US 30 forecast: the index may start rising again

The US 30 stock index remains volatile and may break above the resistance level, which could signal a reversal into an uptrend. The US 30 forecast for today is negative.

US 30 forecast: key trading points

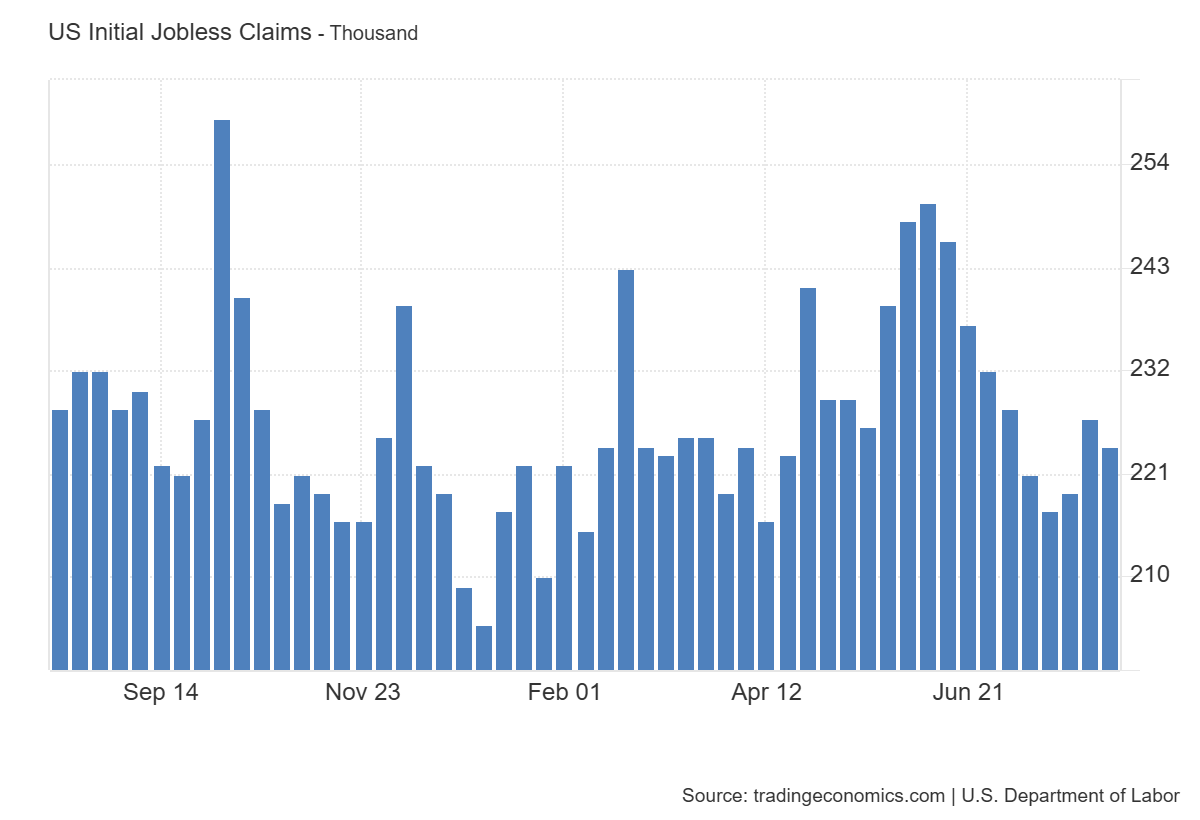

- Recent data: US initial jobless claims for last week came in at 224 thousand

- Market impact: this result can be seen as a moderately positive signal for the US stock market

US 30 fundamental analysis

US initial jobless claims for the week ending 14 August 2025 fell to 224 thousand, slightly below the forecast of 225 thousand and notably lower than the previous reading of 227 thousand. The decline shows that the labour market remains resilient despite signs of economic slowdown. Jobless claims data indicates no sharp rise in unemployment and supports expectations of stable consumer activity.

For the US 30 index, the effect may be moderately positive. A strong labour market boosts investor confidence, especially in sectors driven by domestic demand. Consumer goods and services, retail, and financial companies could benefit, as steady employment supports household income and spending.

