US Tech forecast: the index continues to rise, but the probability of a correction increases

The US Tech stock index remains in a strong uptrend and looks set to continue renewing all-time highs. The US Tech forecast for the coming week is positive.

US Tech forecast: key trading points

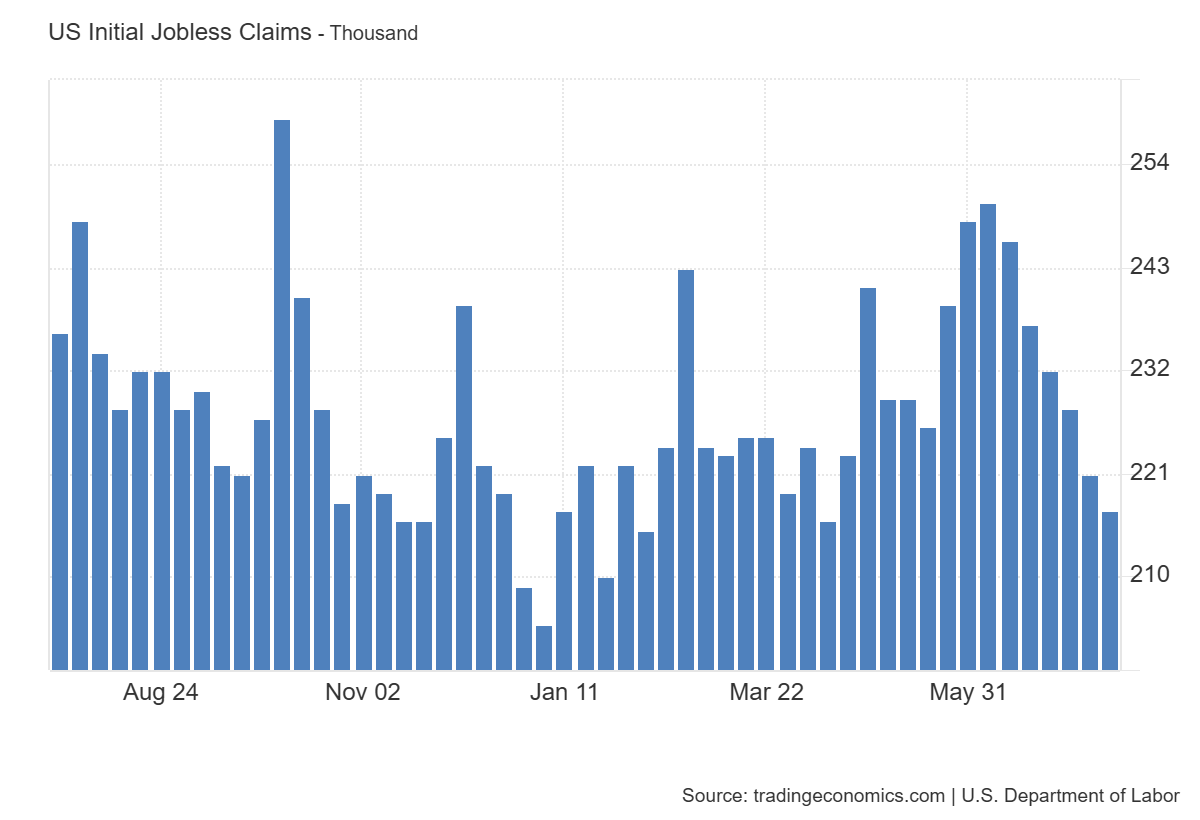

- Recent data: US initial jobless claims for last week totalled 217 thousand

- Market impact: this is generally a positive signal for the US stock market

US Tech fundamental analysis

Initial jobless claims came in at 217 thousand, below the forecast of 227 thousand and the previous figure of 221 thousand. This points to a resilient labour market, with job losses remaining low. Fewer claims suggest continued economic stability, supporting consumer spending and lowering the likelihood of an imminent downturn.

However, this result may also reinforce expectations that the Federal Reserve will maintain higher interest rates for longer to control inflation. This creates a mixed picture for investors. In the tech sector specifically, such statistics can provoke a mixed reaction.

