US Tech forecast: the index resumes growth on positive US GDP data

The downward correction in the US Tech stock index is coming to an end. The US Tech forecast for next week is positive.

US Tech forecast: key trading points

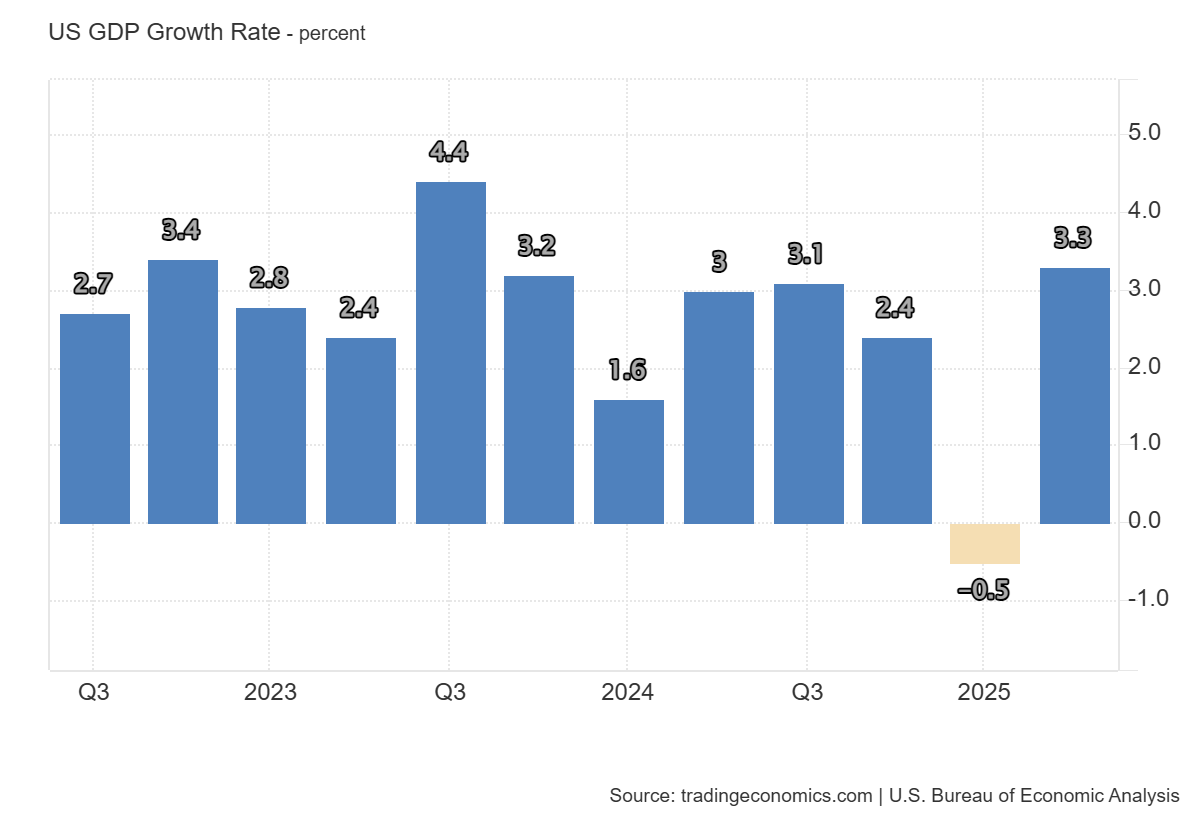

- Recent data: US GDP for Q2 2025 grew by 3.3% year-on-year

- Market impact: this reading is positive for the US equity market

US Tech fundamental analysis

US GDP expanded by 3.3% in Q2 2025 quarter-on-quarter, beating the 3.0% forecast and coming in well above the previous -0.5%. This confirms the recovery of the US economy after a slowdown, supported by both domestic consumption and investments.

US GDP Growth Rate: https://tradingeconomics.com/united-states/gdp-growthFor US equities, such growth is seen as positive, as it indicates resilient demand, improving corporate earnings, and greater economic stability against external shocks. At the same time, faster economic expansion could raise expectations of tighter Federal Reserve monetary policy, creating potential risks for the revaluation of rates and capital costs.

US Tech technical analysis

For the US Tech index, the impact could be mixed. On the one hand, GDP growth supports demand for digital services, semiconductors, and innovative technologies, benefiting tech firms. Cloud solutions, software, and e-commerce stand out as winners, driven by stronger consumption and business activity. On the other hand, robust macroeconomic data may raise concerns about possible rate hikes, which typically puts pressure on the high-tech sector, as it is sensitive to borrowing costs and future earnings discounting.

