JP 225 forecast: the index resumes growth

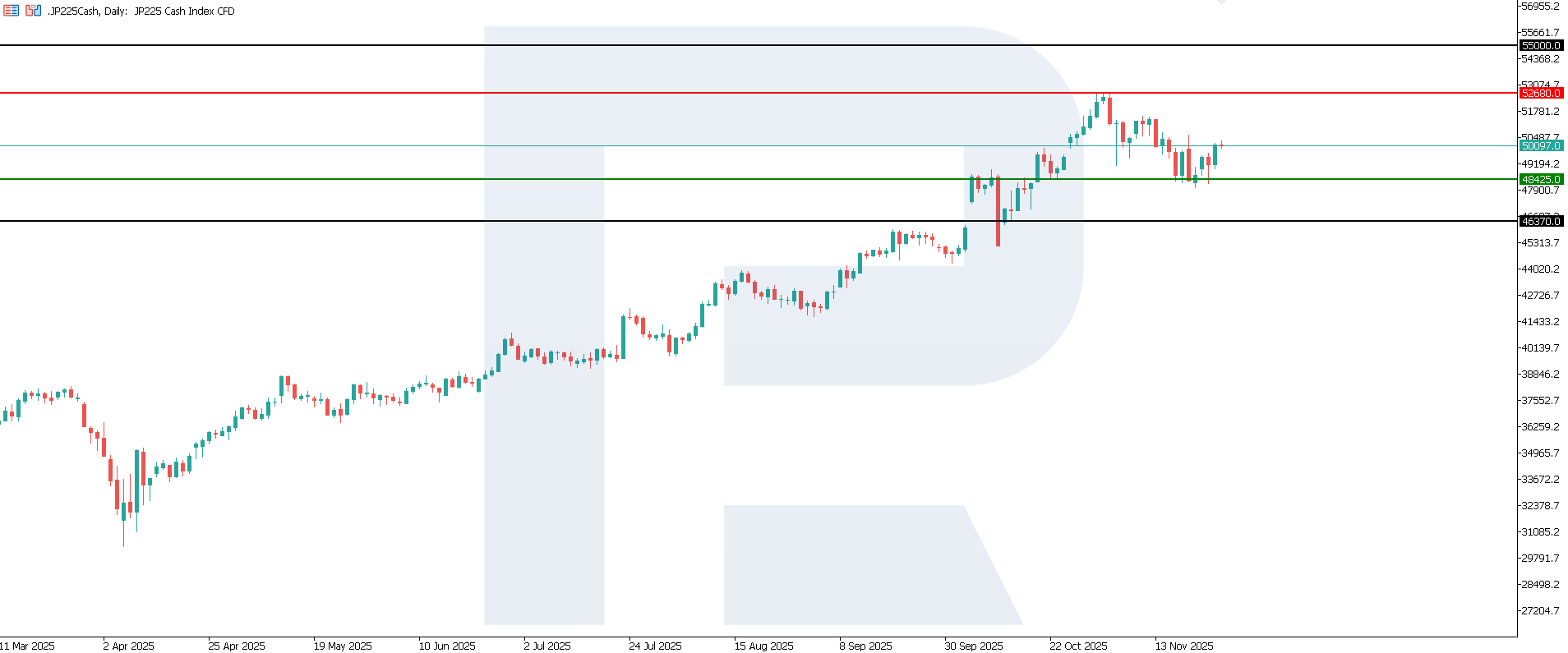

The JP 225 stock index has bounced off the support level within an uptrend. The JP 225 forecast for today is positive.

