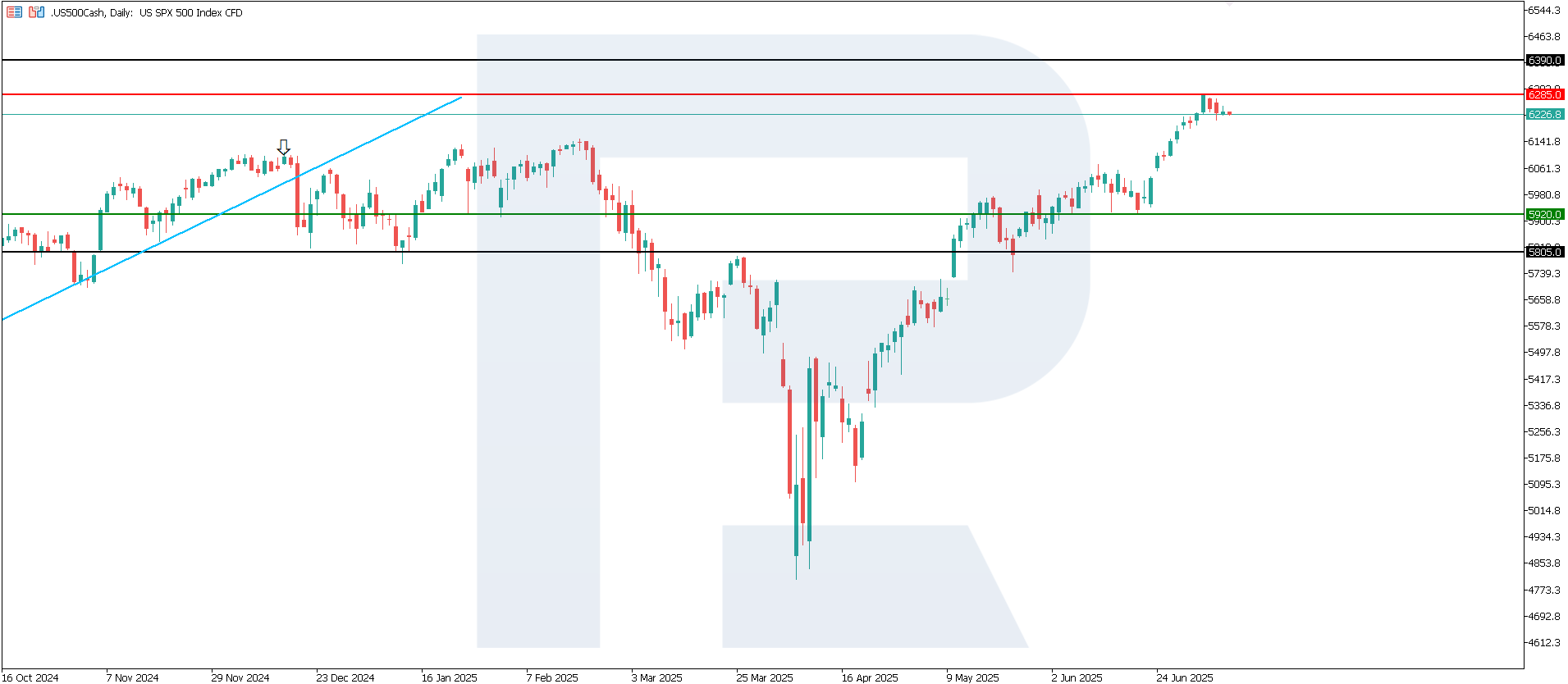

US 500 forecast: correction likely before a new rise towards the all-time high

For the first time in history, the US 500 closed above the 6,200.0 mark – Q2 this year became the best quarter for the index since 2023. The forecast for US 500 today is positive.

