JP 225 forecast: index corrects after hitting new all-time high

The JP 225 index is undergoing a correction, although the broader uptrend remains intact. The JP 225 forecast for today is negative.

JP 225 forecast: key trading points

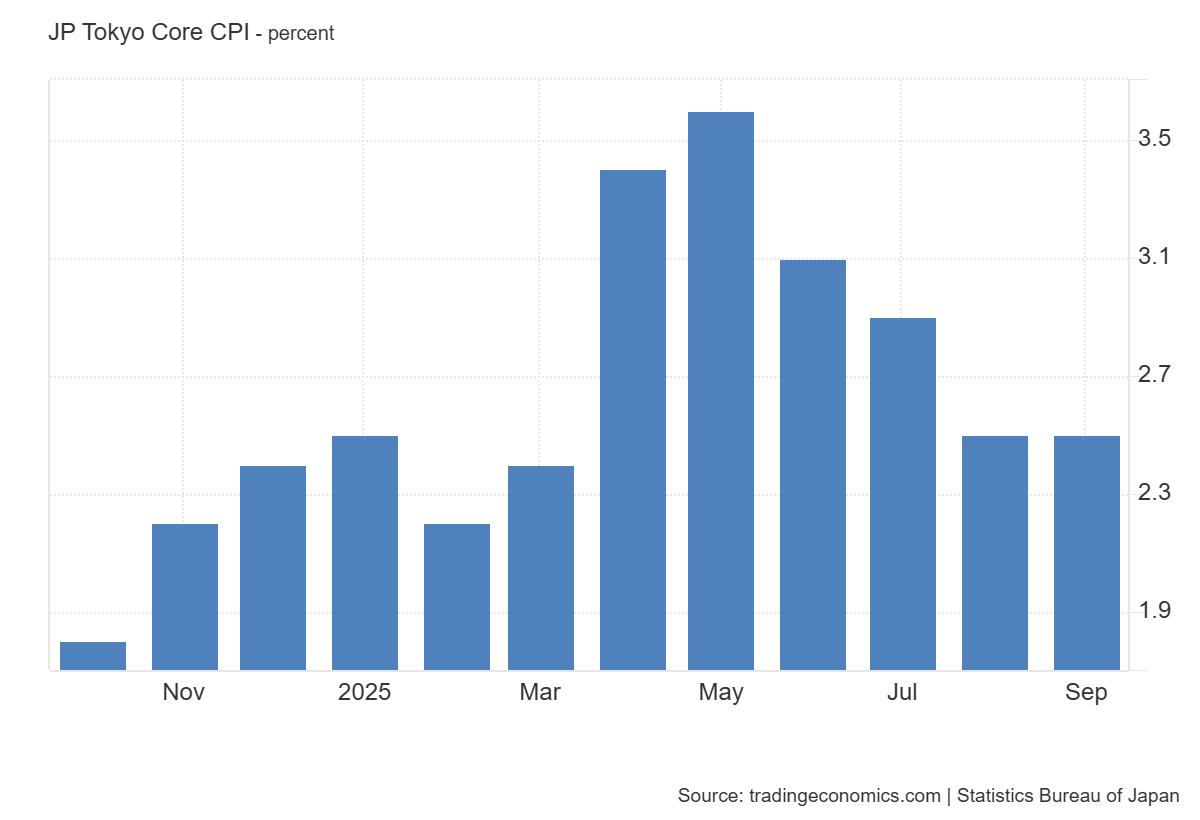

- Recent data: Tokyo core CPI came in at 2.5% year-on-year

- Market impact: the impact on the Japanese equity market is moderately positive

JP 225 fundamental analysis

Tokyo’s core Consumer Price Index stood at 2.5% year-on-year, below the consensus forecast of 2.8% and unchanged from the prior month. This shows that inflationary pressure in Japan’s largest metropolitan area remains stable and softer than expected. For equity markets, this reduces the likelihood of accelerated monetary policy normalisation by the Bank of Japan. The case for aggressive tightening has weakened, which supports valuations for assets sensitive to discount rates.

For the JP 225 index, the overall impact is moderately positive. Softer inflation lowers the risk of sharp rises in yields and capital costs. On the currency side, this increases the likelihood of a weaker yen, which improves overseas revenue conversion for exporters and supports their stock performance, creating a positive ripple across the index.

Japan Tokyo Core CPI YoY: https://tradingeconomics.com/japan/tokyo-core-cpiJP 225 technical analysis

The JP 225 index has entered a corrective pullback. The support level is located at 44,595.0, with resistance at 45,950.0. Currently, the uptrend is highly likely to resume.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 scenario: a breakout below the 44,595.0 support level could push the index down to 43,960.0

- Optimistic JP 225 scenario: a breakout above the 45,950.0 resistance level could boost the index to 46,920.0

Summary

Export-oriented sectors such as autos, electronics, and machinery remain well-supported, benefitting from a weaker yen and lower rate risks, which strengthen margins and competitiveness. Key risks to the baseline scenario include yen fluctuations driven by shifts in Fed and BoJ expectations, as well as a potential rebound in inflation (e.g., due to energy prices). A renewed inflation spike could revive discussions of more decisive policy normalisation, pressuring equity valuations. The next upside target for the JP 225 stands at 46,920.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.