US Tech forecast: the index continues to rise, but correction risks grow

The uptrend in the US Tech stock index has shifted into a downward correction. The US Tech forecast for next week is negative.

US Tech forecast: key trading points

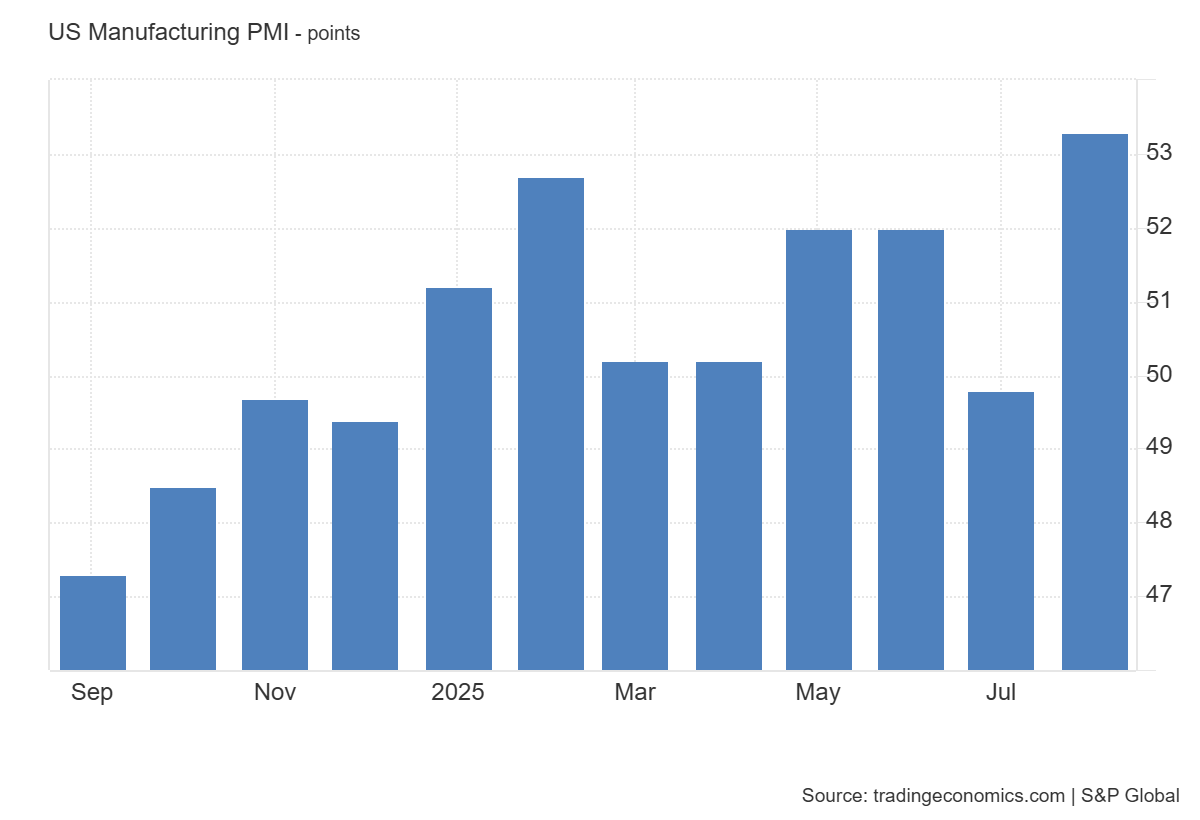

- Recent data: the US manufacturing PMI preliminarily came in at 53.3 in August

- Market impact: this data strengthens expectations for overall economic momentum, which may be viewed positively by equity investors

US Tech fundamental analysis

The US manufacturing PMI reached 53.3 points in August 2025, significantly above the forecast of 49.7 and the previous reading of 49.8. A PMI reading above 50 indicates an expansion in manufacturing activity. This result signals that the industrial sector is in a growth phase with increasing demand for goods.

US Manufacturing PMI: https://tradingeconomics.com/united-states/manufacturing-pmiAlthough PMI directly relates to industrial production, its positive reading indirectly impacts the high-tech sector. Rising manufacturing activity requires more automation, digitalisation of processes, and the use of advanced technologies. This boosts demand for semiconductor products, cloud services, software, and industrial robotics. As a result, the tech-heavy index may find additional support.

