US 500 forecast: the index set a new all-time high and began a correction

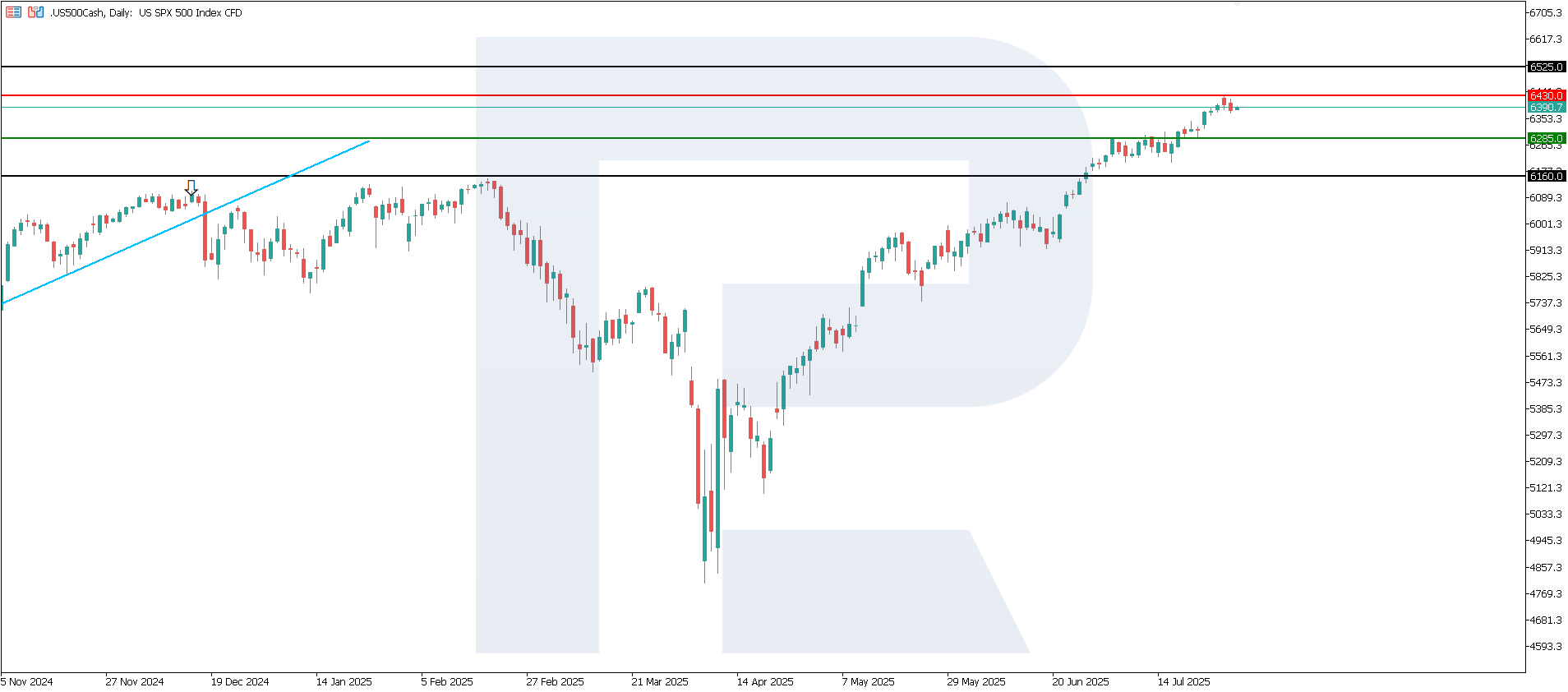

The US 500 index approached the 6,500.0 level, and with each new all-time high, the likelihood of a downward correction increases. Today’s US 500 forecast is positive.