US Initial Jobless Claims: https://tradingeconomics.com/united-states/jobless-claimsUS 30 technical analysis

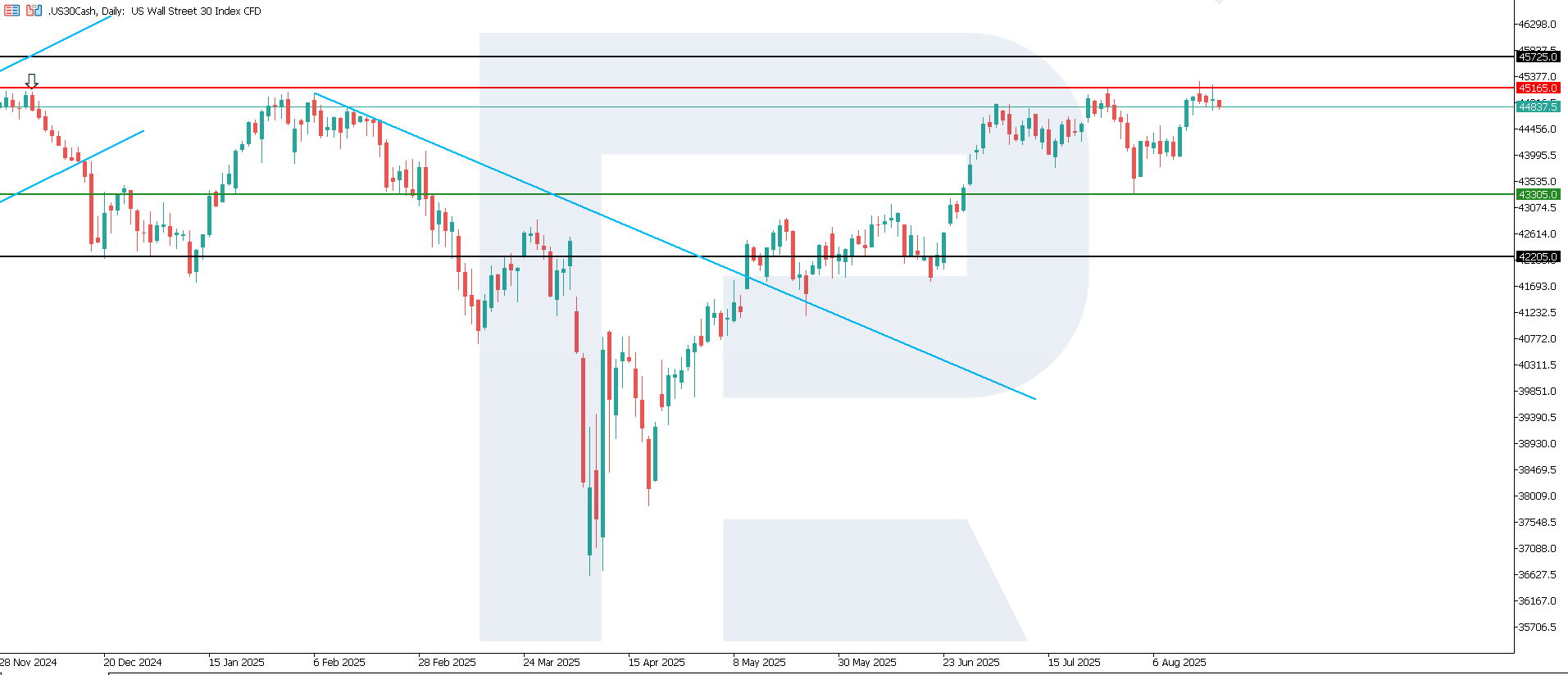

The US 30 index remains in a downtrend. The resistance level has formed at 45,065.0, with the support level at 43,305.0. Volatility remains elevated for the US 30. The price approached the resistance level but has yet to break above it. In this case, the trend could reverse upwards, with the price likely to reach a new all-time high.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 43,305.0 support level could push the index down to 42,205.0

- Optimistic US 30 scenario: a breakout above the 45,065.0 resistance level could drive the index up to 45,725.0

Summary

If a strong labour market is interpreted as a factor preventing the Federal Reserve from cutting rates quickly, this may restrain growth in capital-intensive sectors such as technology. Overall, the data reflects a balance: the labour market remains strong, supporting the economy and some stock market sectors, but investors remain cautious about future monetary policy. The next downside target could be 42,205.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.