JP 225 forecast: the uptrend has returned, with a new all-time high expected

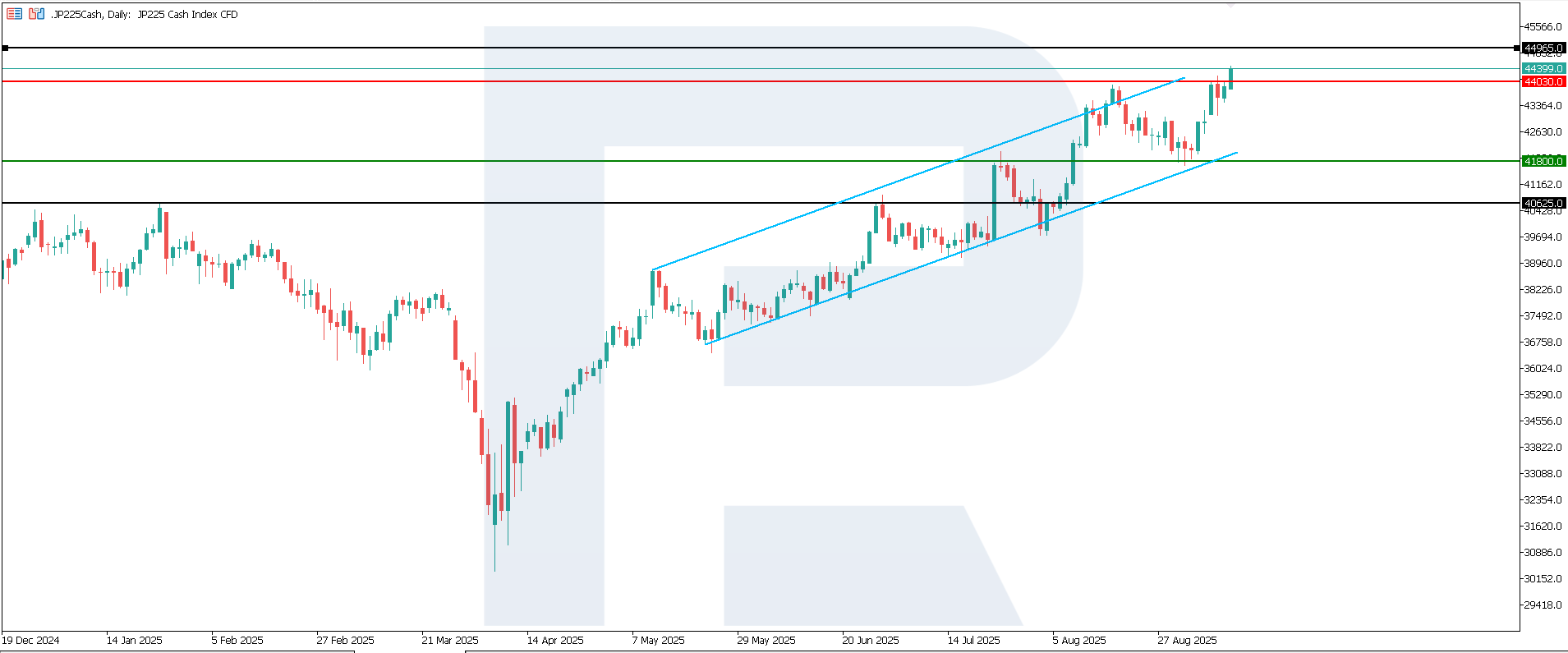

The JP 225 index has resumed growth within its upward channel. The JP 225 forecast for today is positive.

