JP 225 forecast: the index may enter a sideways channel

The JP 225 stock index is trading within an uptrend, although it is currently undergoing a correction. The JP 225 forecast for today is positive.

JP 225 forecast: key trading points

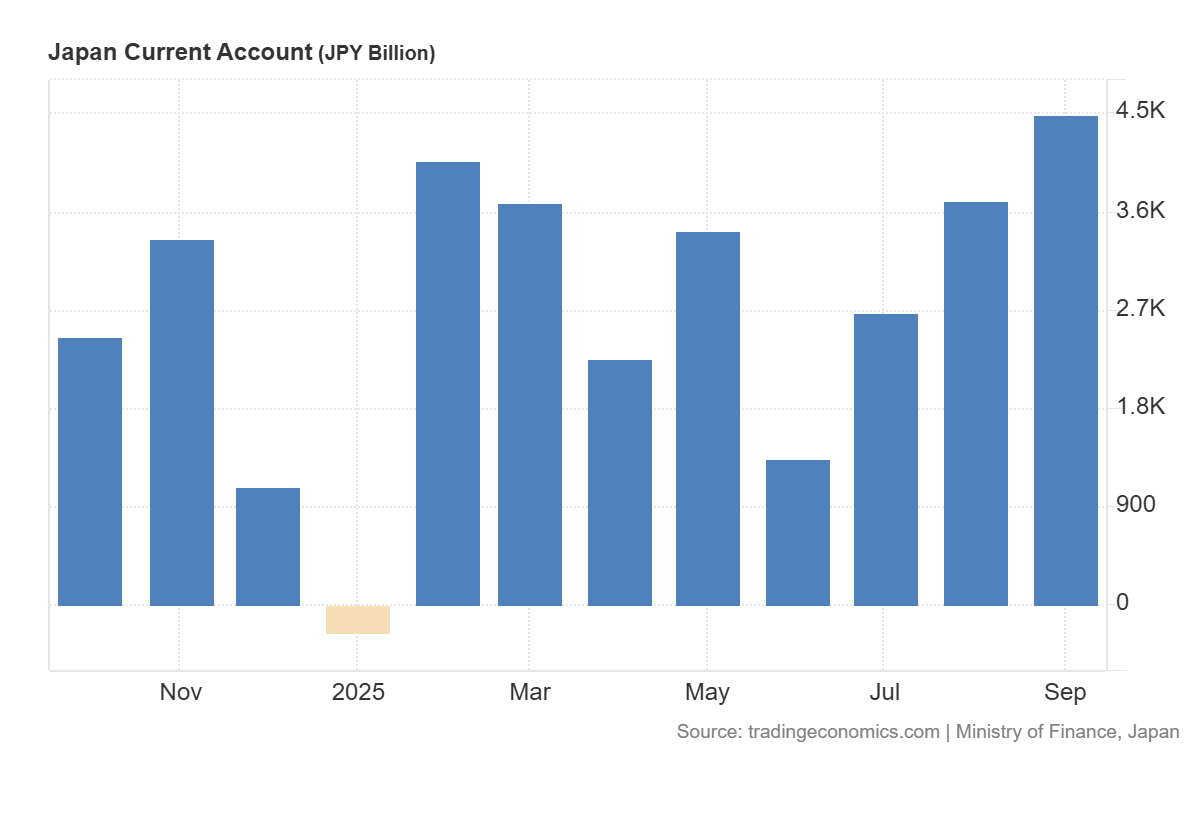

- Recent data: Japan’s current account totalled 4.483 trillion JPY

- Market impact: the effect on the Japanese stock market is mostly positive

JP 225 fundamental analysis

Japan’s current account surplus reached 4.483 trillion JPY, well above both the forecast of 2.468 trillion JPY and the previous value of 3.701 trillion JPY. This indicates that the inflow of foreign income – exports minus imports plus overseas investment returns – was stronger than expected. This is a positive sign for the economy: the external balance remains stable, and the country earns more foreign revenue and investment income.

For the JP 225 index, however, the effect is mixed. A strong surplus can support the yen, and if the currency strengthens, exporters’ profits converted from USD or EUR into JPY will shrink, creating a short-term headwind for automakers, electronics, and industrial machinery producers. On the other hand, a stronger yen makes imported energy and raw materials cheaper, improving margins for domestic-oriented companies.