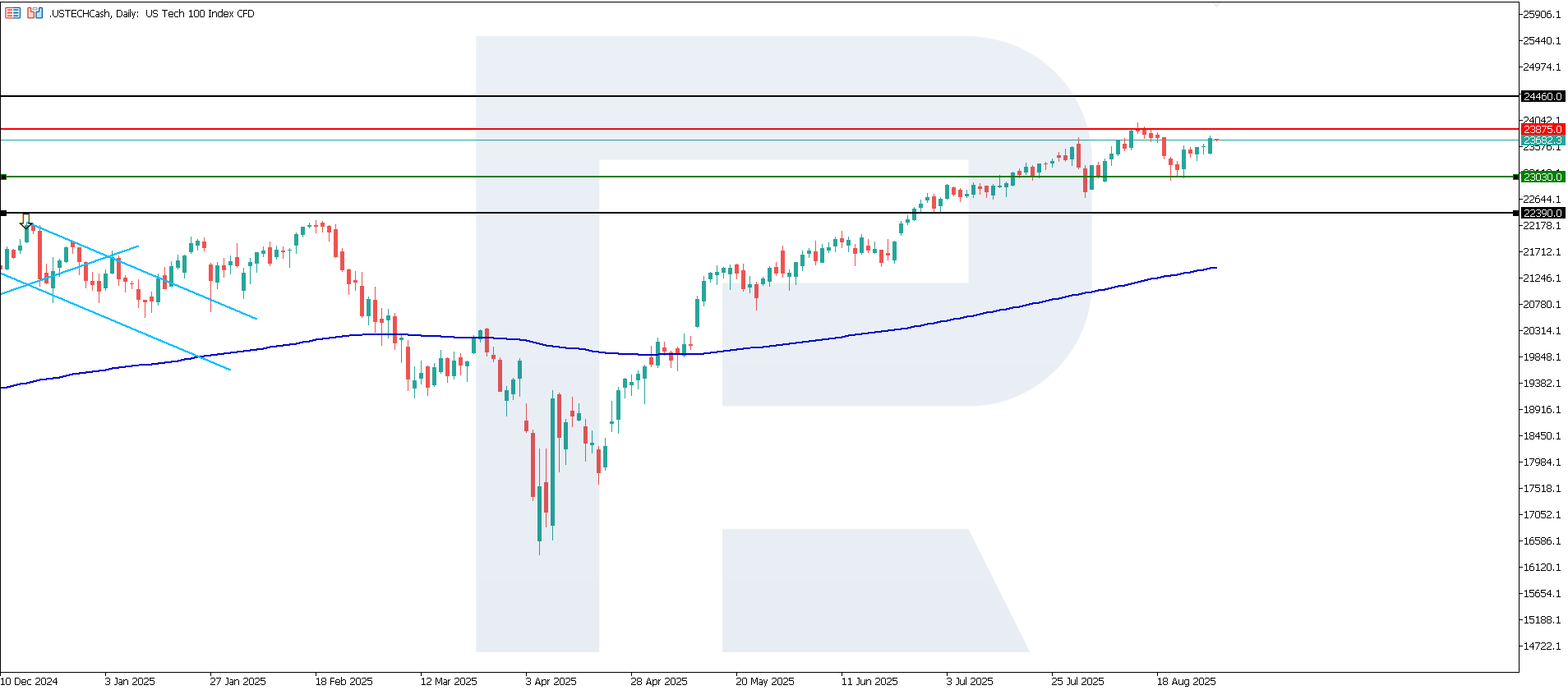

US Tech technical analysis for 29 August 2025The US Tech index broke below the 23,465.0 support level, with a new support line formed at 23,030.0. Resistance stands at 23,875.0. The current downtrend is likely nearing completion, and the price could break above the resistance level, with the next upside target at 24,460.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech scenario: a breakout below the 23,030.0 support level could send the index to 22,390.0

- Optimistic US Tech scenario: a breakout above the 23,875.0 resistance level could push the index to 24,460.0

Summary

In the short term, stronger GDP data is likely to support US Tech by boosting investor confidence in economic growth. However, medium-term risks of correction remain if tighter Fed policy becomes more likely. The index could shift from a downtrend to an uptrend, with the next upside target at 24,460.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.