US 500 forecast: the index completed its correction

The US 500 recovered after a decline. The US 500 forecast for today is positive.

US 500 forecast: key trading points

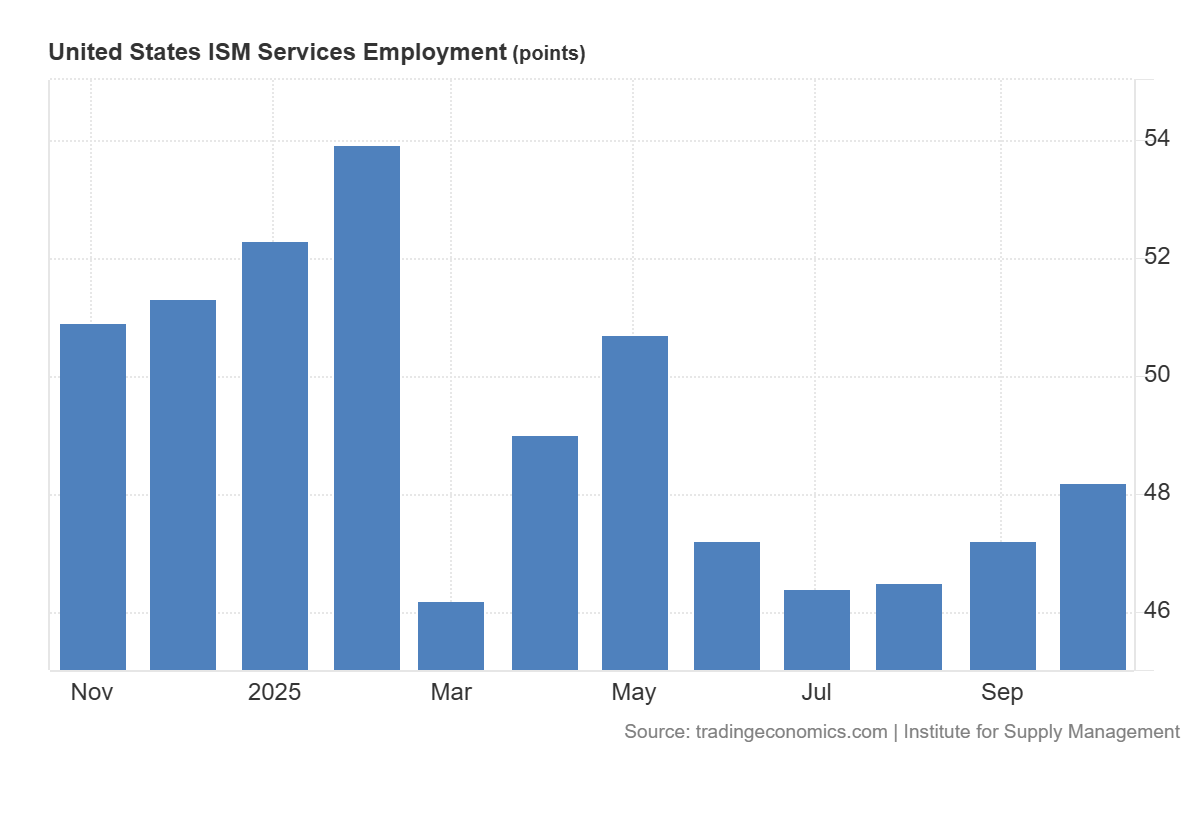

- Recent data: ISM non-manufacturing employment in the US came in at 48.2 in October

- Market impact: the data is moderately positive for the stock market

US 500 fundamental analysis

The ISM Non-Manufacturing Employment Index stood at 48.2 points, compared with the forecast of 47.6 and the previous reading of 47.2. Although the indicator remains below the neutral 50.0 mark, formally signalling contraction in the services sector’s employment, its uptrend suggests gradual improvement. For the US stock market, this indicates that the pressure on the labour market from the services sector is easing: the rate of job reduction is slowing, which lowers the likelihood of a sharp macroeconomic downturn or a hard-recession scenario.

For the US 500, which reflects the broad market, the effect of the indicator can be characterised as moderately positive. Since a large portion of index components belongs to services and consumer sectors, stronger-than-expected employment data (while still below 50.0) reduces the risk of a sharp decline in corporate profitability while supporting expectations of gradual rate cuts.

US ISM services employment: https://tradingeconomics.com/united-states/ism-non-manufacturing-employmentUS 500 technical analysis

The US 500 index corrected towards the 6,655.0 support level, with resistance formed at 6,915.0. Quotes rebounded from support and are now rising within a broader uptrend, with the next potential upside target near 7,085.0.

The US 500 price forecast considers the following scenarios:

- Pessimistic US 500 forecast: a breakout below the 6,655.0 support level could send the index down to 6,540.0

- Optimistic US 500 forecast: a breakout above the 6,915.0 resistance level could drive the index to 7,085.0

Summary

In the short term, the US 500 will likely show lower volatility and maintain an upward or sideways trend. The index’s next direction will depend on confirmation of current signals by upcoming employment and inflation data. From a technical perspective, the US 500 may rise towards 7,085.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.