US 30 forecast: the upward trend continues, the resistance level has not yet been breached

After reaching a new all-time high, the US 30 index trend remains fragile. The outlook for today is positive.

US 30 forecast: key trading points

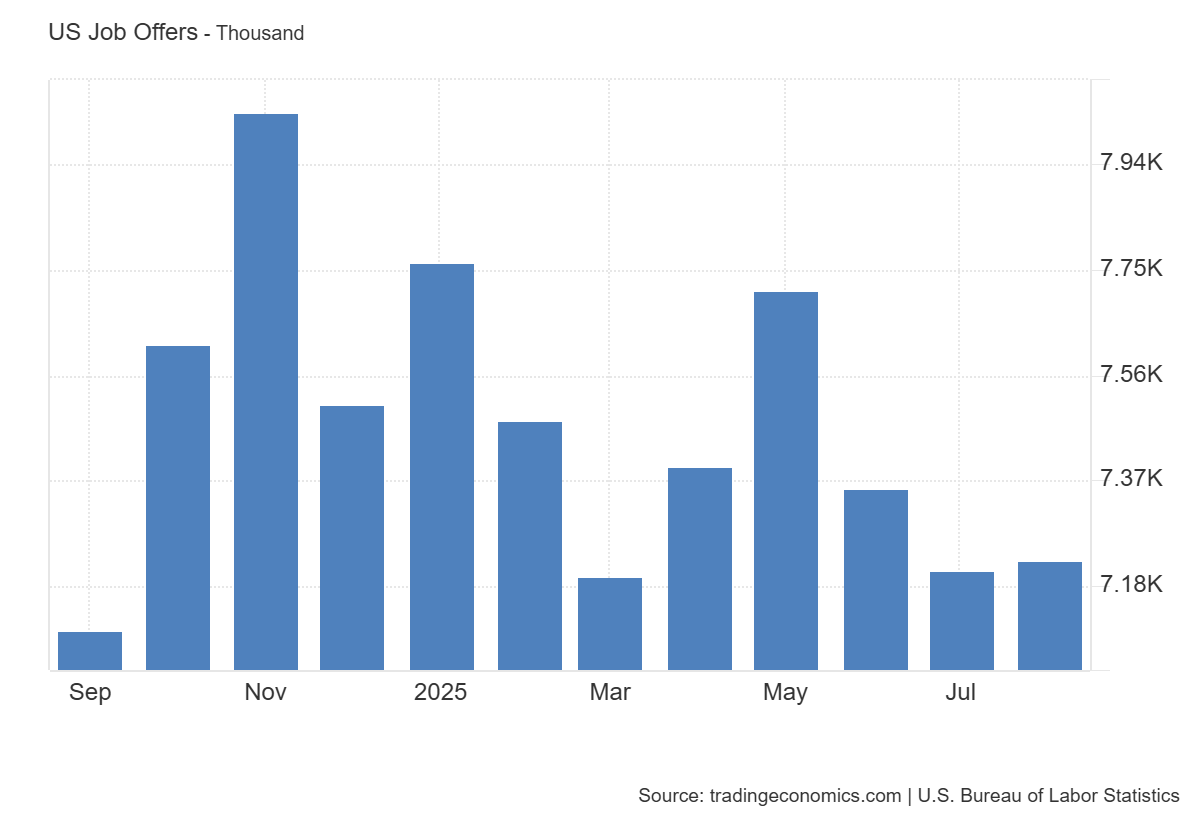

- Recent data: US JOLTS Job Openings for September came in at 7.23M

- Market impact: confirms economic resilience and revenue support for cyclical companies

US 30 fundamental analysis

The JOLTS report showed 7.23M job openings versus a forecast of 7.19M and 7.21M in the previous month. This points to sustained labour demand and underlines the resilience of the job market. Although the increase was modest, it reduces the likelihood of a swift easing of labour market tightness and could maintain upward pressure on wages and core services inflation.

The small upside surprise strengthens the case for the Federal Reserve to take a cautious approach to policy easing. Expectations for aggressive rate cuts in the near term have diminished, while long-term bond yields may stay elevated. This increases the sensitivity of equity markets to rate dynamics and inflation expectations.

