US 30 forecast: the index enters a correction, but the uptrend remains intact

The uptrend in the US 30 index remains strong, suggesting the potential for another all-time high. The US 30 forecast for today is positive.

US 30 forecast: key trading points

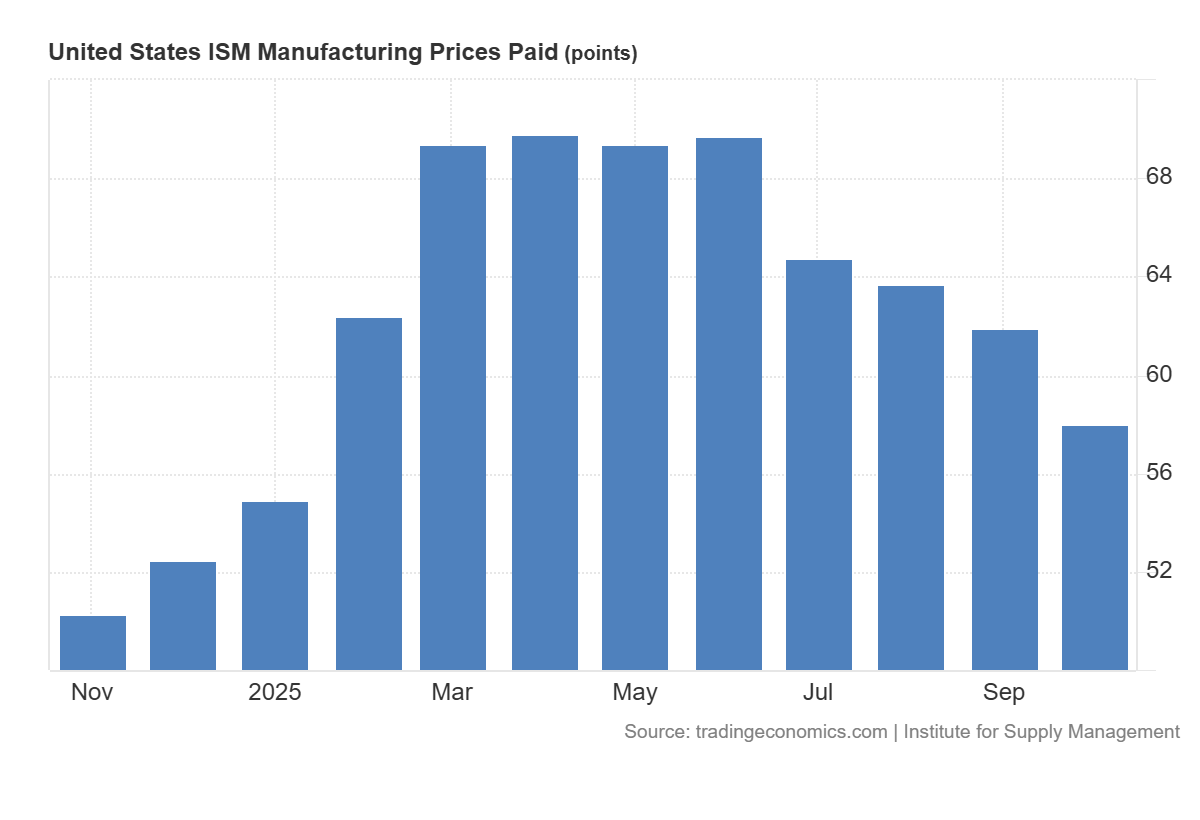

- Recent data: US ISM manufacturing prices for October came in at 58.0

- Market impact: the data has a moderately positive effect on the equity market

US 30 fundamental analysis

The ongoing US government shutdown has now become the longest in history after the Senate once again failed to pass a funding bill yesterday. Meanwhile, the ISM manufacturing prices index came in at 58.0, below the forecast of 62.4 and the previous reading of 61.9. This means that prices paid by manufacturers for raw materials and components are still rising (as the index remains above 50.0), but the pace of growth has slowed significantly and fallen short of expectations. This is effectively a disinflationary signal from the manufacturing sector.

For the US 30 index, the data is moderately positive. Large industrial companies benefit from easing cost pressures and potentially lower discount rates. However, the short-term reaction will depend on whether investors interpret the data as primarily disinflationary or as a sign of weaker end demand.

