US 30 forecast: the uptrend continues, resistance remains unbroken

After reaching a new all-time high, the US 30 index trend remains unstable. The US 30 forecast for today is positive.

US 30 forecast: key trading points

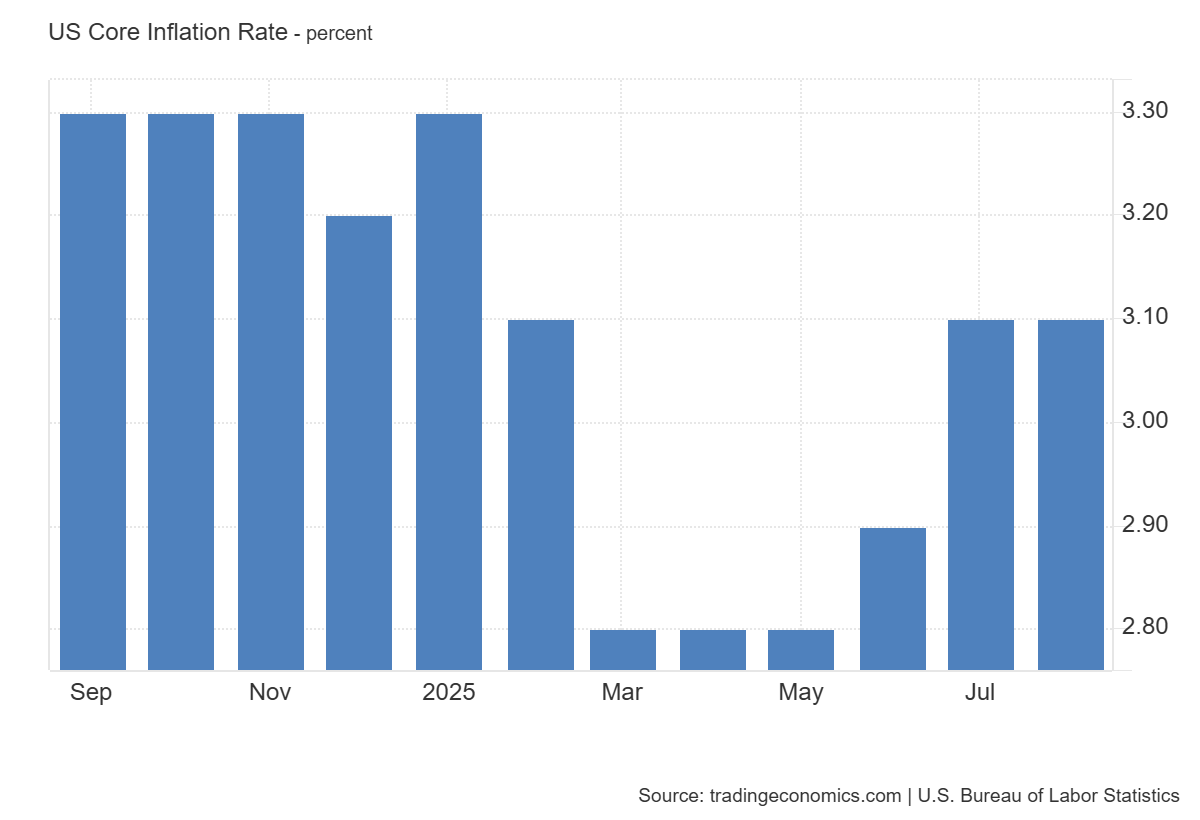

- Recent data: the US core CPI rose 3.1% year-on-year in August

- Market impact: the current reading may have a mixed effect on the US equity market

US 30 fundamental analysis

The US core CPI for August 2025 showed growth of 3.1% year-on-year, matching analysts’ forecasts and remaining unchanged from the previous month. This reflects persistent inflationary pressure in the economy, excluding volatile food and energy categories.

The index’s stability at above 3% highlights that inflation remains higher than the Federal Reserve’s long-term target of around 2%. This signals to markets the need to maintain tight monetary policy. For US stocks, the data sets a neutral-to-restrained tone: on the one hand, the lack of deterioration (no sharp inflation spike) reduces the risk of aggressive Fed tightening, but on the other hand, inflation staying above target caps expectations of an imminent policy easing.

