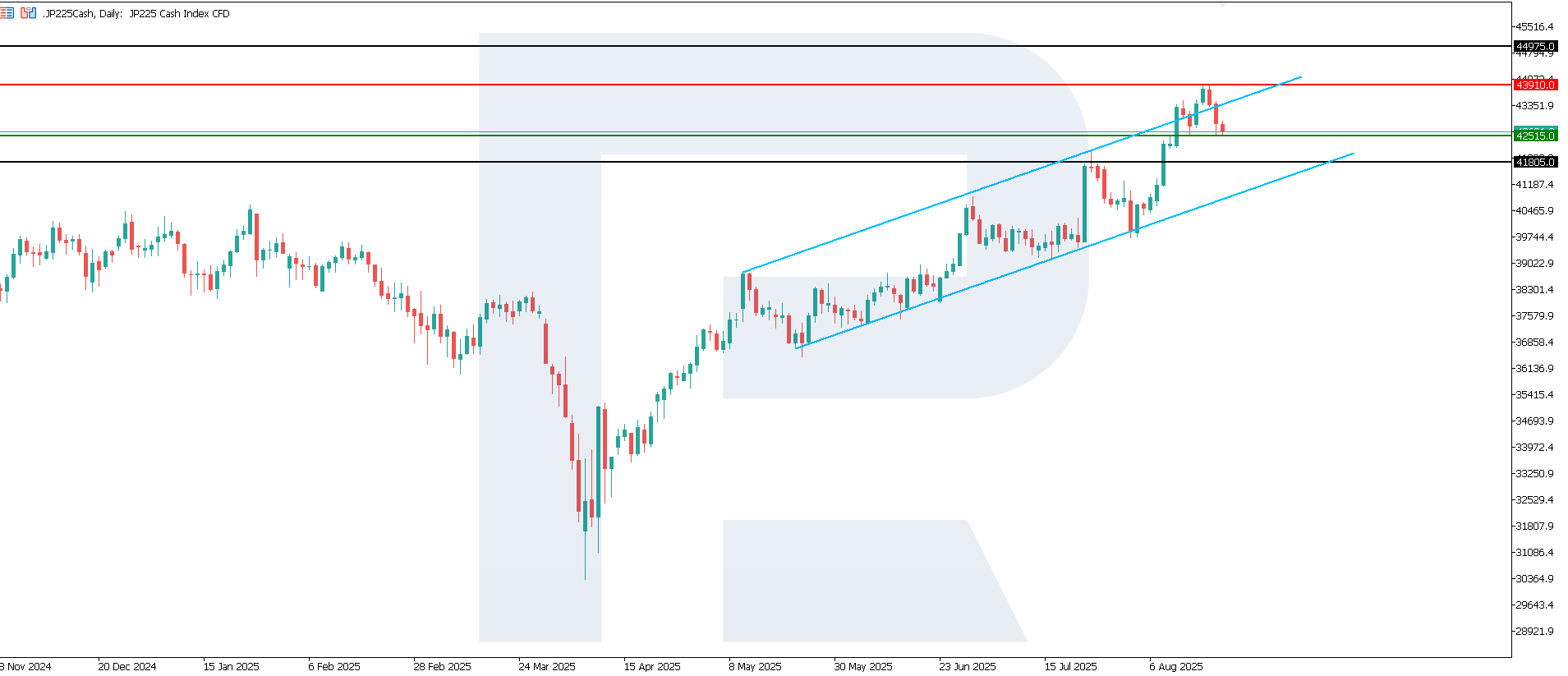

JP 225 forecast: index continues to rise within an ascending channel, correcting after reaching a new all-time high

The JP 225 stock index hit a new all-time high and started a correction. Today’s JP 225 forecast is negative.

JP 225 forecast: key trading points

- Recent data: Japan’s Q2 2025 GDP grew by 0.3%

- Market impact: this is a positive signal for the stock market, as growth exceeded expectations

JP 225 fundamental analysis

Data shown on the chart indicates that Japan’s quarterly GDP growth was 0.3%, above the forecast of 0.1% and the previous figure of 0.1%. Stronger-than-expected GDP growth signals more resilient economic activity in the country. This suggests increased domestic demand, exports, or investments, which creates a positive backdrop for corporate profits and, consequently, the stock market. Stronger macroeconomic data may also reduce recession concerns, reinforcing investor confidence.

For the JP225 index, this positive GDP surprise could contribute to further price growth. The strengthening of sustainable economic growth expectations increases the likelihood of stock market gains. However, investors may also consider potential risks of Bank of Japan’s monetary tightening if the positive momentum proves persistent.

Japan GDP Growth Rate: https://tradingeconomics.com/japan/gdp-growthJP 225 technical analysis

The JP 225 index broke above the 43,385.0 level to hit a new all-time high before undergoing a local correction. The support level is located at 42,515.0, with resistance at 43,910.0. At the moment, there is a chance of a short-term downtrend starting, signalled by a support level breakout.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 scenario: a breakout below the 42,515.0 support level could send the index down to 41,805.0

- Optimistic JP 225 scenario: a breakout above the 43,910.0 resistance level could boost the index to 44,975.0

Summary

Japan’s stronger-than-expected GDP growth is a positive factor for the stock market and the JP 225 index. The financial, industrial, and consumer sectors will likely benefit the most, while exporters may face mixed effects due to the currency factor. The JP 225 index has formed an ascending channel within the broader uptrend, with the next upside target at 44,215.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.