US 500 forecast: key trading points

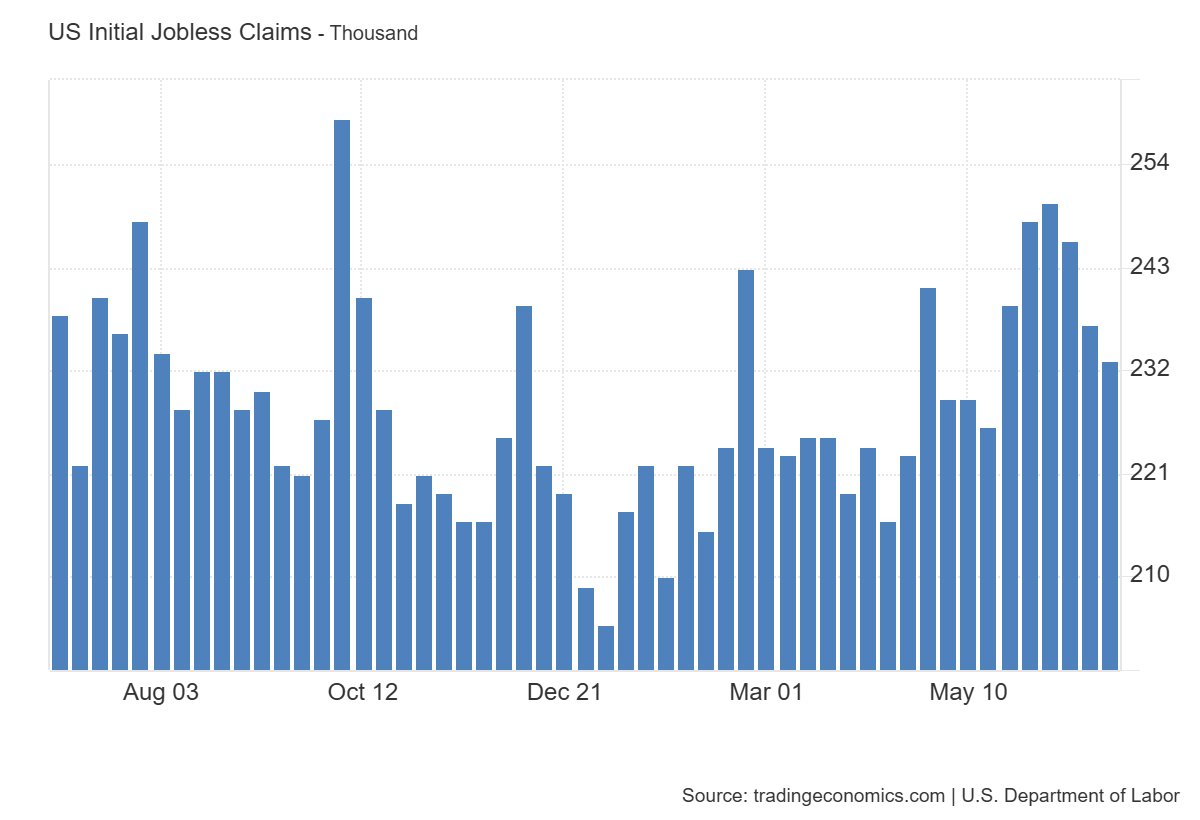

- Recent data: Initial Jobless Claims last week stood at 233,000

- Market impact: improved Initial Jobless Claims creates a positive background for equities as investors see employers continuing to retain and even expand their workforce

US 500 fundamental analysis

Lower-than-expected Initial Jobless Claims (233,000 vs. forecast 240,000 and previous 237,000) indicates a strengthening labour market and reduced pressure on employment. A strong labour market stimulates household spending on durable goods and entertainment, benefiting retail companies, restaurants, and consumer goods manufacturers.

Initial Jobless Claims below expectations signals a robust labour market and rising consumer demand, which is overall positive for the US 500. The biggest beneficiaries will be the consumer and financial sectors, as well as industrial and transportation companies, while tech and real estate stocks will receive stable support from the stronger economic fundamentals.

United States Initial Jobless Claims: https://tradingeconomics.com/united-states/jobless-claimsUS 500 technical analysis

The US 500 index reached a new all-time high above the 6,230.0 level. Support has formed at 5,920.0, with resistance at 6,285.0. A strong upward trend is observed, but a minor corrective pullback cannot be ruled out. However, after it, another upward impulse and a new all-time high can be expected.

Scenarios for the US 500 index price forecast:

- Pessimistic scenario for US 500: if the support level at 5,920.0 is breached, prices may fall to 5,745.0

- Optimistic scenario for US 500: if the resistance level at 6,285.0 is broken, prices may rise to 6,390.0

Summary

Initial Jobless Claims below forecast indicate a strong labour market and rising consumer demand, which is favourable for the US 500 index. It is trading in a strong upward trend and could set a new all-time high. The nearest growth target is 6,390.0. However, a minor corrective pullback can be expected in the short term.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.