US Core Inflation Rate: https://tradingeconomics.com/united-states/core-inflation-rateUS 30 technical analysis

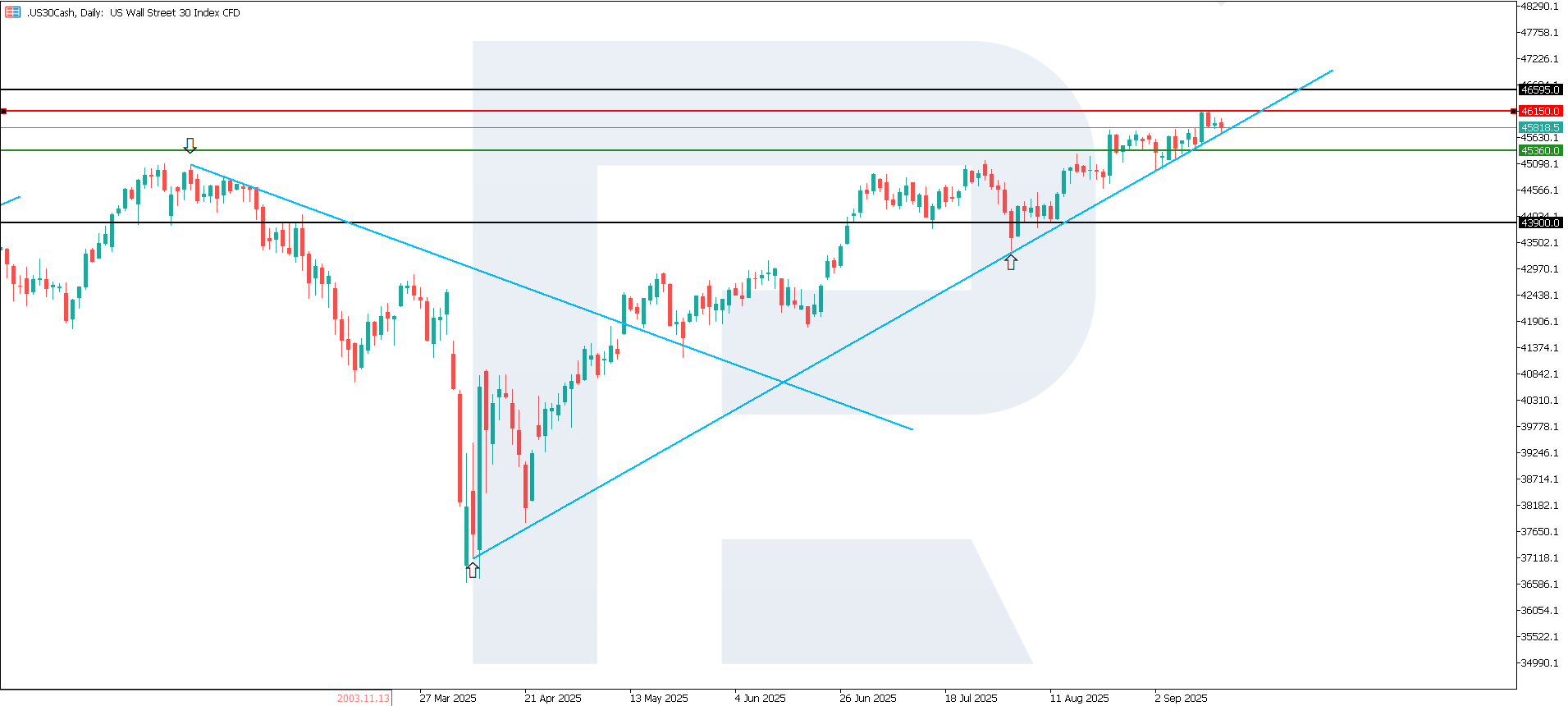

The US 30 index continues to trade in the uptrend, with the support level at 46,150.0 and resistance at 45,360.0. However, persistent high volatility indicates instability in the current trend, with the upside potential remaining limited in the near term. Nevertheless, a new all-time high remains possible.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 45,360 support level could send the index down to 43,90

- Optimistic US 30 scenario: a breakout above the 46,150 resistance level could drive the index up to 46,595.0

Summary

The release of core CPI data at 3.1% reinforces expectations of a slower pace of Fed rate cuts. For the US 30 index, this signals limited upside potential in the short term: the positive factor of data stability is balanced by risks tied to high capital costs and pressure on corporate margins. The next target for growth could be 46,595.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.