JP 225 forecast: quotes still attempting to break resistance within the uptrend

For almost a week, the JP 225 index has failed to continue its growth, raising expectations of a sideways channel forming. The forecast for JP 225 today is positive.

JP 225 forecast: key trading points

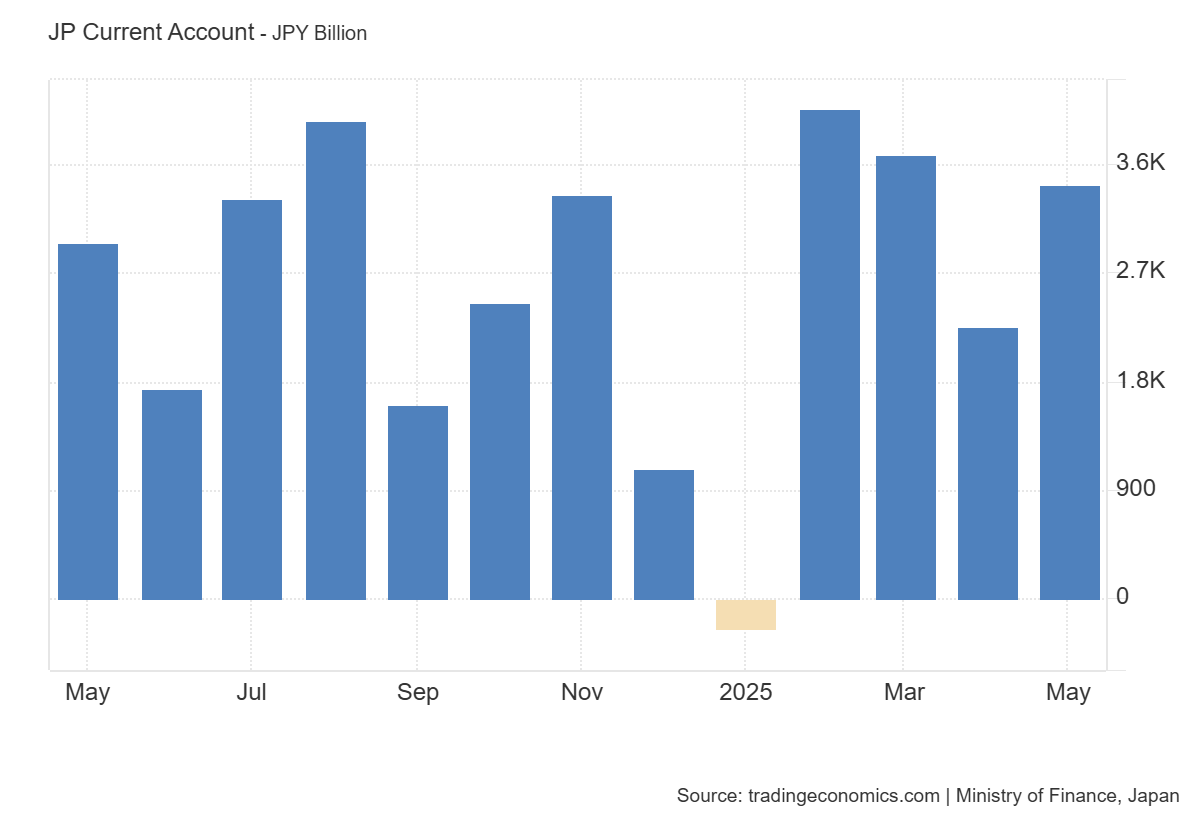

- Recent data: Current Account in Japan for June stood at 3.436 trillion JPY

- Market impact: this is a positive signal for investors in exporting companies

JP 225 fundamental analysis

The Current Account reflects the balance of trade in goods and services, as well as net income from overseas investments. A surplus of 3.436 trillion JPY (forecast 2.940 trillion, previous 2.258 trillion) indicates a significant inflow of foreign currency and strengthens Japan’s position as a net creditor.

An increase in Japan’s current account surplus has a positive impact on the stock market. Exporting companies’ shares will receive the greatest support, along with the financial and consumer sectors, thanks to currency strengthening and improved macroeconomic stability. In the long term, this indicator boosts investor confidence in Japanese assets and creates conditions for sustainable stock market growth.

