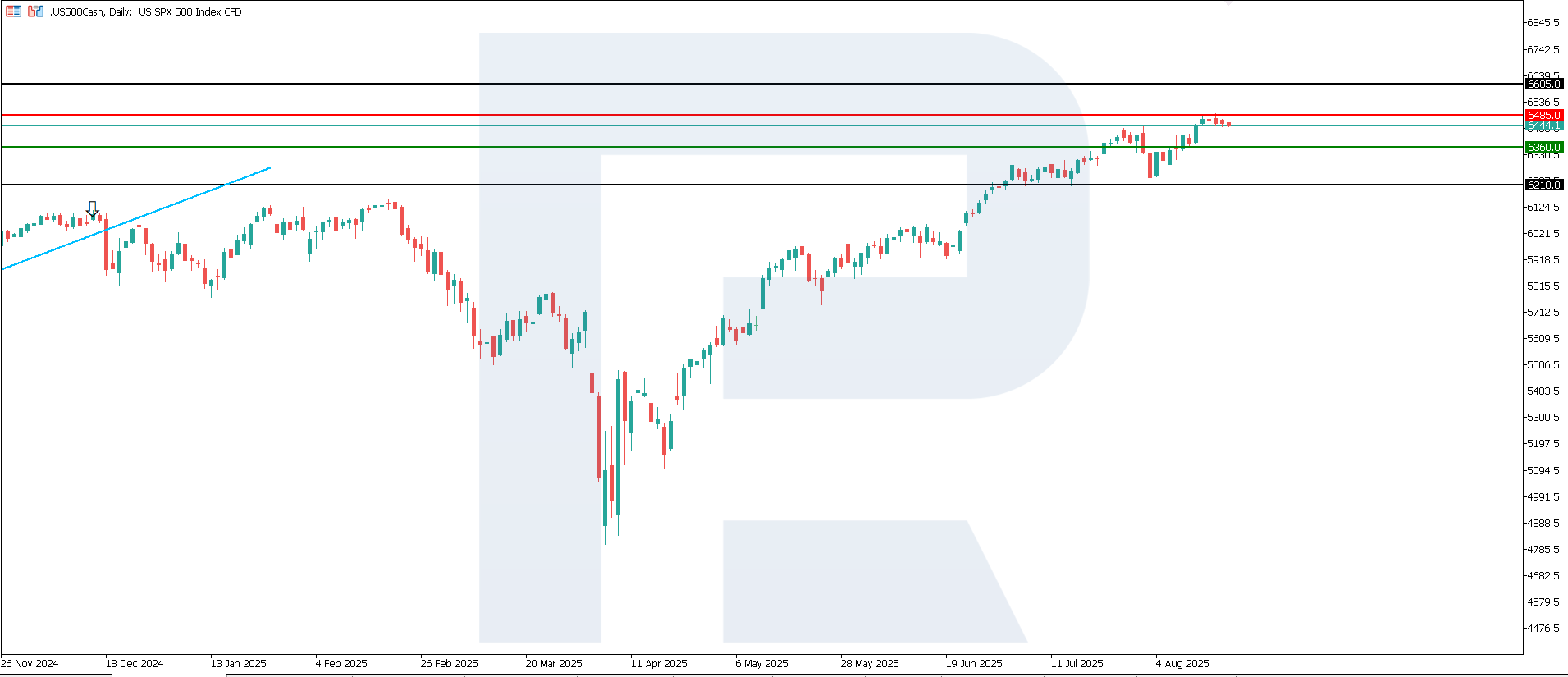

US 500 forecast: prices approached resistance but failed to break through and reach a new all-time high

The US 500 remains in an uptrend, which is highly likely to become medium-term. The US 500 forecast for today is positive.

