US 30 forecast: the index is on the rise

The US 30 index shows strong upward momentum, with prices ready to break above the current resistance level and reach a new all-time high. The US 30 forecast for today is positive.

US 30 forecast: key trading points

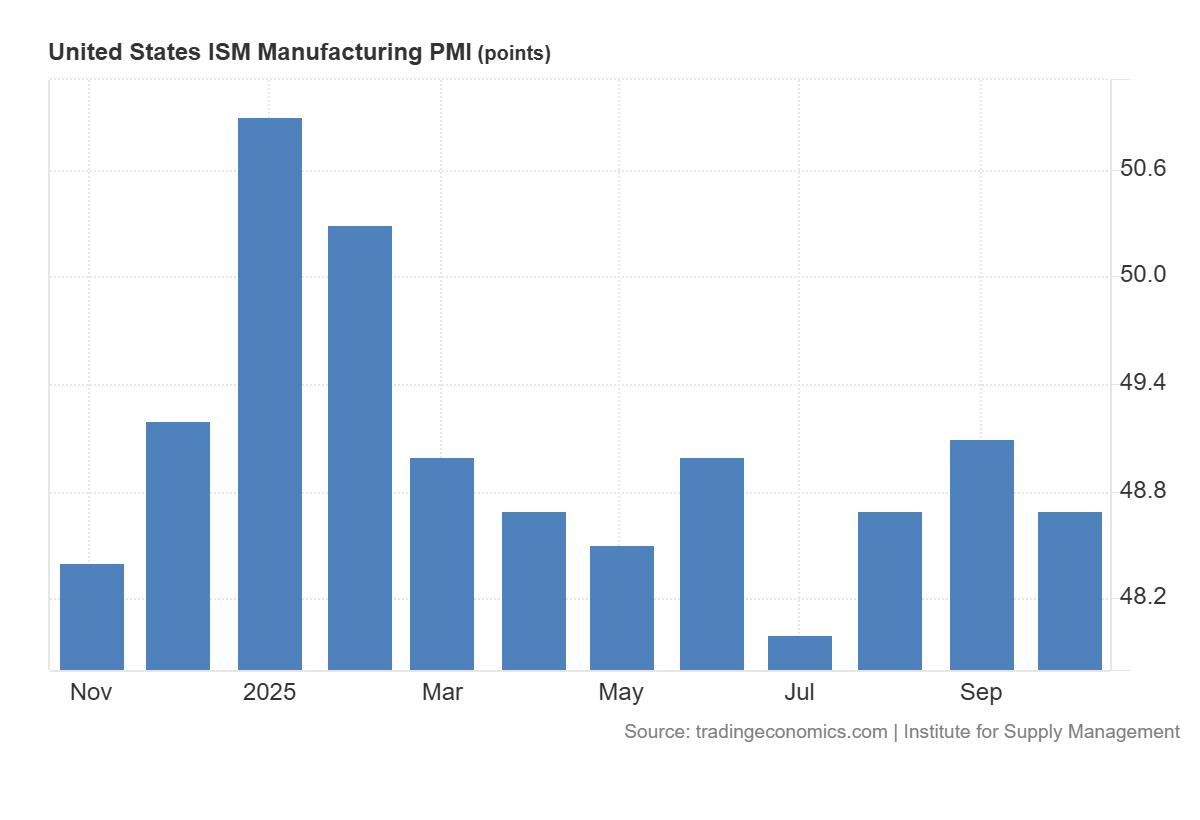

- Recent data: US ISM manufacturing PMI came in at 48.7 in October

- Market impact: the data has a moderately positive effect on the equity market

US 30 fundamental analysis

The US ISM manufacturing PMI fell to 48.7 in October, below the forecast of 49.4 and the previous reading of 49.1. A value below 50.0 indicates a continued contraction in manufacturing activity, and the fact that the indicator came in weaker than expected and lower than the prior level suggests that the slowdown in production is slightly deeper than the market anticipated. For the US equity market, this creates a mixed signal. Weaker manufacturing data raises concerns about the pace of economic growth, potentially prompting investors to act more cautiously towards cyclical stocks such as machinery producers, automakers, and certain industrial and materials corporations.

For the US 30 index, which has a significant share of industrial, financial, and large consumer companies, the impact will be particularly noticeable through the industrial segment. Shares of major manufacturers and related firms may come under pressure due to expectations of weaker demand and lower margins. However, optimism following the end of the government shutdown continues to dominate market sentiment.