US manufacturing PMI: https://tradingeconomics.com/united-states/manufacturing-pmiUS 30 technical analysis

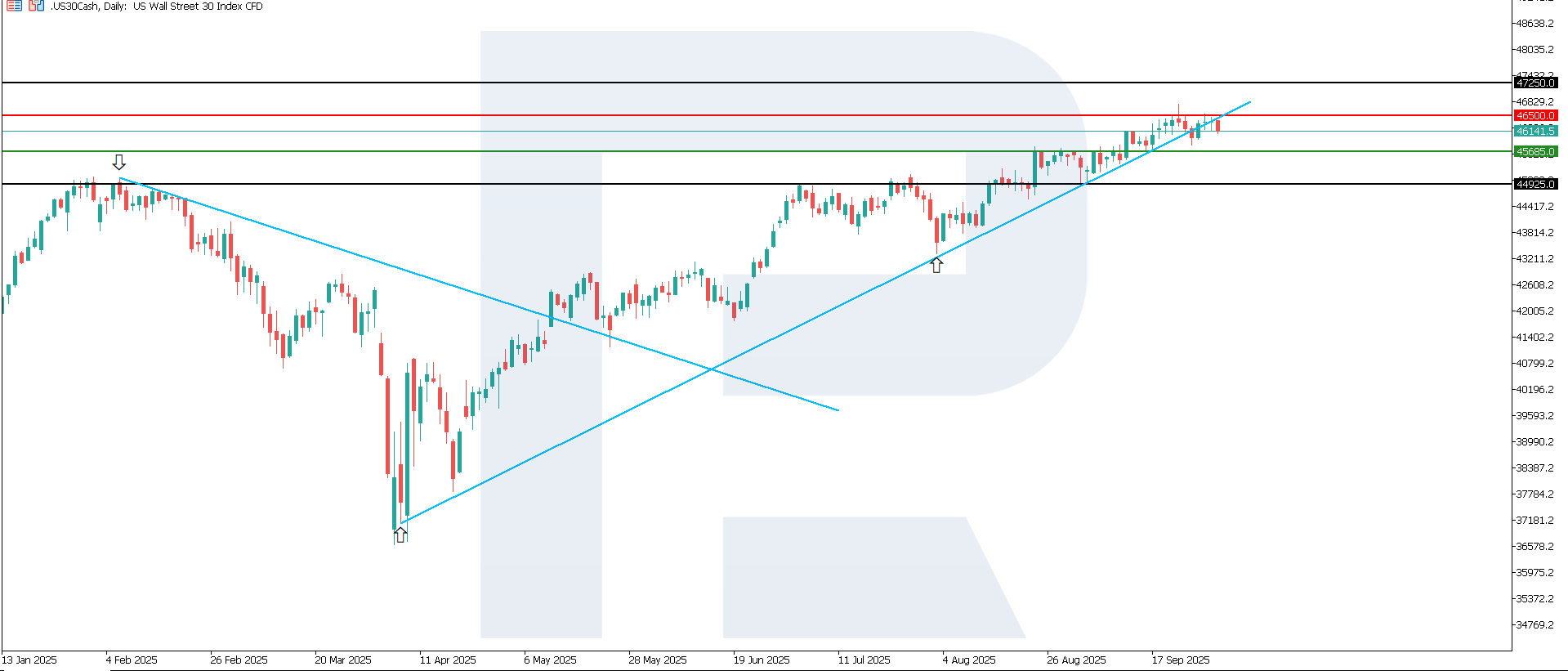

The US 30 index continues to trade in an uptrend, marking fresh record highs. Resistance is set at 46,500.0, while support lies at 45,685.0. Elevated volatility highlights the fragility of the current trend, and near-term upside potential remains capped.

The US 30 price forecast considers the following scenarios:

- Pessimistic case: if support at 45,685.0 breaks, the index could decline to 44,925.0

- Optimistic case: if resistance at 46,500.0 is breached, the index may rise to 47,250.0

Summary

For an index heavily weighted toward industrials, financials, and consumer companies, the reaction will likely be neutral to moderately positive, supported by signs of resilient activity and demand. However, higher bond yields could limit gains and amplify intraday volatility. In the near term, the index may show relative stability compared to more rate-sensitive benchmarks, with performance shaped by Treasury yield movements and Fed commentary. The next upside target is 46,595.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.