US 500 forecast: key trading points

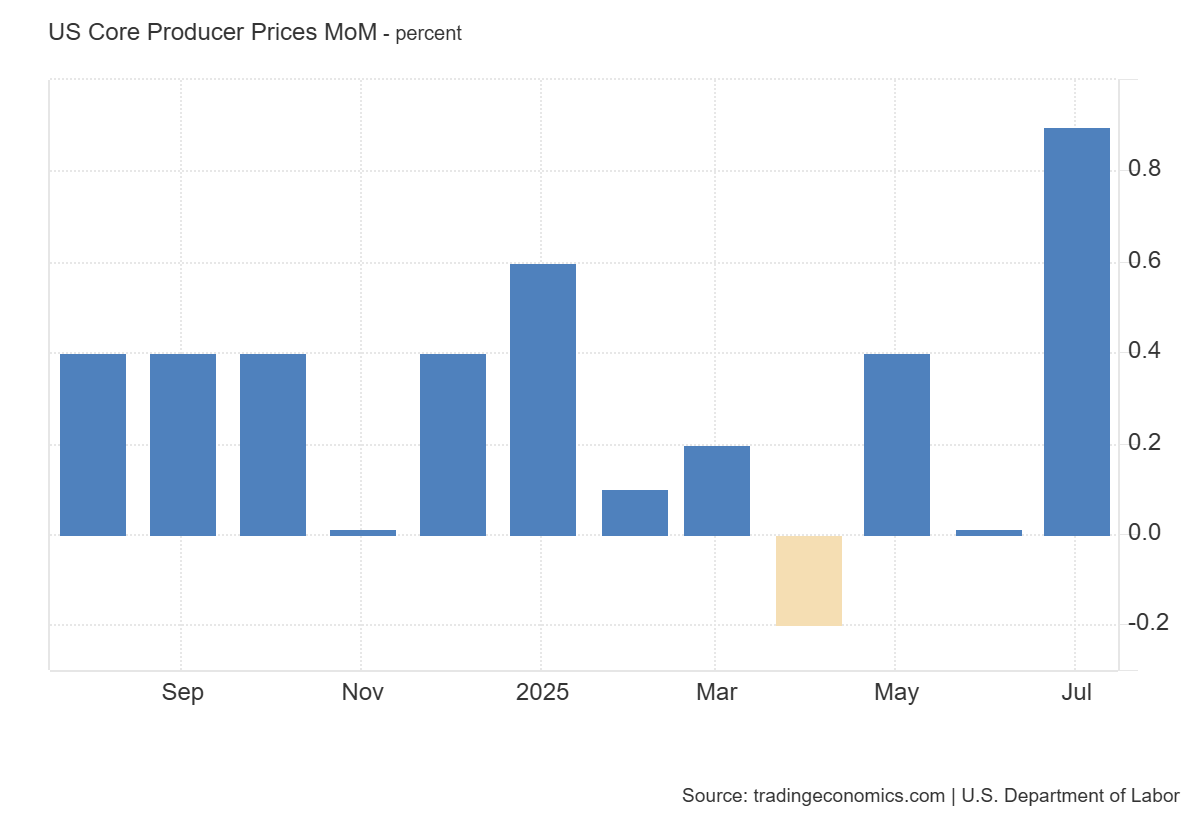

- Recent data: the US Producer Price Index (PPI) came in at 0.9% in July

- Market impact: rising producer costs have a negative effect on the US stock market

US 500 fundamental analysis

The US PPI for July rose by 0.9% from the previous month, well above the forecast of 0.2% and the previous reading of 0.0%. PPI growth is a significant signal, as it reflects higher producer costs, which may be passed on to the end consumer. Overall, this strengthens inflationary pressure and increases the likelihood that the Federal Reserve will adopt a more hawkish stance in monetary policy.

Higher financing rates, in turn, can negatively affect the equity market by making stocks less attractive than bonds and increasing borrowing costs for businesses. For the US 500 index, the effect of such data is likely to be restrictive. Stronger inflation expectations could trigger a correction in the index, particularly in rate-sensitive sectors.

US Core Producer Prices MoM: https://tradingeconomics.com/united-states/core-producer-prices-momUS 500 technical analysis

Having reached an all-time high, the US 500 index continued its upward trajectory. Current price action indicates the formation of an uptrend. The support level is located at 6,360.0, with resistance near 6,485.0. The most probable scenario is a continued upward move, with a potential target around 6,605.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 scenario: a breakout below the 6,360.0 support level could push the index down to 6,210.0

- Optimistic US 500 scenario: a breakout above the 6,485.0 resistance level could drive the index to 6,605.0

Summary

Overall, the PPI data increases risks for the US stock market and could trigger short-term downward pressure on the US 500. However, the reaction will largely depend on further Federal Reserve signals regarding the future path of interest rates. From a technical perspective, the US 500 is set to extend gains towards 6,605.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.