DE 40 forecast: the index trades in a sideways channel

The DE 40 stock index continues to trade within a sideways channel with a slight downward bias. The DE 40 forecast for today is positive.

DE 40 forecast: key trading points

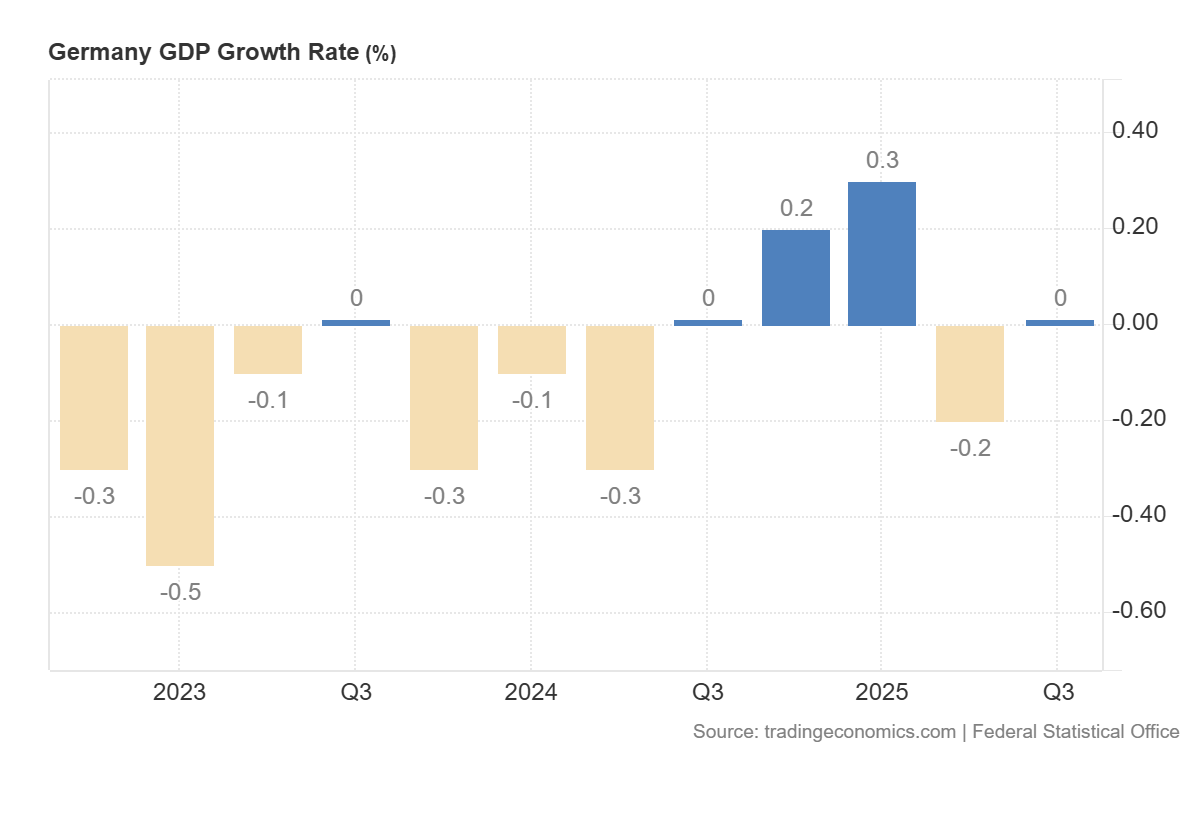

- Recent data: Germany’s GDP for Q3 2025 increased by 0.0%

- Market impact: the data creates a mixed outlook for the German equity market

DE 40 fundamental analysis

The latest German GDP release (q/q: 0.0% vs. 0.0% expected and −0.3% previously) signals economic stabilisation after prior contraction, though not a clear acceleration. Since the data matched the consensus forecast, the surprise factor is minimal, and the short-term risk premium on German assets is unlikely to shift significantly. At the macro level, stagnation implies moderate domestic demand and continued reliance of export-oriented companies on global conditions. Combined with ongoing disinflation, this growth profile supports expectations for dovish ECB rhetoric, which in turn helps the equity market.

For the DE 40 index, the base effect is moderate. The absence of further economic deterioration supports current valuations, but for multiple expansion, investors would need either a clear sign of accelerating business activity or a more explicit ECB easing cycle. In the near term, the index will likely remain range-bound, with key drivers being global yields, ECB comments, and earnings reports of major exporters.

