US 500 forecast: after rebounding from support, the index aims to hit its new all-time high

The US 500 remains in an uptrend, with quotes poised to break above the resistance level. The US 500 forecast for today is positive.

US 500 forecast: key trading points

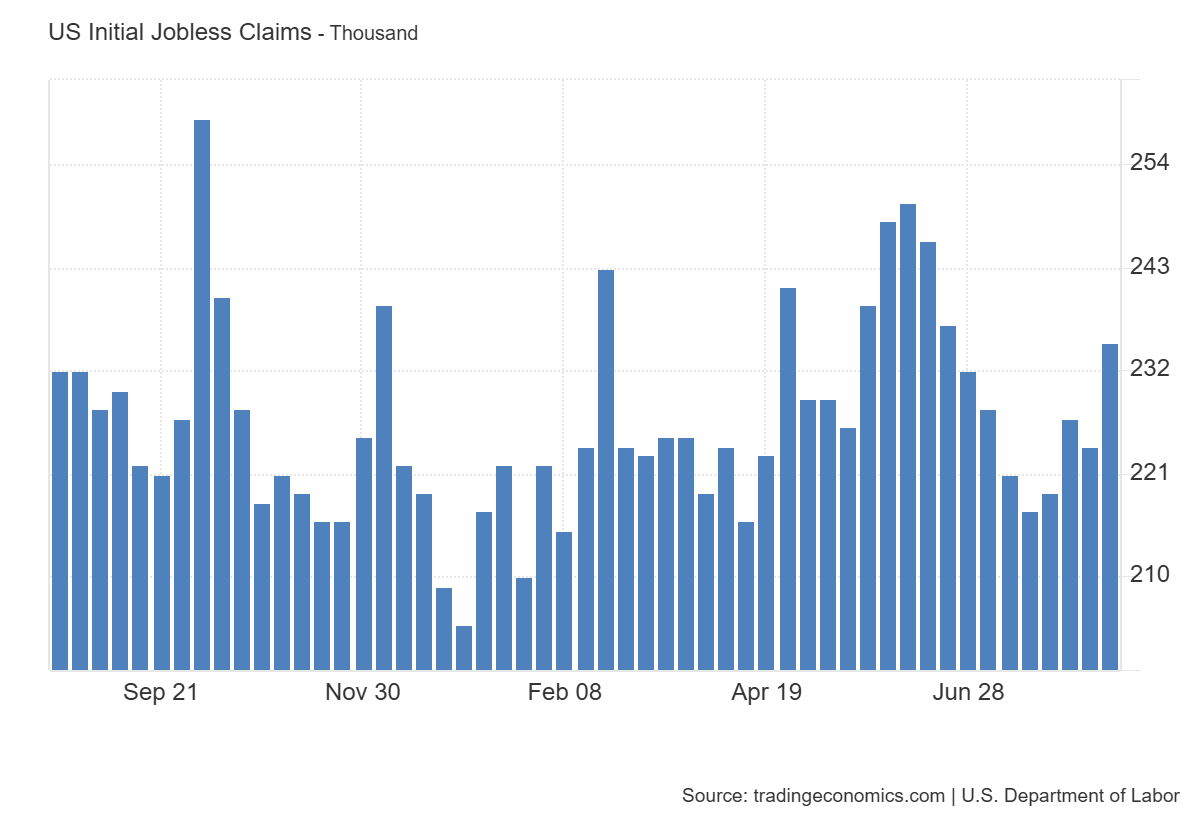

- Recent data: US initial jobless claims came in at 235 thousand last week

- Market impact: this has a dual effect on the US stock market

US 500 fundamental analysis

US initial jobless claims stood at 235 thousand last week, above the forecast of 226 thousand and the previous reading of 224 thousand. The rise in claims indicates some weakening of the labour market. Higher applications may signal a slowdown in economic activity.

Signs of labour market cooling can ease pressure on the Federal Reserve to tighten monetary policy further, supporting expectations of stable or even lower interest rates. For the US 500, this data may trigger a mixed reaction in the short term. The technology and growth sectors may benefit, as they gain from prospects of looser monetary policy, while consumer-focused sectors may come under pressure due to expectations of weaker purchasing power.