Japan Current Account: https://tradingeconomics.com/japan/current-accountJP 225 technical analysis

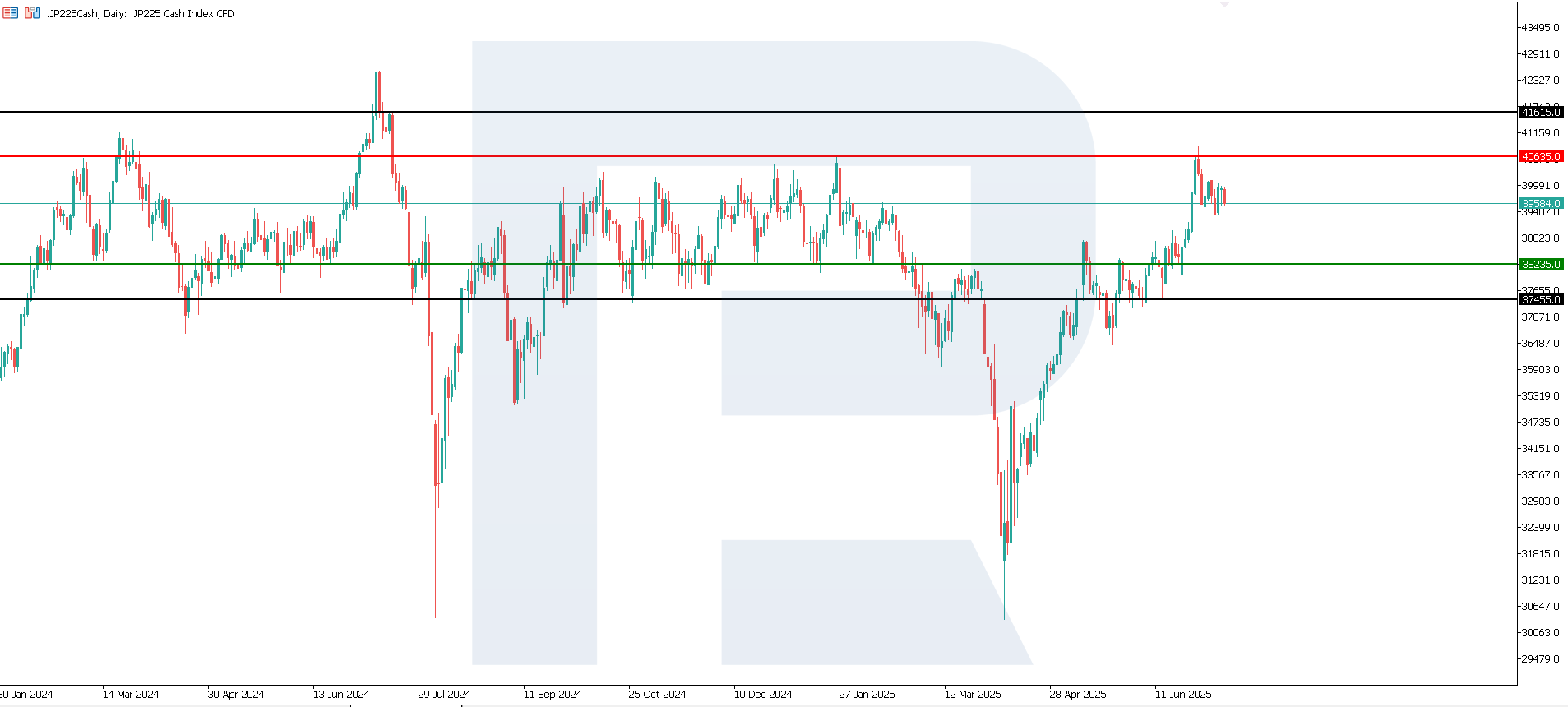

The JP 225 index maintains its upward movement with a stable trend. Support has formed at 38,235.0, with resistance at 40,635.0. A correction is underway at the moment, but it is unlikely to be prolonged or develop into a full-fledged downtrend. Currently, there are no market signals indicating a trend reversal.

Scenarios for the JP 225 index price forecast:

- Pessimistic scenario for JP 225: if the support level at 38,235.0 is breached, prices may fall to 37,455.0

- Optimistic scenario for JP 225: if the resistance level at 40,635.0 is broken, prices may rise to 41,615.0

Summary

The current account indicator shows a significant increase in Japan’s trade surplus and income from overseas investments. Growth in the current account surplus signals a high level of industrial activity and may drive increased demand for energy and raw materials. The JP 225 index continues to move confidently upwards, demonstrating a stable uptrend. The next target for growth is the 41,615.0 level. At present, there are no signs of a possible trend reversal.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.