Japan’s current account: https://tradingeconomics.com/japan/current-accountJP 225 technical analysis

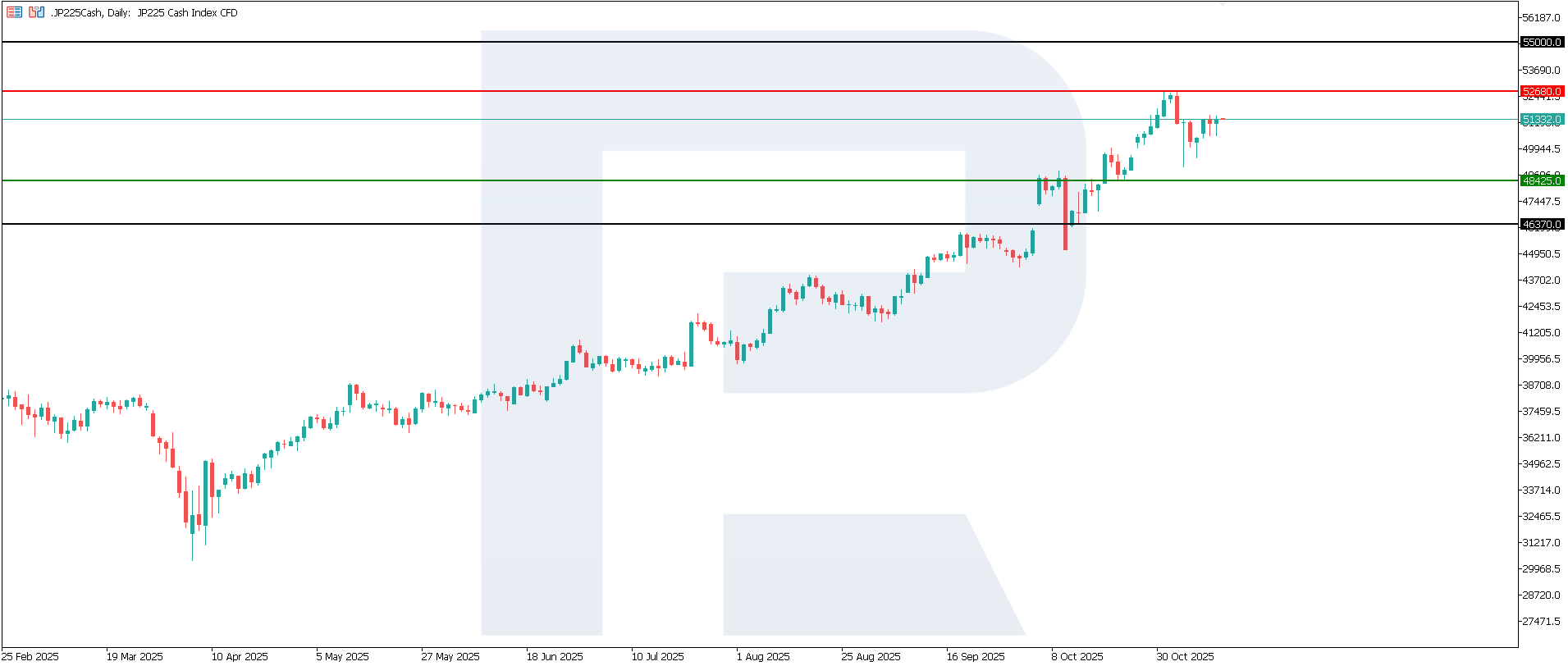

The JP 225 index has completed its correction phase and may enter a sideways trend before resuming growth. The global trend remains upward. The support level is located at 48,425.0, while resistance has formed at 52,680.0. The next potential upside target lies at 55,000.0.

The JP 225 price forecast considers the following scenarios:

- Pessimistic JP 225 scenario: a breakout below the 48,425.0 support level could push the index down to 46,370.0

- Optimistic JP 225 scenario: a breakout above the 52,680.0 resistance level could propel the index up to 55,000.0

Summary

For the JP 225 index, which includes a large share of export-oriented companies, the base reaction is moderately positive. A rotation within the index is likely: automakers and electronics may underperform, while domestic beneficiaries – those profiting from cheaper imports and stable financial conditions – are likely to show resilience. The scale of further movement will depend on how the market interprets the composition of the current account surplus. The next upside target for the JP 225 stands at 55,000.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.