US 30 forecast: the index recovers from the decline and renews its all-time high

Volatility in the US 30 index remains elevated, with the trend reversing upwards once again. The US 30 forecast for today is positive.

US 30 forecast: key trading points

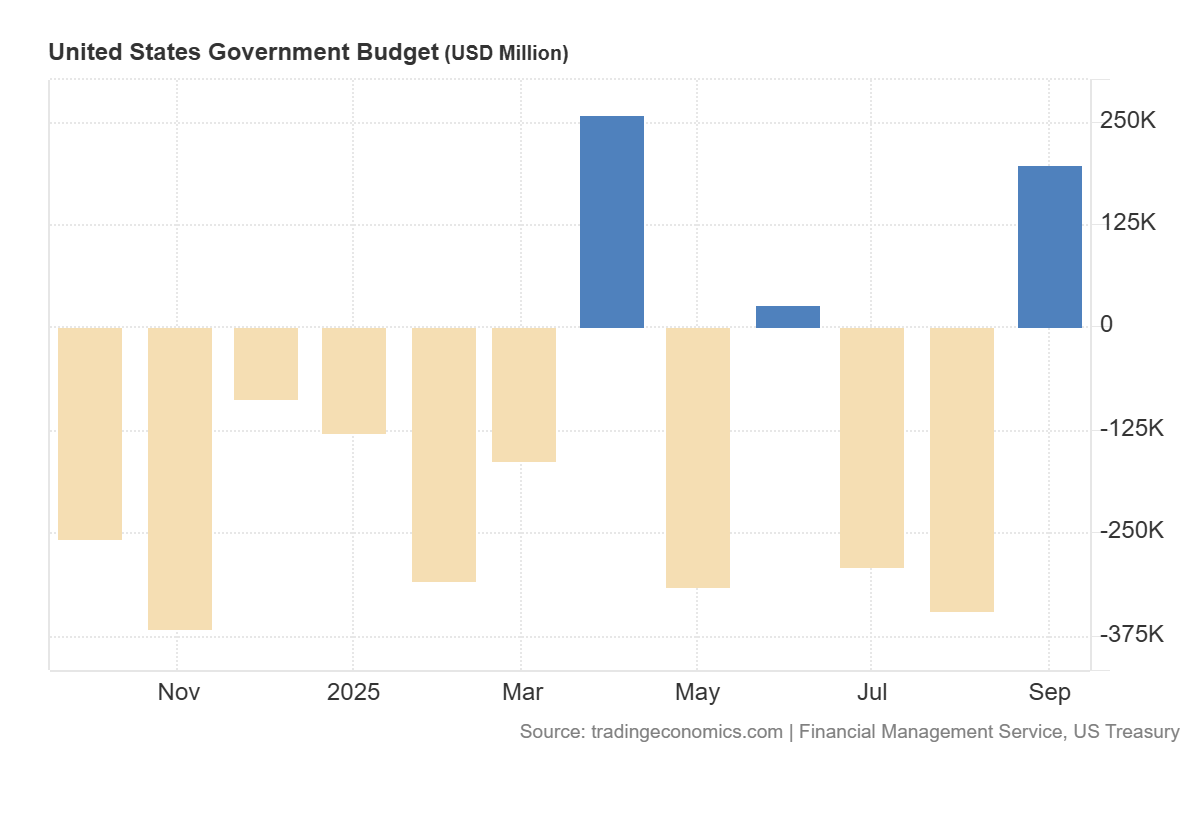

- Recent data: the US federal budget balance came in at 198 billion USD

- Market impact: the data has a moderately positive effect on the equity market

US 30 fundamental analysis

The latest US federal budget data for October 2025 showed a surplus of 198 billion USD, far exceeding both the forecast of 42.3 billion USD and the previous figure of -345 billion USD. This improvement in the budget balance signals strong revenue inflows from tariffs, which could have a mixed macroeconomic impact on US equities. On the one hand, a positive budget balance reduces the government’s borrowing needs, which can ease pressure on Treasury yields – a development typically seen as supportive for the stock market.

For the US 30 index, the short-term reaction is likely to be moderately positive: a stronger fiscal position boosts confidence in the sustainability of public finances and reduces sovereign debt risks. However, in the medium term, the trajectory of the index will depend on whether investors interpret this surplus as a sign of underlying economic strength or not.

