JP 225 forecast: the index hits new all-time high

After a correction, the JP 225 stock index resumed its upward movement and reached a new all-time high. The JP 225 forecast for today is positive.

JP 225 forecast: key trading points

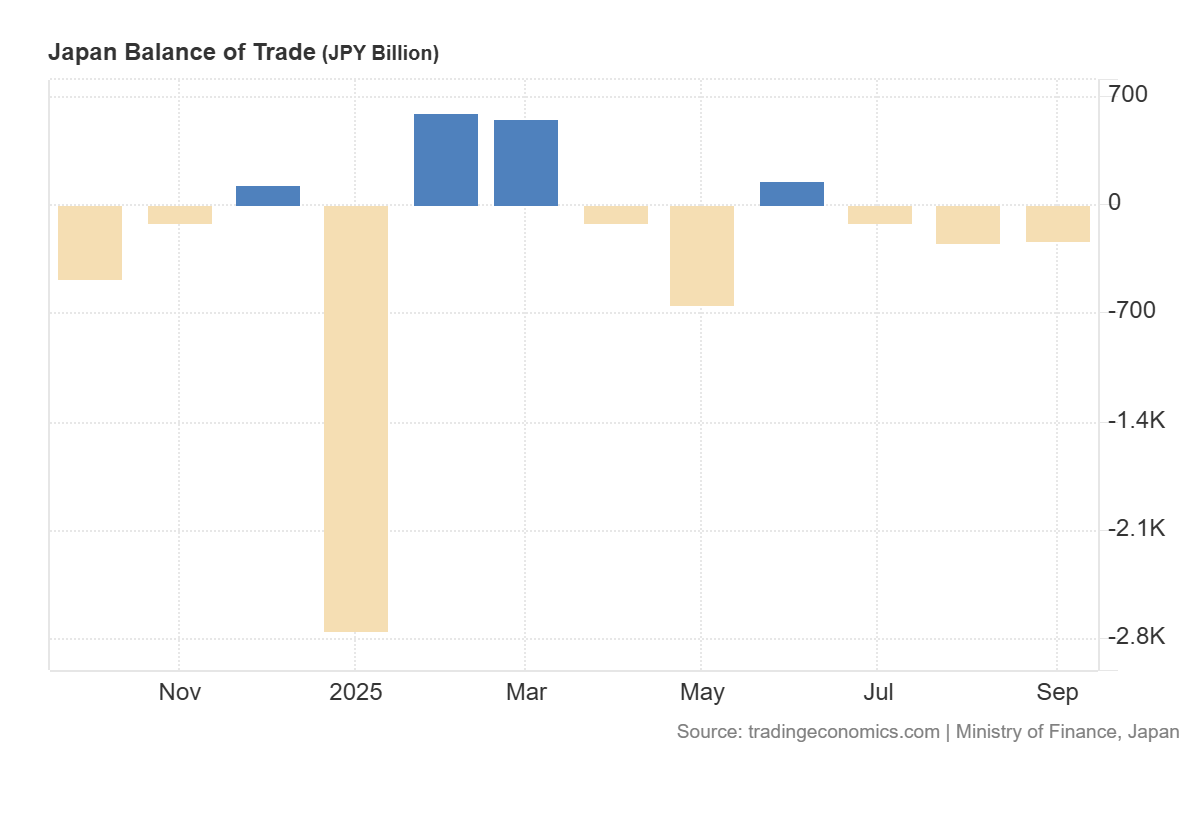

- Recent data: Japan’s balance of trade for September came in at –234.6 billion JPY

- Market impact: the effect on the Japanese equity market is moderately negative

JP 225 fundamental analysis

Japan’s latest trade balance data for October 2025 showed a deficit of –234.6 billion JPY, compared with expectations for a 22 billion JPY surplus and a slightly smaller deficit in the previous period. This indicates that imports continue to outpace exports and that the trade gap is not narrowing. Such dynamics are typically interpreted as a sign of weakening external demand for Japanese goods and high sensitivity of the economy to imported energy resources. This raises the likelihood of lower industrial production figures and slower performance in export-oriented industries.

The release will likely send the JP 225 index lower. However, the downside potential is expected to be limited, as the negative trade data will be balanced by the Bank of Japan’s commitment to maintain ultra-loose monetary policy. Overall, these results increase the risk premium associated with external trade imbalances.

Japan’s balance of trade: https://tradingeconomics.com/japan/balance-of-tradeJP 225 technical analysis

The JP 225 index has reached a new all-time high and is currently undergoing a correction, while the overall trend remains bullish. The support level is located at 47,735.0, while resistance lies at 49,770.0.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 scenario: a breakout below the 47,735.0 support level could send the index down to 46,370.0

- Optimistic JP 225 scenario: a breakout above the 49,770.0 resistance level could drive the index to 51,565.0

Summary

For the stock market, the initial reaction to the trade balance report is typically moderately negative, reflecting weaker macroeconomic expectations and downward revisions to revenue forecasts in cyclical sectors such as automotive, electronics, and industrial equipment. However, the stable monetary policy stance and optimism surrounding Japan’s new political leadership continue to support investor sentiment. The next upside target for the JP 225 could be at 51,565.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.