US Tech technical analysis

On one hand, a strong labour market supports economic activity and demand for digital products and services – a positive factor for large tech companies. On the other hand, tighter monetary policy negatively affects highly valued growth stocks, especially those with low earnings and high sensitivity to interest rate changes.

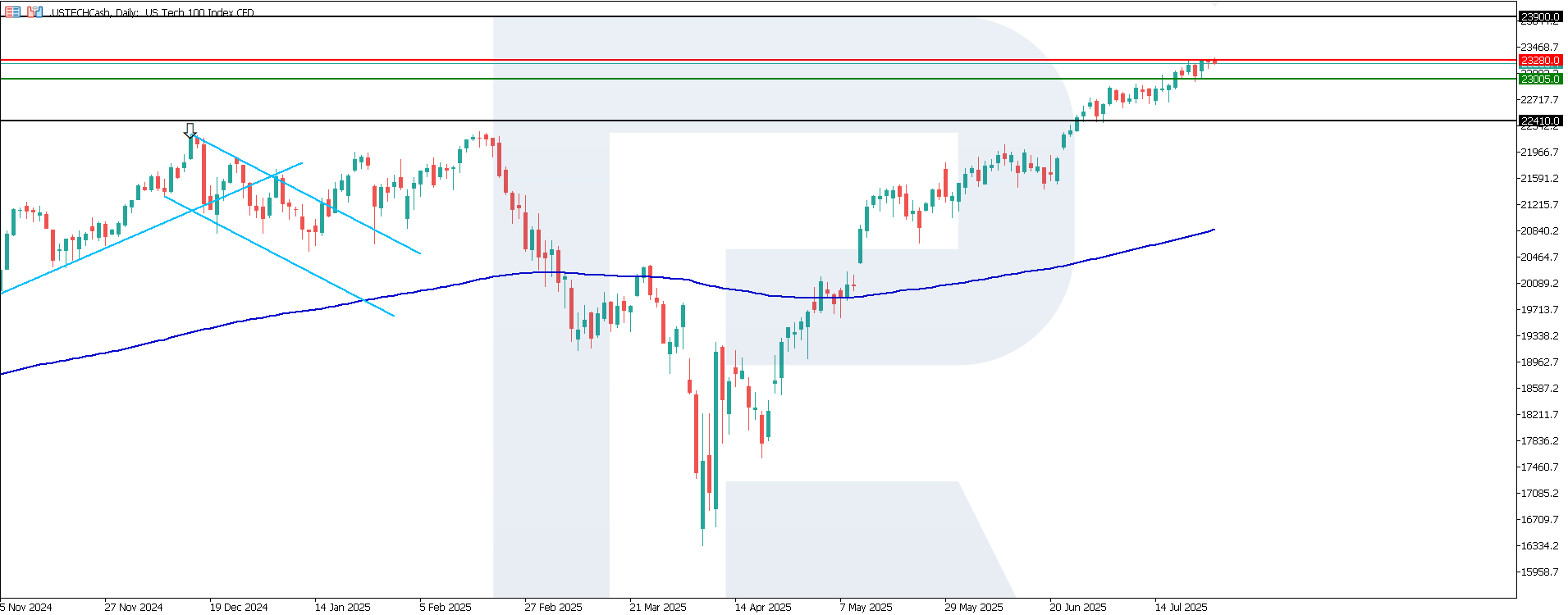

The US Tech index broke above the previous resistance level at 22,900.0, with a new one formed at 23,280.0. The support level has shifted to 23,005.0. The US Tech index reached another all-time high, with the rally likely to continue towards 23,900 before a corrective pullback begins.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech scenario: a breakout below the 23,005.0 support level could send the index down to 22,410.0

- Optimistic US Tech scenario: a breakout above the 23,280.0 resistance level could drive the index up to 23,900.0

Summary

The US Tech index continues to rise, renewing historical highs. Overall, jobless claims data sends a positive economic signal, but may prompt renewed speculation about the Federal Reserve’s rate path, leading to a more cautious market response, especially in the tech sector. The next upside target stands at 23,900.0. Tech giants with solid financial foundations are likely to remain the most resilient in this environment. In contrast, startups and highly valued firms in sectors like AI, fintech, and SaaS may be more vulnerable.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.