United States Initial Jobless Claims: https://tradingeconomics.com/united-states/jobless-claimsUS 500 technical analysis

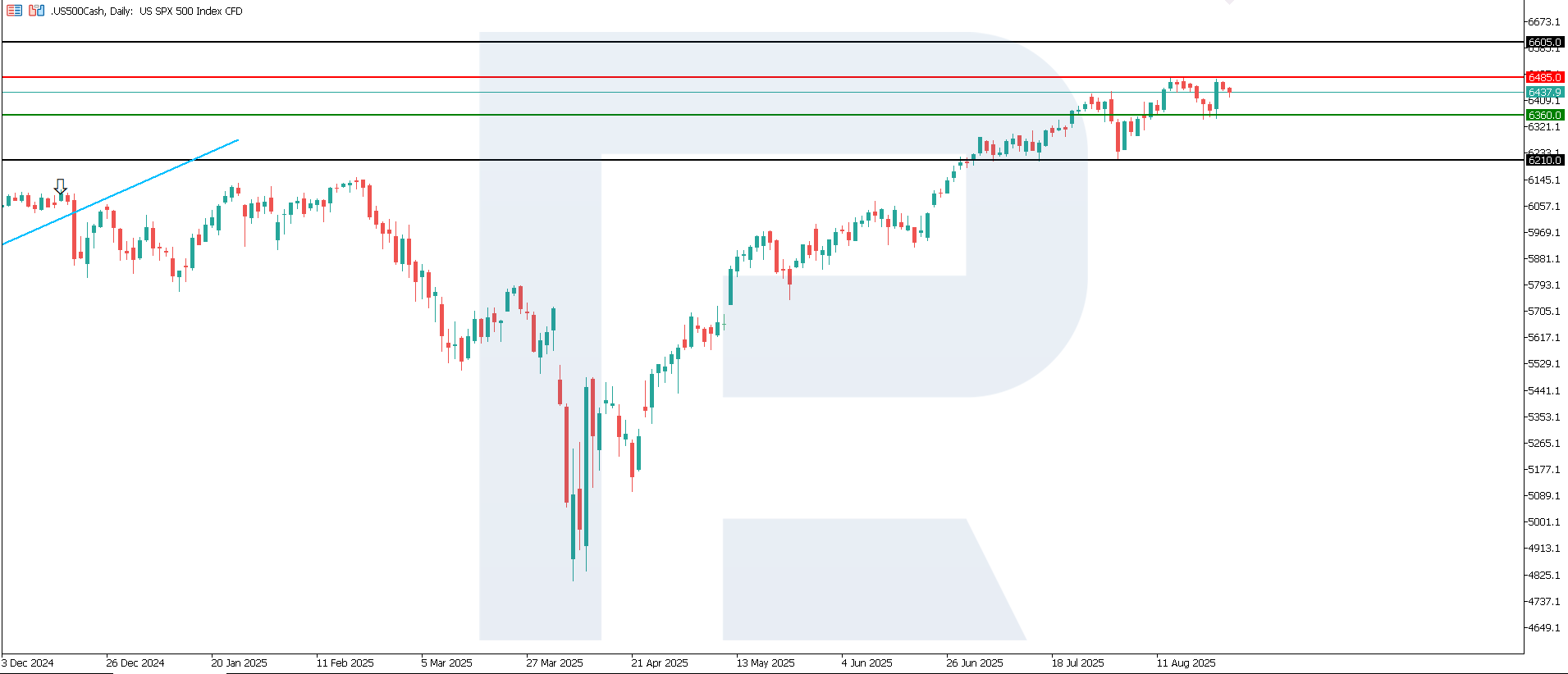

After reaching an all-time high, the US 500 continued to strengthen, forming a solid uptrend. The current support zone is at 6,360.0, while the nearest resistance is at 6,485.0. The most likely scenario remains further growth with a target near 6,605.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 scenario: a breakout below the 6,360.0 support level could push the index down to 6,210.0

- Optimistic US 500 scenario: a breakout above the 6,485.0 resistance level could drive the index to 6,605.0

Summary

Overall, the jobless claims data point to a gradual cooling of the labour market, which increases uncertainty but may act as a factor preventing the Fed from taking aggressive action. This creates a mixed impact on the US 500: technology and capital-intensive companies stand to benefit, while consumer and financial sectors could face more pressure. From a technical perspective, the US 500 will likely continue to rise towards 6,605.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.