US 30 forecast: the index has shifted to a downtrend

The US 30 stock index has once again shown instability and broken below the support level, indicating a shift to a downtrend. Today’s US 30 forecast is negative.

US 30 forecast: key trading points

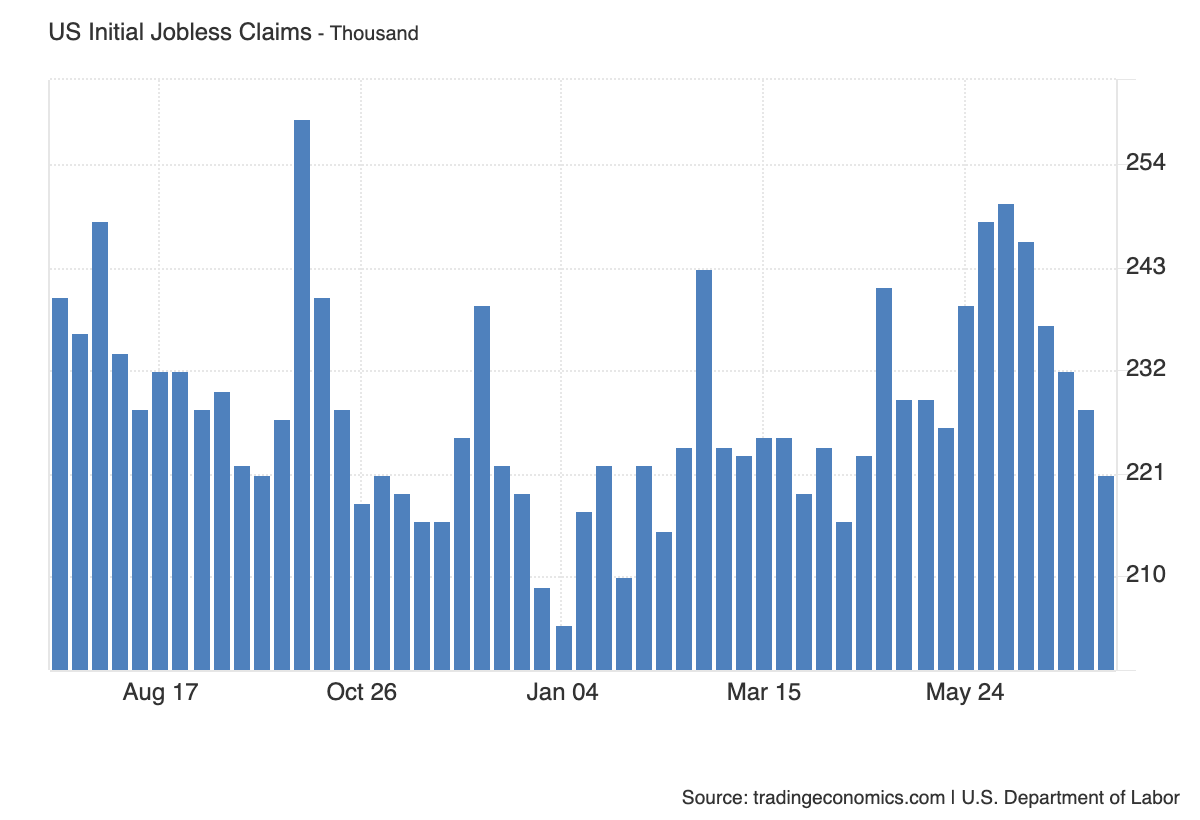

- Recent data: weekly US initial jobless claims came in at 221 thousand

- Market impact: this is a positive signal for US equities, particularly for the US 30 index, as a strong labour market supports consumer demand and stable economic activity

US 30 fundamental analysis

US initial jobless claims came in at 221 thousand, below the forecast of 233 thousand and the previous figure of 228 thousand. The indicator reflects the number of new unemployment benefit claims filed during the week and serves as a gauge of the current situation in the labour market. The decline in claims signals continued resilience and even strengthening of the labour market.

Overall, the data suggests a stable economic environment and fuels investor optimism, driving the US 30 index higher. However, investors also take into account other macroeconomic data and geopolitical risks, so market movements may be volatile.

