US 30 forecast: the index has entered a downtrend

After hitting its all-time high, the US 30 entered a correction phase, which turned into a downtrend. The US 30 forecast for today is negative.

US 30 forecast: key trading points

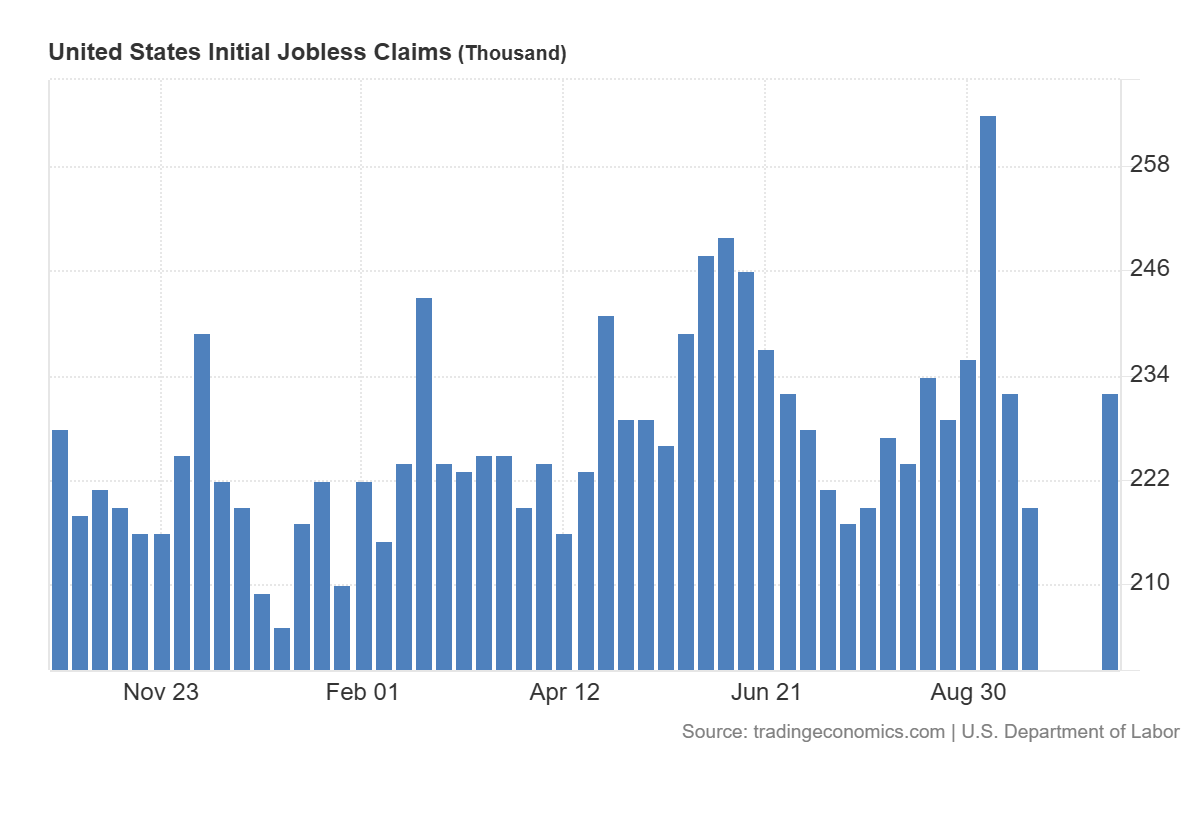

- Recent data: initial jobless claims in the US increased to 232 thousand

- Market impact: the data has a moderately positive effect on the equity market

US 30 fundamental analysis

US initial jobless claims increased to 232 thousand, above the forecast of 223 thousand and the previous reading of 219 thousand. This means more people applied for benefits for the first time, and the figure continues to rise gradually. It signals a slight cooling in the labour market: layoffs are becoming more frequent than analysts expected, even though the overall level remains low by historical standards.

For the US 30, which comprises a large share of industrial companies, financial institutions, and major consumer brands, the impact looks mixed. Many components of the index directly depend on the real economy – industrial production, heavy machinery, banking, and consumer goods. If the market interprets the increase in jobless claims as the beginning of a more notable economic slowdown, these sectors may come under pressure first, as their profits depend heavily on business activity and investment flows. In this case, the US 30 may react cautiously or even decline following the release.

