JP 225 forecast: the index forms a sideways channel

The JP 225 stock index corrected towards the support level, but the global trend remains upward. The JP 225 forecast for today is positive.

JP 225 forecast: key trading points

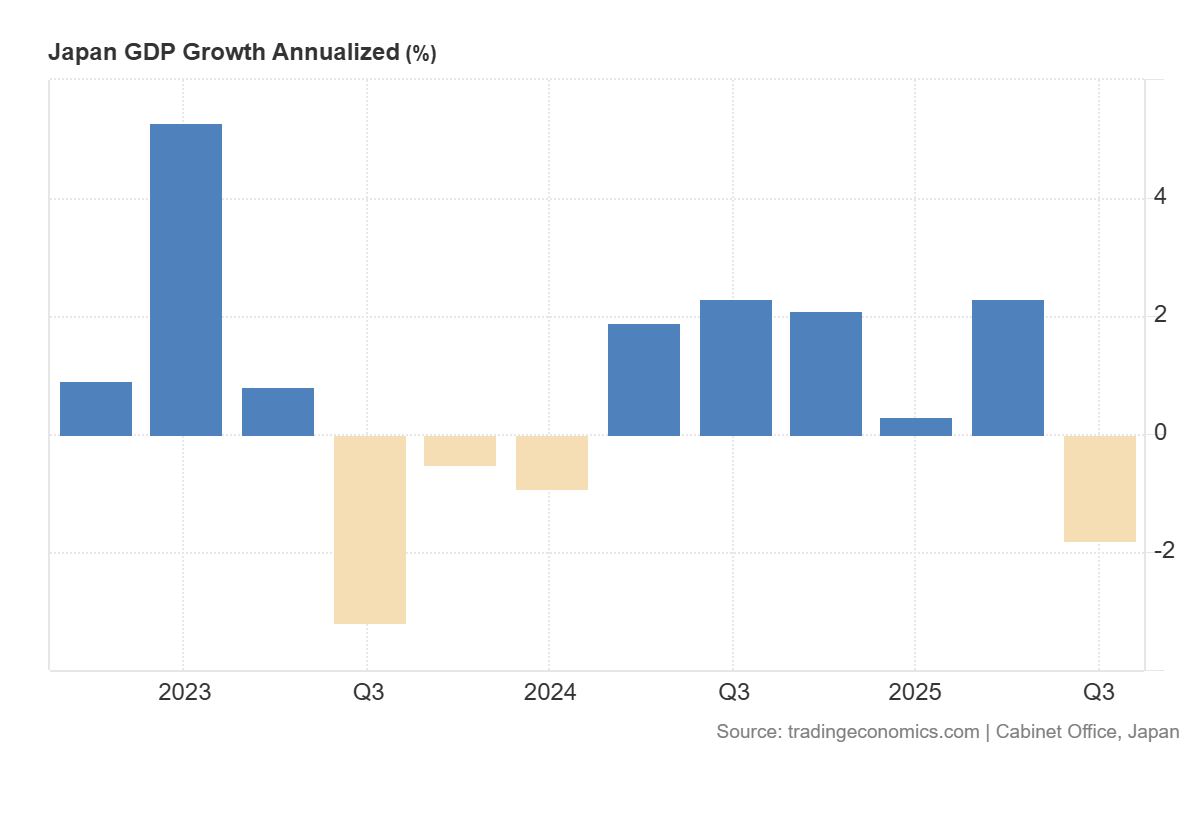

- Recent data: Japan’s GDP in Q3 2025 decreased by 1.8%

- Market impact: moderately negative for the Japanese stock market

JP 225 fundamental analysis

Japan’s annualised GDP indicator showed a decline of -1.8% versus the forecast of -2.5% and the previous growth of 2.3%. This means the economy shifted from expansion to contraction, although the downturn turned out to be less severe than analysts expected. Formally, this still signals cooling: companies on average produce and sell less than a year ago, and both domestic and external demand weakened. Such data is generally negative for the Japanese stock market because a weaker economy usually implies cautious consumer and business behaviour, slower investment activity, and pressure on company revenues, especially those focused on the domestic market.

For the JP 225 index, where a significant share belongs to large export-oriented companies, the effect is also mixed. On the one hand, weak GDP hits expectations for domestic demand. On the other hand, the Bank of Japan’s soft policy and the associated risks of a weaker yen support exporters, as a declining currency boosts their competitiveness and increases profits when converted into yen.