US 500 forecast: key trading points

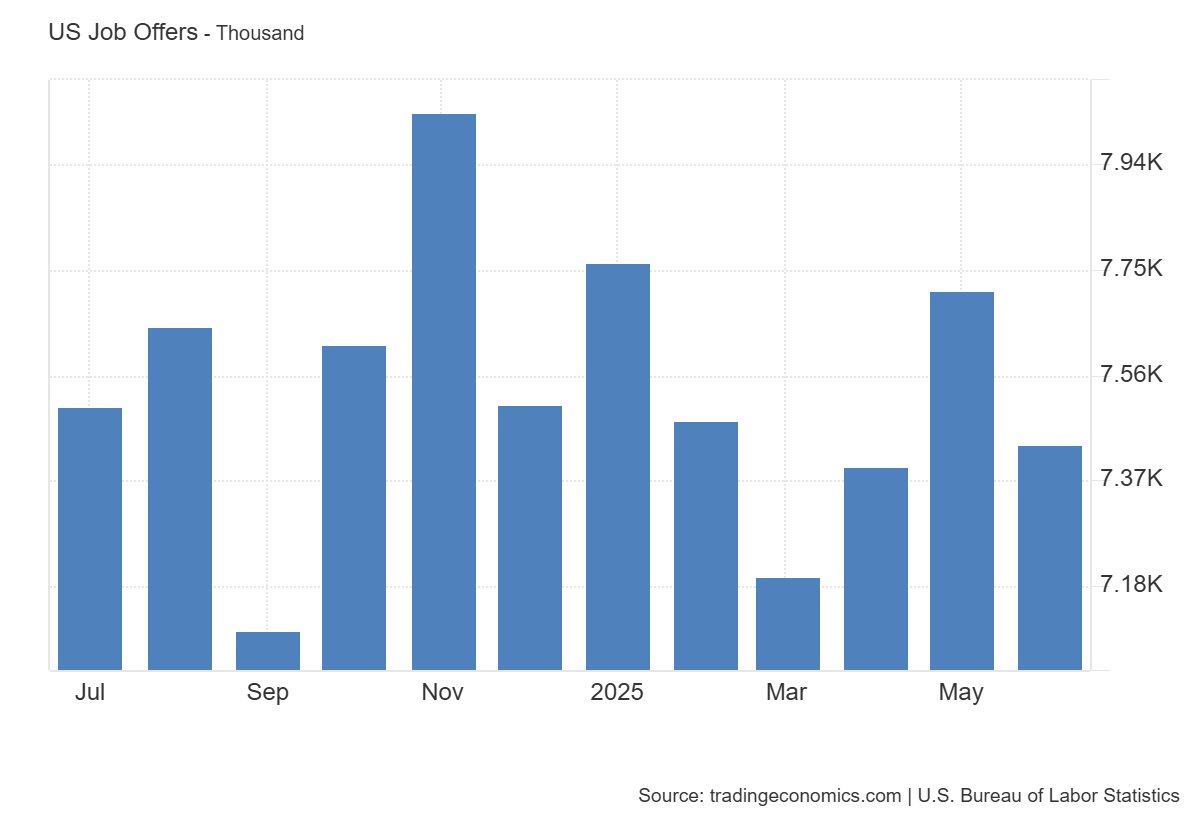

- Recent data: US JOLTS job openings for June came in at 7.43 million

- Market impact: the effect on the US stock market may be mixed, depending on the Federal Reserve’s interpretation of this data

US 500 fundamental analysis

The JOLTS job openings figure reflects the number of available positions in the US and serves as a key indicator of labour market health. The current reading is 7.437 million, below both the forecast of 7.510 million and the previous figure of 7.712 million. This suggests weakening demand for labour and a gradual cooling of the economy. For equities, this may have a twofold impact. On the one hand, fewer job openings ease wage pressure and inflation risks, which increases the likelihood that the Federal Reserve will refrain from raising rates and could eventually resume rate cuts. On the other hand, it points to slowing economic activity, which raises investor caution.

For the US 500 index, the impact varies by sector. The technology and real estate sectors benefit as a more accommodative Fed stance makes funding more accessible and supports growth stocks. Meanwhile, the financial sector may see reduced profitability due to lower interest rates.

US 500 technical analysis

The US 500 index reached a new all-time high, breaking above the 6,400.0 mark. The support level is now located at 6,285.0, with resistance at 6,435.0. While the strong uptrend continues, a minor correction is possible. Subsequently, another rally to new record highs is likely.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 scenario: a breakout below the 6,280.0 support level could push the index down to 6,160.0

- Optimistic US 500 scenario: a breakout above the 6,435.0 resistance level could boost the index to 6,525.0

Summary

Overall, the decline in JOLTS is seen as a short-term positive signal for the market, especially for tech and real estate. However, a further drop in job openings would signal a more serious economic slowdown, which could weigh on cyclical sectors. This week, markets await the US Federal Reserve’s interest rate decision. If the Fed leaves rates unchanged and issues dovish guidance on future monetary policy, the index is likely to continue its upward trajectory. Otherwise, a correction may begin.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.