US 500 forecast: the index attempts to break above resistance and hit new all-time high

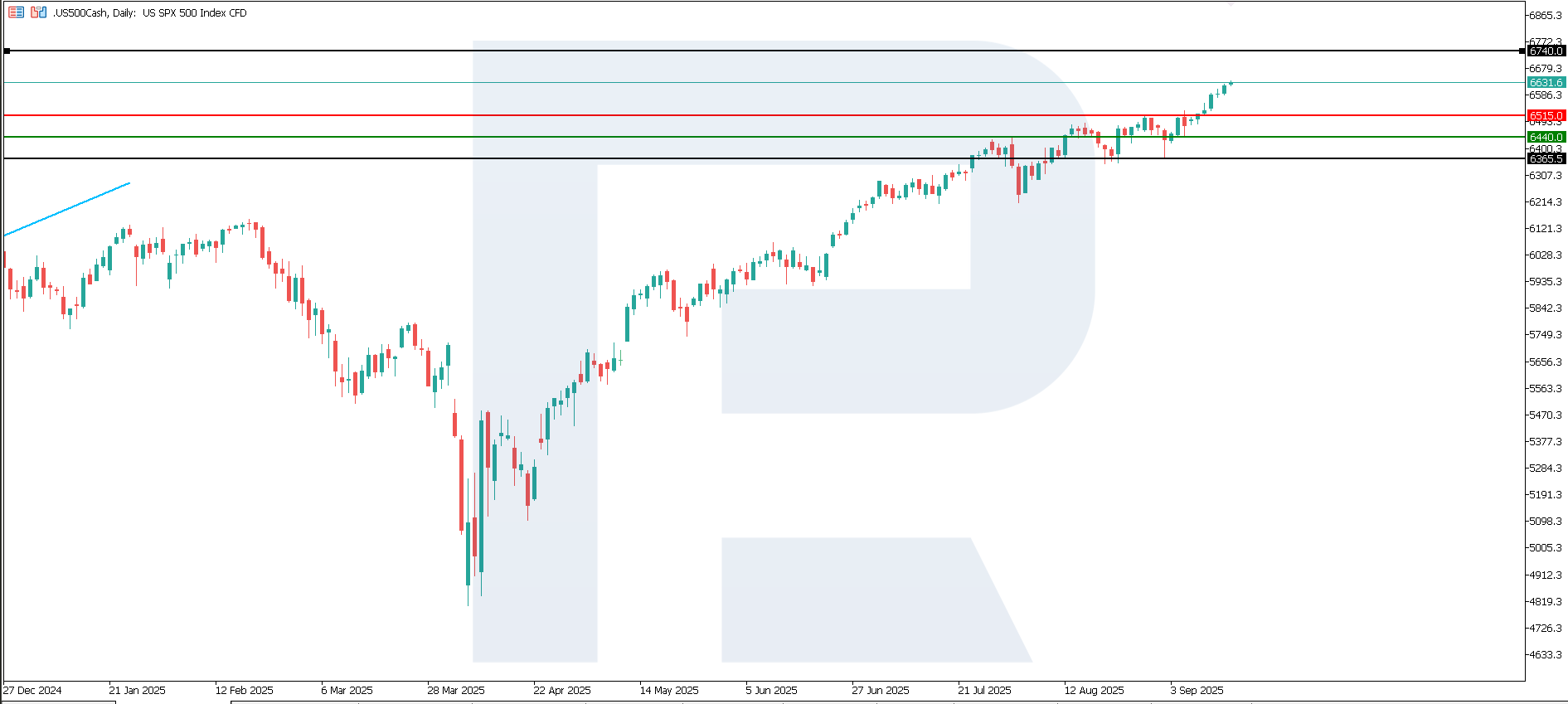

The US 500 index reached a new all-time high within an uptrend. The US 500 forecast for today is positive.