US Tech technical analysis

The semiconductor and equipment segment is seeing a positive effect since stronger production demand drives purchases of new technological solutions. For cloud services and software, demand for digital tools that improve efficiency is expected to grow. In industrial automation and robotics, demand is increasing for equipment and solutions to boost productivity.

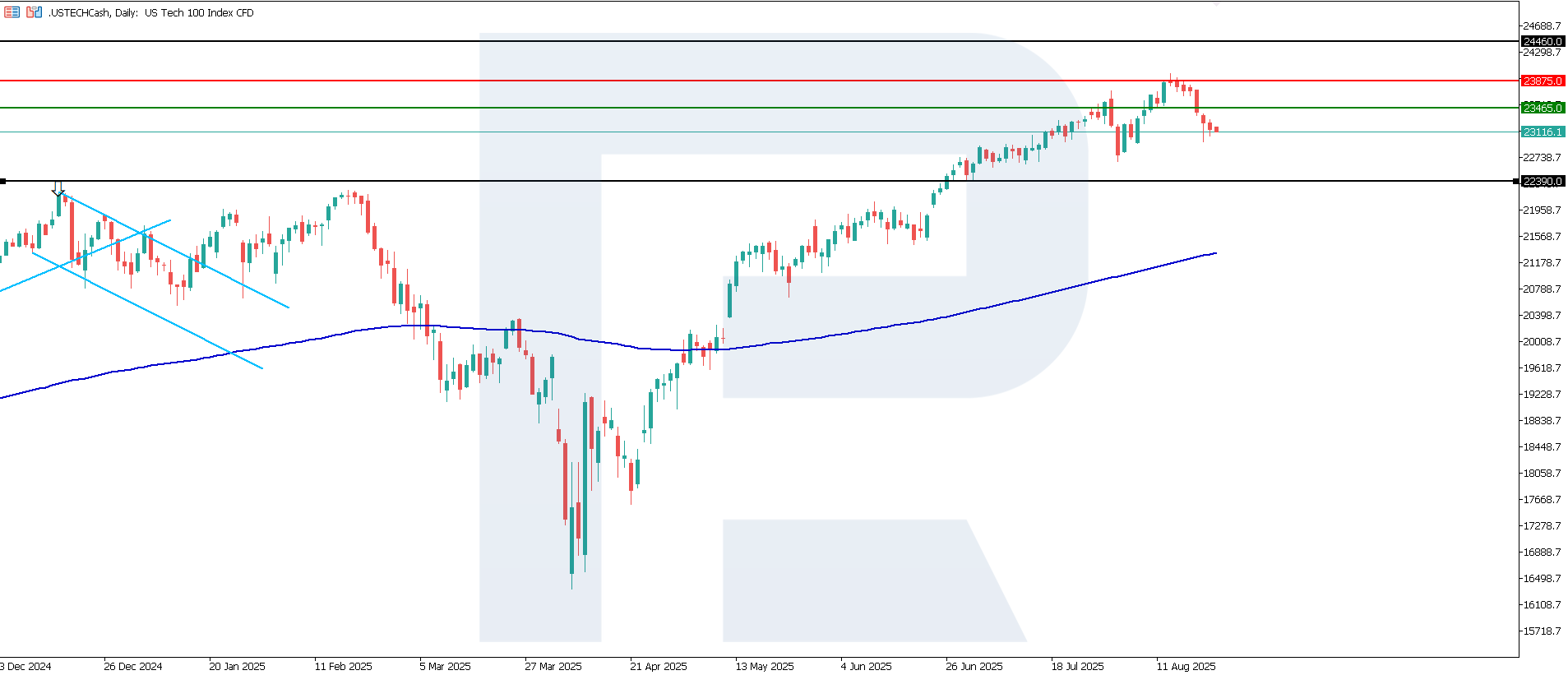

US Tech technical analysis for 22 August 2025The US Tech index broke below the 23,465.0 support level, with a new support line yet to form. Resistance stands at 23,875.0. The current downtrend will likely be short-lived, with the nearest downside target at 22,390.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech scenario: if the price consolidates below the previously breached support level at 23,465.0, the index could dip to 22,390.0

- Optimistic US Tech scenario: a breakout above the 23,875.0 resistance level could drive the index to 24,460.0

Summary

The published PMI data strengthens expectations of US economic resilience and may positively impact the US Tech index, especially in segments tied to industrial technologies and digital solutions. However, the US Tech index has entered a downtrend, with the nearest downside target possibly at 22,390.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.