US 30 index forecast: the index corrects after reaching new all-time high

The US 30 index is undergoing a correction, but the trend remains upward. The US 30 forecast for today is positive.

US 30 forecast: key takeaways

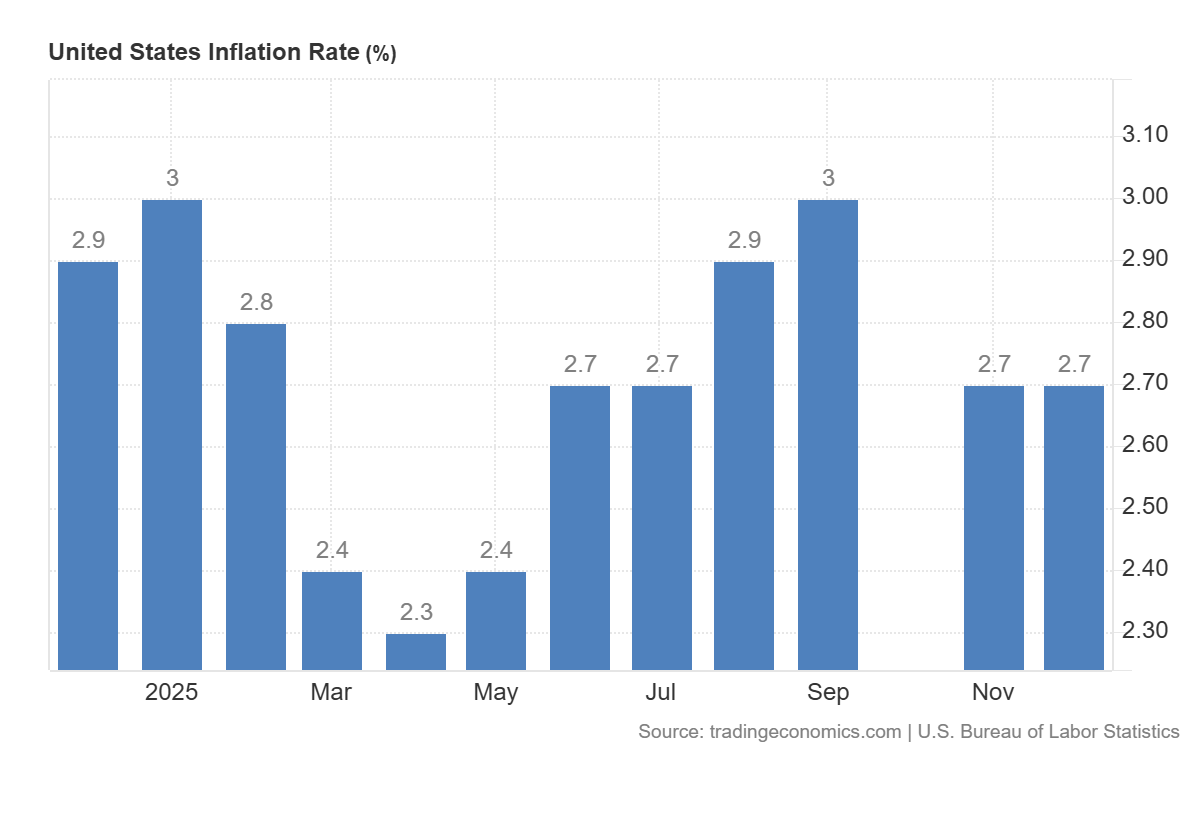

- Recent data: US CPI increased to 2.7% in December 2025

- Market impact: the data has a moderately positive impact on the equity market

US 30 fundamental analysis

The publication of the December CPI looks broadly neutral-to-positive for the equity market, primarily because of the component that is key for assessing monetary policy. The annual headline CPI rate remained at 2.7% and fully matched the consensus forecast and the previous reading, signalling stability in the disinflation trajectory without any unwelcome acceleration. At the same time, core CPI slowed relative to expectations to 2.6% y/y (versus a 2.7% forecast), which reduces concerns about persistent services inflation and strengthens the case for a more accommodative Federal Reserve policy profile over the coming quarters.

For the US 30 index, the impact is typically moderate. Companies within the index are, on average, less sensitive to valuation changes driven by interest rate expectations than high-growth technology stocks, but they do depend on stable consumer demand and the absence of a sharp tightening in credit conditions. Lower-than-expected core inflation supports precisely this scenario: the economy does not appear overheated, and the regulator gains more room for softer policy decisions in the future.