United States initial jobless claims: https://tradingeconomics.com/united-states/jobless-claimsUS 30 technical analysis

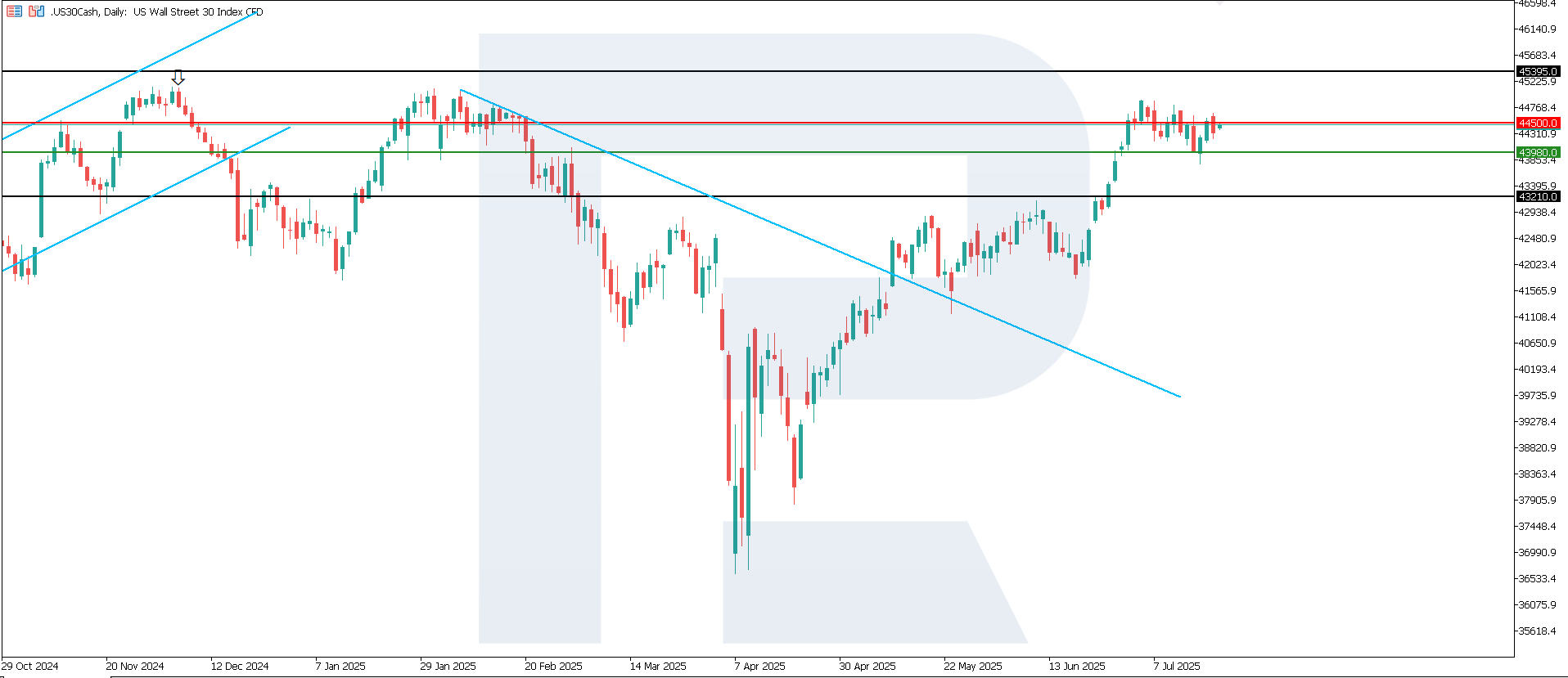

The US 30 index broke below the 44,350.0 support level and entered a downtrend. Resistance has formed at 44,500.0, with support at 43,980.0. It is worth noting the increased volatility and instability of the US 30 index trend.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 scenario: a breakout below the 43,980.0 support level could send the index down to 43,210.0

- Optimistic US 30 scenario: a breakout above the 44,500.0 resistance level could propel the index up to 45,395.0

Summary

The financial sector, consumer goods and services, as well as industrial and transport companies, may benefit the most in the current labour market environment. The tech sector may also find support, as economic stability fosters investment and innovation. However, under a downtrend, there is a high probability of prices falling to the 43,210.0 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.