US ISM manufacturing PMI: https://tradingeconomics.com/united-states/business-confidenceUS 30 technical analysis

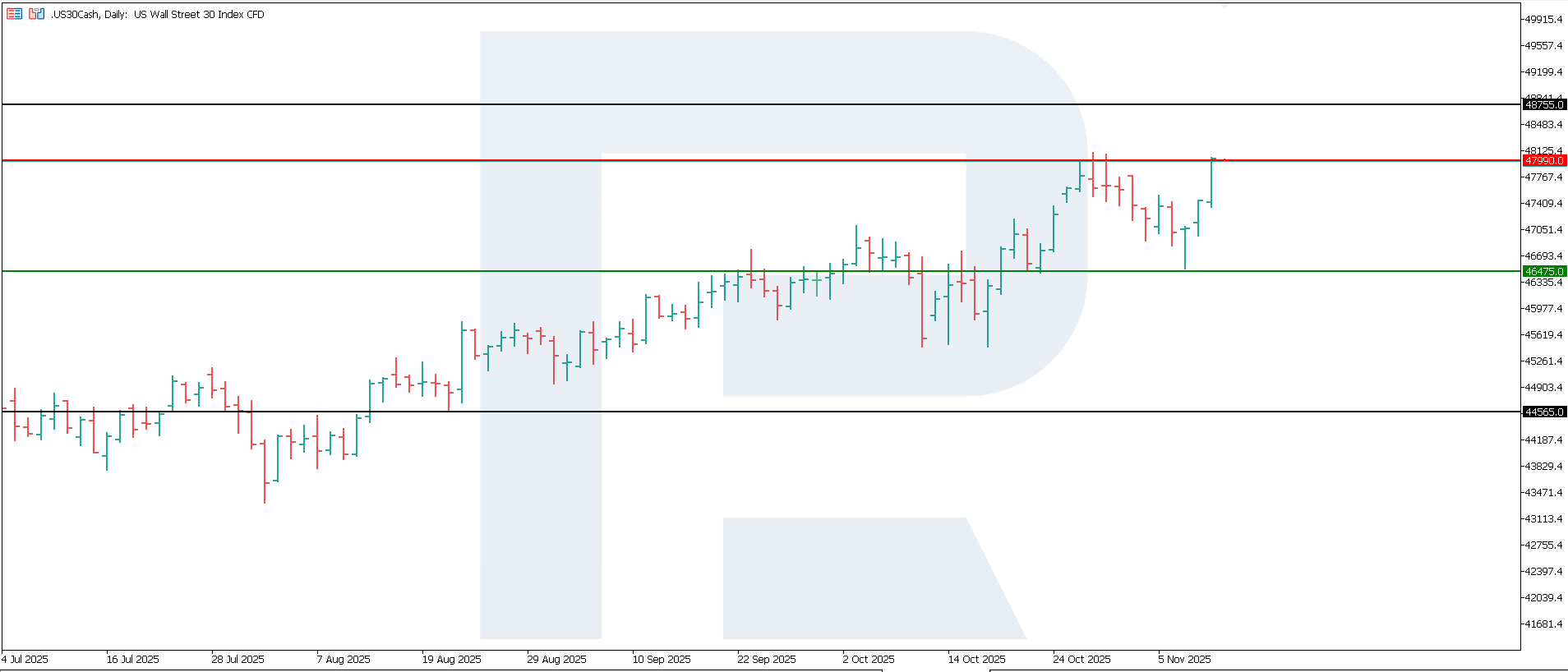

The US 30 index has completed its correction phase and is now preparing to break above the 47,990.0 resistance level, while the support zone is located near 46,475.0. It remains uncertain how long this upward momentum will last, but the next target level is set around 48,755.0.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 46,475.0 support level could push the index down to 44,565.0

- Optimistic US 30 scenario: a breakout above the 47,990.0 resistance level could propel the index to 48,755.0

Summary

Overall, this PMI release pushes the US 30 index towards a moderately negative or neutral reaction, as it raises concerns about the industrial cycle while reinforcing expectations of a softer Federal Reserve policy, reducing the risk of sharp declines in equities. The further trajectory of the US 30 index will depend on whether upcoming indicators, including employment, inflation, and services data, confirm a broader economic slowdown or indicate that current weakness is restricted to manufacturing. From a technical perspective, the next upside target for the US 30 index could be 48,755.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.