US 30 forecast: the index shifts to a downtrend

The US 30 stock index has become volatile again and has broken below a support level, indicating a shift in trend to bearish. The US 30 forecast for today is negative.

US 30 forecast: key trading points

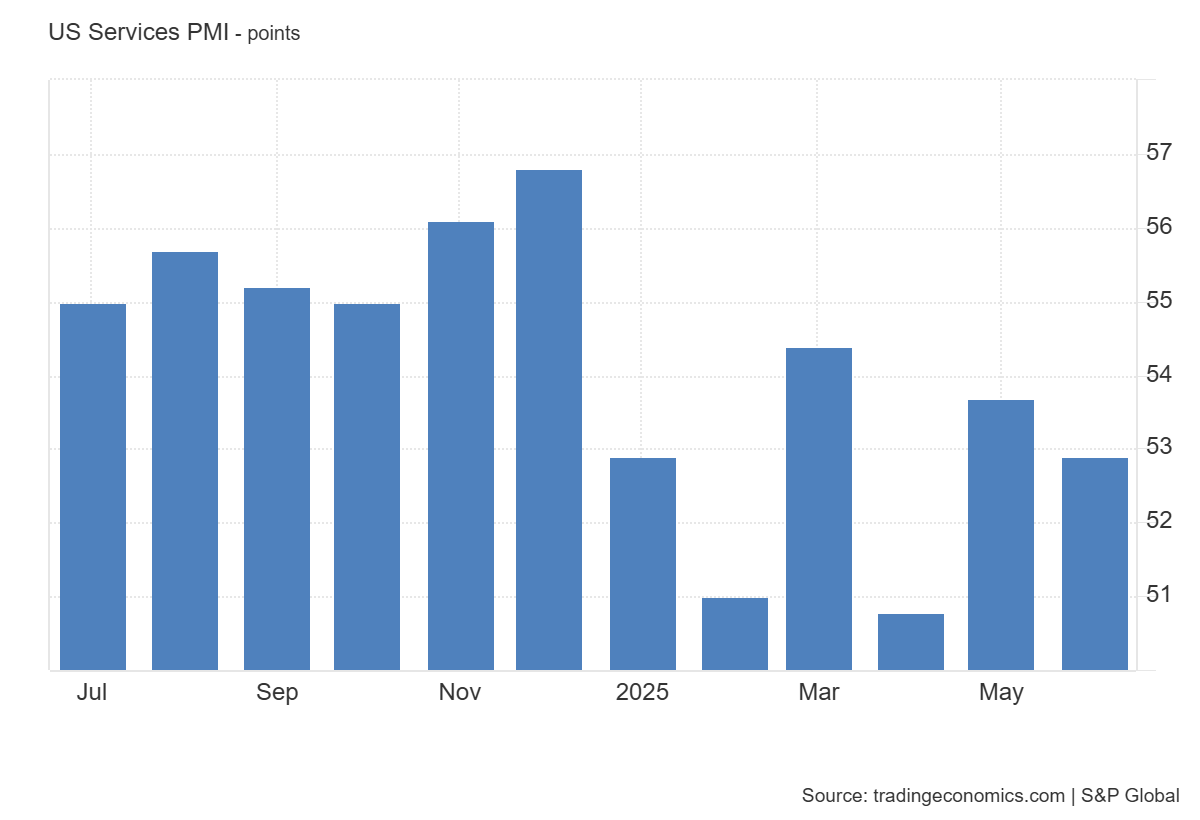

- Recent data: US services PMI for June came in at 52.9

- Market impact: a slightly lower PMI suggests a moderate slowdown in the services sector, which accounts for a significant portion of the US economy – this may prompt investor caution

US 30 fundamental analysis

The US services PMI of 52.9 slightly missed expectations of 53.1 and the previous result of 53.1, signalling a mild slowdown in service sector activity. Industries such as consumer services, financials, healthcare, and real estate – all closely tied to the services economy – may face pressure or slower profit growth. Meanwhile, industrial and tech companies could maintain steadier performance if their outlook is less dependent on services.

Overall, the slight dip in PMI is not a critical signal and likely reflects typical cyclical fluctuation. However, investors may watch upcoming data closely to assess whether the slowdown continues or stabilises. If the downtrend in PMI persists, it could place more pressure on the US 30 index and its related sectors. Conversely, stabilisation or improvement in the PMI would help restore positive market sentiment.

