US 30 index forecast: the index continues to decline

The decline in the US 30 index continues, but the pace of the drop has slowed. The US 30 forecast for today is negative.

US 30 forecast: key trading points

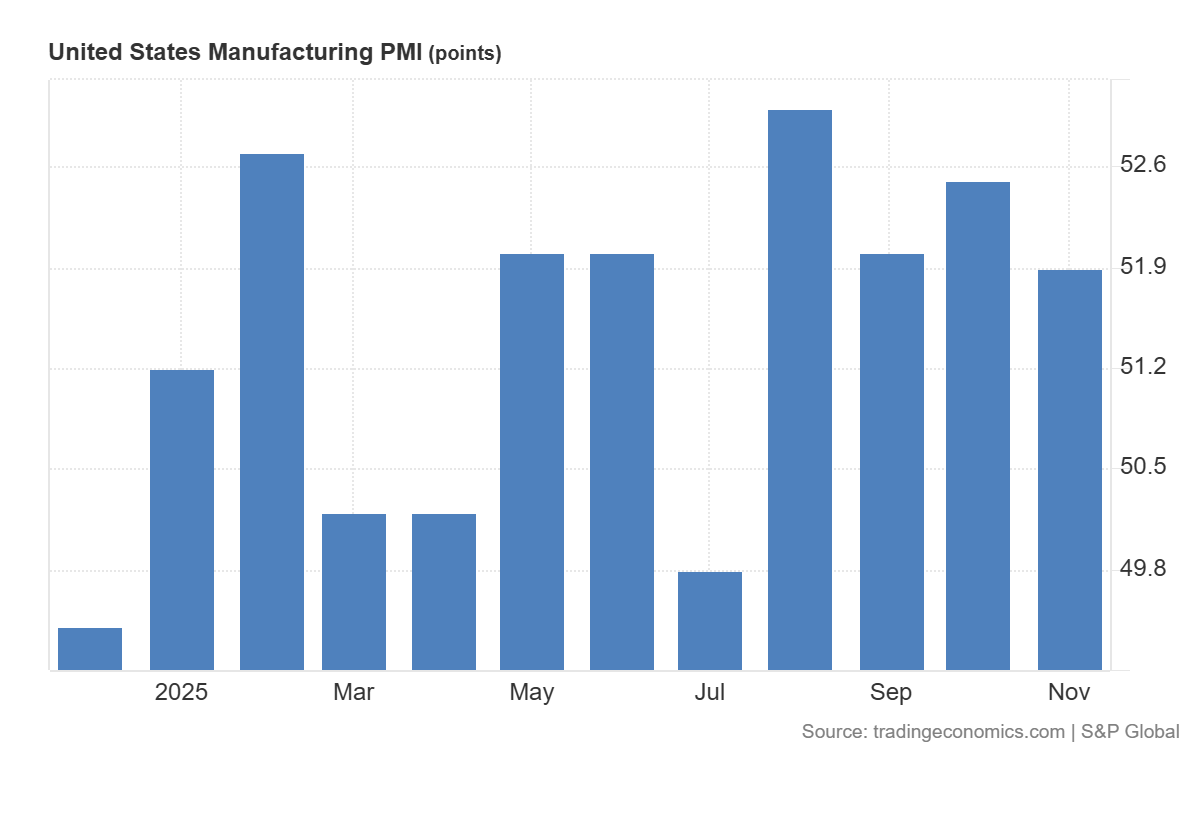

- Recent data: US manufacturing PMI came in at 51.9

- Market impact: moderately positive for the stock market

US 30 fundamental analysis

The US manufacturing PMI came in at 51.9 points, below the forecast of 52.0 and the previous reading of 52.5. The indicator remains above 50.0, which still signals expansion in the manufacturing sector, although the pace of growth has slowed and turned out weaker than expected. In effect, this is a signal of moderate growth: businesses still have orders, overall production is rising, but momentum is not as strong as in previous months.

For the US 30 index, the impact is more significant than for broad or tech-heavy indices because it includes many industrial companies. The decline in the PMI compared to last month and slightly below expectations may indicate that revenue and margin prospects for some industrial and commodity-linked issuers are becoming less clear. This may trigger cautious profit-taking in stocks that previously rallied on expectations of manufacturing recovery, which could temporarily restrain US 30 growth.