Japan’s GDP growth annualised: https://tradingeconomics.com/japan/gdp-growth-annualizedJP 225 technical analysis

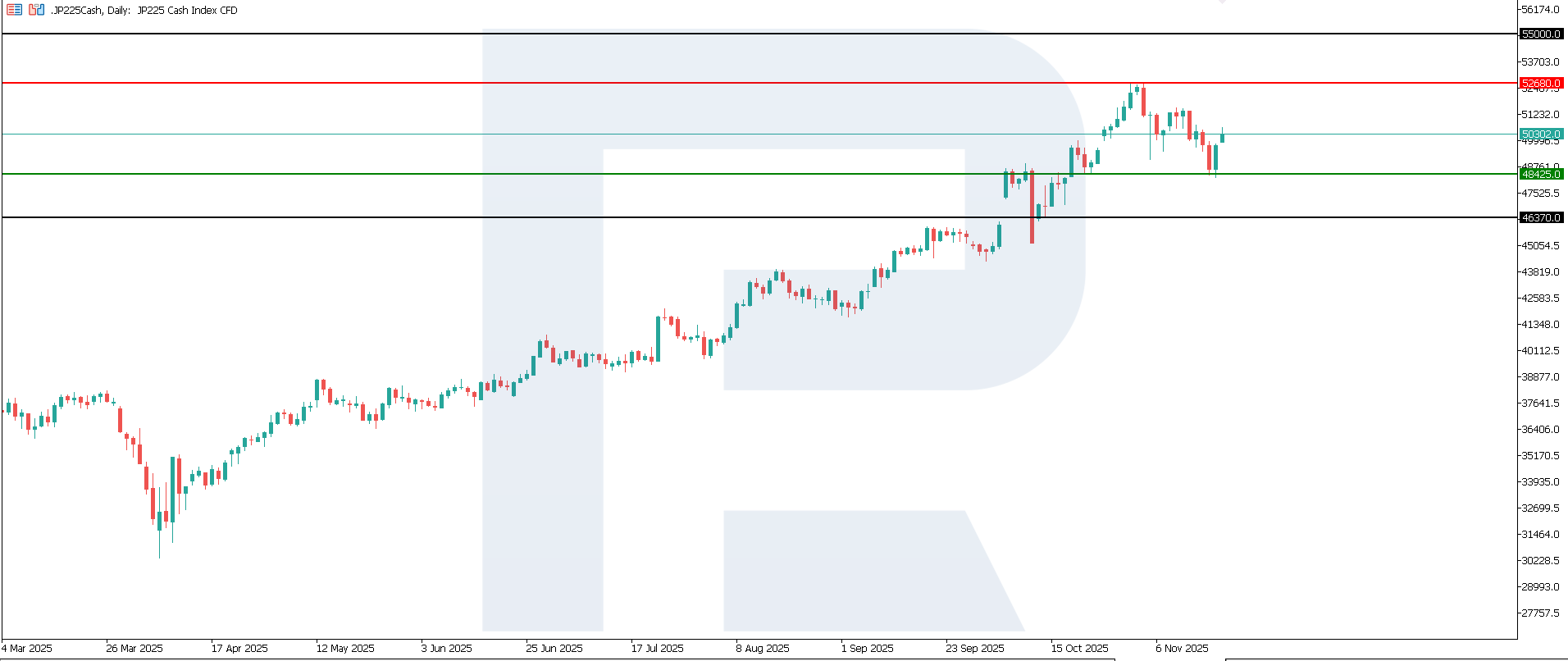

Within the correction phase, the JP 225 rebounded from the 48,425.0 support level. Before resuming its rise, the index may trade sideways. The global trend remains upward. The resistance level has formed at 52,680.0. The nearest upside target stands at 55,000.0.

The JP 225 price forecast considers the following scenarios:

- Pessimistic JP 225 scenario: a breakout below the 48,425.0 support level could send the index down to 46,370.0

- Optimistic JP 225 scenario: a breakout above the 52,680.0 resistance level could drive the index up to 55,000.0

Summary

In the short term, Japan’s stock market and the JP 225 index will likely react with heightened volatility: some investors will price in the risk of further slowdown, while others will bet on central bank support and a potentially weaker yen. In the long run, the future trajectory of the JP 225 will depend on whether upcoming macroeconomic reports confirm a declining trend and what specific actions the Bank of Japan takes. The next upside target for the JP 225 stands at 55,000.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.