US Tech forecast: index continues to rise, but correction risks increase

The US Tech stock index remains in a strong uptrend and is set to hit new all-time highs. The US Tech forecast for the upcoming week is positive.

US Tech forecast: key trading points

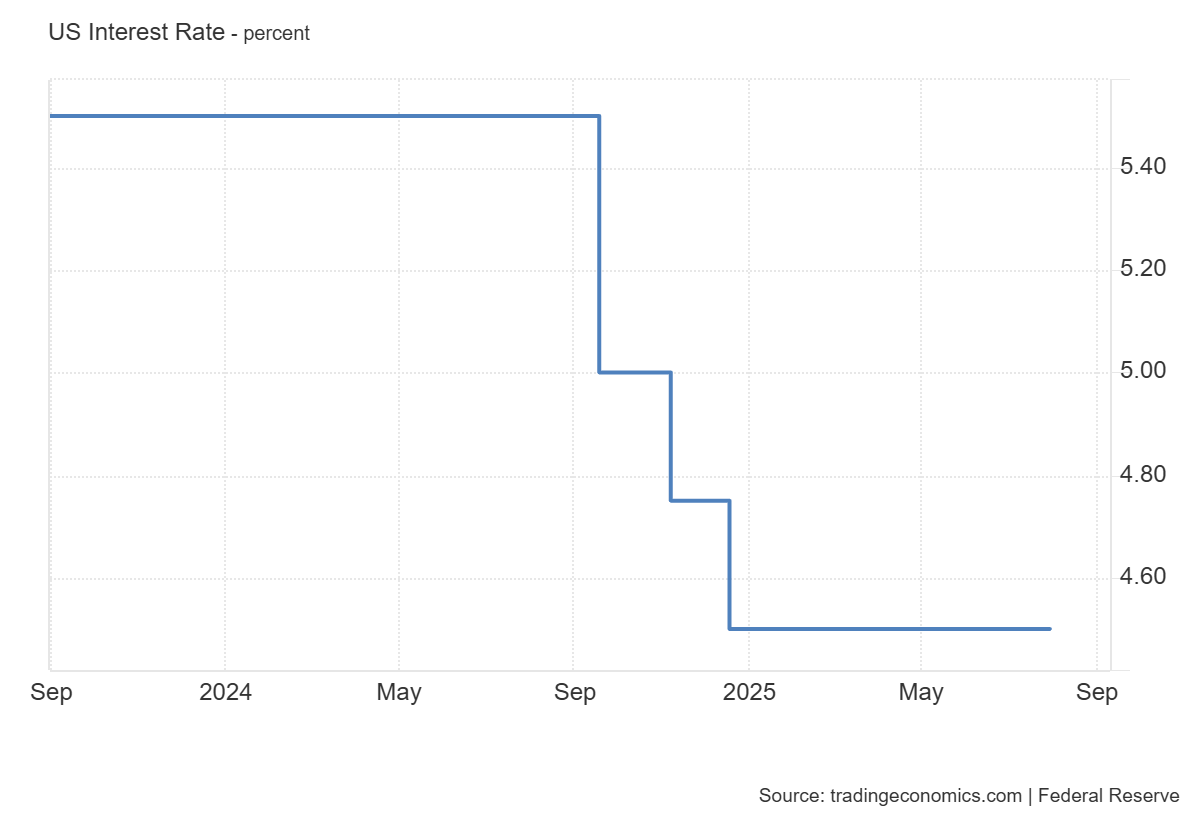

- Recent data: the US Fed interest rate remained at 4.50%

- Market impact: for the US stock market, this outcome reduces uncertainty, as investors now have a clear reference point for the coming months

US Tech fundamental analysis

The Federal Reserve held the rate steady at 4.25-4.50%. Markets are now focusing more on the arguments and assessments made by Jerome Powell. This marks the fifth consecutive meeting in which the rate remained unchanged. In its accompanying statement, the Federal Reserve pointed to a slowdown in economic activity during the first half of 2025. The latest data shows that economic growth has indeed cooled, although unemployment remains low and the labour market is stable. However, inflation remains slightly elevated, and uncertainty around the economic outlook is still high.

Federal Reserve Board members Christopher Waller and Michelle Bowman dissented, favouring a 0.25 percentage point cut to the federal funds rate. While the rate was expected to remain unchanged, the disagreement was notable, with two Fed governors dissenting for the first time since 1993. The most optimistic forecast suggests a rate cut at the September meeting; otherwise, not before December.