US 500 forecast: key trading points

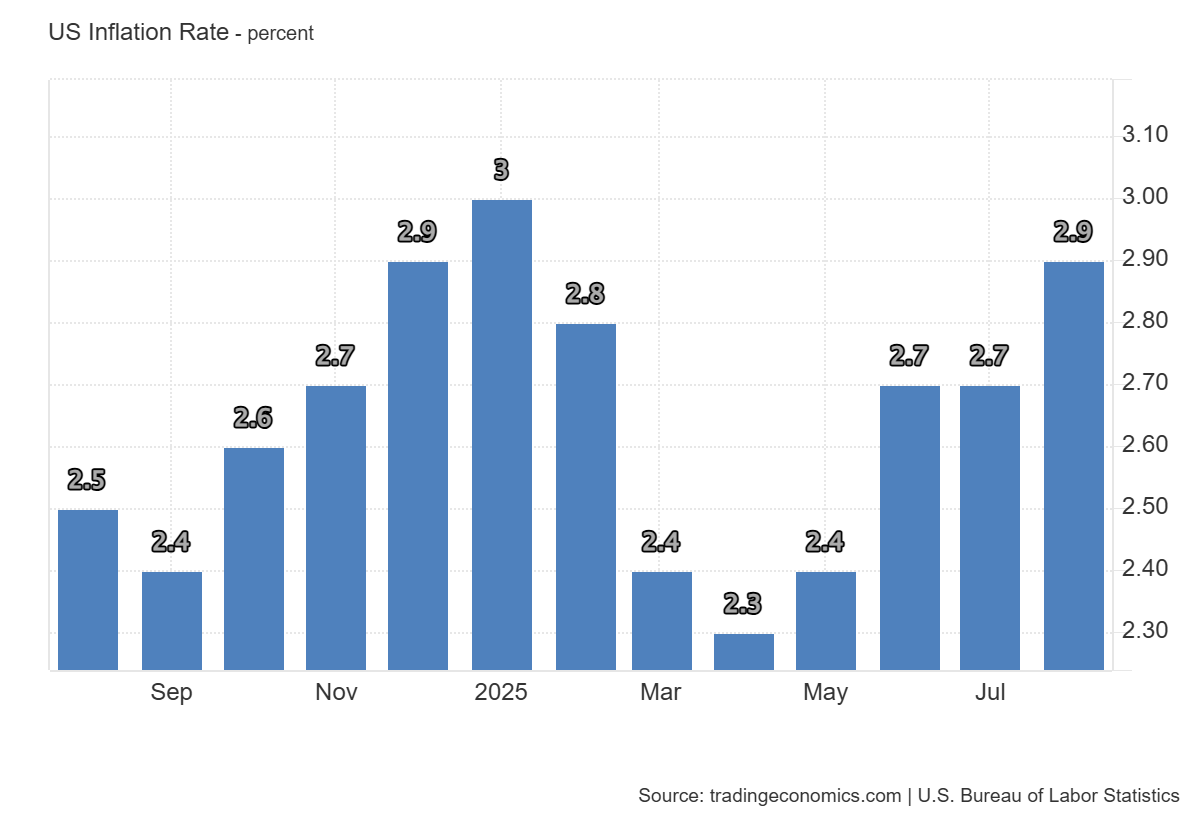

- Recent data: the US CPI rose 2.9% year-on-year in August

- Market impact: since the figure matched the consensus, the short-term market reaction is usually limited as there is little surprise factor

US 500 fundamental analysis

Annual CPI inflation in the US stood at 2.9%, exactly in line with market expectations but higher than the previous month’s 2.7%. Formally, this indicates disinflation progress relative to the 2022–2023 peaks, but also a pause in month-on-month improvement. The fact that the yearly pace accelerated compared to the previous month increases the likelihood that the Fed will move cautiously when easing policy: the path of rate cuts could become more gradual and highly dependent on upcoming inflation and labour market data.

The impact of inflation data varies across the US 500 sectors. Technology and communication services remain most sensitive to interest rate dynamics: higher yields increase valuation pressure, while stable yields keep reactions muted. The consumer discretionary sector is vulnerable to weaker purchasing power, but companies with strong pricing power and low debt levels benefit most.

US Inflation Rate: https://tradingeconomics.com/united-states/inflation-cpiUS 500 technical analysis

After reaching a new all-time high, the US 500 continues to move upwards within a bullish trend. The current support level is at 6,435.0, while the nearest resistance level is yet to form. The most likely scenario is continued growth, with a target near 6,740.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 scenario: a breakout below the 6,440 support level could send the index down to 6,365.0

- Optimistic US 500 scenario: if the price consolidates above the breached 6,515.0 resistance level, the index could climb to 6,740

Summary

Inflation at 2.9% provides no clear signal for monetary easing and caps risk appetite. Support for the index comes from resilient corporate earnings and expectations of a soft economic landing. The key risk is inflation stabilising near 3.0%, which would pressure margins and borrowing costs. From a technical perspective, the US 500 is likely to maintain its upward trajectory towards 6,740.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.