US 500 forecast: index hits new all-time high and begins correction

The US 500 index approached the 6,500.0 level, and with each new all-time high, the likelihood of a downward correction increases. The US 500 forecast for today is positive.

US 500 forecast: key trading points

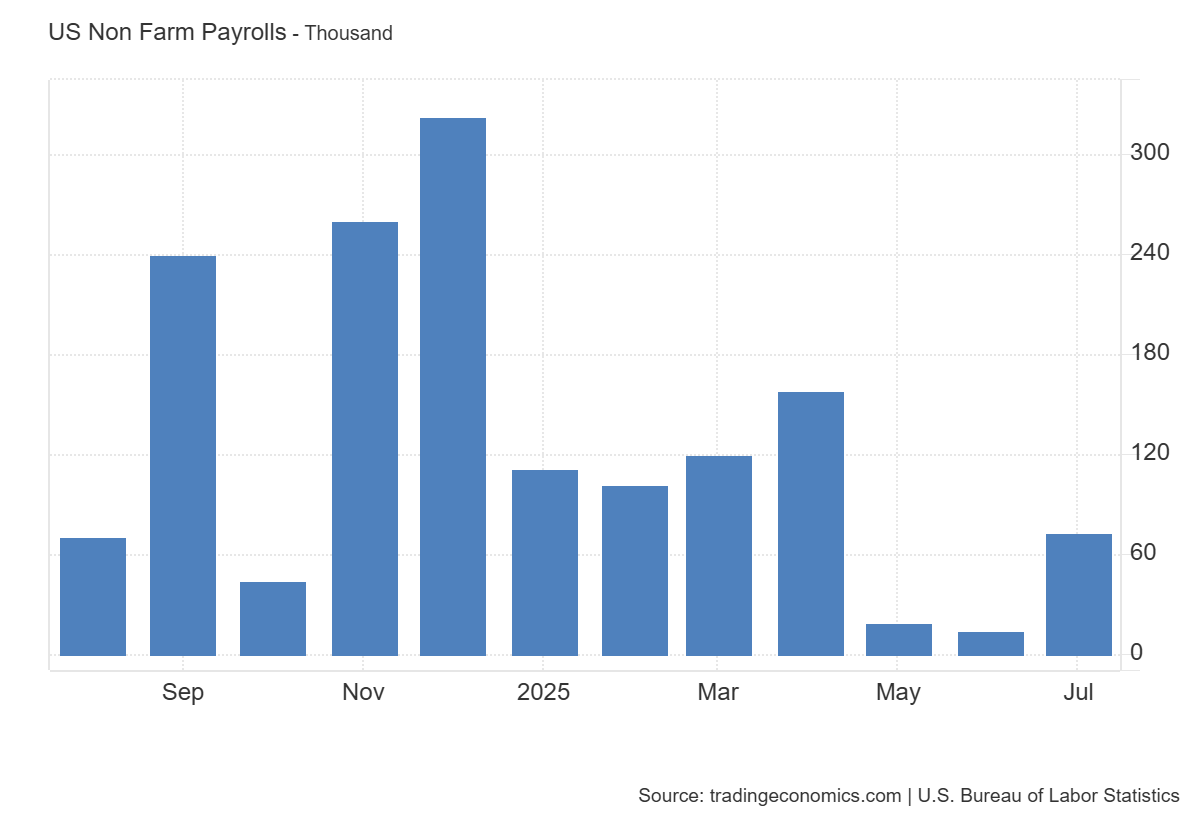

- Recent data: US NFP for July came in at 73 thousand

- Market impact: slower employment growth and a high unemployment rate create uncertainty, which may trigger volatility and investor caution

US 500 fundamental analysis

The Nonfarm Payrolls figure came in at 73 thousand, significantly below the expected 106 thousand, although still above the revised previous value of 14 thousand. This reflects a slowdown in job growth and worsening hiring dynamics. The three-month average job growth is just around 35 thousand, marking the weakest level since the onset of the 2020 pandemic. This suggests a notable cooling in the labour market and could signal a broader economic slowdown.

This serves as a negative signal for the US 500 index, since weak labour data often correlates with slowing economic activity and declining corporate earnings. The technology sector may come under pressure, as company growth depends heavily on a strong economy and robust consumer demand.