Germany’s GDP growth rate: https://tradingeconomics.com/germany/gdp-growthDE 40 technical analysis

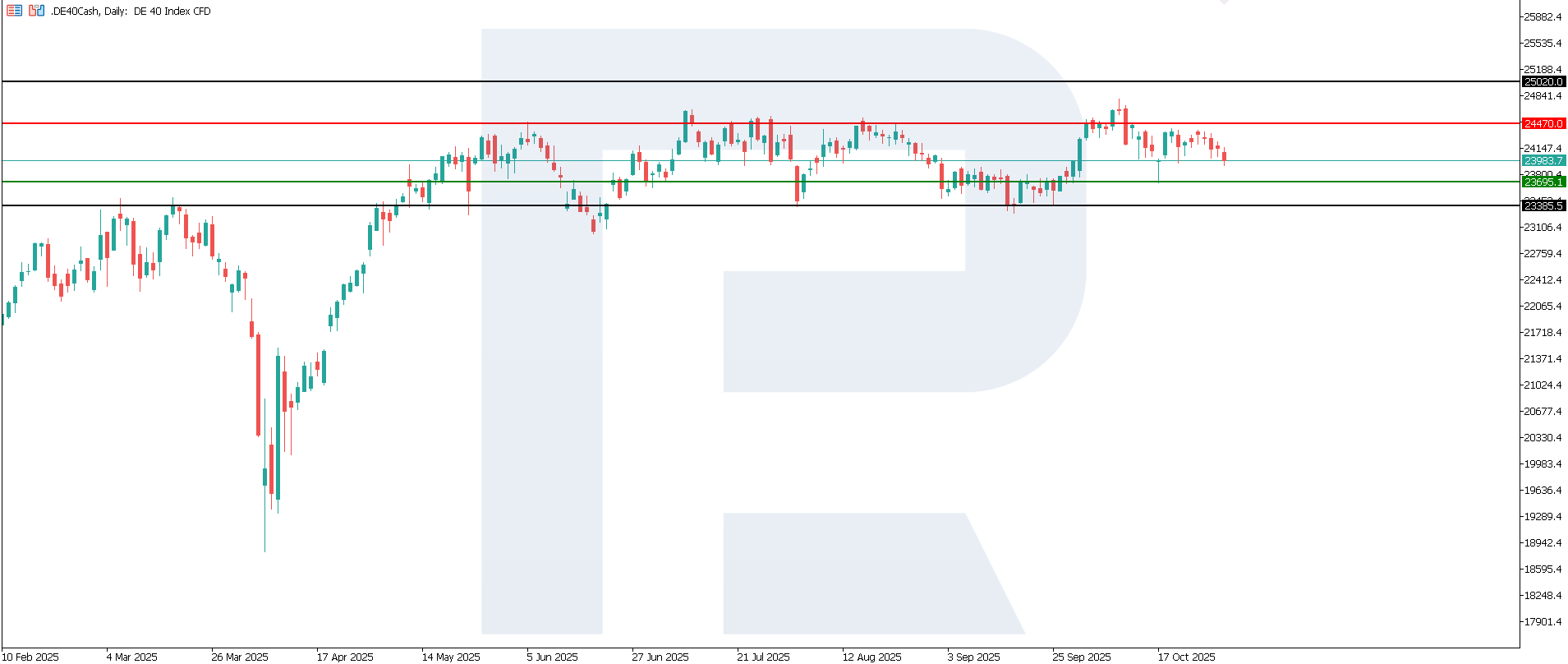

For the DE 40 index, the key resistance level is located near 24,470.0, while the previous 24,160.0 support level has been broken. The prevailing trend is bearish, and its duration remains uncertain. The next downside target is 23,385.0.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: if the price consolidates below the previously breached support level at 24,160.0, the index could dip to 23,385.0

- Optimistic DE 40 scenario: a breakout above the 24,470.0 resistance level could drive the index to 25,020.0

Summary

The balance of risks is moderately tilted to the positive side due to a reduced probability of recession. However, any breakout from the current range will likely depend on external triggers, such as global demand dynamics, energy prices, and new industrial orders. Overall, a flat quarterly trend represents a neutral signal for the German equity market, suggesting a sideways trajectory for the DE 40 with potential for gradual growth in the absence of inflationary surprises. The nearest downside target for the index could be 23,385.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.