US Tech technical analysis

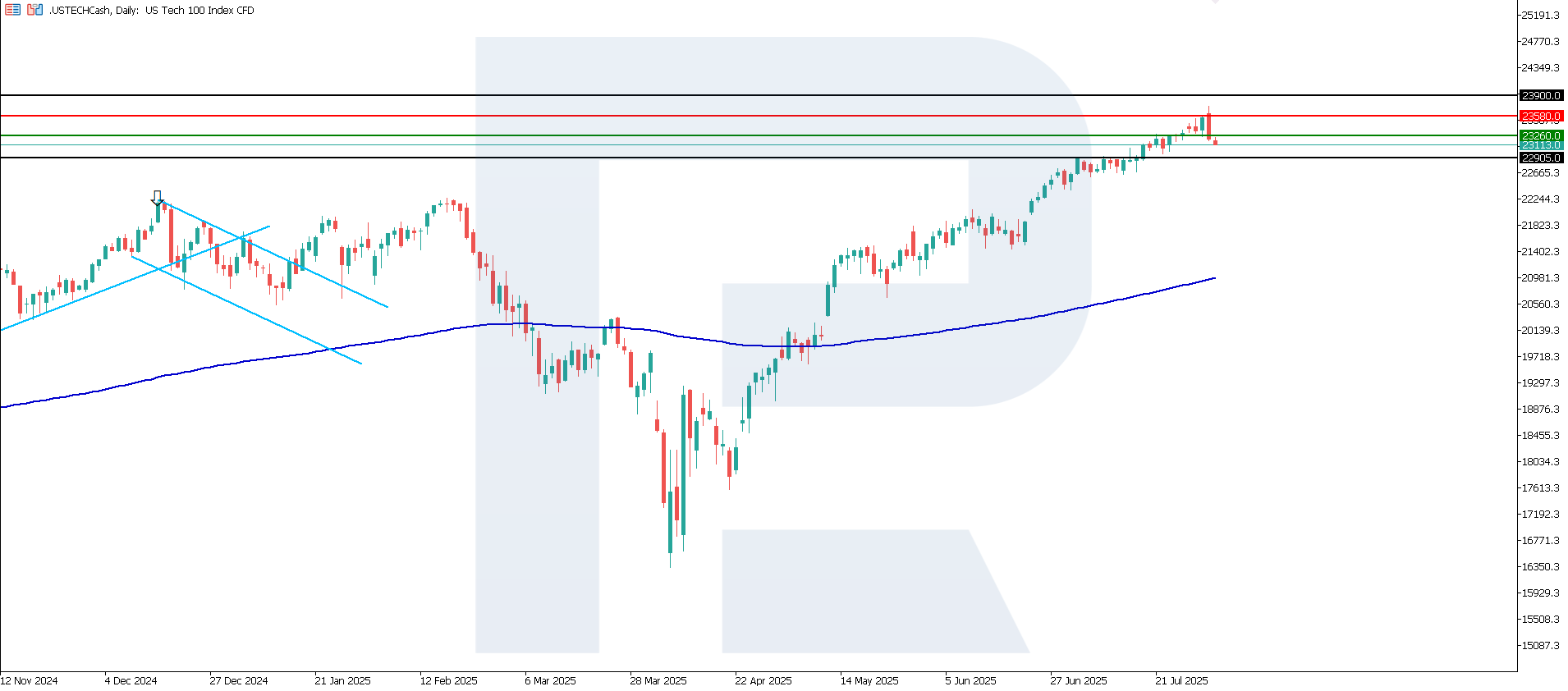

For the US Tech index, the Federal Reserve's decision carries a neutral-to-positive tone. There is no new tightening, which removes additional pressure on valuations, especially for high-growth, tech-heavy firms that are highly sensitive to borrowing costs. However, the absence of a rate cut means capital remains expensive, and the cheap money environment that previously fuelled the rally in Big Tech and AI stocks has not returned yet.

The US Tech index broke below the previous support level at 23,260.0, with resistance shifting to 23,580.0. Prices have entered a corrective downtrend, which is likely to be short-term. The nearest downside target may be around 22,905.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech scenario: if prices consolidate below the breached support level at 23,260.0, the index may fall to 22,905.0

- Optimistic US Tech scenario: a breakout above the 23,580.0 resistance level could propel the index 23,900.0

Summary

The Federal Reserve’s decision keeps the market in a state of balance. While the US Tech is unlikely to rally on rate cuts, a sell-off is also off the table. Investors continue to monitor macroeconomic data for signs of when the Fed might begin to ease policy. High rates slightly limit R&D funding, but global demand for AI technologies continues to make the sector a market favourite. The next upside target could be the 23,900.0 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.