JP 225 forecast: the uptrend has shifted to a short-term downtrend

The JP 225 index continues its correction within a downtrend. The JP 225 forecast for today is negative.

JP 225 forecast: key trading points

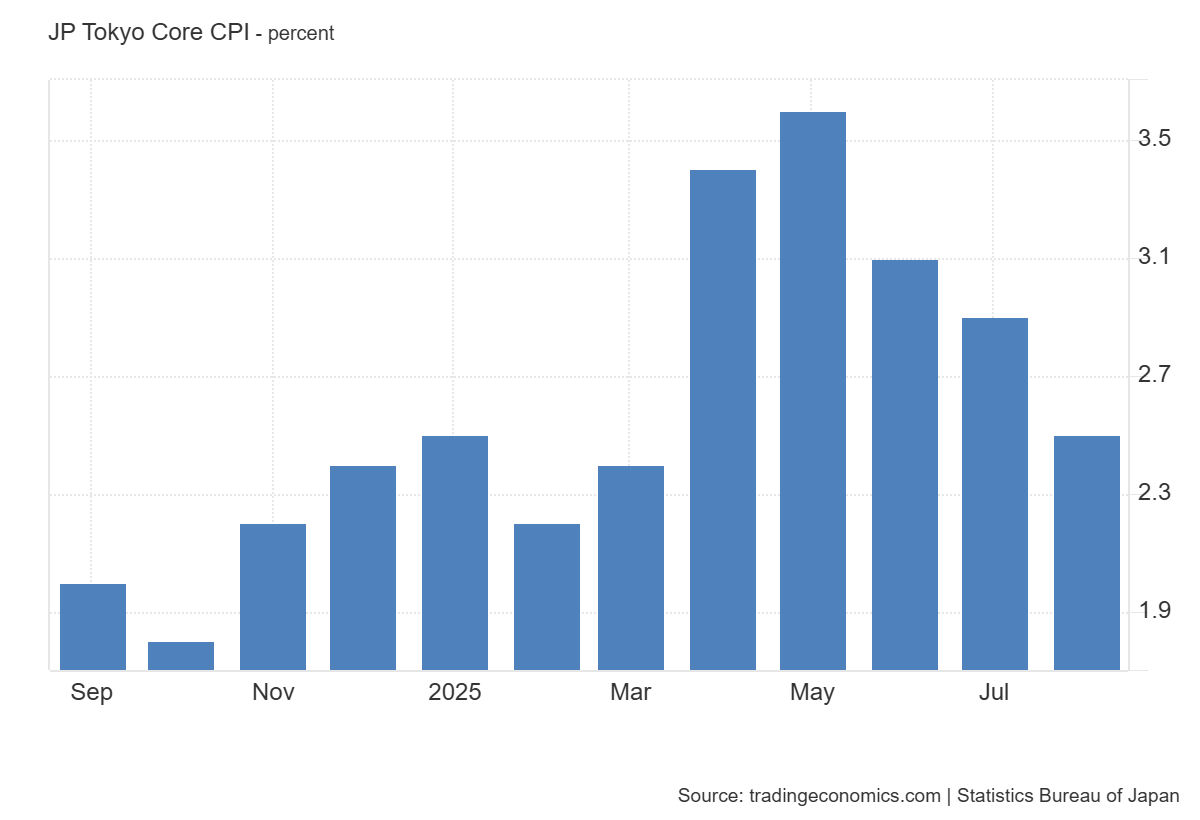

- Recent data: Japan Tokyo CPI for August rose by 2.5% year-on-year

- Market impact: this result is positive for the Japanese stock market

JP 225 fundamental analysis

Tokyo’s Consumer Price Index (CPI) rose by 2.5% year-on-year in August 2025, in line with forecasts but lower than the previous reading of 2.9%. For the Japanese equity market, this result matters. Easing inflation signals reduced pressure on consumers and businesses, which may act as a positive factor for domestic demand. However, inflation remains above the Bank of Japan’s target (around 2.0%), supporting arguments for a cautious review of monetary policy.

For the JP 225, the sectoral impact is mixed. The consumer sector (retail, restaurants, and everyday goods) benefits from lower inflationary pressure, which supports purchasing power. Export-oriented companies may also gain if expectations of a softer Bank of Japan stance put downward pressure on the yen, improving competitiveness abroad. Conversely, the financial sector may face limits, as slower inflation reduces the likelihood of aggressive interest rate hikes, restraining bank margins.