JP 225 forecast: key trading points

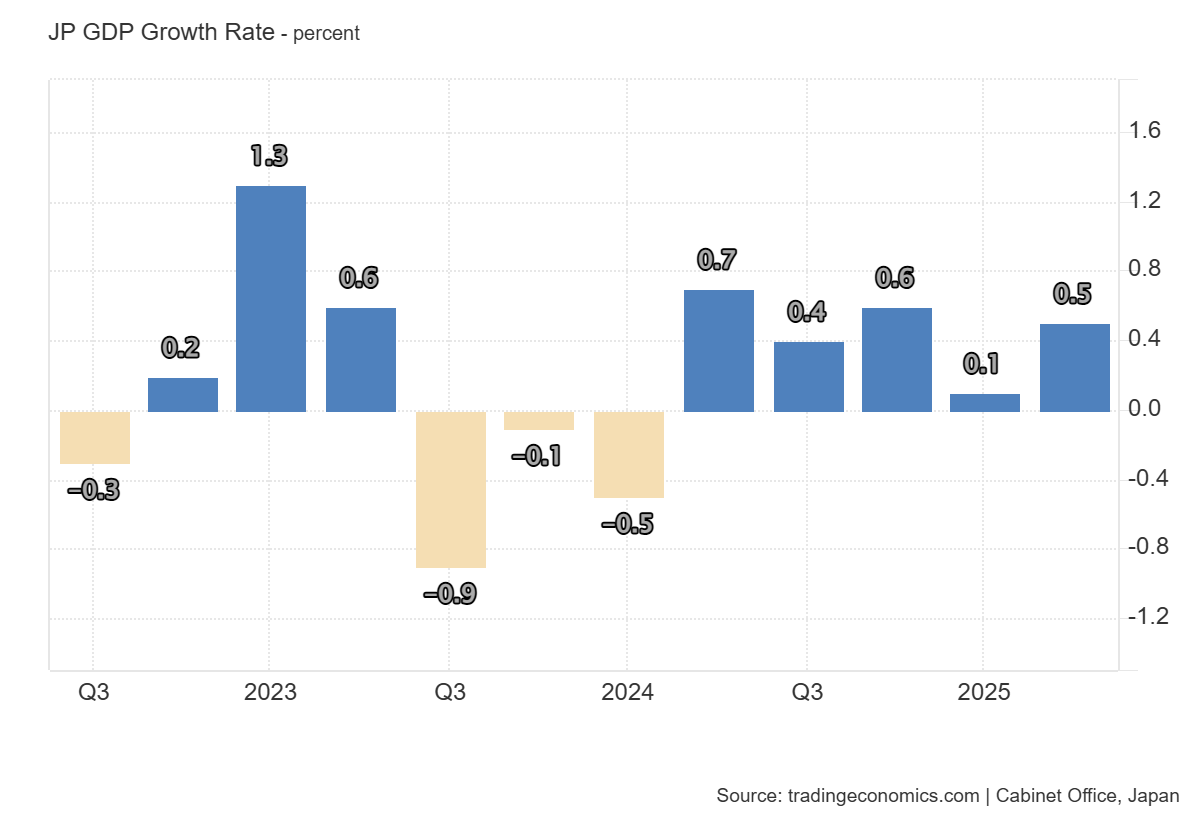

- Recent data: Japan’s quarterly GDP for August grew by 0.5% year-on-year

- Market impact: this result is positive for the Japanese equity market

JP 225 fundamental analysis

Japan’s Q2 GDP showed growth of 0.5% quarter-on-quarter, above the forecast of 0.3% and the previous reading of 0.1%. This result signals that the Japanese economy is showing signs of recovery after a slowdown, which can boost investor confidence and support equities.

For the JP 225 index, this data is a broadly positive factor. GDP growth indicates stronger domestic demand and more resilient production and export dynamics, directly supporting revenues of Japan’s largest corporations included in the index. The financial sector benefits from rising economic activity, as it increases demand for loans and investment services. Industrial and export-oriented companies also gain support from higher global and domestic demand for Japanese goods.

Japan GDP Growth Rate: https://tradingeconomics.com/japan/gdp-growthJP 225 technical analysis

The JP 225 index resumed growth and hit a new all-time high. The support level is located at 41,800.0, with resistance at 44,030.0. Currently, there is a high likelihood of further upward movement.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 scenario: a breakout below the 41,800.0 support level could push the index down to 40,625.0

- Optimistic JP 225 scenario: a breakout above the 44,030.0 resistance level could boost the index to 44,965.0

Summary

Stronger-than-expected GDP growth increases the likelihood of short-term strengthening in the JP 225, although further momentum will depend on a mix of factors, particularly the Bank of Japan’s policy and global market conditions. The index’s uptrend remains intact, with no signs of a reversal in the short term. The next upside target for the JP 225 is 44,965.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.