US 500 forecast: correction may turn into a downtrend reversal

The US 500 is declining and may shift to a downtrend. The US 500 forecast for today is negative.

US 500 forecast: key trading points

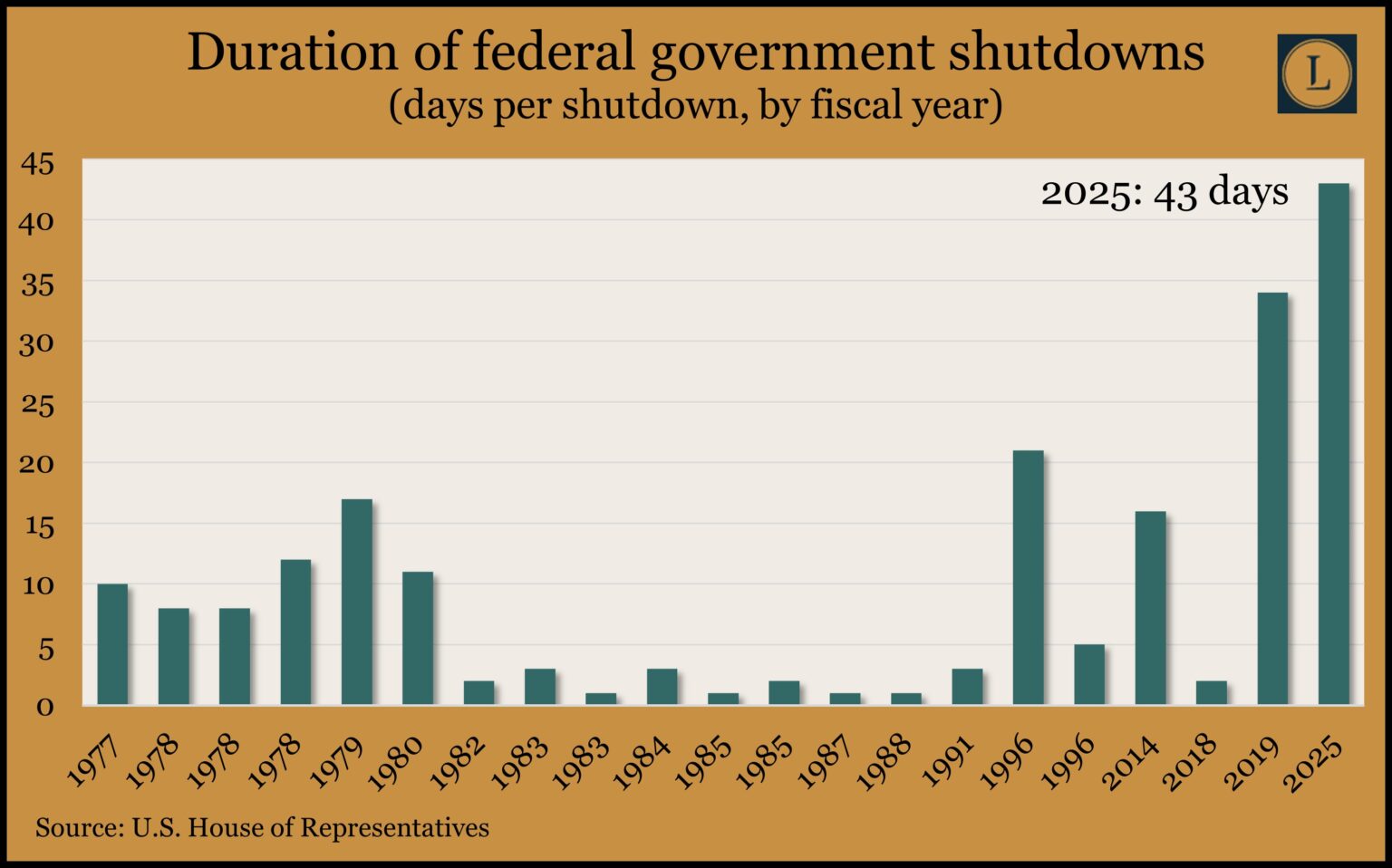

- Recent data: the longest shutdown in US history has ended, lasting 43 days

- Market impact: these conditions are generally positive for the stock market

US 500 fundamental analysis

The end of the longest government shutdown in US history, which lasted 43 days, primarily reduces uncertainty for businesses and investors. According to the Congressional Budget Office, this may slow the country’s economic growth in Q4 by 1.5 percentage points. In Q3, according to preliminary data from the US Treasury, GDP grew by 2.7% year-over-year. For the US stock market as a whole, the end of the shutdown typically brings relief and a gradual restoration of confidence. Companies dependent on government contracts and programs can plan revenue more clearly.