US manufacturing PMI: https://tradingeconomics.com/united-states/manufacturing-pmiUS 30 technical analysis

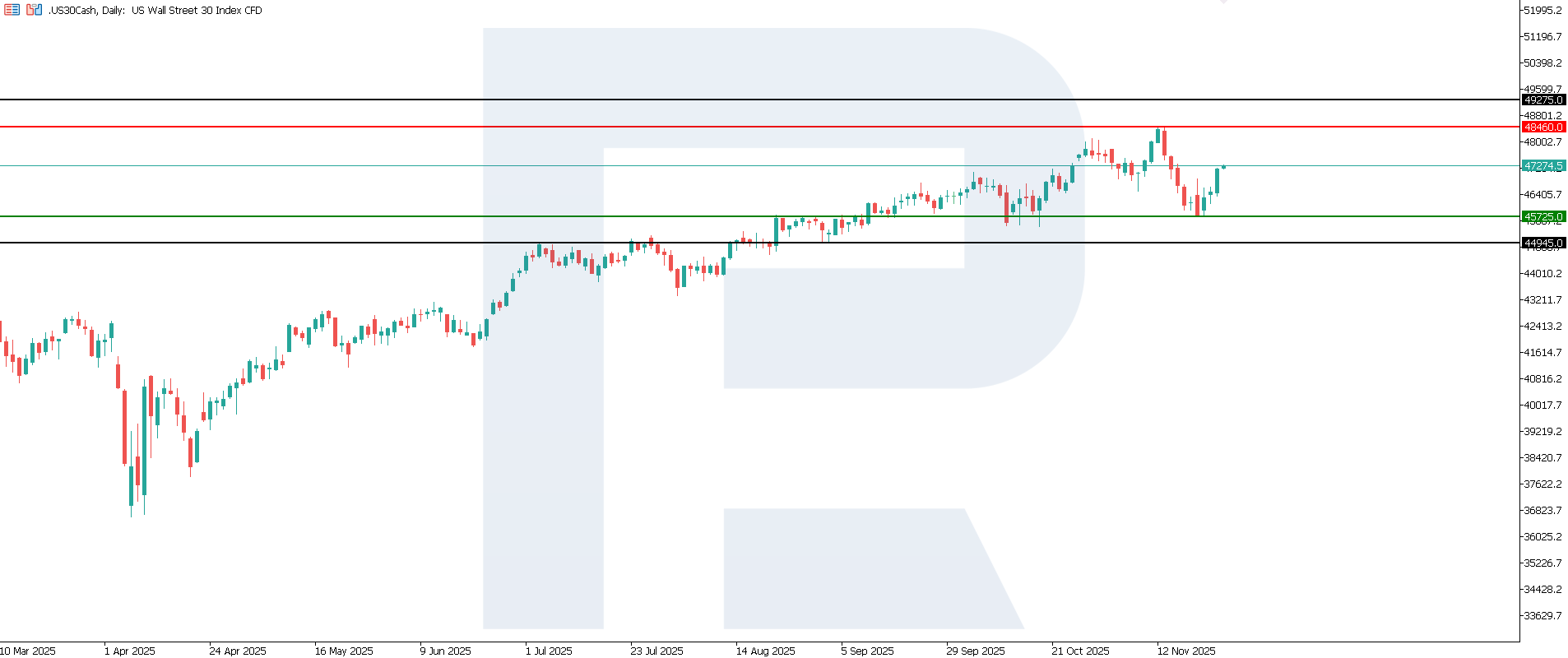

The US 30 index entered a downtrend, with the support level at 45,725.0 and a new resistance level at 48,460.0. Volatility remains elevated, so the trend may change in the short term. The nearest downside target lies at 44,945.0.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 45,725.0 support level could send the index down to 44,925.0

- Optimistic US 30 scenario: a breakout above the 48,460.0 resistance level could drive the index to 49,275.0

Summary

Overall, a PMI reading of 51.9 is not alarming, as it simply confirms that the US economy continues to grow, but without the previous acceleration in manufacturing. For the US stock market and the US 30 index, this means that there are no strong new impulses from the manufacturing segment of macroeconomic data: nothing to celebrate, but no reason for panic either. Further dynamics will depend on whether this moderate scenario is supported by other data, such as services, inflation, and labour market reports. The nearest downside target could be 44,945.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.