JP 225 forecast: key trading points

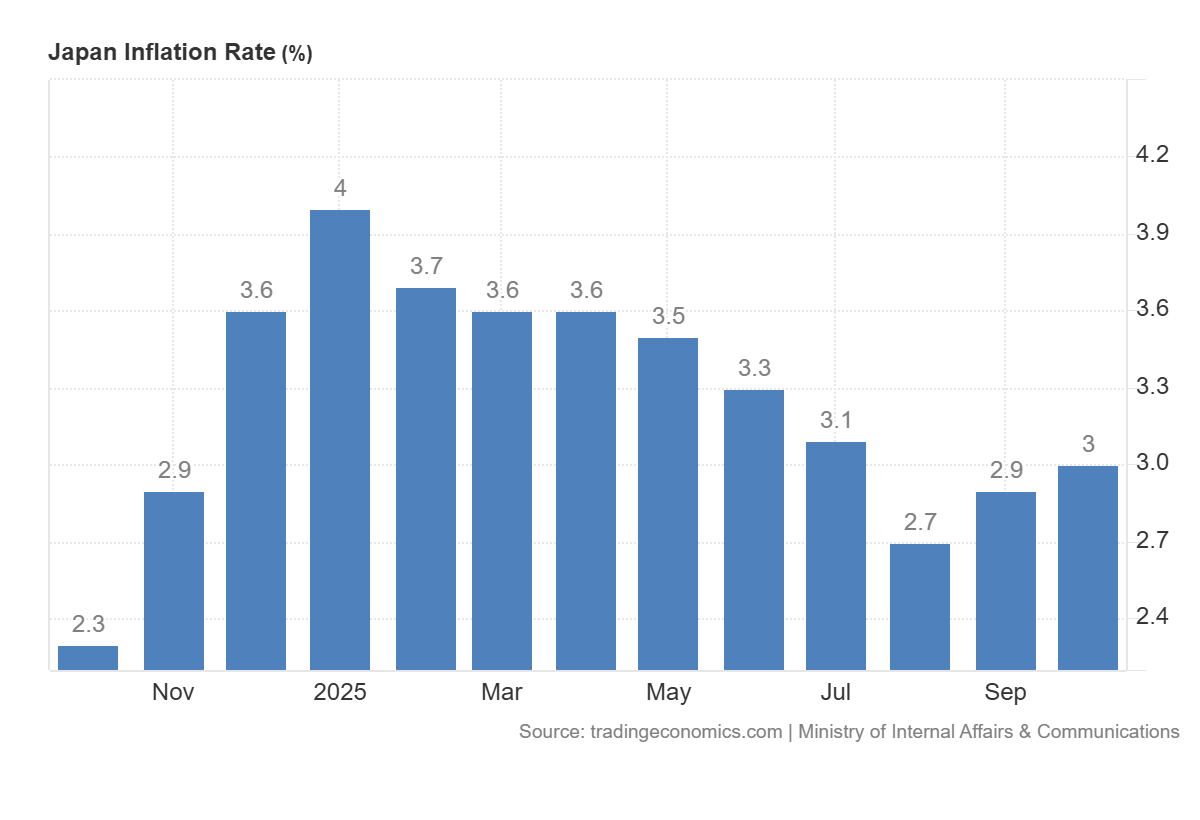

- Recent data: Japan's inflation rose 3.00% year-on-year in October 2025

- Market impact: moderately negative for the Japanese stock market

JP 225 fundamental analysis

Japan’s core Consumer Price Index showed an annual increase of 3.0%, in line with the forecast and slightly above the previous 2.9%. For the market, this indicates that inflation remains above the Bank of Japan’s 2.0% target but is not accelerating more than expected. In other words, the economy is no longer stuck in chronic deflation, but we also see no signs of runaway inflation that would force the regulator to sharply tighten policy.

For the JP 225 index, the impact is mixed as it includes many export-oriented companies, for which the key factors are the yen’s exchange rate and borrowing costs. If the market decides that with this level of inflation, the Bank of Japan may afford to slightly raise rates or further loosen its yield-curve control, this could strengthen the yen. A stronger yen reduces exporters’ profits when foreign revenue is converted into the national currency – typically negative for automakers, electronics manufacturers, and industrial equipment companies. On the other hand, a signal of controlled, predictable inflation reduces the risk of sudden, unexpected regulatory moves.

Japan’s inflation rate: https://tradingeconomics.com/japan/indicatorsJP 225 technical analysis

Within the correction phase, the JP 225 rebounded from the 48,425.0 support level. Before resuming its rise, the index may trade sideways for some time, while the long-term uptrend remains intact. The resistance level has formed at 52,680.0. The next upside target stands at 55,000.0.

The JP 225 price forecast considers the following scenarios:

- Pessimistic JP 225 scenario: a breakout below the 48,425.0 support level could push the index down to 46,370.0

- Optimistic JP 225 scenario: a breakout above the 52,680.0 resistance level could boost the index up to 55,000.0

Summary

In the short term, the Japanese stock market and the JP 225 index will likely react moderately: without sharp moves, possibly with slight fluctuations influenced by the yen’s movement and Japanese government bond yields. Some sectors may behave differently: domestically oriented companies benefit from confirmation of stable inflation and potential growth in wages and prices, while exporters may come under pressure if investors price in a stronger yen. In the medium term, the JP 225’s trajectory will depend on how the Bank of Japan interprets the inflation data. The next upside target for JP 225 remains 55,000.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.