For the US 500, the end of the shutdown often leads to a moderately positive reaction. The days following the announcement of restored federal funding are expected to see a decline in anxiety, reduced demand for safe-haven assets, and partial return of capital to equities. The US 500 index may rise due to improved sentiment and short-covering.

Duration of federal government shutdowns (days per shutdown, by fiscal year): https://www.landaas.com/podcast/money-talk-podcast-friday-nov-14-2025/US 500 technical analysis

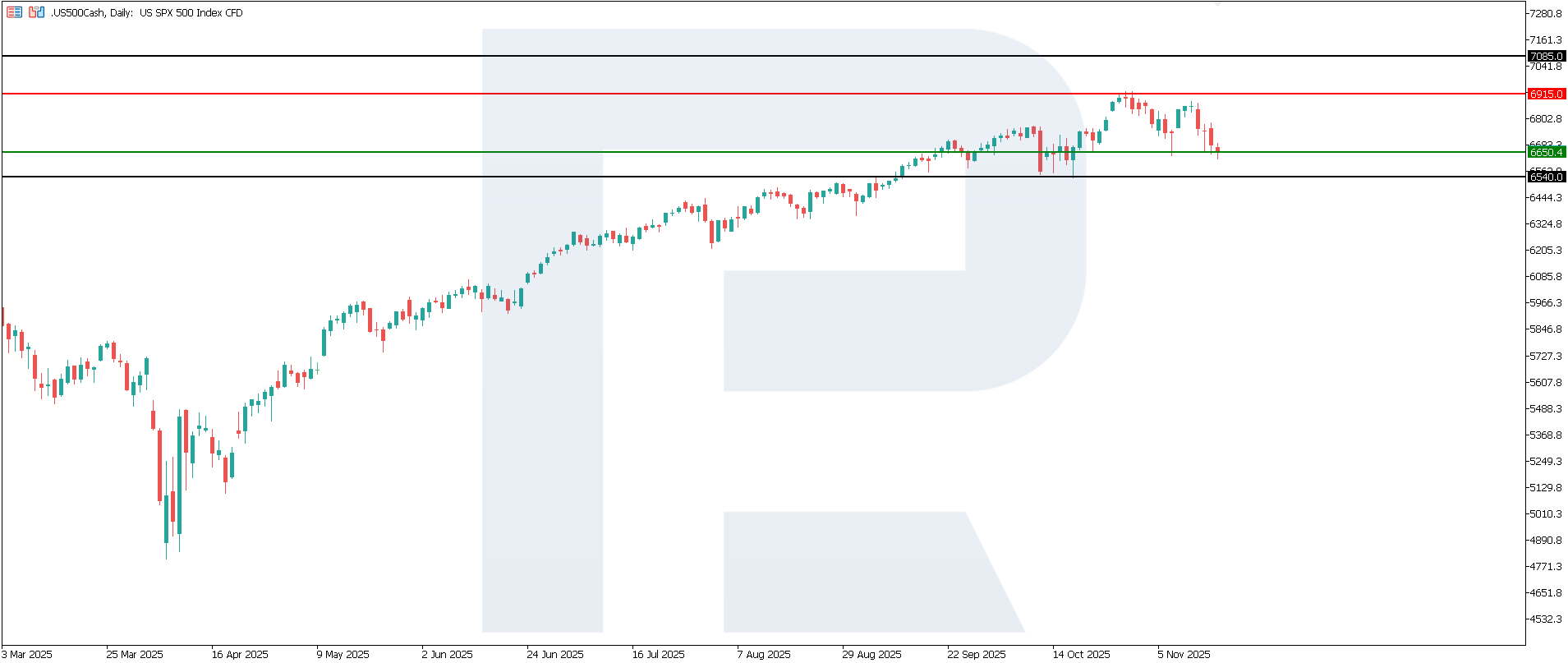

The US 500 index has approached the 6,655.0 support level, with resistance at 6,915.0. Prices may break below support, causing the trend to reverse downwards. In this case, the downside target could be near 6,540.0.

The US 500 price forecast considers the following scenarios:

- Pessimistic US 500 forecast: a breakout below the 6,655.0 support level could push the index down to 6,540.0

- Optimistic US 500 forecast: a breakout above the 6,915.0 resistance level could boost the index to 7,085.0

Summary

In the longer term, the impact of the shutdown’s end on the US 500 will depend on the eventual outcome of the budget conflict. If the compromise is stable and does not imply a renewed threat of another shutdown, the index may consolidate at higher levels as the risk of a repeat crisis decreases. However, if the agreement is temporary and debates over the debt ceiling and budget deficit quickly return, the market will treat the current end of the shutdown as a pause rather than a resolution. From a technical perspective, the US 500 index may fall to 6,540.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.