US initial jobless claims: https://tradingeconomics.com/united-states/jobless-claimsUS 30 technical analysis

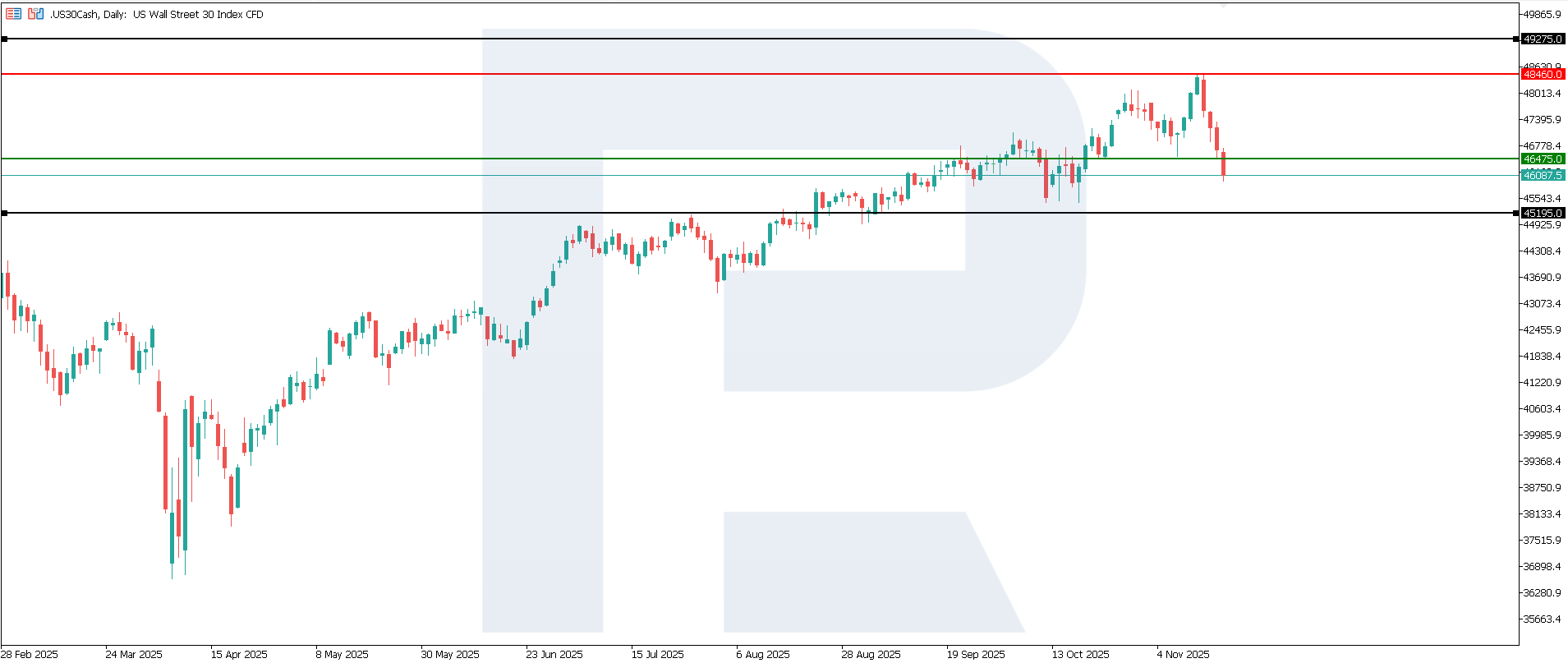

The US 30 index entered a downtrend after breaking below the 46,475.0 support level. A new resistance level formed at 48,460.0. Volatility remains elevated, so the trend may change in the short term. The nearest downside target lies at 45,195.0.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: if the price consolidates below the previously breached support level at 46,475.0, the index could fall to 45,195.0

- Optimistic US 30 scenario: a breakout above the 48,460.0 resistance level could propel the index to 49,275.0

Summary

For the broader US equity market and the US 30, the current situation increases short-term caution, while also opening the possibility for softer interest rate conditions later on. The final reaction will depend on whether upcoming labour market reports confirm a weakening trend and how the Federal Reserve responds. From a technical perspective, the next downside target could be 46,475.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.