Japan Tokyo Core CPI YoY: https://tradingeconomics.com/japan/tokyo-core-cpiJP 225 technical analysis

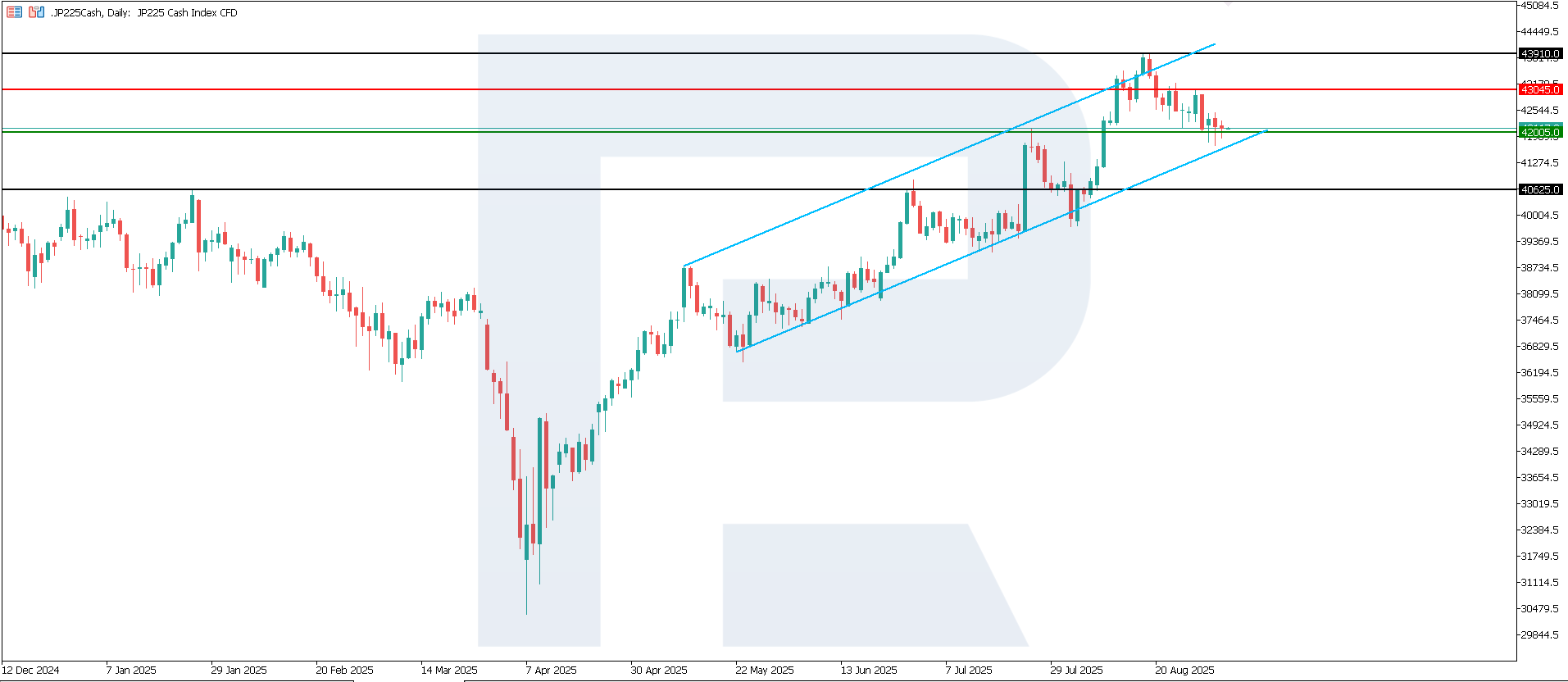

The JP 225 index declined below the 43,385.0 level before entering a downtrend. The support level is located at 42,005.0, with resistance at 43,045.0. Currently, there is a likelihood of further short-term downward movement.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 scenario: a breakout below the 42,005.0 support level could send the index down to 40,625.0

- Optimistic JP 225 scenario: a breakout above the 43,045.0 resistance level could drive the index to 43,910.0

Summary

Overall, the slowdown in Tokyo’s inflation may be seen by investors as a stabilising factor, increasing the attractiveness of Japanese equities. For the JP 225, this creates a base for moderate growth, especially in consumer demand–driven and export-oriented sectors. The next downside target for the JP 225 index is 40,625.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.