US Nonfarm Payrolls: https://tradingeconomics.com/united-states/non-farm-payrollsUS 500 technical analysis

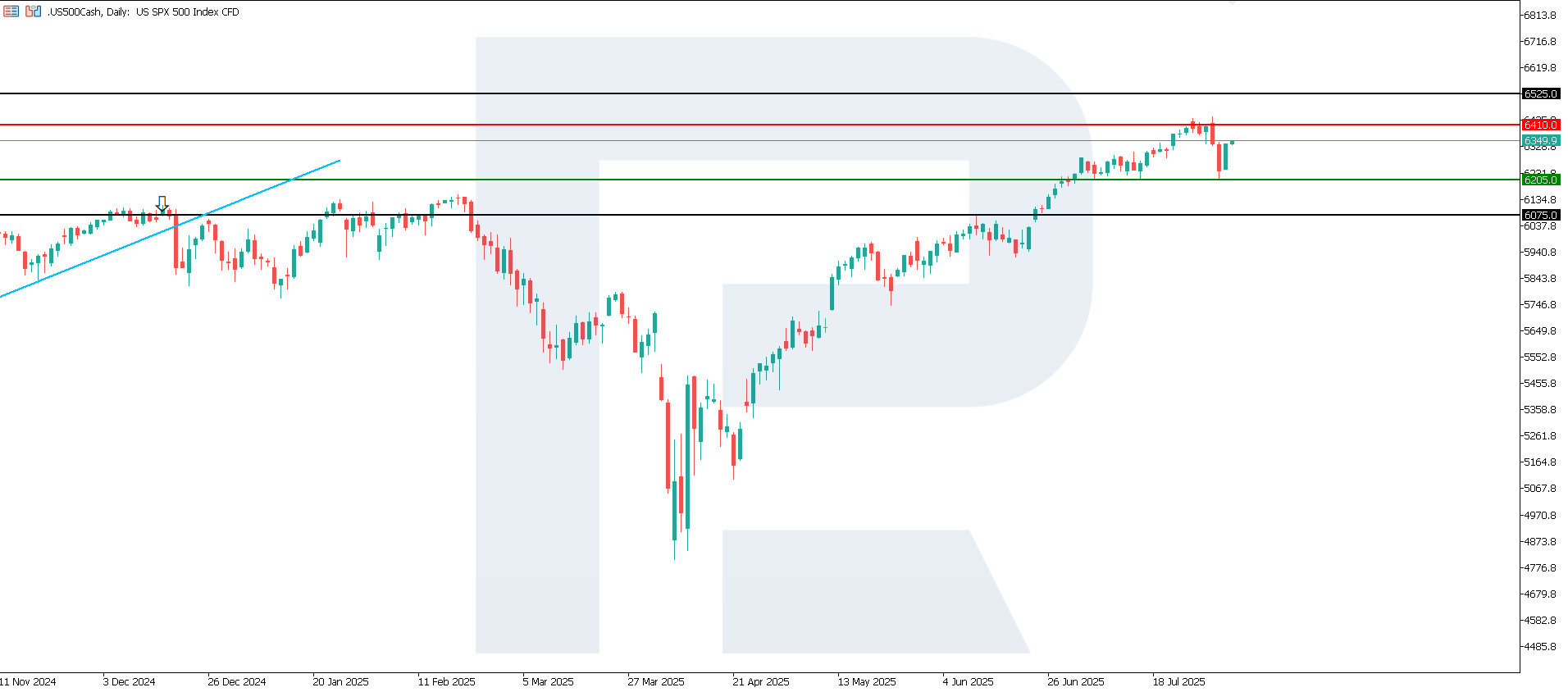

After reaching an all-time high, the US 500 entered a correction phase. The current trend is downward, but it is unlikely to be long-term. The support level is located at 6,205.0, with resistance at 6,410.0. A decline to the 6,075.0 target appears to be the most probable scenario.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 scenario: a breakout below the 6,205.0 support level could send the index down to 6,075.0

- Optimistic US 500 scenario: a breakout above the 6,410.0 resistance level could drive the index to 6,525.0

Summary

The US stock market may experience elevated volatility and investor caution in the near term, driven by weak labour market data. The US 500 index, particularly the technology sector, faces risks due to signs of economic slowdown. However, a stable unemployment rate and the revision of prior data may reduce expectations of a sharp deterioration, helping prevent a steep decline. However, from a technical perspective, a further drop towards 6,075.0 remains the most likely outcome.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.