US ISM manufacturing prices paid: https://tradingeconomics.com/united-states/ism-manufacturing-pricesUS 30 technical analysis

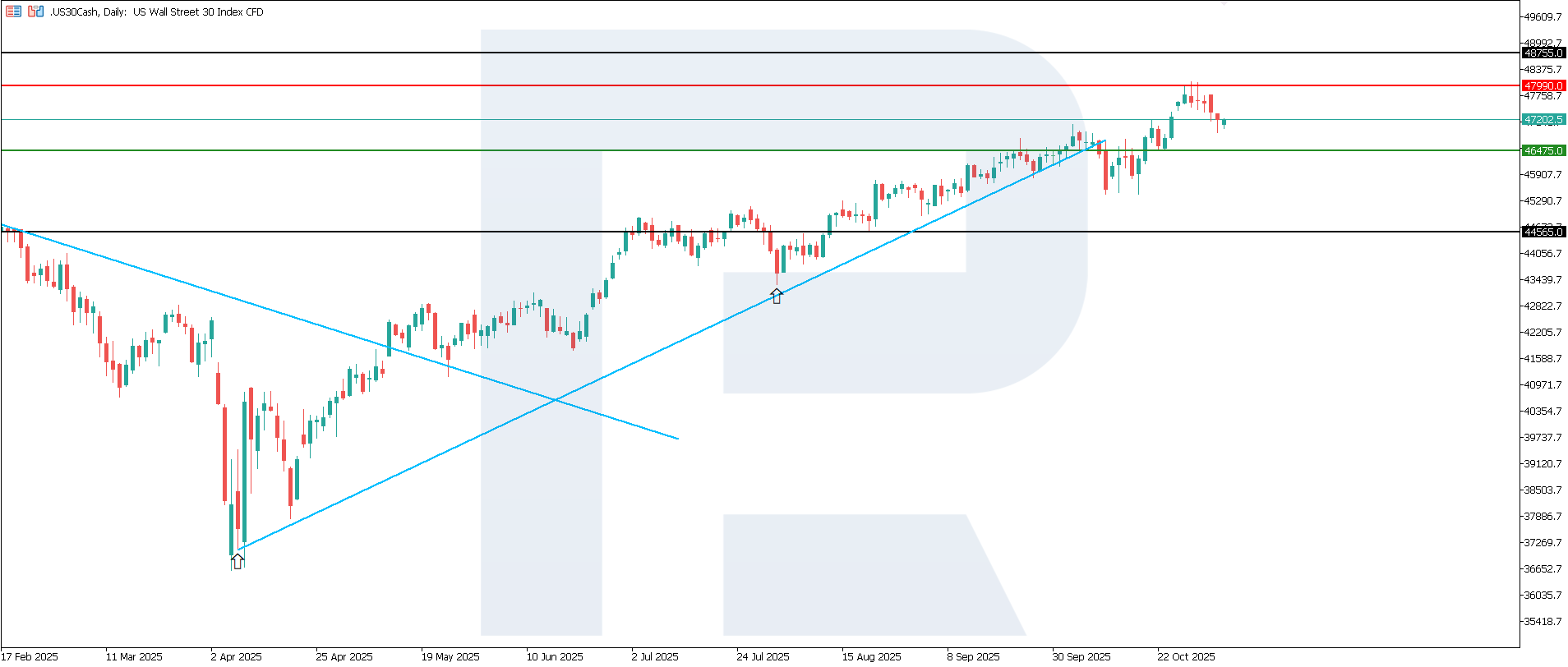

The US 30 index is undergoing a correction, but the broader trend remains bullish. The resistance level has formed at 47,990.0, while support is located near 46,475.0. It is difficult to say how long this trend will last. The next upside target is set at 48,755.0.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 46,475.0 support level could send the index down to 44,565.0

- Optimistic US 30 scenario: a breakout above the 47,990.0 resistance level could drive the index to 48,755.0

Summary

Overall, the latest ISM manufacturing prices release eases inflationary and bond yield pressures, creating a more supportive environment for a revaluation of US 30 equities. However, the scale of the rally is likely to remain limited until other business activity indicators confirm that slower price growth is not accompanied by a sharp drop in real demand. The next upside target could be 48,755.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.