US inflation rate: https://tradingeconomics.com/united-states/inflation-cpiUS 30 technical analysis

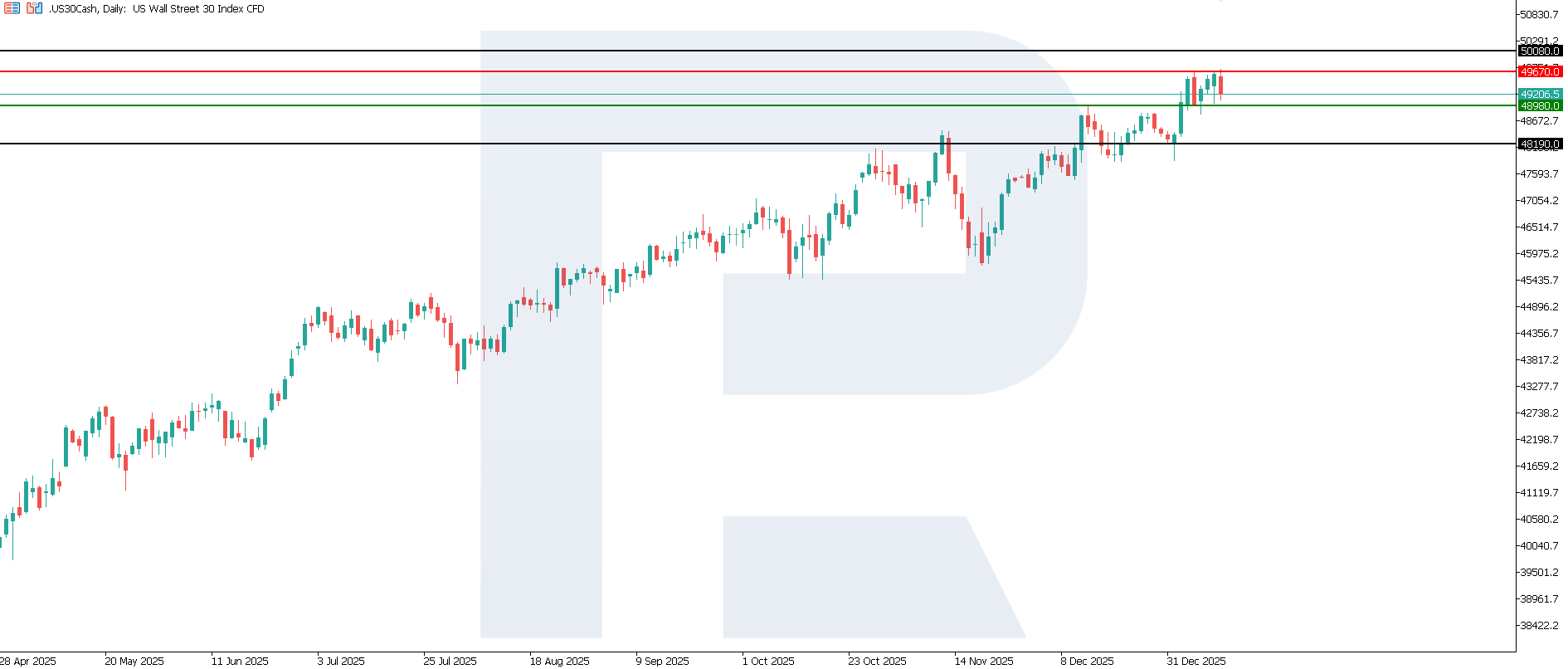

The US 30 index has entered an upward phase, with a key support level formed around 48,980.0. The 49,670.0 resistance level has been broken, and a new one has not yet been established. Current dynamics are characterised by a moderate correction, but the trend remains upward. The nearest upside target for the index is estimated at 50,080.0.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 48,980.0 support level could send the index down to 48,190.0

- Optimistic US 30 scenario: if the price consolidates above the previously breached resistance level at 49,670.0, the index could climb to 50,080.0

Summary

The December CPI report is generally favourable for the US equity market, with a moderately positive effect most likely for the US 30 index, as core inflation came in below expectations and did not increase the risk of interest rates remaining elevated for a longer period. The only less favourable element of the report was the monthly increase in headline inflation of 0.3% versus expectations of 0.2%. However, this reading did not accelerate compared with the previous month, and a difference of one-tenth of a percentage point rarely changes the overall picture when annual indicators are stable, and core inflation is not rising. The nearest upside target could be the 50,080.0 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.