Federal Reserve rate cut

US Tech fundamental analysis

The US Producer Price Index (PPI) fell by 0.1% m/m, below expectations of a 0.3% rise and after a 0.7% increase in the previous month. This indicates easing input cost pressure for real sector companies. Historically, PPI trends partially pass through to consumer inflation (CPI/PCE) with a lag, so the current result increases the likelihood of a smoother price trajectory in H2 and reduces the risk of secondary cost-driven inflationary effects.

US Producer Price Index (PPI) MoM: https://tradingeconomics.com/united-states/core-producer-prices-momFor financial markets, the main channel of influence lies in Fed policy expectations and bond yields. A weaker PPI reinforces dovish sentiment: the probability of a pause and/or earlier rate cuts rises, the term premium on Treasuries declines, and discount rates for future cash flows fall. This environment favours long-duration growth assets, particularly technology stocks. The US Tech index is statistically sensitive to lower yields, as a large share of its market capitalisation comes from companies with long growth horizons.

US Tech technical analysis

In the short term, the base case is moderate upside in the US Tech, driven by lower yields and improved risk-to-reward ratio for long-term growth stories. The strongest performance is typically shown by large platforms and high-quality software assets, alongside more volatile, unprofitable growth names. The sustainability of the rally, however, depends on confirmation of the inflation trend in consumer prices.

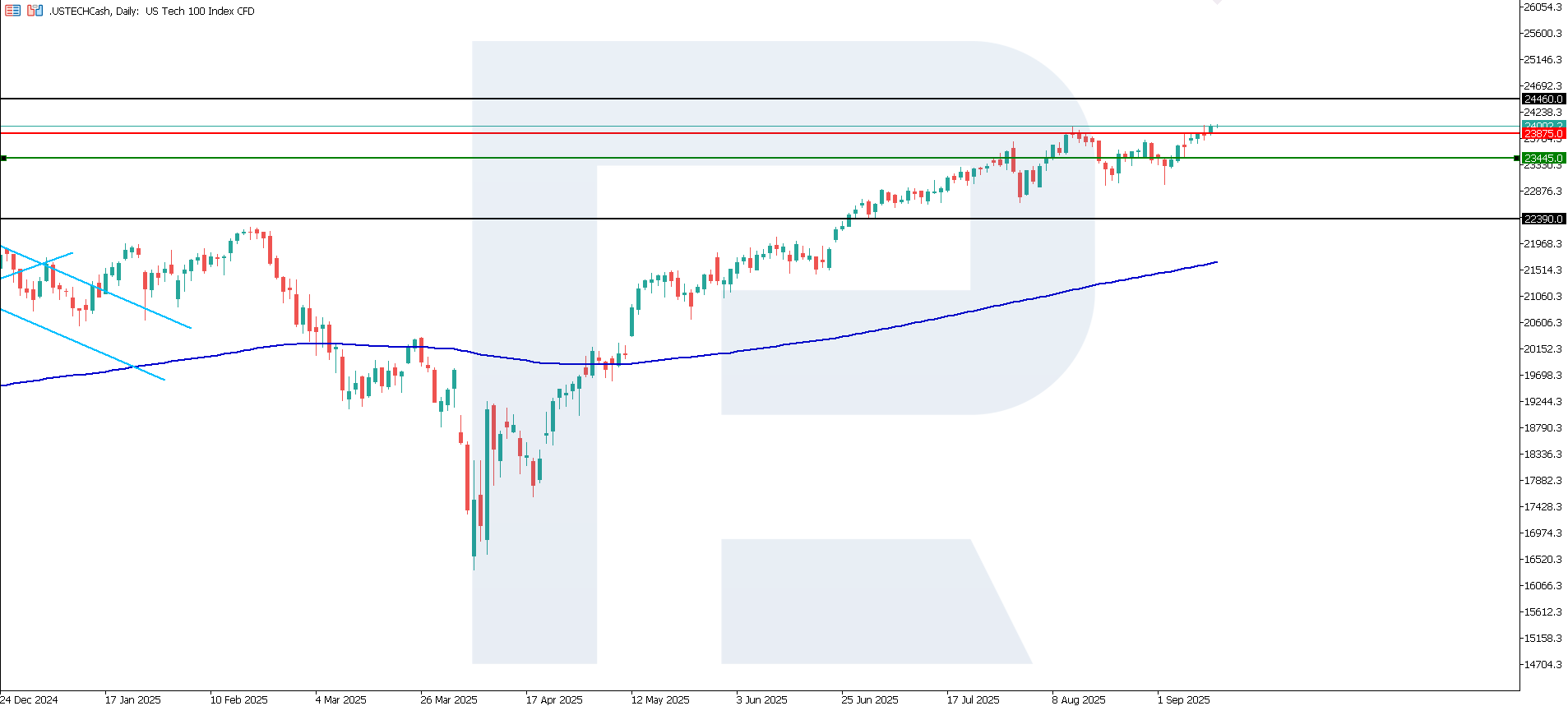

US Tech technical analysis for 12 September 2025The US Tech index broke above the previous resistance level at 23,875.0, with a new support line formed at 23,445.0. A new resistance level is yet to form. The uptrend will likely be medium-term, with the nearest upside target at 24,460.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech scenario: a breakout below the 23,445.0 support level could send the index to 22,390.0

- Optimistic US Tech scenario: if the price consolidates above the previously breached resistance level at 23,875.0, the index could advance to 24,460.0

Summary

The PPI report eases inflation concerns and strengthens expectations of a more dovish Fed policy, creating a supportive backdrop for the US Tech index. Growth stocks benefit the most, while cyclical subsectors tied to end demand show a more restrained reaction. The nearest upside target is 24,460.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.