US government budget: https://tradingeconomics.com/united-states/government-budget-valueUS 30 technical analysis

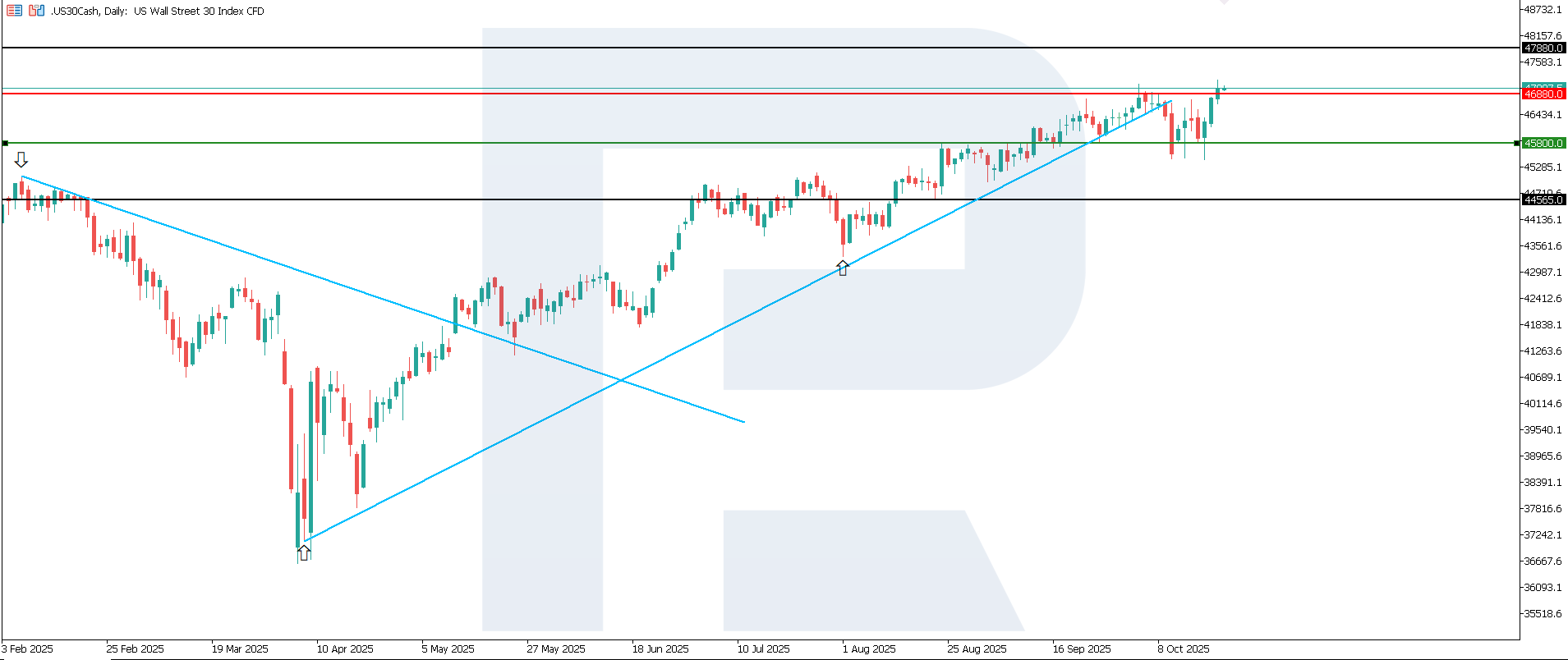

The US 30 index hit a new all-time high, forming an uptrend. The 46,880.0 resistance level has been broken, while support lies near 45,800.0. At this stage, it remains uncertain how long the current uptrend will last.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 45,800.0 support level could send the index down to 44,565.0

- Optimistic US 30 scenario: if the price consolidates above the previously breached resistance level at 46,880.0, the index could climb to 47,880.0

Summary

The strong US budget surplus reinforces confidence in the country’s fiscal stability and supports the US 30 index in the short term. However, in the medium term, the impact will depend on whether economic momentum can be maintained without additional fiscal stimulus. No economic data is available due to the government shutdown. The next upside target for the index could be at 47,880.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.