United States services PMI: https://tradingeconomics.com/united-states/services-pmiUS 30 technical analysis

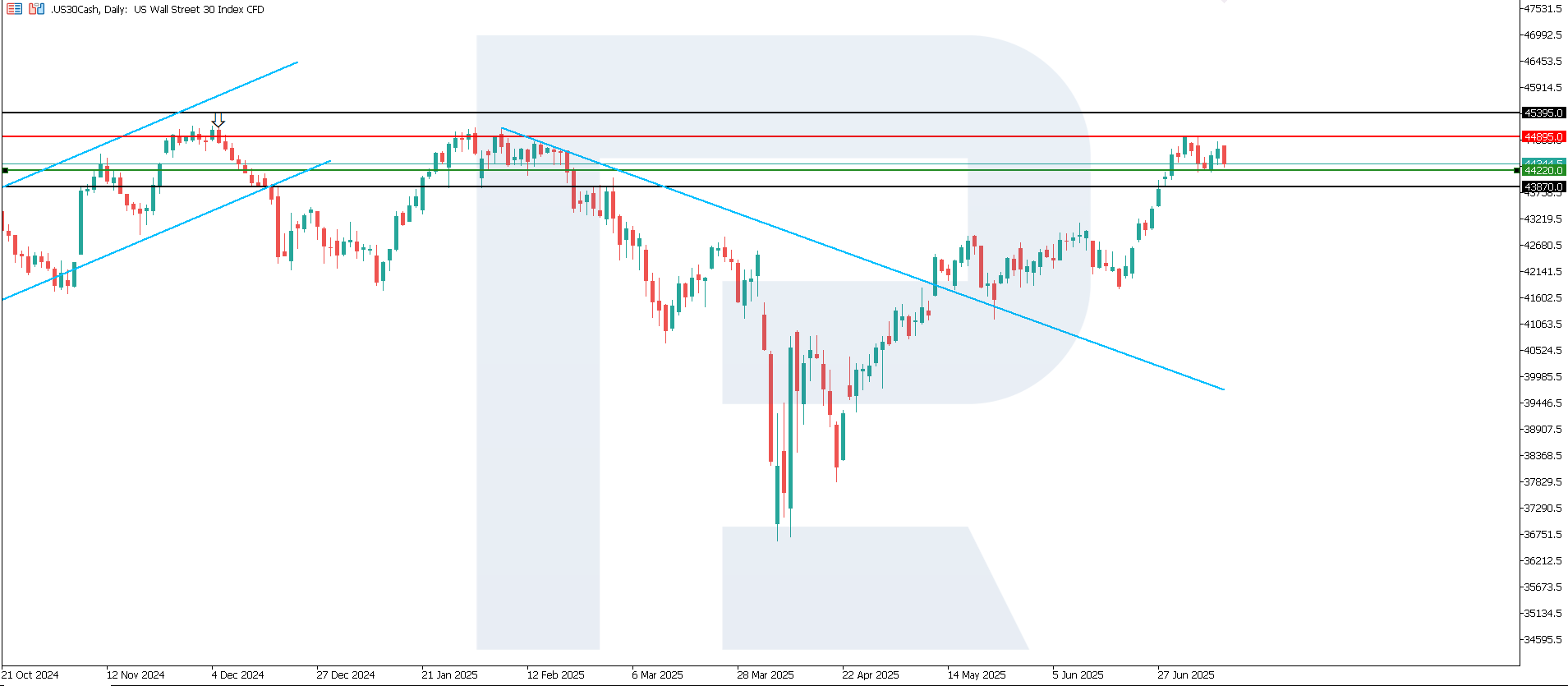

The US 30 index broke below the 44,350.0 support level, entering a downtrend. The resistance level formed at 44,895.0, with support at 44,220.0. It is worth noting the increased volatility and unstable trend in the US 30.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 scenario: a breakout below the 44,220.0 support level could push the index down to 43,870.0

- Optimistic US 30 scenario: a breakout above the 44,895.0 resistance level could drive the index up to 45,395.0

Summary

The US 30 index shows elevated volatility, with the trend shifting once again – this time to a downtrend. However, the recent breakout below the 44,350.0 support level might prove to be a false signal. The US services PMI is a key gauge of activity in the services sector, which makes up around 70% of US GDP. The latest reading came in at 52.9, below the forecast of 53.1 and the previous result of 53.1, indicating a moderate slowdown, while the sector remains in expansion.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.